Introduction

Given the background of globalization and “the new economy”, corporate governance’s particularities within the bank system increase the awareness of both practitioners and world organizations, concerned in advocating worldwide soundproof doctrines – whichever we talk about the OECD’s Principles of Corporate Governance, Basel Committee’s or the community law.

In respect to the corporate governance system in Romania, the main governance pillars are represented by:

- constitutive act – which has the role of defining the bank’s field of activity, the relationships between the shareholders, the management and administration bodies, and the competences granted to them, respectively, as well as the guidelines on bank administration, control and financial management);

- management activity framework – which is systematically assessed and reviewed accordingly and includes different concepts (like: bank structure and organization – central administration-level/units network-level), management and administration bodies/levels, as well as operations’ principles, rules and regulations;

- internal control system – with its three constituents: internal audit function, compliance activities and risk management function (with precise degree specificities being subordinated to each bank);

- system of delegating the limits of decision-making authority;

- organization and operation rules, code of ethics, internal procedures and regulations, etc.;

- principles of stakeholder engagement and communication (shareholders, clients, employees, public institutions, regulators, public interest, etc.).

Through this study, we do not propose outlining exhaustive topics associated with corporate governance in banks, since previously tremendous researches already depicted these – Mehran et. al (2011), Mehran & Mollineaux (2012), de Haan & Vlahu (2013) – but we rather aim to outline an exploration of the capability of the Romanian bank system to stand by the corporate governance principles.

In Romania, both the applicable laws (The Corporate Governance Code of the Bucharest Stock Exchange (BSE)) and the most recent Romanian researches (Bunea M. (2013), Spătăcean & Ghiorghiţă (2012), Manea (2015)) agree that when it comes to dealing with reporting status on the corporate governance principles in banks, the following key elements are “pertinent for analysing and testing the degree of enabling corporate governance principles in banks” as follows

- tasks and duties of both governance structures and control structures (with an emphasis on the Supervisory Board’s responsibilities);

- monitoring structures’ role (and possible contiguous conflicts of interest);

- minority shareholders’ and interest owners’ status;

- corporate governance risks and the amendments made to the internal control function (in order to prevent and detect these risks);

- role of internal audit;

- importance of ethics”.

Unfortunately, over the last years, consequent to the 2007-2008 financial crisis, it was observed that bank practitioners have not succeeded in, actually, comprehending risks. As a result, they have encountered not only several discontinuity gaps, but also a sturdy lack of authority in terms of decisional issues, and the instantaneous result consisted in the spawn of a substantial trust deficit in credit institutions, in general.

It is believed, in this context, that the areas that were affected the most were:

- the conflict of interests,

- the ineffective application and implementation of corporate governance principles, and

- the role of external auditors and monitoring authorities.

Taking all these into consideration, so as to reach our objectives, we have presumed as being mandatory to broaden our exploration from the six axes initially depicted to a more thorough and broaden analysis and further demonstration of the main attributes constructing a set of eleven pillars/key elements which are to be assessed within the four banks that are currently listed on BSE, namely: Banca Transilvania, BRD, Erste Group and Patria Bank.

Research Methodology

Since this paper’s purpose is to assess the degree of applying sound corporate governance principles by the significant players in the Romanian banking system, research methodology was fundamentally based on both; observations – on disclosed documents published on the websites of the analysed banks – and also on the use of a scoring method in assessing the degree of smearing corporate governance principles, which permitted us to transform assertive and qualitative data into numerical quantitative data.

Data collection finds its correspondence in developing methods of mediated information collection from examining both the Corporate Governance Code of the BSE and the Corporate Governance Codes made public on the official websites of the analysed banks, as well as from their published Annual Reports.

The main research method used is a non-participating observation – founded on the information collected from the “Comply or Explain” Statement to determine if banks are smearing corporate governance and transparency elements.

Also, by using the score function’s model (Spătăcean & Ghiorghiţă (2012), Manea (2015)), this study seeks to explore the degree to which the key concepts, principles and techniques typical to corporate governance are spread and enabled, by taking the four banks that are currently listed on BSE as a reference.

Therefore, this study required both a qualitative and a quantitative approach, on the basis of the empirical data collected out of the sample of the four banks that are currently listed on BSE.

The analysed sample is consisting of four banks that are currently listed on BSE: Banca Transilvania (BT), BRD (BRD), Erste Group (EG) and Patria Bank (PB).

The qualitative approach is enlightened by the fact that the research has prerequisited interpretations, clarifications, explanations and deep understanding of the analysed phenomena, while the quantitative method has concentrated on quantifying through numerical expressions by using a score system based on a function determined for each bank from the sample.

Testing the Importance of The Key Corporate Governance Elements Within the Romanian Banks Listed On BSE

The study proposes ways in order to determine to which degree these Romanian banks abide by the requirements and key principles of corporate governance, in an attempt to maximize their enactment and performance.

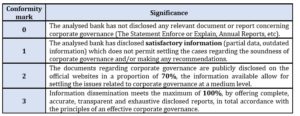

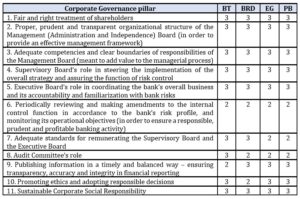

With the purpose of achieving this goal, a set of eleven pillars/key elements has been identified and proposed:

Fig. 1: Key elements of bank corporate governance

Source: own projection

Case study

The research objectives are subordinated to the main purpose of assessing the importance given to key corporate governance elements for the sample of the four listed banks operating on the Romanian banking market.

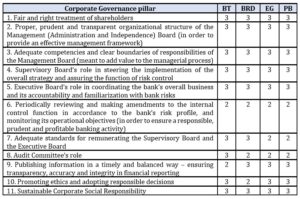

By using professional reasoning, for each of the eleven presented axes, we allocated an “importance coefficient” – kimp.i which is a representative to each key element deliberated to be relevant for the enforcement of the corporate governance principles in the Romanian bank system:

Fig. 2: Importance level associated to the most relevant pillars within the corporate governance principles

Source: own projection

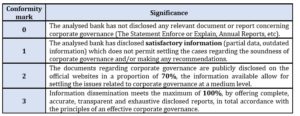

Furthermore, to each answer scrutinised (either from the “Enforce or Explain” statement or from the Published Annual Reports), a “conformity mark” – confi, was also assigned as depicted in the table below:

Table 1: Significance of the conformity marks given to the collected and interpreted information

Source: own projection

Findings and Results

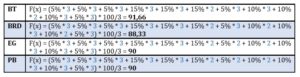

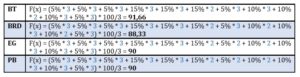

Taking into consideration both the importance coefficient kimp.i assigned to each pillar considered essential in our analysis and the conformity marks confi associated to each key element of the corporate governance, we have obtained the values of the score function F(x) (Spătăcean & Ghiorghiţă (2012)) for the four studied banks. The obtained values of the score function show the final mark assigned to each bank, in the form of an “expression of conformity with the corporate governance instruments in the banking field”, as illustrated in the table below:

Table 2: Quantitative determinations regarding the conformity with the working most relevant pillars proposed

Source: own projection

The equation used for the score function is:

Values of the score function for the sample of banks are:

With an average score of 90,00 out of a total of 100,00 points, only one entity was above the average (Banca Transilvania, with a score of 91,66). While two credit institutions – Erste Group and Patria Bank) reached a score of exactly 90,00 points, BRD (with a satisfactory score of 88,33) did not surpass the average, as a result of the hitches and weaknesses faced in several areas:

- unsatisfactory amendments of the internal control system (in inadequate corroboration with the entity’s risk profile);

- non-settlement of the independence issue regarding the Management Board’s members;

- unclear duties and responsibilities of the audit committee;

- promotion of unsuitable or imprecise standards for remunerating the Executive Board, and the

- incomplete or inadequate implementation of the Code of Ethics’ principles.

Following the data processing and the observation of the information published by the four analysed banks, the result is the following strengths regarding the key elements of corporate governance:

- all 4 banks are managed by a Supervisory Board, which has 7 to 11 members;

- the risk management function is carried out under the coordination of a Risk Committee, which has the role of identifying, evaluating and managing the risks

- the audit function is performed by a permanent and independent Audit Committee, which has an advisory function in relation to the bank’s policies and stratagem regarding the internal control system, internal audit and external audit;

- regarding the supervisory authority, the 4 banks are conditional for the control and observation, abiding by the rules enacted by the National Bank of Romania.

Our approach was to identify the shortcomings and deficiencies, i.e. to formulate recommendations for boosting the impact of corporate governance’s key elements on improving the banking system’s performance. Therefore, following the research, we also identified weaknesses, such as corporate governance issues that require efforts for revision, enhancing and improvement, such as:

- lack of diversity in the composition of the Supervisory Board and Executive Board and a lack of a clear and concrete policy on gender balance, social and cultural origin, professional profile and education;

- no real evaluation of the performances of the members of the two boards of management;

- unsatisfactory supervision of risk management and risk exposure framework;

- lack of authority from the risk management function, so that high risk activities can be stopped in time;

- lack of diversification in risk management, often limiting only to those categories of risk which are considered as priority and, implicitly, the loss of sight of the overall picture, i.e. the totality of risks to which the credit institution exposes to;

- unreasonable and disproportionate directors’ remuneration, based on short-term value of bank’s action, as being the only performing criteria.

Conclusions

Unlike previous research studies that aimed similar purposed – assessing potential effects of corporate governance on entities’ value – this paper offers a particular approach on a specific business field; the banking one, that was little explored until now.

As this study is defined by freshness (the implementation of banking governance concepts is only at the beginning in Romania) from the scores acquired by the sample of banks analysed, it can be perceived – in a general approach – the degree of awareness and interest paid by the leadership of banks (and the parties involved) in respects to the main primordial key elements of corporate governance.

Although some deficiencies and flaws have been identified – as an outcome of the systemic risk encountered in the bank system – Romania’s most important banks are now on the path of implementing and enabling the key pillars of corporate governance, one by one.

Our contribution consists not only in outlining some gaps in the Romanian regulation and the requisite to improve corporate governance implementation, but also in briefly emphasizing those regulatory requirements that are ought to be enhanced so as to upsurge the effectiveness of corporate governance in Romanian banks that are listed on BSE.

Following our research, we found a favourable approach by the banks listed on the BSE regarding the value and relevance of key elements regarding corporate governance in banking performance.

Thus, we appreciate that the scrutinized banks have a noteworthy awareness (and availability!) in the implementation of the key elements of corporate governance and, at the same time, we reached the final conclusion that they seem to make substantial efforts in comprehending their role, necessity and importance in the sustainability and continuous enhancement of the banking system’s performance in Romania.

Consequently, there is no doubt that there is a worldwide sustained concern for the understanding and implementation of the key elements of the corporate governance; a deep concern that was emphasized by the financial crisis in the period 2007-2009 at European Union’s level.

Reliability, soundness and transparency in the relationship with shareholders, clear delimitation and full ownership, optimal evaluation of the risk management function – in our opinion, all these are crucial in order to guarantee a good, qualitative corporate governance, capable of sustaining a national banking system and a national economy.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Bunea, M. (2013). The Corporate Governance Impact on Banking Performance Increase. Cross-Cultural Management Journal, 15(02), 11-21.

- Cocriş, V., Ungureanu, M.C. (2007). Why Are Banks Special? An Approach from the Corporate Governance Perspective. Annals of the Alexandru Ioan Cuza University, Iaşi LIV, 55-66.

- De Haan, J., Vlahu, R. (2013). Corporate Governance of Banks: A Survey, Working Paper De Nederlandsche Bank, no. 386.

- Firescu, V., Brânză, D. (2013). Corporate Governance in Romanian Enterprises: Features, Dimensions and Limits. SEA – Practical Application of Science, 1(2), 77-83.

- Manea, M-D. (2015). Corporate Governance within the Romanian Bank System. Procedia Economics and Finance, 27, 454-459.

- Mehran, H., Morrison, A., Shapiro, J. (2011). Corporate Governance and Banks: What Have We Learned from the Financial Crisis? Federal Reserve Bank, New York, Staff Report, no. 502.

- Mehran, H., Mollineaux, L. (2012). Corporate Governance of Financial Institutions. Federal Reserve Bank, New York, Staff Report, no. 539.

- Mülbert, P.O. (2009). Corporate Governance of Banks after the Financial Crisis – Theory, Evidence, Reforms. ECGI – European Business Organisation Law Review, working paper.

- Onofrei, M., Firtescu, B-N, Terinte, P-A. (2018). Corporate Governance Influence on Banking Performance. An Analysis on Romania and Bulgaria. Scientific Annals of Economics and Business, 65 (3), 317-332.

- Popescu, C.R.G. (2019) Corporate Social Responsibility, Corporate Governance and Business Performance: Limits and Challenges Imposed by the Implementation of Directive 2013/34/EU in Romania. Sustainability, 11.

- Popescu, C.R.G., Banța, V.C. (2019) Performance Evaluation of the Implementation of the 2013/34/EU Directive in Romania on the Basis of Corporate Social Responsibility Reports. Sustainability, 11.

- Sharma, N. (2014). Extent of Corporate Governance Disclosure by Banks and Finance Companies listed on Nepal Stock Exchange. Advances in Accounting, Incorporating Advances in International Accounting, 30, 425-439.

- Slimane, F.B., Angulo, L.P. (2018). Strategic Change and Corporate Governance: Evidence from the Stock Exchange Industry. Journal of Business Research, 3(2), 7-19.

- Spătăcean, I.O., Ghiorghiţă, L. (2012). Testing Compliance with Corporate Governance Principles on the Romanian Capital Market. Studia Universitatis Petru Maior, Series Oeconomica, fasciculus 1, 70–87.

- Zhang, J., Yang, J. (2011). Corporate Governance and Performance of Listed Commercial Banks during Financial Crisis. Journal of the Washington Institute of China Studies, 5 (4), 1-21.

- *** – The Corporate Governance Code of the Bucharest Stock Exchange.

- *** – Green Book on Corporate Governance in Financial Institutions and Remuneration Policies.