Introduction

It is like a small stone swung by David that flies a cross and hits Goliath face; the small amount of individual-level irrationality, such as money illusion, can have large effects (Akerlof & Yellen, 1985; Haltiwanger & Waldman, 1985, 1989). The modern economics discredited view on money illusion has indeliberately made this mistake in discounting which not only lead to wrong decisions and inefficient equilibria, but also the notion of money illusion, which seems to be thoroughly discredited in modern economics, unfortunately with its presence and impact on most people’s daily life become profound and wide-spread.

A good example of this phenomenon is the effect of two financial crises in Indonesia, i.e., the Asian financial crisis 1997 and the global financial crisis 2008. Indonesia’s post-economic global crisis panorama, based on Indonesia’s Central Bureau of Statistics (BPS) released data 1998, reported a unique phenomenon in financial and economic perspectives and theory, i.e., the inflation and consumption index was relatively high even though it was reported that the economic condition was in financial distress.

The BPS also reported that there was a shifting pattern in people’s private consumption, where the number of secondary needs’ sales was increasing drastically (BPS, 2009). The producers of motorcycles, mobile phones, electronic goods and other luxurious goods were enjoying a big demand while many economistssaid that the world economy still was in the global crisis. This phenomenon is the main factor to examining the effect of money illusion phenomenon on the Jakarta metropolises’ perception on the value of money– the most-assumed educated people in Indonesia since they live in capital city– and their living-cost spending management. The researchers predict in this study that people spent more money on secondary needs consumption in 2008 due to the fact that “cheaper price illusion” has diluted their basic aptitude in measuring economic matters in relative value.

Prior studies revealed that this illusion normally occurred in less-educated people (Shafir, Diamond & Tversky, 1997; Susianto, 1998; Ariani, 1999; Cahyadi, 1999; Prihastuti, 2001). However, these empirical findings are not fit with the current fact when most Indonesian people rejected the Indonesian Central Bank proposal to redenominate the Rupiah (Indonesian currency). They argued that redenomination will give a lesser real value when the nominal value was reduced (Kompas.com, 2010).

This situation gives more insights on how illusion affects all levels of society. However, to the researchers’ knowledge, very few studies focus on the effect of money illusion on educated people with middle-lower income, as Jakarta metropolises. This study will fill in the gap of prior studies, by using Jakarta as the representation of other 33 provinces’ capital city in Indonesia, to test the illusion in the most-vulnerable affected people.

This paper will examine the work of Bakshi (2009), which reports relatively sufficient-educated people are not free from money illusion. If the study results confirm this argument, it will be important for the government to create a certain policy and implementable programs that educate people on good knowledge of measuring economic matters correctly. Hence, at the end, the policy and programs will influence the national competency in economy.

Finally, this study is carried out in two steps, where the answer of the first question will determine whether the researchers continue to the second step. The first question is, “Does the money illusion phenomenon really affect the Jakarta metropolis’ middle-lower income?” If the phenomenon occurs, then the second question to be answered is, “What are the competing determinants of the illusion? Is it the educational background, the type of job, the living expense, or the family pattern of monthly living expense?” The answer of the second question will have resonance in the recommended policies.

This paper is organized in the following manner. First, background on money illusion is provided, including the basic concept of money illusion, numerosity heuristic approach and prior money illusion studies in Indonesia. Research hypotheses are then proposed regarding the demographic characteristics of Jakarta metropolis middle-lower income group. The methodology and experimental approach, including discussion of sampling frame and measures, are then discussed. The answers from 90 respondents are then analyzed, and the results of logic regression test of respondents’ characteristics are provided. Finally, implications for money illusion and government policy and future research on individual’s money illusion related to business and government’s strategies of launching certain political economies are presented.

Literature Review

The Money Illusion and Behavioral Economics

The failure of standard economic models to provide proper explanation to what is happening in different areas of economic activity has opened the behavioral economists to build models that have explanatory power and are based on the observations of real behavior. Those experts moreover define themselves based on their appliance of psychological insight into economic phenomena. Therefore, the accuracy of analytical predictions and causal analysis are significantly dependent on how realistic are the variety of psychological, social, or institutional assumptions. Nowadays, there is an escalating understanding of importance of behavioral economics in public policy decision making and implementation. Most of the studies related to this analyze how people’s emotions and thoughts can affect the way they make money-related decisions. One of the important chapters of behavioral economics is money illusion, which emerges from the idea that economic decisions of individuals are not always a result of pure rationality.

In principle, the phenomenon of money illusion arises whenever people misestimate the real value of their nominal wealth. Fisher (1928:4) defines this illusion as “the failure to perceive that the dollar, or any other unit of money, expands or shrinks in value”. Therefore, money illusion refers to individual or aggregate economic behavior that consists in failing to distinguish transactions in terms of either nominal or real monetary values. In context of financial market, someone suffering from money illusion regards his stock of nominal assets as convertible into potentially more or less real goods and services (“commodities”) than market prices actually allow.

Kane and Klevorick (1967) argued that the essence of money illusion laid in such misperceptions of the price level (P, a weighted average of individual commodities’ prices), the rate of exchange between nominal assets (W) and commodities. Meanwhile, Safir et al. (1997) simply defined it as the tendency to think in terms of nominal rather than real monetary values. This inability can be simply analogized similar to the test of tree illusion as seen below.

Figure 1. The Illusion Trees

If most people assume that the block at the most left side is higher than the other two blocks at the right side, therefore, he or she gets the illusion. In reality, all blocks have the same size and height. Unfortunately, most people suffer money illusion due to the fact that the principle of money neutrality does not apply in our world, especially when inflation neither cause the assets and debts to rise nor commodity prices to rise.

Economists generally assume that money illusion is an error that can be easily eradicated through education and learning. Shiller’s (1997) survey on why people dislike inflation shows that there is a significant difference between the general public and the professional economists in how they view inflation when they were asked about prices and inflation explicitly, i.e., when prices and inflation were made salient in the survey. On the other hand, psychological research suggests that ‘transfer of learning’ across situations is surprisingly weak.

In the last century, economic psychologists have identified several irrational money-related beliefs and behaviors exhibited by consumers (Furnham & Argyle, 1998). Prior studies done by Gamble Garling, Charlton and Ranyard (2002), Modigliani (1986), Pantikin (1965) and Shaffir et al. (1997), among others, have demonstrated the persistence of this behavioral bias—known as the money illusion—in various contexts including currency redenomination.

This mis-perception shows that not only individuals are prone to money illusion, but they believe other people’s behavior is affected by money illusion. The work of Soman, Wertenbroch & Chattopadhyay (2002) reported that economic literature had focused on understanding possible macro-economic implications of money illusion without much attention to the psychological mechanism behind that illusion. Therefore, by this indirect effect, even if on the individual basis money illusion is small, the great impact on aggregate demand/supply, etc., is possible (see Fehr & Tyran, 2001).

The challenging influence of money illusion or its other derivation has been sourcing for multi- perspective studies, especially due to the little explanation of the money illusion, such as studies proposed to account for the typical reactions by consumers to currency redenomination including perceived increases in the prices of goods and services (Brachinger, 2006; Hobijn Ravenna & Tambalotti, 2006; Ranyard, 2007), errors in the monitoring of personal expenditures (Ranyard, 2007; Routh & Burgoyne, 1989, 1990), disturbance in consumer evaluation of transaction (Soman et al., 2002) and some increases in the giving of money at church (Cannon & Cipriani, 2006).

In their examination of the phenomenon of money illusion, Jonas, Greitemeyer, Frey & Schulz-Hardt (2002) found that the nominal value of currency biases its subjective value in a number of ways. People perceived currency with lower nominal value than the familiar currency to be of lesser value, thus leading to an increase in consumer prices so as to be compatible with the nominal value of prices in the familiar currency.

Soman et al. (2002) showed, through a number of experiments, that the numerosity of the nominal difference between prices and reference standards were salient in the evaluation context. Although consumers evaluate transactions in the context of budgetary constraints, they do assess their purchasing power by using the numerosity heuristic. That is, they judge the numerosity of the nominal difference between prices and the number of units into which the difference can be divided. The work of Soman et al. (2002) found that the numerosity heuristic, more so than the anchoring and adjustment heuristic, offered a better explanation of money illusion.

Money Illusion and Numerosity Heuristic

In prior studies, the numerosity heuristic (see, for example, Pelham, Sumarta & Myaskovsky, 1994; Showers 1992; Pelham & Swann, 1989; Wilder 1978, 1977)—the tendency among animals and humans to over infer quantity from numerosity—tends to be activated when people’s cognitive resources are taxed or they are unable to make use of higher order cues for inferring quantity. Under such circumstances, people rely disproportionately on numbers as cues for inferring quantity.

Although Pelham et al. (1994) argued that the numerosity heuristic was a strategy of last resort when individuals are cognitively taxed; they were open to the interpretation that the strategy could also be one of first resort. However, once again, in general, economists have no hesitation in assuming that economic agents are rational, one aspect of these rationalities is free from money illusion. The general premise is that economic decision affects real outcome that directly determines agent’s well-being in question.

When the making of highly systematic judgment requires the use of correct decision rule and the available cognitive resources to apply the systematic decision rule, finding out the real price of goods and services that requires one to calculate it by adjusting inflation over the period of years can hardly be accomplished without access to economic data (Ramoniene & Brazys, 2007). In these circumstances, it is not surprising for people to rely on some form of numerosity heuristic as a first resort (Pelham et al., 1994). The work of Pelham et al. (1994) reports that if inferring quantity from numerosity is less cognitively demanding than the engagement of more systematic reasoning, then it is possible that numerosity is a “default” strategy people rely on in making spontaneous judgments in their daily lives.

The work of Soman et al. (2002) clearly explains how a change in the numerosity of the scale can and does result in changes in spending behavior and total spending. Therefore, it is important that any party, such as the government (political economy decision maker) and businesses to take note of the direct and indirect aggregated economic effects of money illusion. For example, Dusansky and Kalman (1974) observed that in addition to changes in purchasing behavior, disturbances in commodity prices can influence consumer utility.

The Money Illusion Studies in Indonesia

Some prior money illusion studies in Indonesia revealed contradicting results. Susianto’s (1998) study on income factor showed that the proportion of respondents who experienced both types of money illusion did not differ significantly. Meanwhile, the work of Ariani (1999) on certain aspects, such as income, transactions, accounting and mental perception in hypertensive against foreign currencies revealed that middle-class housewives were free from money illusion.

Those findings are different from the work of Cahyadi (1999) that finds the lower-income people are exposed to money illusion in context of the transaction aspect. Based on the unclear findings of money illusion in Indonesia, the present study will expand the coverage by adding demographic characteristics, such as education, occupation, living expense and family pattern of monthly living expense to detect the phenomenon’s effect on middle lower and assumedly educated group, i.e., the Jakarta metropolis middle-lower income group.

Research Methodology

By adopting the idea of numerosity heuristic of Pelham et al. (1994), this paper interviewed and gave a simulated case randomly to 90 selected respondents assumed falling to these criteria, as follows:

- Aged between 21-60 years, assumed as the decision maker or responsible for having money and supporting the family expenditure,

- The maximum family monthly expenditure Rp3.500.000 (equal to US$ 406),

- Level of education at least elementary school

- Employed or working (either permanent, part-time or hourly-based salary),

- Living in Jakarta.

This study deployed a case-based questionnaire consisting of 2 cases. The respondents were required to respond to those two cases, to detect whether they were affected by money illusion. The first case is related to the effect of money illusion on income factor. In this case, it is depicted that an employee receives an increasing salary, however this increase is still below the inflation rate. Another employee assumedly receives the same increasing salary with a lesser nominal value than the first one, assuming there is no inflation. Then, the respondent was asked to choose between these two employees: who is wealthier (labeled as income 1) and happier (labeled as income 2).

The second case is related to the transaction aspect of money illusion. In this case, two persons buy gold at the beginning of the year. At the end of the year, one of them sells his own gold with a higher nominal price (about 23% higher than its purchasing price) under the scenario that the inflation rate is 25%. In the other scenario, the second employee sells the gold at a lower nominal price (about 1% lower than its purchasing price) assuming there is no inflation.

The respondent was asked to choose which one of these two employees made a good selling. Based on the answer of both cases, the researchers were able to determine whether the respondents were exposed to the money illusion phenomenon. To see the effect of the demographic characteristics and the respondent’s role on family financial planning, this study adopted the modified model from prior researches, e.g., Pujiastuti (2001) and Shafir et al. (1997).

Results and Discussion

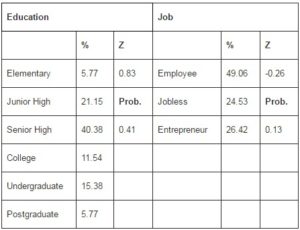

After getting the data, the exploratory data analysis is imperative. The results show that the study has successfully gotten an intended sample, most respondents of which were low-income people (75.2% income < Rp 2 million ≈ US$ 200), employed (53.2%), responsible for the household finances (66.1%), high school educated (45.5%) and were at a productive age.

Table 1. Descriptive Statistics

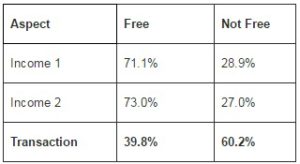

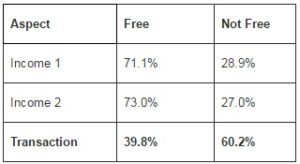

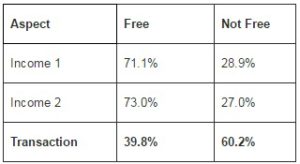

Based on the results of questionnaires that have been deployed, it is noted that most people are free from money illusion phenomenon on income level. While, on the level of transaction they are not free from the phenomenon. The complete result is presented in Table 2.

Table 2. Money Illusion Phenomenon

Referring to previous studies, this empirical finding as to income aspect is in line with Shafir (1997), Susianto (1998), Ariani (1999) and Prihastuti (2001) which state there is more than 60% people unattached from the illusion. However, whether the income earned is connected to someone’s happiness level, as it is on label income 2, the result is different from Shafir’s (1997) which indicate more people are not free from the illusion. Perhaps, people in Jakarta were left vulnerable by many economic crises. So, they gain the knowledge automatically through the repeated experiences since the discussion on the economic crisis was available through mass media.

Furthermore, the result as to transaction aspects shows a similar result to Shafir et al. (1997) and Cahyadi’s (1999) work, but is different from the works of Ariani (1999) and Prihastuti (2001). Perhaps the respondents still believe that it would be best to sell something at higher price than its original purchase price regardless of the inflation rate. To give a more comprehensive picture on the transaction aspects of the money illusion phenomenon, the following discussion examines the determinants of the phenomenon.

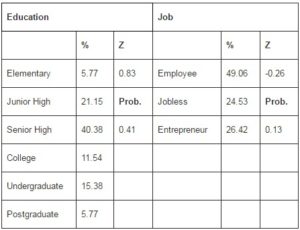

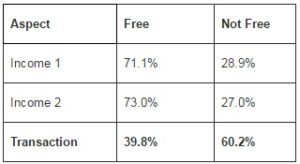

Table 3a. The Proportion of People Not Free from the Phenomenon on Transaction Aspect level

Table 3b. The Proportion of People Not Free from the Phenomenon on Transaction Aspect

It is noted from Table 3 that 75% of the respondents not free from the illusion are college or university educated level. It is also known that the smallest proportion from education background comes from Postgraduates. However, it fails to meet statistics criteria by using logit regression method. So, the finding is similar to Wong (2005) and Prihastuti (2001).

While, in the context of job background, the largest proportion comes from people who work as companies’ employee. Moreover, it is very interesting that the entrepreneurs who are assumed to be illusion- free provide higher proportion than the unemployed group. Perhaps, the job background is not the determinant of the illusion phenomenon as shown in Table 2. The results of logit regression on the job background and the Z score reveal that the coefficient is not statistically significant.

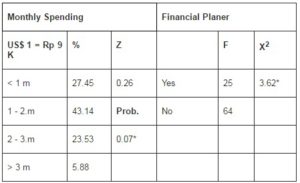

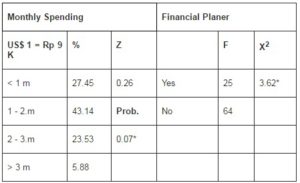

Yet, the monthly spending is positively significant as the determinant of illusion when logit regression is used. This finding supports previous studies by Shafir (1997) and Cahyadi (1999). The researchers argue that there is evidence that the more money people have, the more they love their treasury. So, they prefer to sell their assets at higher prices. Finally, by determining the chi square value, it is found that the probability of financial planners in the family exposed by the illusion is lower than families which are not, since the financial planner will be more accustomed to financial transaction than people who are not the planners.

The experiment results show that money illusion has permanent real effect over time. Since the subjects in the experiment are assumedly well-equipped with economic knowledge, it cannot be granted based on the study results that real world people are necessarily free from money illusion. Rather, the present empirical findings suggest the non-neutrality of money, at least in the short run, with strong real and permanent effect of people’s characteristics in economics. Furthermore, the researchers can extend and support the works of Fehr and Tyran (2001) and Wong (2005) that the well-educated metropolis of middle-lower income group still are exposed to the pierce of the veil of money. Equivalently, it can be said that the present empirical findings support the arguments of the delusion of money as the unmitigated problem by any process of coordination and learning in a short period of time. In addition, the researchers believe that the money illusion problem is so fascinating that even entrepreneurs can do wrong. This illusion can affect financially literate people, i.e. the observed entrepreneurs.

The presence of money illusion may determine different earning profiles and surveys that are meant to test for the presence of money illusion based on “the rule of thumb” or on framing. It is important to illustrate that people show preferences not entirely consistent with rationality; therefore it might be helpful, for example, for companies to adequately motivate their workers in other terms rather than wages, and to emphasize the importance of fairness and morale among workers. Earning profiles and money illusion would represent an interesting turning point for economic policies implication, for instance the importance of correctly delivering the message about the real and nominal terms of the changes that are to come along with the implementation of new regulations.

Another effect of money illusion is that it could affect people’s perceptions of outcomes. For example, there are experiments that provided the following findings: people usually recognize a 2% cut in nominal income as unfair, but considering a 4% inflation, a 2% rise in nominal income is perceived as fair, although the two situations are rationally equivalent. As a result, nominal representation of an economic situation is almost certainly the natural representation for most individuals.

Conclusion

This study provides an overview on how lower middle income people in Jakarta are exposed by money illusion phenomenon. Money illusion occurred in the aspect of transaction, but was not found in income aspect. It is also noted that monthly spending and the role of financial planner in the family are statistically valid as the determinants of money illusion in transaction aspect. So, this finding supports the studies of Shafir (1997), Susianto (1998), Ariani (1999), Cahyadi (1999) and Pujiastuti (2001) on income aspect. Yet, the results are contradicted to Pujiastuti (2001) as to transaction aspect. There are some implications of the empirical findings, such as to maintain nominal value as the base for employees’ salary payment than the real value. In the context of the state’s economic policies, the choice of delivering economic performance should be in nominal values than real values, along with other implications on the microeconomic level. However, further research is still needed to further attest the findings.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Afrane, S. (1997). “Impact Assessment of Microfinance Interventions in Ghana and South Africa: A Synthesis of Major Impacts and Lessons,” Journal of Microfinance, 4, 37–58.

Publisher – Google Scholar

Amado, S., Teközel, M., Topsever, Y., Ranyard, R., Del Missier, F. & Bonini, N. (2007). “Does “000, 000” Matter? Psychological Effects of Turkish Monetary Reform,” Journal of Economic Psychology, 28, 154–169.

Publisher – Google Scholar

Ariani, A. S. (1999). ‘Money Illusion on Middle-Group Income Housewife Group [Money Illusion Pada Ibu Rumah Tangga Kelas Menengah Di Jabotabek],’ Unpublished Final Project. Jakarta: Faculty of Psychology – University Of Indonesia.

Bakshi, A. S. M. R. K. (2009). “Rational Agents and Economics Training: The Case of Money Illusion in Experimental Study,” Journal of Economic Theory, 3(2), 27-32.

Publisher – Google Scholar

Benassy, J.- P. (1995). “Money and Wage Contracts in an Optimizing Model of the Business Cycle,” Journal of Monetary Economics, 35, 303–315.

Publisher – Google Scholar

Bernsten, P. L. (1997). ‘How We Take Risk,’ Across the Board, Vol. 34, Issue 2, 231-241.

Brachinger, H. W. (2006). Euro or “Teuro”? The Euro-Induced Perceived Inflation in Germany and Switzerland, University of Fribourg. Department of Quantitative Economics Working Paper No. 5.

Publisher

Braun, V. & Clarke, V. (2006). “Using Thematic Analysis in Psychology,” Qualitative Research in Psychology, 3, 77–101.

Publisher – Google Scholar – British Library Direct

Cahyadi, H. (1999). ‘The Money Illusion Phenomenon on Packaging Choice [Fenomena Money Illusion Pemilihan Kemasan],’ Unpublished Master Thesis. Jakarta: Master of Management – University of Indonesia.

Cannon, E. S. & Cipriani, G. P. (2006). “Euro-Illusion: A Natural Experiment,” Journal of Money, Credit and Banking, 38, 1391–1403.

Publisher – Google Scholar – British Library Direct

Dusansky, R. & Kalman, P. J. (1974). “The Foundation of Money Illusion in a Neoclassical Micro-Monetary Model,” The American Economic Review, 64, 115–122.

Publisher

European Central Bank. (2003). The Introduction of Euro Banknotes and Coins: One Year on. http://europa.eu/scadplus/leg/en/lvb/l25058.htm. [Accessed on 7 January 2012].

Publisher

European Commission. (2002). ‘Qualitative Study on EU Citizens and the Euro in the Months Following its Introduction,’ http://ec.europa.eu/public_opinion/quali/ql_euro0502_en.pdf. [Accessed on 7 January 2012].

Google Scholar

Fehr, E. & Tyran, J.- R. (2001). “Does Money Illusion Matter?,” The American Economic Review, 5, 1239.

Publisher – Google Scholar – British Library Direct

Fischer, I. (1928). The Money Illusion. New York: Adelphi.

Publisher – Google Scholar

Furnham, A. & Argyle, M. (1998). The Psychology of Money. New York: Routledge.

Publisher – Google Scholar

Gamble, E., Gärling, T., Charlton, J. & Ranyard, R. (2002). “Euro Illusion: Psychological Insights into Price Evaluations with a Unitary Currency,” European Psychologist, 7, 302–311.

Publisher – Google Scholar – British Library Direct

Gott, S. (2007). ““One Touch” Quality and “Marriage Silver Cups”: Performative Display, Cosmopolitanism, and Marital Poatwa in Kumasi Funerals,” Africa Today, 54, 79–106.

Publisher – Google Scholar – British Library Direct

Hobijn, B., Ravenna, F. & Tambalotti, A. (2006). “Menu Costs at Work: Restaurant Prices and the Introduction of the Euro,” Quarterly Journal of Economics, 121, 1103–1131.

Publisher – Google Scholar – British Library Direct

Jonas, E. & Frey, D. (2003). “Searching for Information about Financial Decisions in Euro versus DM,” European Psychologist, 8, 92–96.

Publisher – Google Scholar – British Library Direct

Jonas, E., Tobias Greitemeyer, T., Frey, D. & Schulz-Hardt, S. (2002). “Psychological Effects of the Euro-Experimental Research on the Perception of Salaries and Price Estimations,” European Journal of Social Psychology, 32, 147–169.

Publisher – Google Scholar – British Library Direct

Kane, E. J. & Klevorick, A. K. (1967). “Absence of Money Illusion: A Sine Qua Non for Neutral Money?,” Journal of Finance, 23, 419-423.

Publisher – Google Scholar

Kompas.Com (2010). Indonesian House of Representative Rejected the Redenomination.http://bisniskeuangan.kompas.com/read/2010/08/06/07483736/DPR.Tolak.Redenominasi.Rupiah. [Accessed 12 December 2011].

Publisher

Kühberger, A. & Keul, A. (2003). ‘Quick and Slow Transition to the Euro in Austria: Point of Sale Observations, and a Longitudinal Panel Survey,’ Vienna, IAREP. Paper Presented at the Euro-Workshop, 3rd–5th Of July; 2003.

Google Scholar

Marques, J. F. & Dehaene, S. (2004). “Developing Intuition for Prices in Euros: Rescaling or Relearning Prices?,” Journal of Experimental Psychology Applied, 10, 148–155.

Publisher – Google Scholar – British Library Direct

Modigliani, F. (1986). “Life Cycle, Individual Thrift, and the Wealth of Nations,” The American Economic Review, 76, 297–313.

Publisher – Google Scholar

Mussweiler, T. & Englich, B. (2003). “Adapting to the Euro: Evidence from Bias Reduction,” Journal Of Economic Psychology, 24, 285–292.

Publisher – Google Scholar

Pantikin, D. (1965). Money, Interest and Prices: An Integration of Monetary and Value Theory. New York: Harper Row.

Publisher – Google Scholar

Pelham, B. W., Sumarta, T. T. & Myaskovsky, L. (1994). “The Easy Path from Many Too Much: Thenumerosity Heuristic,” Cognitive Psychology, 26, 103–133.

Publisher – Google Scholar – British Library Direct

Pelham, B. W. & Swann, W. B., Jr. (1989). “From Self-Conceptions to Self-Worth: On the Sources and Structure of Global Self-Esteem,” Journal of Personality and Social Psychology, 57, 672–680.

Publisher – Google Scholar

Prihastuti, E. (2001). ‘The Effect of Money Illusion on the Housewife of High-Income Group,’ Unpublished Master Thesis. Jakarta: Master of Management Program UI.

Raeff, C., Greenfield, P. M. & Quiroz, B. (2000). Conceptualizing Interpersonal Relationships in the Cultural Contexts of Individualism and Collectivism. In S. Harkness, C. Raeff, & C. M. Super (Eds.), New Directions for Child and Adolescent Development (Pp. 59–74). San Francisco: Jossey-Bass.

Publisher – Google Scholar – British Library Direct

Raghubir, P. & Srivastava, J. (2002). “Effect of Face Value on Product Valuation in Foreign Currencies,” Journal of Consumer Research, 29, 335–347.

Publisher – Google Scholar – British Library Direct

Raghubir, P. & Srivastava, J. (2009). “The Denomination Effect,” The Journal of Consumer Research, 36, 701–713.

Publisher – Google Scholar

Ramoniene, L. & Brazys, D. (2007). “Euro Introduction Effects on Individual Economic Decisions: Testing the Presence of Difference Assessment Account among Lithuanian and Latvian Consumers,” Baltic Journal of Economics, 6, 29–55.

Publisher – Google Scholar

Ranyard, R. (2007). “Euro Stories: The Irish Experience of Currency Change,” Journal of Consumer Policy, 30, 313–322.

Publisher – Google Scholar – British Library Direct

Ranyard, R., Routh, D. A., Burgoyne, C. B. & Saldanha, G. (2007). “A Qualitative Study of Adaptation to the Euro in the Republic of Ireland: II: Errors, Strategies, and Making Sense of the New Currency,” European Psychologist, 12, 139–146.

Publisher – Google Scholar – British Library Direct

Routh, D. A. & Burgoyne, C. B. (1989). ‘Absent-Mindedness with Money: It’s Incidence, Classification, and Correlates,’ In T. Tyszka & P. Gasparski (Eds.), Homo Oeconomicus: Facts and Presumptions (Vol. II, Pp. 619–633). Warsaw: Polish Academy of Sciences.

Google Scholar

Routh, D. A. & Burgoyne, C. B. (1990). ‘Further Development of the Absent-Mindedness with Money Questionnaire (AWMQ): Aspects of Construct Validity,’ In S. E. G. Lea, P. Webley, & B. M. Young (Eds.), Applied Economic Psychology in the 1990s (Vol. I, Pp. 487–500). Exeter: Washington Singer.

Google Scholar

Salminen, P. & Wallenius, J. (1993). “Testing Prospect Theory in Deterministic Multiple Criteria Decision Making Environment,” Decision Sciences, Vol. 24, 2, 321-333.

Publisher – Google Scholar – British Library Direct

Shaffir, E., Diamon, P. & Tversky, A. (1997). “Money Illusion,” Quarterly Journal of Economics, 112, 341–374.

Publisher – Google Scholar – British Library Direct

Showers, C. (1992). “Compartmentalization of Positive and Negative Self-Knowledge: Keeping Bad Apples Out of the Bunch,” Journal of Personality and Social Psychology, 62, 1036–1049.

Publisher – Google Scholar

Soman, D., Wertenbroch, K. & Chattopadhyay, A. (2002). ‘Currency Numerosity Effects on the Perceived Value of Transaction,’ INSEAD Working Paper Series. 124/MKT. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=336206. [Accessed 14 Aug 2010]

Susianto, H. (1998). ‘Psychology, Economy, and Indonesia,’ Journal of Social Psychology, 13, 1, 15-25.

Triandis, H. C. (1989). “The Self and Social Behavior in Differing Cultural Contexts,” Psychological Review, 96, 506–520.

Publisher – Google Scholar

Tversky, A. & Kahneman, D. (1974). “Judgment under Uncertainty: Heuristics and Biases,” Science, 185, 1124–1131.

Publisher – Google Scholar

Tyszka, T. & Przybyszewski, K. (2006). “Cognitive and Emotional Factors Affecting Currency Perception,” Journal of Economic Psychology, 27, 518–530.

Publisher – Google Scholar

Van Der Geest, S. (1995). “Old People and Funerals in a Rural Ghanaian Community: Ambiguities in Family Care,” Southern African Journal of Gerontology, 4, 33–40.

Publisher – Google Scholar

Wilder, D. A. (1977). “Perception of Groups, Size of Opposition, and Social Influence,” Journal of Experimental Social Psychology, 13, 253–268.

Publisher – Google Scholar

Wilder, D. A. (1978). “Homogeneity of Jurors: The Majority Influence Depends on Their Perceived Independence,” Law and Human Behavior, 2, 363–376.

Publisher – Google Scholar

Wong, Wei-Kang. (2005). Does Money Illusion Still Matter After Some Economics Education? Working Paper on Department of Economics, NUS, Singapore.

Publisher – Google Scholar