Introduction

Services have been subject to small attention in the academic research during the last decades. They have intangible-features and, therefore, theorists face major problems linked to services measurement. Services are considered as less productive and less-innovative and are regarded as residual activities. However, a recent literature contradicts such considerations and admits that services are also subject to the innovation processes (Gadrey, 1992; Miles, 1994; Gallouj and Weinstein, 1997), which is related mainly to the development of the information and communication technologies (hereafter, ICT).

The development of the ICTs has given service firms more opportunities to develop higher added-value service activities. These firms are motivated to introduce varieties of new services. However, in the academic side we have some limitations. In one hand, the empirical studies on innovation have been focused notably on innovation in the manufacturing sector. However, research on innovation in the service sector is rather rare. On the other hand, the topic that has been treated, in this context, is the impact of some factors, such as R&D expenditure, the firm’s size and the patent race on the firms’ performance, but never the impact of innovation on the firm performance. Innovation-performance relationship is a quite recent topic.

It has been studied by Mansury and Love (2008) for American companies, Mairesse and Mohnen (2003) for European companies, Lopes and Godinho (2005) for Portuguese firms, Cainelli and Savona (2006) for Italian firms. However, empirical analyses at the firm level that investigate the relationship between service innovation and the firms’ performance in the case of emerging countries remain rather limited such as the case in Tunisia.

The aim of our paper is not limited to find out the major determinants of innovation decisions but also to analyze the impact of this innovation on the performance of Tunisian service firms.

To fulfill this purpose, a survey has been carried out in order to identify the firm’s innovation motivations and tools. Our data has been collected through a questionnaire, which has been hand out to some Tunisian service firms. Then our econometric analysis is done using the Heckman’s two-stage econometric model.

The paper is structured as follows. The next section provides brief review on the literature dealing with the innovation-performance relationship. Section 3 contains a description of the data set and the variables used in the empirical analysis.

The regression model used to estimate the impact of innovation on performance and the results of the empirical analysis are presented in section 4 and 5 respectively. The concluding section synthesizes the main empirical findings presented in the paper.

Literature review

Until recently, the empirical innovation studies have been focused on manufacturing sector (Pavitt, 1984; Love and Roper, 2001; Duget, 2006; Lööf and Heshmati, 2002; Du et al, 2007). Studies on service innovation are rare. Some research on service innovation has been identified. They are focused on the modes, types, and reasons of innovation in services (Miles, 1994; Gallouj and Weinstein, 1997; Sirilli and Evangelista, 1998).

However, there is less research on the impact of service innovation on firms’ performance, especially at the firm level. As Cainelli et al (2006) point out, this is in part due to the scarcity of micro level data but it is also related to the lack of methodological tools to measure innovation activities in the service sector. Cainelli et al (2006) analyze the relationship between innovation and economic performance in services, focusing on the two-way relationship between the innovation and the economic performance in the Italian service sector.

Three various mechanisms were identified. The first one considers the innovation as a determinant of the economic performance whereas the second one regards the economic performance as a powerful determinant of innovation activity. The third considers a dynamic relation between the innovation and the economic performance. They consider “the creation of a new service” and “expenditure in innovation activities” as measures of productivity. They found that the performance positively affects innovation and that innovation activities have a positive impact on sales’ growth and on productivity.

In the same context, Lopes and Godinho (2005) presents a model that links innovation effort to economic performance in the Portuguese service sector, along the lines of Crépon et al (1998). In order to estimate the complex nature of the relationship between innovation and economic performance, they use a system of three simultaneous equations.

The first one explains the innovation effort intensity by its determinants. The second one relates service innovation to the innovation effort intensity. Finally, the third relationship links productivity to the service innovation and to the effort intensity. They find that innovation effort intensity has a positive and significant effect on innovation output. Thus, if firms spend more on innovation activities they will have a higher probability to develop a service innovation.

As a recent empirical research, Mansury and Love (2008) examine the innovation impact on economic performance of American services firms. They distinguish between “new-to-market” and “new-to-firm innovation”. This study pays particular attention to the role of the innovation externalities and their effect on business performance. The authors found that service innovation and its extent has a positive effect on sales’ growth, but no effect on productivity.

This finding contradicts the result found by Mairesse and Mohnen (2003) who found out a positive relationship between the productivity level and product innovation but process innovation has not any effect on the productivity.

The data-set

In this paper, we present a model that links innovation activities to firm’s performance, along the lines of the Mansury and Love (2008) model, which analyze the impact of innovation on the performance of US business service firms. The present research examines the relationship between innovation and performance for Tunisian service firms. With regard to the introduction of new services, we use two levels of innovation: “new to the firm” and “new to the market” innovation (i.e. introduced by the firm for the first time but it’s not the case for competitors). We notably deal with service firms that are specialized in the value-added services.

Data were collected through a questionnaire1 , which has been distributed to some Tunisian service firms. The questionnaire collected information about the firm’s features (size, the share of qualified workers, group belonging…), their R&D expenditure devoted to the innovation activities as well as the objectives of their innovations. The questionnaire also incorporates some questions on the turnover which allows us to calculate the productivity and the sales growth over the period 2005-2007.

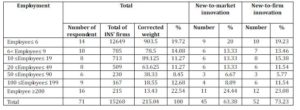

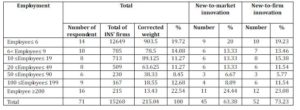

Table 1 show that 22.54% of respondents come from very large firms, 19.72% from micro firms and 14.08% from small firms. In addition, this table reveals that 63.38% of the surveyed firms have introduced at least one “new-to-market” innovation but 73.23% have introduced at least one “new-to-firm” innovation.

Table 1 : Distribution of the firms according to the siz

Of the 150 questionnaires directly distributed, 71 usable responses were obtained, representing a response rate of 47%. However, these observations are not adequately weighted. Our sample has been stratified by NAT2 size (7classes by number of employees:1-6, 6-9, 10-19, 20-49, 50-90, 100-199, 200 and over) in order to obtain a better weights of our sample observations.

Model and estimation

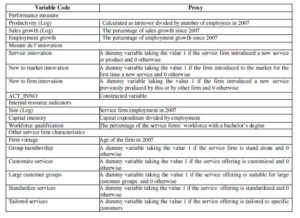

To analyze the impact of the innovation activities on the performance of the Tunisian companies, most of the previous studies measured the innovation by indicators such as R&D expenditures, number of patents or copyrights, etc. In our paper, we adopt an econometrical method considering that the innovation can be measured by some determinants. These determinants incorporate indicators of internal resources such as employment, firm vintage, the human resources and the membership of group.

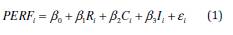

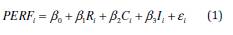

Our model is presented as follows:

Where is the performance of firm i

is the performance of firm i , is a set of internal resource indicators

, is a set of internal resource indicators , is a set of other firm characteristics and

, is a set of other firm characteristics and  is a measure of innovation. In this model, the performance is measured by three economic indicators that are labor productivity (turnover per employee3 ), sales growth (percentage of the volume of sales) and the employment growth over the period 2005-2007.

is a measure of innovation. In this model, the performance is measured by three economic indicators that are labor productivity (turnover per employee3 ), sales growth (percentage of the volume of sales) and the employment growth over the period 2005-2007.

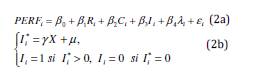

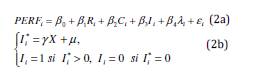

We use the Heckman two-stage econometric model to estimate the parameters of this model. In the first stage, we estimate the determinants of innovation decision where the dependent variable is a dummy indicating whether or not the firm has innovated over the previous three years. In the second stage, we estimate the parameters of the firm’s performance equation, considering the innovation frequency (estimated at the first stage) as one of its determinants. The estimation by the Probit model (the first stage) determines the inverse Mills ratio4

The model in two stages can be expressed as follows:

Where  is a dummy variable taking 1 if the firms

is a dummy variable taking 1 if the firms innovate and 0 otherwise

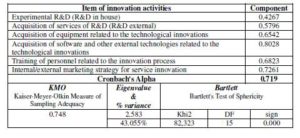

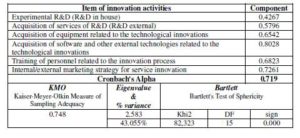

innovate and 0 otherwise . is a vector of the explanatory variables including “firm vintage”, “group membership”, “size’ firm”, “personal qualification”. Furthermore, using the Principal Component Analysis (ACP), we compute a synthetic index about firms’ innovation activities. This constructed variable is noted as “ACT_INNO” throughout the paper5 .

. is a vector of the explanatory variables including “firm vintage”, “group membership”, “size’ firm”, “personal qualification”. Furthermore, using the Principal Component Analysis (ACP), we compute a synthetic index about firms’ innovation activities. This constructed variable is noted as “ACT_INNO” throughout the paper5 .

Results

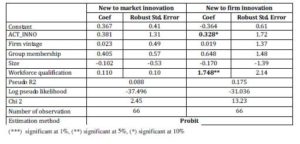

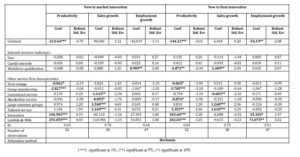

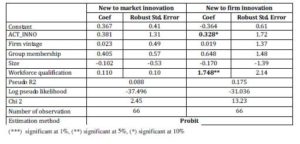

Table 3 reports the econometric estimation results of equation (2a) which help to analyze the relationship between innovation and performance of the service firms. Our results show that innovation has different effects on the three economic indicators of the performance. It has a positive effect both on productivity and on employment growth. However, it has no effect on sales growth.

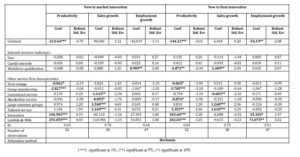

The impact of innovation on productivity, employment and sales growth

As shown in table 3, the “new to market” and “new to firm” innovation has a positive and statistically significant effect on firm productivity (measured by the turnover per employee). This suggests that innovation activities, undertaken in order to develop and implement service innovations, may improve firms’ productivity. However, opposite effects has been noted by Mansury and Love (2008). They interpret this finding as a “disruption effect”. In the short term, the introduction of new services to the firm may disturb production and reduce productivity. The origin of difference is linked to the innovation measurement. They consider the percentage of “new to market” and “new to firm” services in total sales as innovation measurement rather than a dummy innovation variable.

We note that “new to market” innovation affects positively the employment growth. This result suggests that firms innovate is positively correlated to employment. Similar effect has been noted by Cainelli et al (2006). Another important result concerns the role of workforce qualification. The workforce qualification has a positive and statistically significant effect on the sales growth as well as on the employment growth. The workforce qualification6represents an important determinant of the innovation decision. This result proves that the workforce qualification is positively correlated to productivity.

Our estimation results show also that the “new to market” and “new to firm” innovation has no effect on the sales growth. We can say that consumers do not rapidly perceive new technologies (the adoption of new services takes time and thus the consumers maintain the old technologies). As illustration, we observe nowadays third generation (3G) technologies in telecommunication industry are less easy to use or to manipulate (the reason is that service providers charge the customers a very high prices in order to cover the fixed costs of innovation).

The role of the other service firm characteristics

Table 3 shows that firms which offer a service to more specific customers have a positive effect on productivity and sales growth. This finding suggests that service firms which offer products and services to specific customers are more productive and have an important sales growth. This result has been also noted by Mansury and Love (2008). Specific customers give incentives to firms to sell new products and to consider new marketing strategies. The sales growth arises from the increase of the production and thus of the productivity. Moreover, we note that reaching a large mass of service allows the service firms to realize an economy of scale. This finding indicates that if firm invests in the marketing niches and offers quality service, it will have to attract more market share.

Conclusion

In this paper, we used the Heckman two-stage econometric model in order to analyze the relationship between the innovation decision and the performance of firms in the context of the service sector. Numerous are the studies which showed the existence of a positive relationship between the innovation, the productivity and the sales growth in the manufacturing industry. In contrast, the empirical studies at the firm level remain limited in the case of developing countries and in particular for Tunisia. In this study, we analyze the motivation of firms to innovate and the determinants of new to market and new to firm innovations.

In this analysis, we used a data from a survey of 71 Tunisian service firms and we focus especially on the high value-added services. Our results show that the presence of service innovation has different effects on the three indicators of performance (productivity, sales growth and employment growth). We find that innovation has a positive and significant effect on the productivity and on the employment growth but it has no effect on the sales growth.

Table 2: Determinant of service innovation

Table 3: Estimation of the impact of innovation on performance

Table 3 is a very large table please look at it in PDF format

APPENDIX

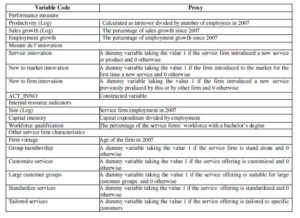

Variable definitions are given in table A1.

Table A1: List of variables

Table A2: Matrix of component

Endnotes :

1The questionnaire was a modified version of the third community survey on innovation CIS III and the second European survey on innovation 1997.

2National Institute of the Statistics (INS): distribution of companies by activity and by number of employees in 2007.

3Due to the absence of data on value added and capital stock, we approximately measure productivity using the indicator turnover per employee. This measure was also used by Mairesse and Mohnen (2003).

4 For more detail, see Greene (2003).

5Table A2 displays the PCA result on innovation determinants.

6We consider as qualified, the percentage of the service firms’ workforce with a bachelor’s degree.

References

Cainelli, G., Evangelista, R. and Savona, M. (2006), “Innovation and economic performance in services: a firm-level analysis”, Cambridge Journal of Economics, 30 (3), 435-458.

Publisher – Google Scholar – British Library Direct

Crépon, B., Duguet, E. and Mairesse, J. (1998), “Research, innovation and productivity: an econometric analysis at the firm level”, Economics of Innovation and New Technology, (7), 115-158.

Publisher – Google Scholar

Du, J., Love, H. and Roper, S. (2007), “The innovation decision: An economic analysis”, Technovation, (27), 766—773.

Publisher – Google Scholar

Duget, E. (2006), “Innovation height, spillovers and TFP growth at the firm level: Evidence from French manufacturing”, Economics of Innovation and New Technology, (15), 415-442.

Publisher – Google Scholar – British Library Direct

Gadrey, J. (1992) L’économie des services, La Découverte, Paris.

Gallouj, F. and Weinstein, O. (1997), “Innovation in services”, Research Policy, (26), 537 — 556.

Publisher – Google Scholar

Greene, WH. (2003) Econometric Analysis, Fifth Edition, Prentice Hall.

Publisher – Google Scholar

Lööf, H. and Heshmati, A. (2002), “Knowledge capital and performance heterogeneity: a firm level innovation study”, International Journal of Production Economics, (76), 61-85.

Publisher – Google Scholar

Lopes, F. L. and Dodinho. M. Mira., (2005), “Services Innovation and Economic Performance: An analysis at the firm level“, DRUID Working Papers, N°05-08.

Publisher – Google Scholar

Love, JH. and Roper, S. (2001), “Location and network effects on innovation success: evidence for UK, German and Irish manufacturing plants”, Research Policy, (30), 643-661.

Publisher – Google Scholar

Mairesse, J. and Mohnen, P. (2003), “R&D and productivity: a re-examination in light of the innovation surveys”. Paper presented in DRUID Summer conference, Copenhagen, 12-14 June 2003.

Mansury, M. Love, A. and James, H. (2008), “Innovation, productivity and growth in US business services: A firm-level analysis”. Technovation, (28), 52-62.

Publisher – Google Scholar

Miles, I. (1994), “Innovation in Services”, In M. Dodgson, R. Rothwell (Eds.), the Handbook of Industrial Innovation. Edward Elgar: Cheltenham, UK.

Pavitt, K. (1984), “Sectoral patterns of technical change: Towards a taxonomy and a theory”, Research Policy, (13), 343-373.

Publisher – Google Scholar

Sirilli, G. and Evangelista, R. (1998), “Technological innovation in services and manufacturing: results from Italian surveys”, Research Policy, (27), 881-899.

Publisher – Google Scholar