Introduction

The global financial crisis which ravaged various sectors of Nigeria’s economy has made it difficult for the government to solely undertake essential services. Therefore, a Public-Private partnership has been encouraged by the government and has extended to the educational sector of the economy. Having realized the reality of tertiary education in the country, the Nigerian

government, on May 10, 1999, issued a certificate of registration to three private universities in Nigeria (Ajadi, 2010). The universities include Babcock University, Igbinedion University and Madonna University (Ajadi, 2010). In Nigeria, private universities have been established to render services side by side with the public universities. Private universities are set up to provide a high level of work force for the development of the country (Olawore, 2013). The major challenge that faced the establishment of private universities was the inadequate fund (Olawore, 2013). Ajadi (2010) observes that the supply of education in Nigeria is limited by the amount of funds. One of the measures adopted by private universities to improve their internal revenue generation base was the setting up of Business Entrepreneurship Venture (BEV). BEV creates a high level of job satisfaction to the teeming youths and enhances life status (Martin, 2006).

Higher levels of BEV accomplishments lead to higher income earnings which reduce the unemployment rate within the society. Apart from generating revenue to the institution, it nurtures the mindsets of students for entrepreneurial skills. The impacts of the BEV are that it serves as a basis of producing young generations of Nigerians who are entrepreneurial oriented and could be employers of labour in the nearest future (Daniel, 2010; Badariah, Abdul and Mariana 2016). According to Alexander (2014), BEV is very essential in any bad economy or recession situation. It could be the only alternative in changing the economic situation from the worst to a stable one, by injecting new innovative business ideas that turn into job opportunities as a means to reduce unemployment (Zalinaim, Firdaus and Azman 2016). The paper therefore seeks to unveil the impact BEV has on private universities development with a particular reference to Landmark University. Also, it aims at ascertaining whether there is a relationship between their Landmark University (LMU) ventures and the University revenue over the period of 5 years after operation.

Conceptual Framework

The concepts that are the focus of this study are the internally generated revenue and entrepreneurship.

Internally generated revenue is the revenue that is generated within an organization. Within the university system, it is used to supplement their funding stream through the establishment of revenue yielding ventures or projects (Abosede and Akintola, 2014). Such projects or ventures like bookshops, hotels and catering services, printing press, consultancy services, pure water factories and so on, are veritable means of raising funds needed to enhance their service delivery.

Adams (2002) is of a different opinion, that the government is to increase the universities subvention to 100% as the major source of funds to the institution. Governments are to safeguard the poor economy by means of increasing the tax rate and partnering with non-governmental organizations (Bruno, 2014). The generated revenue may not safeguard the university performance if the resources of revenue are not well protected from corrupt leaders (Stella, 2015). Generating revenue also requires adequate access to capital for potential investment which is the biggest hurdle to growing a business venture (William and Ramana, 2009). An insufficient fund is a threat to an efficient innovator (William and Ramana, 2009). Therefore, Adeyemi (2011) posits that Universities are confronting many competitive challenges accompanied with poor funding and the only solution is to actively engage in entrepreneurship through the establishment of new funding streams and research investment. Entrepreneurship is the practice of starting a business from scratch to meet customers’ needs. This satisfies the entrepreneur either in terms of profit maximization or the status attained which can strengthen the economy of the nation by generating massive returns to the organization at all levels (IGR) (Vera, 2012; Ilesanmi, 2012). The word ‘entrepreneurial’ came from the word ‘entrepreneur’. Entrepreneurial is therefore described as a person that makes money by starting a business which involves identifying opportunities and the ability and willingness to take risks to maximize profit (Vera, 2012). Enterprises that are involved in the identification of business opportunities in Nigeria, undertake the risks involved in bringing together all the factors of production to establish and run the enterprises for profit or non-profit intentions (David, 1995).

Literature Review

Entrepreneurship is the process of initiating, organizing and innovating business, with the sole aim of creating new market ideas and for making profit. It has been the driving force of Internal Generated Revenue (IGR) mobilization for the institutional growth. Onuoha (2013) observes that there should be alternative means or non – traditional ways of sourcing for fund in the tertiary institution. Extant literature presents the impact of business entrepreneurship programmes on IGR at the university level (Tax Payer Guide, 2015). In 2016, the National Bureau of Statistics (NBS) declared that the Nigerian economic growth dropped drastically into recession, which resulted in the poor funding of the government owned institutions (National Bureau of Statistics, 2016). The Nigerian Government confirmed that the recent economic recession was responsible for the poor funding of educational public institutions in the Country (Vanguard Newspaper, 26 September 2016).

Many universities workers have been agitating for their salary to be fully paid and workers in states like Bayelsa have also been clamoring for their seven months’ salaries and related arrears which led to the closure of government owned tertiary institutions (News Agency of Nigeria, October 3 2016). However, some State governors have openly made a commitment to restore the lost dignity of education in their States (News Agency of Nigeria, June 21 2016). These contributed to the battered educational system in the country with the poor funding. This therefore calls for an urgent sustainable IGR source for the universities as a supplement to the traditional means of allocation. Entrepreneurship is considered to be the channel of the economic growth in Nigeria due to its innovativeness, rebranding, product development and minimizing unemployment rate in the country (Adeoye, 2015; Amir and Mohammad, 2016). Alexander (2014) asserted that Entrepreneurship is very crucial in sustaining organizations. The impact of entrepreneurship is to generate revenue for the organization (Carree and Thurik, 2002). Undergraduate students are valuable assets that can contribute to the business development programme within the university context (Huub, Dugassa and Alemfrie, 2015). Ajaero (2016) stipulated that a standard BEV is the bedrock of the national development. BEV is one way by which institutions generate the desired revenue to provide a solution to the funding crises and thereby reduce the rate of poverty in a community (Eze, 2016; Ogueze and Orji, 2015).

Internally Generated Revenue (IGR) is becoming essential in solidifying financing, and running the education system in Nigeria. According to David, Yung-Chi, Benjamin and Chiyan (2015), a successful IGR is a feasible means to improve the funding of an institution by enterprising, and to make the entrepreneurial institution become financially autonomous. With the recent trend of the economic challenges in Nigeria, there is a need for the University Management to look inward in funding the institution through alternative channels (Ibeogu and Ulo, 2015; Felicia and Hezekiah (2016). Famade, Omiyale, Grace and Adebola (2015) stated that to improve the financial stand in education, another approach of generating funds for institutions is required. Institution management can supplement its funding stream by establishing business ventures or consultancy services to raise funds which are highly needed for the smooth running of the university. IGR is associated with many activities as means of generating alternate sources of revenue to enhance the financial condition of the university education system (Gregory, Dave, Timothy, Robert and Cora 2006),

Landmark University (LMU), as a private institution, has adopted a revenue generated strategy by running business ventures in order to generate revenue (Sani, 2015). The BEV of Landmark includes LMU commercial farms, LMU Health Centre, Centre for System and Information Services (CSIS), Mechanical Workshops, LMU Bakery, LMU Pure Water Factory, LMU Guest House, Car Wash, Boutique, Shopping Mall, Bookshop and Unisex Saloon; all are a subsidiary of Landmark University Development Venture (LMDV) which has greatly boosted the University’s IGR. Ogbogu (2011) stated that other means of generating funds in financing institutions can only be preferred through the universities business entrepreneurship activities like ventures and consultancy services. Also, conventional universities are directly funded by the State, as they are owned by the government. However, many institutions have reformed themselves from being mainly for learning and research purposes to entrepreneurial universities with a robust tie to business activities (Barbara and Bostjan, 2014).

Entrepreneurial and Business Entrepreneurship Venture

The word entrepreneur refers to the person who takes initiatives by introducing new innovative ideas to start a new business in order to carry out business activities and act as a catalytic agent for a new project to maximize profit (Edwsaurd and Martin, 2007). It is the creation of a new venture and providing better ways of running the business (Jahangir and Zhiping, 2016). It refers to providing innovations that confront the current market orders (Hamilton and Harper, 1994). Schumpeter, (1912, 1934, 1942) in his theory of Business Enterprise, stated that the entrepreneur is a promoter of an organization, endowed with the characteristic of being a venture capitalist and profit driver (Alvaro and Salvador, 2014). This is also an innovation in terms of commercializing an invention (Alvaro and Salvador, 2014). However, Kirzner (1973) stated that an entrepreneur is a person that is able to discover opportunities and transform their competitive domain by engaging them in enterprises with the intention of achieving large market share, (Florian, Dominic, Mathew and Janic, 2017).

According to Metcalfe and Ramlogan (2005), Hezelkorin (2013), and Didier and Fernadez (2016), the entrepreneur education is the way of training and educating youths to be self-reliable to reduce the high unemployment rate in the labour market (Filippo et al., 2015). The societal transformation requires foundational learning (Mathias and Marco, 2012); and the implementation of a redesigned curriculum related to self-reliance through the academic teaching to increase productivity. Better development depends on institutional programmes to meet the demand for capacity building within a global knowledgeable economy (Maria, Joanne, Moria, Natalie and Roy, 2016). Quality education services require reliability, empathy, responsiveness and assurance (Zhang et al., 2016). Providing a conceptual integration of the literature on business venture (Jonathan, Janice, Alain and Phillip, 2010), Joseph Tixier and Barbara Barone (2010), Maria and Soumodip (2017) stated that a strong impact (i.e. the activities that generate new ideas) could only be spawned by creating opportunities outside the organization.

Thus, Entrepreneurship Venture (EV) is a construct that has gained importance in the field of business and management to the extent that managers are tending to engage in entrepreneurial related risks and actively pursuing new opportunities to sustain the organization (Florian, 2017). Entrepreneurship Venture (EV) helps to increase the awareness of the youths towards the essence of the entrepreneurial experience (Florian Dominic, Mathew and Janice, 2017) that educates them on why, when, and how opportunity is created, recognized and utilized, which helps to access new technologies and in return accelerates the economic growth (Adam and Micheline, 2013). Entrepreneurship Venture (EV) is much more than a curriculum or a skill in a university (Dominic, Chang and Dirk, 2016). It has become a major part of the mechanisms towards attaining poverty alleviation (Adebowale, 2011). Judging from this approach, it can be added that EV is a required skill in engaging the teeming youths towards an entrepreneurial ambition (Agu and Ayogu, 2015 and Wim, 2013).

Funding Universities from the Internally Generated Revenue (IGR) Perspective

Private owned universities in Nigeria are solely funded from their internally generated funds which facilitate the smooth running of private institutions. For this reason, government-owned-institutions in Nigeria should wake up and inculcate this alternative funding as another means of funding the university without depending on the Federal or State governments’ subventions which is now facing challenges in meeting the funding of public universities (Ezekwesili, 2016). Universities that are founded for research purposes and non-funding pose a threat to the adequate research. Hence, money generated from other means can be used as a supplement for research purposes. No doubt, policies such as the business acquired policy, the business theory on entrepreneurial programmes, Market and consumer theory, the demand and supply theory, PESTEL analysis and American and Japanese Keiretsu theory are approaches to boost the revenue for tertiary institutions.

According to David (2015), institutions are graciously urged to go for another means of educational funding as in the case of the total commercialization of the university technology that has been practiced in Taiwan as a relief as to the government in order to address all the economic issues confronting the nation. It is becoming progressively clearer that IGR has become a tradition and alternative means of funding in Landmark University. This is because the University is adequately engaging in business practices like University Medical Centre, Landmark University Development venture, and Commercial Farm beside the regular tuition fees, students’ subscriptions and other administrative charges, which form part of their innovative ideas. Considering the challenges confronting education in Nigeria, it is imperative to drive the revenue mobilization for the government owned institutions not to endanger the future of our teeming youths by supporting revenue generation, (Adeyemi, 2011).

Discussion and Results

The study used descriptive economic analytical tools in studying four business units of the private university with 57 observations for the period of 2013 – 2017, to basically examine the trend of revenue of these selected business ventures in the University. This was done by examining each venture using CMF, CFT, SHM and GTH as independent variables, and the dependent variable is represented by Internally Generated Revenue (IGR). This ultimately led to the accomplishment of an important aim of the study which is to ascertain whether there is a relationship between their ventures and the University revenue over the period of 5 years after operation.

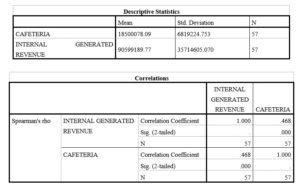

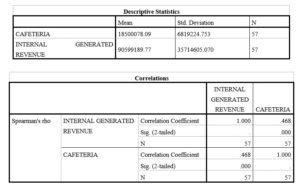

The Descriptive technique showed the summary of the information for a number of variables in a single table and computed the systemized values. Table 4.1 below shows the descriptive statistics. The Descriptive results disclose a representation of data between the dependent variable and each of the independent variables.

Hypothesis 1

H0: There is no significant relationship between LMU Cafeteria and the University IGR.

H1: There is a significant relationship between LMU Cafeteria and the University IGR.

Table 4.1: Descriptive Statistics and Correlations

Spearman’s rho correlation of university IGR and LMU Cafeteria = 0.468

P-Value = 0.000

Interpretation

The correlation coefficient of the university IGR and LMU Cafeteria is 0.468 which implies that the strength of the relationship between the University IGR and the LMU Cafeteria is a moderate positive relationship.

The P-value is 0.000 (< 0.05) which implies that the authors will reject the null hypothesis and conclude that there is a significant relationship between LMU Cafeteria and the University IGR.

It can also be said that 23% (0.4682) of the variation in the University IGR is explained by the LMU Cafeteria revenue.

Hypothesis 2

H0: There is no significant relationship between LMU Shopping mall and the University IGR.

H1: There is a significant relationship between LMU Shopping mall and the University IGR.

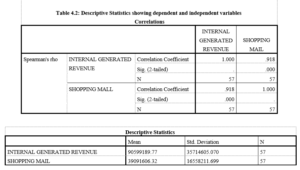

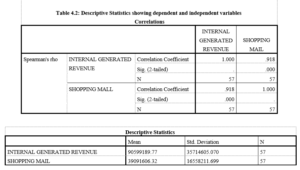

Table 4.2 below shows the descriptive statistics. The Descriptive results disclose a representation of data between the dependent variable and each of the independent variables.

It can also be said that 23% (0.4682) of the variation in the University IGR is explained by the LMU Cafeteria revenue.

Hypothesis 2

H0: There is no significant relationship between LMU Shopping mall and the University IGR.

H1: There is a significant relationship between LMU Shopping mall and the University IGR.

Table 4.2 below shows the descriptive statistics. The Descriptive results disclose a representation of data between the dependent variable and each of the independent variables.

Spearman’s rho correlation of university IGR and LMU shopping mall = 0.918

P-Value = 0.000

Interpretation

The correlation coefficient of the University IGR and LMU shopping mall is 0.918 which implies that the strength of the relationship between the university IGR and the LMU Shopping mall is a perfect positive relationship.

The P-value is 0.000 (< 0.05) which implies that the authors will reject the null hypothesis and conclude that there is a significant relationship between LMU shopping mall and the University IGR.

It can also be said that 84% (0.9182) of the variation in the University IGR is explained by the LMU Shopping mall.

Hypothesis 3

H0: There is no significant relationship between LMU Commercial farm and the University IGR.

H1: There is a significant relationship between LMU Commercial farm and the University IGR.

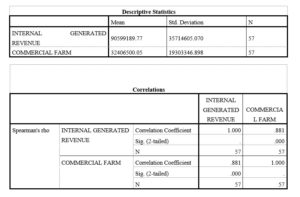

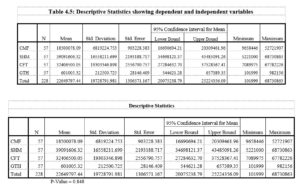

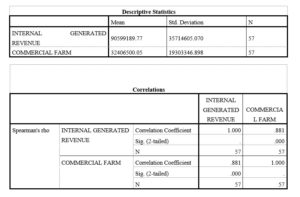

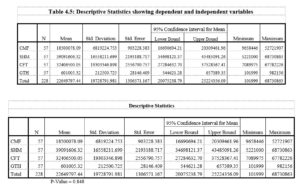

Table 4.3 below shows the descriptive statistics results that disclose a representation of data between the dependent variable and each of the independent variables.

Table 4.3: Descriptive Statistics showing dependent and independent variables

Spearman’s rho correlation of University IGR and LMU Commercial farm = 0.881

P-Value = 0.000.

Interpretation

The correlation coefficient of the University IGR and LMU Commercial farm is 0.881 which implies that the strength of the relationship between the University IGR and the LMU shopping mall is a strong positive relationship.

The P-value is 0.000 (< 0.05) which implies that the authors will reject the null hypothesis and conclude that there is a significant relationship between LMU Commercial farm and the University IGR.

It can also be said that 78% (0.8812) of the variation in the University IGR is explained by the LMU Commercial farm.

Hypothesis 4

H0: There is no significant relationship between LMU Guest house and the University IGR.

H1: There is a significant relationship between LMU Guest house and the University IGR.

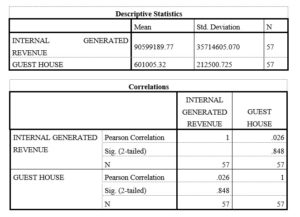

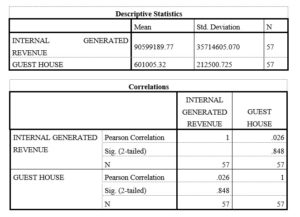

Table 4.1 below shows the descriptive statistics results that disclose a representation of data between the dependent variable and each of the independent variables.

Table 4.4: Descriptive Statistics showing dependent and independent variables

Pearson correlation of university IGR and LMU Guest house = 0.026

Interpretation

The correlation coefficient of the University IGR and LMU Guest house is 0.026 which implies that the strength of the relationship between the University IGR and the LMU Guest house is a weak positive relationship.

The P-value is 0.848 (> 0.05) which implies that the authors do not reject the null hypothesis and conclude that there is no significant relationship between LMU Guest house and the University IGR.

It can also be said that 0.068% (0.0262) of the variation in the University IGR is explained by the LMU Guest house.

TEST 2

HYPOTHESIS 1

H0: µ1= µ2= µ3= µ4

H1: The means are not equal (for at least one mean)

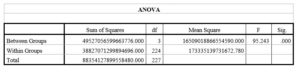

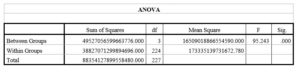

Table 4.6: The ANOVA table shows the hypotheses

Interpretation

The ANOVA table above shows that P-Value = 0.000 which implies that the authors will reject the null hypothesis because P-value (0.000) is less than 0.05 and then they conclude that there is statistically a significant difference between the means of LMU Cafeteria, LMU Shopping mall, LMU Commercial farm and LMU Guest house at 5% Level of significance.

Conclusion and Recommendations

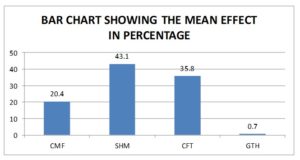

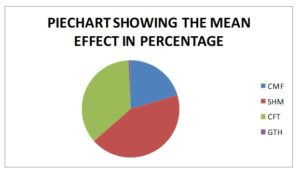

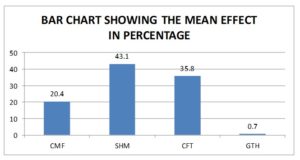

The global financial crisis which ravaged the various sectors of the country’s economy has made it difficult for the government to solely undertake essential services. Therefore, the government has encouraged a Public-Private partnership, which has extended to the educational sector of the economy. Landmark University Cafeteria, Shopping Mall, Commercial Farm, and Guest House constitute four areas of the internally generated revenue with means of 20.4%, 43.1%, 35.8%, and 0.7% respectively. The correlation coefficient of the University IGR and LMU Commercial farm show a positive relationship. The study therefore recommends that the university management needs to put in place effective measures that would ensure the long-term sustainability of the internally generated revenue. Furthermore, marketing strategies that would attract more customers must be initiated by the university management to boost the internally generated revenue.

Acknowledgment

This is to acknowledge Landmark University Centre for Research, Innovation and Development for funding the publication of the research work.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Adam, S. and Micheline, G. (2013), Entrepreneurship, Innovation, and Economic Development: An Overview, 1-30.

- Abosede, AJ and Akintola, OA. (2014), ‘Local Government Funding: Entrepreneurial Perspective to Internally Generated Funds,’ International Journal of Managerial Studies and Research (IJMSR), 2(5), 9-16.

- Adams OU. and Onuka (2002), Funding the Nigerian University Education: The Role of the Various Stakeholders, 149-161.

- Adebowale, A. (2011), Micro-credit: An Amelioration of Poverty for Small-scale Entrepreneurs in Nigeria, Lagos, University of Lagos.

- Adeoye, (2015), ‘The Effect of Entrepreneurship on Economy Growth and Development in Nigeria,’ International Journal of Development and Economic Sustainability, 3(2), 49-65.

- Adeyemi, TO. (2011), ‘Financing of Education in Nigeria: An Analytical Review,’ American Journal of Social and Management Sciences (AJSMS), 1-3.

- Agu, EO and Ayogu, D. (2015), Assessing the Prospects and Problems of Entrepreneurship Development in Nigeria.

- Ajadi, TO. (2010), ‘Private Universities in Nigeria: The Challenges Ahead,’ American Journal of Scientific Research, 7, 15-24.

- AlexAnder, S. K. (2014). Entrepreneurs and their Impact on Jobs and Economic Growth, IZA World of Labor DIW Berlin, University of Potsdam, and IZA, Germany 1-10.

- Alvaro Cuervo, DR and Salvador, R. (2014), Entrepreneurship: Concepts, Theory and Perspective.

- Amir, RSS and Mohammad, M. (2016), ‘Achieving Sustainability through Schumpeterian Social Entrepreneurship: The role of Social Enterprises,’ Journal of Cleaner Production, 137, 347-360.

- Badariah, D., Abdul, R. A. and Mariana, U. (2016). ‘The Effectiveness of the Entrepreneurship Education Program in Upgrading Entrepreneurial Skills among Public University Students, 6th International Research Symposium in Service Management’, IRSSM, 6: 117-123.

- Barbara, K. and Bostjan, A. (2015), The Entrepreneurial University, Academic Activities and Technology and Knowledge Transfer in Four European Countries.

- Carree, MA and Thurik, AR. (2002), The impact of entrepreneurship on economic growth, 1-28.

- Daniel, S. (2010), The Role of Entrepreneurship in Economic Growth, 1-9.

- David, JT. (2010), ‘Business Models, Business Strategy and Innovation: Long Range Planning,’ Undergraduate Economic Review, 6(1), 172-194.

- David, WL., Yung-Chi, S., Benjamin, JC and Chiyan, JC. (2015), Toward Successful Commercialization of University Technology: Performance Drivers of University Technology Transfer in Taiwan, Elsevier Inc.

- David, K. (1995), Entrepreneurial Opportunities in an Entrepreneurial Firm: A Structural Approach, 19(3).

- De Filipo, D., Casani, F. and Sanz-Casado, E. (2015), University Excellence Initiatives in Spain, a Possible Strategy for Optimizing Resources and Improvement Local Performance.

- Dominic, SK., Chang Hoon Oh, L. and Dirk, DC. (2016), Engagement in Entrepreneurship in Emerging Economies: Interactive Effects of Individual-level Factors and Institutional Conditions, 25, 933–945.

- Famade, OA., Omiyale, GT and Adebola, YA. (2015), ‘Towards Improved Funding of Tertiary Institutions in Nigeria,’ AJHSS, 3, 83-90.

- Gregory, AI. et al. (2006), A Report to the Board of Education on Alternative Revenue Sources, 1-29.

- Hamilton and Harper, DA. (1994), The Entrepreneur in Theory and Practice, 3-18.

- Huub, LM., Dugassa, TG. and Alemfrie, DC. (2015), Entrepreneurship Education in Ethiopian Universities: Institutional Assessment Synthesis Report, 1-111.

- Ibeogu, AS and Ulo, FU. (2015), Internally Generated Revenue in the Local Government System and Sustainable Community Development in

- Nigeria: A Study of Abakaliki Local Government Area, Ebonyi State. 3(11): 111-120.

- Jonathan, P., Janice, B., Alain, F., Phillip, H., Tixier, J. and Barbara, B. (2010), University Entrepreneurship Support: Policy Issues, Good Practices and Recommendations OECD, LEED.

- Olawore, OP. and Ajayi, TB. (2013), The Emergence of Private Universities in Nigeria and their Various Challenges.

- Onuoha, LN. (2013), Financing Higher Education in Nigeria: The Role of Internally Generated Revenue and How University Management can Maximize the Sources.

- María, JA., Salvador Pérez-Moreno, Isabel, M. (2017), How Economic Freedom Affects Opportunity and Necessity Entrepreneurship in the OECD Countries, (73), 30–37.

- Maria de Lurdes, C. and Soumodip, S. (2017), Organizations as Biomes of Entrepreneurial Life: Towards a Clarification of the Corporate Entrepreneurship Process, 70, 44–54.

- Martin, R. (2006), Theories of Entrepreneurship: Historical Development and Critical Assessment.

- Nigerian Bureau of Statistics (NBS), Visit on 11/11/2016 venturesafrica.com.

- News Agency of Nigeria June 21, 2016 and October, 3rd, 2016. Visit Friday March 3rd, 2017.

- Ogbogu, OC. (2011), ‘Modes of Financing Nigerian Universities and the Implication on Performance,’ International Educations Research, 7, 8-23.

- Ogueze, VC. and Orji, UO. (2015). The Cost of Unemployment and its Effect on Gross Domestic Product Growth in Nigeria, 1-10.

- Sani, A. (2015), ‘Public and Private Higher Education Financing in Nigeria,’ European Scientific Journal March 2015 edition, 11(7), 92-109. Tax Payer Guide, (2015).

- Vanguard newspaper, 26th September, 2016.

- Vanguard newspaper (2015). Developing Internally Generated Revenue in an area of Diversification, April 19, 2015

- Vera, CR. (2012), The Entrepreneur in Economic Theory: From an Invisible Man Toward a New Research Field, School of Economics and Management, University of Porto.

Appendix 1

Graphical Representation

Fig. 4.1: Bar chart showing the mean effect in percentage of LMU Cafeteria, LMU Shopping Mall, LMU Commercial Farm and LMU Guest House on the University Internally Generated Revenue

Interpretation

The bar chart above shows the mean effect of LMU Cafeteria, LMU Shopping mall, LMU Commercial farm and LMU Guest house on the University IGR in percentage. It further shows that LMU cafeteria contributes with 20.4% to the University IGR, LMU Shopping mall contributes with 43.1% to the University IGR, LMU Commercial farm contributes with 35.8% to the University IGR, and LMU Guest house contributes with 0.7% to the University IGR.

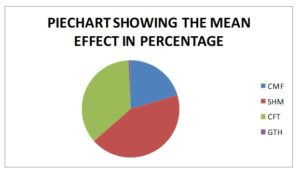

Fig. 4.2: Pie chart showing the mean effect in percentage of LMU Cafeteria, LMU Shopping Mall, LMU Commercial Farm and LMU Guest House on the University Internally Generated Revenue

Interpretation

The pie chart above shows the mean effect of LMU Cafeteria, LMU Shopping mall, LMU Commercial farm and LMU Guest house on the University IGR in percentage. It further shows that LMU Cafeteria contributes with 20.4% to the University IGR, LMU Shopping mall contributes with 43.1% to the University IGR, LMU Commercial farm contributes with 35.8% to the University IGR, and LMU Guest house contributes with 0.7% to the University IGR.