Introduction

Malaysia as many other economies is dominated by a large proportion of small and medium enterprises (SMEs). In the manufacturing sector alone, SMEs constituted 96.6 per cent (37,866) of the total number of establishment, contributed 35.0 per cent (RM192 billion) to total manufacturing output, and involved mostly in textiles and apparel (23.2 percent), metal and non-metallic mineral products (16.7 percent) and food and beverages (15.0 per cent) (Mohd. Aris, 2007).

Due to the large contribution of the sector to the economy (Jutla et al., 2002; Singh et al., 2010), competitiveness and development of SMEs must be sustained over time. Intense competition under the global economic framework requires SMEs to reconsider their competitive position vis-Ã -vis their local and foreign rivals. Porter (1980) reminded that competitive strategies differentiating a particular firm from its competitors would determine its survival in business.

To D’Cruz and Rugman (1992), a firm would be more competitive if it is able to design, produce, and market products or services superior to those offered by its rivals. All these market changes and needs reveal why it is almost impossible to find any industrial player, who refuses to innovate (Hurley and Hult, 1998). This also reminds the firms that innovation is no more a luxury, but a necessity (Kaplan and Waren, 2007).

Due to the growing importance of innovation to human beings in general and entrepreneurship in particular, many empirical studies were conducted to examine the relationship between this strategic factor and firm performance (for examples, Guimaraes and Langley, 1994; Lin and Chen, 2007; Trienekens et al., 2008; Bakar and Ahmad, 2010; Peng et al., 2011; Chong et al., 2011).

However, the previous studies inclined to focus on one or two dimensions of innovation, such as product innovation (Alegre et al., 2006; Espallardo and Ballester, 2009; Zhang and Duan, 2010; Bakar and Ahmad, 2010), product and process innovation (Georgellis et al., 2000; Ar and Baki, 2011; Prajogo et al., 2007; Medina and Rufin, 2009) and market innovation (Johne, 1999). For the sake of knowledge development, this paper evaluates the impact of various dimensions of innovation on the performance of SMEs. The findings in this paper would be useful for theoretical discussion as well as for policy formulation and entrepreneurial development.

Literature Review

Innovation

The early concept of innovation in economic development and entrepreneurship was popularized by Joseph Schumpeter, a German economist. Innovation, in his view, comprises the elements of creativity, research and development (R&D), new processes, new products or services and advance in technologies (Lumpkin and Dess, 2001).

To Kuratko and Hodgetts (2004), innovation is the creation of new wealth or the alteration and enhancement of existing resources to create new wealth. Innovation is also seen as a process of idea creation, a development of an invention and ultimately the introduction of a new product, process or service to the market (Thornhill, 2006). At present, this concept is applied in every facet of social lives and activities. This makes the innovation concept become more multidimensional and intricate.

Beaver (2002) believes that innovation is an essential element for economic progress of a country and competitiveness of an industry. Innovation plays an important role not only for large firms, but also for SMEs (Jong and Vermeulen, 2006; Anderson, 2009). Sandvik (2003) argues that innovation is one of the most important competitive weapons and generally seen as a firm’s core value capability.

Innovation is also considered as an effective way to improve firm’s productivity due to the resource constraint issue facing a firm (Lumpkin and Dess, 1996). Bakar and Ahmad (2010) add that the capability in product and business innovation is crucial for a firm to exploit new opportunities and to gain competitive advantage.

Firm Performance

Outsiders normally evaluate a firm’s ability based on its performance (Bonn, 2000). This implies why performance is like a mirror to a firm. The level of goal accomplishment generally defines a firm’s performance (Achrol and Etzel, 2003).

Firm performance is the outcomes achieved in meeting internal and external goals of a firm (Lin et al., 2008). As a multidimensional construct, performance has several names, including growth (Dobbs and Hamilton, 2006; Wolff and Pett, 2006), survival, success and competitiveness. The concept of firm growth was introduced in the early 1930s known as the “Law of Proportionate Effect” (sometimes called Gibrat’s rule of proportionate growth). The Law of Proportionate Effect is frequently used as a benchmark for many studies to determine business growth. Gibrat’s (1931) explains a firm’s growth rate does not depend on the size of a firm.

Traditionally, a variation in firm performance is associated with industrial structure (Frazier and Howell, 1983). The neo-classical economic theory perceives a firm’s growth as a process of attaining the minimum point of average cost. In other words, the process of a firm’s growth is similar to the process of profit optimisation (Trau, 1996).

In 1959, Penrose developed a resource-based-view theory (Garnsey, 1988), where a firm’s performance is dependent upon the resources and capabilities it has as a source of sustainable competitive advantages in the market (Wernerfelt, 1984; Peteraf, 1993; Mahoney, 1995). Garnsey (1988) argues that firms must access, mobilize and deploy resources before they can grow. Adoption of various strategies by firms also determines firm performance. Different firm uses different strategies of performance (Collins and Porras, 2000); hence, a firm’s performance is concentrated in its strategy (Short et al., 2007).

Depending on organizational goals, different methods are adopted by different firms to measure their performance. This performance indicator can be measured in financial and non-financial terms (Darroch, 2005; Bagorogoza and Waal, 2010; Bakar and Ahmad, 2010). Most firms, however, prefer to adopt financial indicators to measure their performance (Grant et al., 1988; Hoskinson, 1990). Return on assets (ROA) (Zahra, 2008), average annual occupancy rate, net proï¬t after tax and return on investment (ROI) (Tavitiyaman et al., 2012) are the commonly used financial or accounting indicators by firms.

Some other common measures are profitability, productivity, growth, stakeholder satisfaction, market share and competitive position (Garrigos-Simon and Marques, 2004; Marques et al., 2005; Bagorogoza and Waal, 2010).

However, financial elements are not the only indicator for measuring firm performance. It needs to combine with non-financial measurement in order to adapt to the changes of internal and external environments (Krager and Parnell, 1996). Supporting this opinion, Rubio and Aragon (2009) divided business performance into four dimensions, that is internal process, open system, rational goal and human relations, where each dimension is measured by any changes in its own variables.

Innovation and Firm Performance

The importance of innovation is described by Roberts and Amit (2003) as a means leading to a competitive advantage and superior profitability. As revealed in many studies, innovation and firm performance have a positive relationship (for examples Zahra and Das, 1993; Capon et al., 1990; Calantone et al., 1995; Han et al., 1998). Innovation would appear in product, process, market, factor and organisation (Kao, 1989), but the first three dimensions are more familiar in the innovation literature (see Johne and Davies, 2000; Otero-Neira et al., 2009).

Product Innovation

Product innovation can be defined as the creation of a new product from new materials (totally new product) or the alteration of existing products to meet customer satisfaction (improved version of existing products) (Gopalakrishnan and Damanpour, 1997; Langley et al., 2005).

It also refers to the introduction of new products or services in order to create new markets or customers, or satisfy current markets or customers (Wang and Ahmed, 2004; Wan et al., 2005). Myers and Marquis (1969) contend that product innovation can be made by exploiting new ideas. Product innovation provides a variety of choice for products (Craig and Hart, 1992).

Product innovation is one of the important sources of competitive advantage to the firm (Camison and Lopez, 2010). With innovation, quality of products could be enhanced, which in turn it contributes to firm performance and ultimately to a firm’s competitive advantage (Garvin, 1987; Forker et al. 1996). According to Hult et al. (2004), product innovation offers a potential protection to a firm from market threats and competitors. Bayus et al. (2003) proved that product innovation had positive and significant link with organizational performance.

Using a total number of 744 Spanish-firm samples, Espallardo and Ballester (2009) confirmed a positive impact of innovation on firm performance. Similarly, Alegre et al. (2006) found that both product innovation dimensions (efficacy and efficiency) were strongly and positively related to firm performance. The introduction of novel product is positively associated with firm performance was also confirmed by Varis and Littunen (2010). Therefore, the first hypothesis is stated as:

Hypothesis 1: Product innovation is positively associated with firm performance.

Process Innovation

In general, process innovation is the process of reengineering and improving internal operation of business process (Cumming, 1998). This process involves many aspects of a firm’s functions, including technical design, R&D, manufacturing, management and commercial activities (Freeman, 1982). To Oke et al. (2007), process innovation concerns with the creation of or improvement in techniques and the development in process or system.

For instance, innovation in technology, skill, techniques, system and procedure, which is used in the process of transforming input into output (Zhuang et al., 1999). In a production activity, process innovation can be referred to as new or improved techniques, tools, devices, and knowledge in making a product (Gopalakrishnan and Damanpour, 1997; Langley et al., 2005; Wan et al., 2005; Oke et al., 2007).

Crucial to the manufacturing industry, process innovation should be emphasized by a firm as its primary distinctive competence for competitive advantage (Nemetz and Fry, 1988). More specifically, such an innovation is positively associated with firm growth (Morone and Testa, 2008).

Consistent with this argument, Varis and Littunen’s (2010) study on SMEs in Finland found that process innovation is positively related with firm performance. Using new technology as a proxy for process innovation, Anderson (2009) found a significant relationship between new technology and firm performance. Recent evidence by Ar and Baki (2011) reconfirmed the positive and significant influence of product and process innovation on firm performance. As such,

Hypothesis 2: Process innovation is positively associated with firm performance.

Market Innovation

According to Johne (1999), market innovation deals with the market mix and market selection in order to meet a customer’s buying preference. Continual market innovation needs to be done by a firm because state-of-the-art marketing tools, particularly through the Internet, make it possible for other competitors to reach potential customers across the globe at a light speed.

Rodriguez-Cano et al. (2004) assert that market innovation plays a crucial role in fulfilling market needs and responding to market opportunities. In this respect, any market innovation has to be directed at meeting customers’ demand and satisfaction (Appiah-Adu and Satyendra, 1998).

The importance of market innovation to firm performance, albeit limited, is discussed in the literature, too. Sandvik (2003) discovered that market innovation has a positive effect on sales growth of a firm. To Johne and Davies (2000), market innovation would augment sales through the increasing demand for products, which in turn yields additional profit to innovative firms.

Similarly, Otero-Neira et al. (2009) found strong evidence that market innovation positively influenced business performance. Adding to this finding, Varis and Littunen (2010) using an estimated model confirmed a highly significant relationship between a market-related innovative activity and firm performance. This leads to the following hypothesis:

Hypothesis 3: Market innovation is positively associated with firm performance.

Research Methods

Data Source

Primary data used in this study were collected from SMEs in the food and beverage, textiles and clothing, and wood-based sub-industries. A strict rule was applied for collecting the data, amongst others, the selected firms must be: SMEs (with not more than 150 full-time employees); in operation for at least three years; and run by the owner or manager. A pilot survey was done with the help of a predetermined questionnaire. It was conducted in the same industries on 20 non-sample key informants (the owner or manager of the firms), who had sufficient knowledge and experience in the issues under investigation. This exercise was carried out to check time duration taking a respondent to complete the questionnaire and to validate items used for each construct. This strategy would reduce response bias and measurement error (Kumar et al. 1993) in the sample.

Upon satisfactory with the responses on the field and preliminary reliability tests (with Cronbach’s alpha of more than 0.70 for each construct under the study), an actual survey using a self-administered questionnaire was carried out by the researchers with the assistance of six trained enumerators. The questionnaire was completed by the respondents in 15-20 minutes time. In the case where the respondents were extremely busy entertaining their customers during the first visit, the questionnaire had been left for several days before it was collected in the next visit.

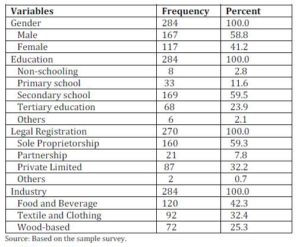

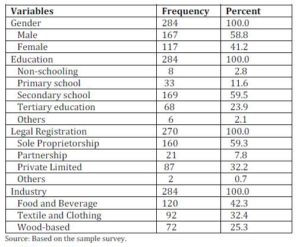

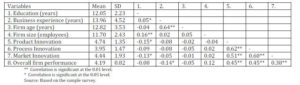

A total of 284 SMEs all over the country (except Sarawak) participated in the study. Some characteristics of the sample respondents and SMEs are shown in Table 1. It shows that a majority of the respondents were male (58.8 per cent).

The highest level of education for most of the respondents was secondary school. However, about 24 per cent of the respondents had tertiary education, indicating that entrepreneurship turned out to be an increasing choice among Malaysians. With respect to legal registration of the business, a majority of the business was sole proprietorship and private limited. In terms of sample distribution by sub-industry, 42.3 per cent were from food and beverage, 32.4 per cent from textile and clothing and 25.3 per cent from wood-based.

Table 1: Some Characteristics of the Sample

Measures

Independent Variables

Innovation as an independent variable in this study was divided into product innovation, process innovation and market innovation. Product innovation included three items, namely the introduction of new product, technological newness in product, and product differentiation. Process innovation comprised three items, that is R&D orientation, the application of new technology and new combination of materials in production. Market innovation consisted of three items, i.e. the application of online transaction, innovative marketing and promotion, and the ability to find new markets. All these items were adapted from Otero-Neira et al. (2009), and Lan and Wu (2010).

The respondents were asked, “In the last three years, to what extent has your firm emphasised each item of innovation”. Their responses were based on a given 7-point scale, ranging from ‘1= hardly emphasised’ to ‘7=strongly emphasised’. The degree of their emphasis on innovation was then averaged by calculating the mean score across the number of items for each innovation dimension (see Segev, 1987). Prior to this process, exploratory factor analysis with Varimax rotation had been used to identify the latent independent constructs, i.e. the three innovation dimensions. One component was found to be extracted from each construct identification process.

A quick check on reliability of each innovation dimension produced Cronbach’s (1951) Alpha of more than 0.70, indicating the reliability of the instrument for further use. A one-way analysis of variance (ANOVA) was run to test if there was any difference in innovation dimensions across the three sub-industries (Ï < 0.05). The results showed no significant differences in all innovation dimensions between the sub-industries. Therefore, the analysis of innovation by sub-industries was ignored. In other words, total sample and not sub-samples was adopted in this study.

Dependent Variables

In the absence of objective performance measures, self-assessment of firm performance by the respondents themselves is more relevant (Love et al., 2002). Performance indicators in this study were returns on sale, returns on asset, profitability, market share, sales revenue, labour productivity and employment. These multidimensional performance measures are relevant, especially when objective performance measures are unreachable (see, Kellermanns et al., 2010). For each item, the respondents were asked to compare their growth performance against their competitors in the same industry for the last three years on a 7-point scale ranging from “1=very low” to “7=very high”. Such assessment method is regarded reliable benchmarks (Delaney and Huselid, 1996) and taken care of for possible influence of the industry factor. This overall performance measure was summed up and then averaged to obtain a performance index for meaningful interpretation. The Varimax Rotation method and the reliability test revealed high loadings of the seven items (0.61 to 0.86) on the overall performance construct with Cronbach’s alpha of 0.93, meaning that the items were the strong representative of the performance construct.

Control Variables

Some control variables which commonly appear in the business performance literature were included in the model. They were the level of owner’s education (Nichter and Goldmark, 2009; Fairlie and Robb, 2007; Mengistae, 2006), owner’s business experience (Mengistae, 2006; Alowaihan, 2004), firm age (Birley and Westhead, 1990) and firm size (Ozgulbaset al., 2006); Orser, et al., 2000). Owner’s education, owner’s business experience, and firm age were measured by the number of years of education, experience and business operation, respectively. Firm size was measured by the number of full-time employees.

Results and Discussion

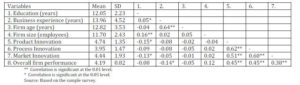

As shown in Table 2, the respondents, on average, had 12-year education (mean, 12.05), but longer business experience (mean, 13.96 years). Most of the firms were in the industry for more than ten years (mean age, 12.82), but their size was rather small (mean firm size, 11.70). More unfortunately, the emphasis of the SMEs on innovation was rather moderate. The mid-rank value of this study was 4. Judging from the mean values of product innovation (mean, 4.74), process innovation (mean 3.95) and market innovation (mean, 4.44); the SMEs gave more emphasis on product innovation and less on the other two dimensions of innovation. Probably due to moderate level of innovation, the overall performance of the SMEs (mean, 4.19) was moderate, too.

The correlation statistics in Table 2 show that the association between the independent variables is low to modest, indicating the absence of multicollinearity problems and thus allowing for a regression analysis. The multicollinearity problems were also cross-checked with the Tolerance and VIF. The tolerance values of the independent variables ranged between 0.594 and 0.984, which are not less than 0.10. In the meantime, the VIF values of the independent variables ranged between 1.016 and 3.147, which are well below the cut-off 10. All this suggests that the multicollinearity assumption is not violated and the regression results are not distorted by this problem (see Pallant, 2007).

Table 2: Mean, Standard Deviation and Correlations of the Variables

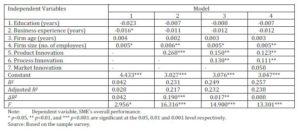

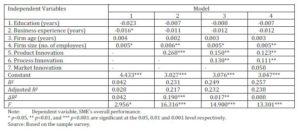

The hierarchical regression analysis was applied to estimate the impact of innovation on firm performance. As displayed in Table 3, four models were estimated in order to see how much changes would occur when one particular variable after another included in the empirical model. Separating the model estimations would help us to see the contribution of each factor more clearly through the improvement of the explanatory power of the model (the R-square).

The R-square change (ΔR2) improved significantly in Model 2 and Model 3, when product innovation and process innovation were included into the models, indicating the importance of these two innovation dimensions to firm performance. In contrast, the inclusion of market innovation in Model 4 did not improve the R-square significantly in comparison with Model 3. This indicates that market innovation does not contribute much to the variation in firm performance.

Since Model 4 estimated all the variables under the study, this model is given due attention. Results in Model 4 show that firm size was the only control variable influencing firm performance positively and significantly (β=0.005, p < 0.01).

This finding is sensible since larger firms are better able to: employ more competent employees, obtain more efficient production facilities (Sandesara, 1966), exploit economies of scale and economies of scope, and formalise procedures; where all this makes their operations more efficient, leading to their superior performance relative to smaller firms (Penrose, 1959).

Quite the opposite, the other three control variables – education, business experience and firm age – did not significantly affect firm performance. Alowaihan (2004) argues that high education does not guarantee an entrepreneur to have technical and business management skills; thus, education had insignificant impact on firm performance. Dyke and Fisher (1992) reminded that the types and sources of business experience would determine the strength and direction of the relationship between this factor and firm performance.

It will be significantly positive if the experience gained by an entrepreneur is similar and suited to the present business. In contrast, there will be no significant relationship between the two constructs if the experience acquired is dissimilar and unsuited to the present business. This may also be the case when the experience does not enhance the existing competency and expertise of an entrepreneur related to the need of present business (Reuber et al. 1990). With regards to firm age, more than half (52.0 per cent) of the firms in this study were rather new (up to ten years old), which may explain why the variation in this factor did not significantly change firm performance. This justification is consistent with another study on Spanish SMEs (Moreno dan Casillas, 2007).

Table 3: Results of the Hierarchical Regression Analysis

In line with Hypothesis 1 and Hypothesis 2, product innovation and process innovation impacted firm performance positively and significantly with β = 0.123 (p < 0.01) and β = 0.111(p < 0.01) respectively. Interestingly, the relatively stronger impact of product innovation compared to process innovation on firm performance is in agreement with a study elsewhere (Ar and Baki, 2011). In contrast, the impact of market innovation on firm performance was not significant and not supportive of Hypothesis 3. A question remains here why the increased market innovation among innovative firms was not translated into superior firm performance.

Some scholars caution that the environmental factors may dilute the impact of market innovation on firm performance (Gatignon and Xuereb, 1997; Carbonell and Rodriguez, 2006). This means that market innovation does not guarantee the innovative firms to reap benefit from their innovative actions, when there are rapid changes in business environment they operate. The adoption of e-commerce and e-marketing, for example, would give little impact on a firm’s performance in the market, when the other firms (particularly larger firms) behave similarly.

Theoretically, the findings in this paper consolidate the existing belief that innovation in product and process impact firm performance positively and significantly. Empirically, this suggests that SMEs in Malaysia, particularly in the food and beverage, textiles and clothing and wood-based sub-industries would also benefit from such innovation. Practically, the findings remind SMEs and policy makers about the importance of innovation in product and process to a firm. Despite the moderate level of innovation among the sampled SMEs, it empirically proved that such innovation contributed superior performance to those who were more innovative.

The globalisation process has indeed forced many firms to be competitive in the global marketplace (Temperley et al., 2004). For firms to remain competitive, they need innovative strategies for enhancing their competitiveness in the market (Morris et al., 2008). The necessary recipe for coping with this phenomenon is continuous innovation (Long, 2006; Anderson, 2009; Darroch and McNaughton, 2002). In business, consumer behavior determines a firm’s success in the marketplace. In this regard, consumer preferences, perception and satisfaction must be carefully studied and analysed.

A large amount of information must be processed by a firm so that any uncertainty in the decision-making process about innovation could be minimised (Lievens and Moanert, 2000). The real challenge for a firm is to influence the perceptions, needs and wants of the market, so that its products are seen superior in value in the eyes of its existing and potential consumers. Thus, product innovation in the form of the introduction of new product, technological newness in product, and product differentiation gives superior value and more impact on performance indicators of a firm compared to process innovation.

Despite the positive impact of innovation, it comes with certain amount of costs. Innovation is considered useful only when the benefits acquired are more than the cost borne by the firms. In reality, innovation development requires high capital, skills (Darroch and McNaughton, 2002; Long, 2006) and risk (Simpson et al., 2006). Irrespective of the unit of analysis (firm, industry or country), innovation can be done only when resources (especially capital) are sufficient for doing R&D (Kemp et al., 2003). Worse still, innovation normally attracts a host of imitators.

As a result of this race, it may gobble up the profits that the first mover raises, and finally many resource-constrained SMEs may have to withdraw from the market. This reminds the SMEs that indiscriminate imitating behavior may lead to failure in the end. As a way out, only by undertaking continuous innovation can a firm improve its performance and survive in the market (Hsueh and Tu, 2004).

Conclusion

This paper evaluates the impact of innovation on firm performance. For this purpose, a total of 284 samples were collected from SMEs in the food and beverage, textiles and clothing and wood-based sub-industries. The data were analysed using a hierarchical regression analysis. The findings confirmed the hypotheses that product innovation and process innovation influenced firm performance significantly, where the impact of the former was stronger than the latter. Besides consolidating the existing theory on the importance of innovation for explaining a variation in firm performance, the findings also inform SMEs and policy makers that innovation is a critical factor in today’s entrepreneurial activities.

In theory, it cannot be denied that innovation would enhance firm performance. Practically, those who did innovation experience better performance. This is good for firms under the present competitive environment. However, real impact of this strategic move should be really assessed by the firms whether their action is worthwhile or not, which is beyond the scope of this paper. Those who do not emphasize innovation as yet have to consider the cost-benefit ratio of innovation first. Due to high costs of innovation in terms of R&D expenditure and personnel and resource constraints facing SMEs, this move incurs a high risk to the firms.

At the same time, little emphasis on innovation also brings a high risk, given the turbulent environment of global competition today. Thus, SMEs have to really spend their time and money on gathering enough information about the market demand and trend for their products, competitors and sources of innovation before any decision can be made. This decision making process for undertaking innovation should be the focus of future research.

This paper do not distinguish between internal (in-house) and external (exogenous) sources of innovation. Future studies should examine the impact of these different sources of innovation which may affect SMEs differently.

This issue is interesting to be studied because it is unknown whether the SMEs under investigation used their own internal or external resources to do innovation in product and process. It other words, how product and process innovation is done in the SMEs should be examined, so that other SMEs could factor in the knowledge in their decision making process of innovation. Both sources of innovation have their own advantages and disadvantages and may give possible outcomes differently.

References

Achrol, R. S. & Etzel, M. J. (2003). “The Structure of Reseller Goals and Performance in Marketing Channels,” Journal of the Academy of Marketing Science, 31(2), 146-163.

Publisher – Google Scholar

Alegre, J., Lapiedra, R. & Chiva, R. (2006). “A Measurement Scale for Product Innovation Performance,” European Journal of Innovation Management, 9 (4), 333-346.

Publisher – Google Scholar

Alowaihan, A. K. (2004). “Gender and Business Performance of Kuwait Small Firms: A Comparative Approach,”International Journal of Commerce and Management, 14 (3/4), 69 — 82.

Publisher – Google Scholar

Anderson, A., Wahab, K. A., Amin, H &; Chong, R. (2009). “Firm Performance: An Analysis from the Theory of Innovation,” Australian Graduate School Entrepreneurship. [Online], [Retrieved July 29, 2012], http://www.swinburne.edu.au/lib/ir/onlineconferences/agse2009/000162.pdf

Publisher

Appiah-Adu, K. & Satyendra, S. (1998). “Customer Orientation and Performance: A Study of SMEs,” Management Decisions, 36 (6), 385-94.

Publisher – Google Scholar

Ar, I. M. & Baki, B. (2011). “Antecedents and Performance Impacts of Product versus Process Innovation: Empirical Evidence from SMEs Located In Turkish Science and Technology Parks,” European Journal of Innovation Management, 14 (2), 172-206.

Publisher – Google Scholar

Bagorogoza, J. & Waal, A. D. (2010). “The Role of Knowledge Management in Creating and Sustaining High Performance Organisations the Case of Financial Institutions in Uganda,” World Journal of Enterprenuership Management and Sustainable Development, 6 (4), 307-323.

Publisher – Google Scholar

Bakar, L. J. A. & Ahmad, H. (2010). “Assessing the Relationship between Firm Resources and Product Innovation Performance,” Business Process Management Journal, 16(3), 420-435.

Publisher – Google Scholar

Barbara, J. O., Sandy, H. S. & Allan, L. R. (2000). “Performance, Firm Size, and Management Problem Solving,” Journal of Small Business Management, 38 (4), 42-58.

Publisher – Google Scholar

Bayus, B. L., Erickson, G. & Jacobson, R. (2003). “The Financial Rewards of New Product Introductions,” Management Science, 49 (2), 197-210.

Publisher – Google Scholar

Beaver, G. (2002). Small Business, Entrepreneurship and Enterprise Development, Pearson Education Ltd, United Kingdom.

Publisher – Google Scholar

Birley, S. & Westhead, P. (1990). “Growth and Performance Contrast Between ‘Types’ of Small Firms,” Strategic Management Journal, 11(7), 535-557.

Publisher – Google Scholar

Bonn, I. (2000). “Staying on Top: Characteristics of Long-Term Survival,” Journal of Organizational Change Management, 13(1), 32-48.

Publisher – Google Scholar

Calantone, R. J., Vickery, S. K. & Droge, C. (1995). “Business Performance and Strategic New Product Development Activities: An Empirical Investigation,” Journal of Product Innovation Management, 12, 214-23.

Publisher – Google Scholar

Camison, C. & Lopez, A. V. (2010). “An Examination of the Relationship between Manufacturing Flexibility and Firm Performance: The Mediating Role of Innovation,” International Journal of Operations & Production Management, 30(8), 853-878.

Publisher – Google Scholar

Cano, C. R., Carrillat, F. A. & Jaramillo, F. (2004). “A Meta-Analysis of the Relationship between Market Orientation and Business Performance: Evidence from Five Continents,” International Journal of Research in Marketing, 21 (2), 179-200.

Publisher – Google Scholar

Capon, N., Farley, J. U. & Hoenig, S. M. (1990). ‘A Meta-analysis of Financial Performance,’ Management Science, 36 (10), 1143-1160.

Google Scholar

Carbonell, P. & Rodriguez, A. I. (2006). “The Impact of Market Characteristics and Innovation Speed on Perceptions of Positional Advantage and New Product Performance,” International Journal of Research in Marketing, 23(1), 1-12.

Publisher – Google Scholar

Chong, A. Y. L., Chan, F. T. S., Ooi, K. B. & Sim, J. J. (2011). “Can Malaysian Firms Improve Organizational/ Innovation Performance via SCM,” Industrial Management and Data System, 111 (3), 410-431.

Publisher – Google Scholar

Collins, J. C. & Porras, J. I. (2000). “Built to Last — Successful Habits of Visionary Companies,” London: Random House. [Online], [Retrieved September 15, 2011], http://dowlingconsulting.ca/Builtto.pdf

Publisher

Craig, A. & Hart, S. (1992). “Where to Now in New Product Development Research,” European Journal of Marketing, 26 (11), 1-49.

Publisher – Google Scholar

Cronbach, L. J. (1951). “Coefficient Alpha and the Internal Structure of Tests,” Psychometrika, 16, 297-334.

Publisher – Google Scholar

Cumming, B. S. (1998). “Innovation Overview and Future Challenges,” European Journal of Innovation Management, 1(1), 21 — 29.

Publisher – Google Scholar

Darroch, J. (2005). “Knowledge Management, Innovation and Firm Performance,” Journal of Knowledge and Management, 9(3), 101-115.

Publisher – Google Scholar

Darroch, J. & McNaughton, R. (2002). “Examining the Link between Knowledge Management Practices and Types of Innovation,” Journal of Intellectual Capital, 3(3), 210-222.

Publisher – Google Scholar

D’Cruz, J. & Rugman, A. (1992). ‘New Concepts for Canadian Competitiveness,’ Kodak Canada, Toronto.

Google Scholar

Delaney, J. T. & Huselid, M. A. (1996). “The Impact of Human Resource Management Practices on Perceptions of Performance in for-Profit And Nonprofit Organizations,” Academy of Management Journal, 39, 949-969.

Publisher – Google Scholar

Dobbs, M. & Hamilton, R. T. (2006). “Small Business Growth: Recent Evidence and New Directions,” International Journal of Entrepreneurial Behaviour and Research, 13 (5), 296-322.

Publisher – Google Scholar

Dyke, L. S. & Fisher, E. M. (1992). ‘An inter-industry Examination of the Impact of Owner Experience on Firm Performance,’ Journal of Small Business Management, 30 (4), 72-87.

Google Scholar

Espallardo, M. H. & Ballester, E. D. (2009). “Product Innovation in Small Manufacturers, Market Orientation and the Industry’s Five Competitive Forces: Empirical Evidence from Spain,” European Journal of Innovation Management, 12 (4), 470-491.

Publisher – Google Scholar

Fairlie, R. W. & Robb, A. (2007). “Families, Human Capital and Small Business: Evidence from the Characteristics of Business Owners Survey,” Industrial and Labor Relations Review, 60 (2), 225-245.

Publisher – Google Scholar

Forker, L. B., Vickery, S. K. & Droge, C. L. M. (1996). “The Contribution of Quality to Business Performance,”International Journal of Operations and Production Management, 16 (8), 44-62.

Publisher – Google Scholar

Frazier, G. L. & Howell, R. D. (1983). “Business Definition and Performance,” Journal of Marketing, 47, 59 — 67.

Publisher – Google Scholar

Freeman, C. (1982). ‘The Economics of Industrial Innovation,’ 2nd ed., Frances Printer, London, UK.

Google Scholar

Garnsey, E. (1988). “A Theory of the Early Growth of the Firm,” Industrial and Corporate Change, 7 (3), 523-556.

Publisher – Google Scholar

Garrigos-Simon, F. J., & Marques, D. P. (2004). ‘Competitive Strategies and Firm Performance: A Study in the Spanish Hospitality Sector,’ Management Research, 2 (3), 251—269.

Garvin, D. A. (1987). “Competing on the Eight Dimensions of Quality,” Harvard Business Review, 65 (6), 101-109.

Publisher

Gatignon, H. & Xuereb, J.- M. (1997). “Strategic Orientation of the Firm and New Product Performance,” Journal of Marketing Research, 34 (1), 77-90.

Publisher – Google Scholar

Georgellis, Y., Joyce, P. & Woods, A. (2000). “Entrepreneurial Action, Innovation and Business Performance: The Small Independent Business,” Journal of Small Business and Enterprise Development, 7 (1), 7-17.

Publisher – Google Scholar

Gibrat, R. (1931). ‘Les Inégalités Économiques,’ Paris, France, 1931.

Google Scholar

Gopalakrishnan, S. & Damanpour, F. (1997). “A Review Economics of Innovation Research in Sociology and Technology Management,” Omega, 25 (1), 15-28.

Publisher – Google Scholar

Grant, R. M., Jammine, A. P. & Thomas, H. (1988). “Diversity, Diversification, and Profitability among British Manufacturing Companies 1972—1984,” Academy of Management Journal, 31, 771—801.

Publisher – Google Scholar

Guimaraes, T. & Langley, K. (1994). “Developing Innovation Benchmarks: An Empirical Study,” Benchmarking for Quality Management and Technology, 1 (3), 3-20.

Publisher – Google Scholar

Han, J. K., Kim, N. & Srivastava, R. K. (1998). “Market Orientation and Organizational Performance: Is Innovation a Missing Link?,” Journal of Marketing, 62 (4), 30-45.

Publisher – Google Scholar

Hoskin, K. (1990). ‘Using History to Understand Theory: A Re-considerations of the Historical Generri of ‘Strategy’,’ Paper prepared for the E1ASM Workshop on Strategy, accounting and control, Venice, Italy.

Google Scholar

Hsueh, L.- M. & Tu, Y.- Y. (2004). “Innovation and the Operational Performance of Newly Established Small and Medium Enterprises in Taiwan,” Small Business Economics, 23, 99—113.

Publisher – Google Scholar

Hult, G. T. M., Hurley, R. F. & Knight, G. A. (2004). “Innovativeness: Its Antecedents and Impact on Business Performance,” Industrial Marketing Management, 33 (5), 429-38.

Publisher – Google Scholar

Hurley, R. F. & Hult, G. T. M. (1998). ‘Innovation, Market Orientation and Organizational,’ Industrial Marketing Management, 24 (5), 439-456.

Johne, A. (1999). “Successful Market Innovation,” European Journal of Innovation Management, 2 (1), 6-11.

Publisher – Google Scholar

Johne, A. & Davies, R. (2000). “Innovation in Medium-Sized Insurance Companies: How Marketing Adds Value,”International Journal of Bank Marketing, 18 (1), 6-14.

Publisher – Google Scholar

Jong, J. P. J. & Vermeulen, P. A. M. (2006). “Determinants of Product Innovation in Small Firms: A Comparison across Industries,” International Small Business Journal, 24 (6), 587-609.

Publisher – Google Scholar

Jutla, D., Bodorik, P. & Dhaliwal, J. (2002). “Supporting the E-Business Readiness of Small and Medium-Sized Enterprises: Approaches and Metric,” Internet Research: Electronic Networking Applications and Policy, 12 (2), 139-64.

Publisher – Google Scholar

Kao, J. J. (1989). “Entrepreneurship, Creativity and Organization: Text, Cases and Readings,” Prentice Hall, New Jersey.

Publisher

Kaplan, M. J. & Warren, A. C. (2007). ‘Patterns of Entrepreneurship,’ Second Edition, John Wiley and Sons Inc, USA.

Kellermanns, F. W., Eddleston, K. A., Sarathy, R. & Murphy, F. (2010). ‘Innovativeness in Family Firms: A Family Influence Perspective,’ Small Business Economics. [Online], [Retrieved September, 6, 2012], DOI 10.1007/s11187-010-9268-5

Kemp, R. G. M., Folkeringa, M., Jong, J. P. J. & Wubben, E. F .M. (2003). Innovation and Firm Performance, Research Report H200207, Netherlands.

Publisher – Google Scholar

Krager, J. & Parnell, J. A. (1996). “Strategic Planning Emphasis and Planning Satisfaction in Small Firms: An Empirical Investigation,” Journal of Business Strategies, spring: 120.

Publisher – Google Scholar

Kumar, N., Stern, L. W. & Anderson, J. C. (1993). “Conducting Interorganizational Research Using Key Informants,”Academy of Management Journal, 36, 1633—51.

Publisher – Google Scholar

Kuratko, D. F. & Hodgetts, R. M. (2004). ‘Entrepreneurship: Theory, Process and Practices,’ 6th edition, Smith western, USA.

Langley, D. J., Pals, N. & Ort, J. R. (2005). “Adoption of Behaviour: Predicting Success for Major Innovations,” European Journal of Innovation Management, 8 (1), 56-78.

Publisher – Google Scholar

Lan, Q. & Wu, S. (2010). “An Empirical Study of Entrepreneurial Orientation and Degree of Internationalization of Small and Medium-Sized Chinese Manufacturing Enterprises,” Journal of Chinese Entrepreneurship, 2 (1), 53-75.

Publisher – Google Scholar

Lievens, A. & Moanert, R. K. (2000). “Communication Flows During Financial Service Innovation,” European Journal of Marketing, 34 (9/10), 1078-110.

Publisher – Google Scholar

Lin, C.- H., Peng, C.- H., & Kao, D. T. (2008). “The Innovativeness Effect of Market Orientation and Learning Orientation on Business Performance,” International Journal of Manpower, 29 (8), 752-772.

Publisher – Google Scholar

Lin, Y. Y.- Y. & Chen, M. Y.- C. (2007). “Does Innovation Lead to Performance? An Empirical Study of SMEs in Taiwan,”Management Research News, 30 (2), 115-132.

Publisher – Google Scholar

Long, N. V. (2006). ‘Performance and Obstacles of SMEs in Vietnam Policy Implications in Near Future,‘ International IT Policy Program (ITPP), Seoul National University, Seoul, Korea.

Love, L. G., Priem, R. L., & Lumpkin, G. T. (2002). “Explicitly Articulated Strategy and Firm Performance under Alternative Levels of Centralization,” Journal of Management, 28 (5), 611—627.

Publisher – Google Scholar

Lumpkin, G. T. & Dess, G. G. (1996). “Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance,”Academy of Management Journal, 21 (1), 135-72.

Publisher – Google Scholar

Lumpkin, G. T. & Dess, G. G. (2001). “Linking Two Dimensions of Entrepreneurial Orientation to Firm Performance: The Moderating Role of Environment and Industry Life Cycle,” Journal of Business Venturing, 16, 429-51.

Publisher – Google Scholar

Mahoney, J. T. (1995). “The Management of Resources and the Resource of Management,” Journal of Business Research, 33, 91-101.

Publisher – Google Scholar

Marquis, D. G. & Myers, S. (1969). ‘Successful Industrial Innovations,’ National Science Foundation, Washington, DC.

Google Scholar

Medina, C. & Rufin, R. (2009). “The Mediating Effect of Innovation in the Relationship between Retailers, Strategic Orientations and Performance,” International Journal of Retail and Distribution Management, 37 (7), 629-655.

Publisher – Google Scholar

Mengistae, T. (2006). “Competition and Entrepreneurs’ Human Capital in Small Business Longevity and Growth,” Journal of Development Studies, 42 (5), 812-836.

Publisher – Google Scholar

Mohd. Aris, N. (2007). “SMEs: Building Blocks for Economic Growth,” Department of Statistics. [Online], [Retrieved August 2, 2012], http://www.statistics.gov.my/portal/download_journals/files/2007/Volume1/Contents_smes.pdf

Publisher

Moreno, A. M. & Casillas, J. C. (2007). “High-growth SMEs versus Nonhigh-Growth SMEs: A Discriminant Analysis,”Entrepreneurship and Regional Development, 19, 69-88.

Publisher – Google Scholar

Morone, P. & Testa, G. (2008). “Firms Growth, Size and Innovation an Investigation Into: The Italian Manufacturing Sector,” Economics of Innovation and New Technology, Taylor and Francis Journals, 17 (4), 311-329.

Publisher – Google Scholar

Morris, M. H., Kuratko, D. F. & Covin, J. G. (2008). Corporate Entrepreneurship and Innovation, Second Edition, Mason,Thomson South-western.

Publisher – Google Scholar

Nemetz, P. L. & Fry, L. W. (1988). “Flexible Manufacturing Organizations: Implications for Strategy Formulation and Organization Design,” Academy of Management Review, 13 (4), 627-638.

Publisher – Google Scholar

Nichter, S. & Goldmark, L. (2009). “Small Firm Growth in Developing Countries,” World Development, 37 (9), 1453—1464.

Publisher – Google Scholar

Oke, A., Burke, G. & Myers, A. (2007). “Innovation Types and Performance in Growing UK SMEs,” International Journal of Operations and Production Management, 27 (7), 735-753.

Publisher – Google Scholar

Otero-Neira, C., Lindman, M. T. & Fernández, M. J. (2009). “Innovation and Performance in SME Furniture Industries: An International Comparative Case Study,” Marketing Intelligence & Planning, 27 (2), 216-232.

Publisher – Google Scholar

Ozgulbas, N., Koyuncugil, A. S. & Yilmaz, F. (2006). ‘Identifying the Effects of Firm Size on Financial Performance of SMEs,’ The Business Review, Cambridge, 6 (1), 162-167.

Pallant, J. (2007). ‘SPSS: Survival Manual,’ 3rd ed. NSW, Australia, Allen & Unwin.

Google Scholar

Peng, D. X., Schroeder, R. G. & Shah, R. (2011). “Competitive Priorities, Plant Improvement and Innovation Capabilities, and Operational Performance: A Test of Two Forms of Fit,” International Journal of Operations & Production Management, 31 (5), 484-510.

Publisher – Google Scholar

Penrose, E. T. (1959). ‘The Theory of the Growth of the Firm,’ Oxford University Press: New York.

Peteraf, M. A. (1993). “The Cornerstones of Competitive Advantage: A Resource-Based View,” Strategic Management Journal, 14 (3), 179-191.

Publisher – Google Scholar

Porter, M. E. (1990). The Competitive Advantage of Nations, New York: Free Press, MacMillan.

Publisher – Google Scholar

Prajogo, D. I., Laosirihongthong, T., Sohal, A. & Boon-itt, S. (2007). “Manufacturing Strategies and Innovation Performance in Newly Industrialised Countries,” Industrial Management & Data Systems, 107 (1), 52-68.

Publisher – Google Scholar

Reuber, A. R., Dyke, L. S. & Fisher, E. M. (1990). “Experientially Acquired Knowledge and Entrepreneurial Venture Success,” Academy of Management Best Paper Proceedings, 69-73.

Publisher – Google Scholar

Roberts, P. W., & Amit, R. (2003). “The Dynamics of Innovative Activity and Competitive Advantage: The Case of Australian Retail Banking, 1981 to 1995,” Organization Science, 14 (2), 107-122.

Publisher – Google Scholar

Rubio, A. & Aragon, A. (2009). “SMEs Competitive Behavior: Strategic Resources and Strategies,” Management Research, 7(3), 171—190.

Publisher – Google Scholar

Sandesara, J. C. (1966). ‘Scale and Technology in India Industry,’ Oxford Bulletin of Economics, 28 (3), 181-198.

Sandvik, I. L. & Sandvik, K. (2003). “The Impact of Market Orientation on Product Innovativeness and Business Performance,” International Journal of Research in Marketing, 20 (4), 255-376.

Publisher – Google Scholar

Segev, E. (1987). “Strategy, Strategy Making and Performance in a Business Game,” Strategic Management Journal, 8, 565-77.

Publisher – Google Scholar

Short, J. C., Ketchen, D. J., Palmer, T. B. & Hult, G. T. (2007). “Firm, Strategic Group, and Industry Influences on Performance,” Strategic Management Journal, 28 (2), 147-167.

Publisher – Google Scholar

Simon, F. J., Marques, D. P. & Narangajavana, Y. (2005). “Competitive Strategies and Performance in Spanish Hospitality Firms,” International Journal of Contemporary Hospitality Management, 17 (1), 22-38.

Publisher – Google Scholar

Simpson, P. M., Siguaw, J. A. & Enz, C. A. (2006). “Innovation Orientation Outcomes: The Good and the Bad,” Journal of Business Research, 59 (10-11), 1133-41.

Publisher – Google Scholar

Singh, R. K., Garg, S. K.. & Deshmukh S. G. (2010). “The Competitiveness of SMEs in a Globalized Economy Observation from China and India,” Management Research Review, 33 (1), 54-56.

Publisher – Google Scholar

Tavitiyaman, P., Zhang, H. Q., & Qu, H. (2012). “The Effect of Competitive Strategies and Organizational Structure on Hotel Performance,” International Journal of Contemporary Hospitality Management, 24 (1), 140-159.

Publisher – Google Scholar

Temperley, N. C., Galloway, J. & Liston, J. (2004). “SMEs in Australia’s High-Technology Industry: Challenges and Opportunities,” CSIRO/AEEMA.

Publisher

Thornhill, S. (2006). “Knowledge, Innovation and Firm Performance in High- and Low-Technology Regimes,” Journal of Business Venturing, 21, 687-703.

Publisher – Google Scholar

Trau, F. (1996). Why Do Firms Grow?, Working Paper, 26, Roma, Italy.

Publisher – Google Scholar

Trienekens, J., Uffelen, R., Debaire, J. & Omta, O. (2008). “Assessment of Innovation and Performance in the Fruit Chain: The Innovation-Performance Matrix,” British Food Journal, 110 (1), 98-127.

Publisher – Google Scholar

Varis, M. & Littunen, H. (2010). “Types of Innovation, Sources of Information and Performance in Entrepreneurial SMEs,”European Journal of Innovation Management, 13 (2), 128-154.

Publisher – Google Scholar

Wan, D., Ong, C. H. & Lee, F. (2005). “Determinants of Firm Innovation in Singapore,” Technovation, 25 (3), 261-8.

Publisher – Google Scholar

Wang, C. L. & Ahmed, P. K. (2004). “The Development and Validation of the Organizational Innovativeness Construct Using Confirmatory Factor Analysis,” European Journal of Innovation Management, 7 (4), 303-13.

Publisher – Google Scholar

Wernerfelt, B. (1984). “A Resource-Based View of The Firm,” Strategic Management Journal, 5, 171-80.

Publisher – Google Scholar

Wolff, J.A. & Pett, T.L. (2006). “Small-firm Performance: Modeling the Role of Product and Process Improvements,”Journal of Small Business Management, 44 (2), 268-84.

Publisher – Google Scholar

Zahra, S. A. (2008). “Being Entrepreneurial and Market Driven: Implications for Company Performance,” Journal of Strategy and Management, 1 (2), 125-142.

Publisher – Google Scholar

Zahra, S. A. & Das, S. R. (1993). “Innovation Strategy and Financial Performance in Manufacturing Companies: An Empirical Study,” Product and Operations Management, 2 (1), 90-101.

Publisher – Google Scholar

Zhang, J. & Duan, Y. (2010). “The Impact of Different Types of Market Orientation on Product Innovation Performance: Evidence from Chinese Manufacturers,” Management Decision, 48 (6), 849-867.

Publisher – Google Scholar

Zhuang, L., Williamson, D. & Carter, M. (1999). “Innovate or Liquidate — Is All Organizations Convinced? A Two-Phased Study into the Innovation Process,” Management Decision, 37 (1), 57-71.

Publisher – Google Scholar