Introduction

In the post-crisis period, when the company’s cash flows slow down the growth rate, the management of specialised surplus and non-core assets will help to maintain the competitive position of the company in the market, and in the most successful cases, to bring an increase in the market value of the equity. Excess and non-core property, as a rule, requires maintenance costs (including tax payments) and is not involved in the generation of income of the enterprise. The lease of such property will allow the company to cover the necessary operating costs and increase the non-operating profit of the company. To offer this property for rent, the owner will be required to assign a market-based rental rate.

The scientific novelty of this research is in presentation of a model taking into account risk analysis for the implementation of the method of assessing the market rental payment for surplus and non-core property of the enterprise, developing a methodology for determining the market rental payment.

The paper solves the problem of justification of the market rental payment using the method of iterative calculations in the framework of the cost and profitable approaches. The proposed step-by-step algorithm for determining the rental income is suitable for defining the market rental payment for specialised surplus and non-core assets of the enterprise in an underdeveloped market.

The paper deals with fixed assets that are a business forming unit (part of the property complex) at industrial enterprises of chemical, coal, oil and gas and other industries. Specialised assets are defined in paragraph 14 of the FSO No. 10 (2015) as “a set of technologically related objects that are not presented on the market as an independent object and have a significant value only as part of the business”. Non-core assets are defined in the Order of the Government of the Russian Federation (2017) as “assets owned by a commercial legal entity on the right of ownership, the presence / alienation (in any way) of which cannot affect the implementation of the enterprise’s development strategy”. For example, in chemical industry about 70 % of the initial balance cost is contained in machines, chemical equipment and pumps, another 20 % is contained in real estate (buildings, facilities and tanks).

It should be noted that specialised property does not have an independent utility for continued use. The use of specialised property as a part of the entire production complex determines the usefulness of such assets. The rented objects can have an independent utility only in liquidation proceedings. However, the authors in the framework of this paper do not consider such situation.

Literature Review

The chosen research topic extends the Value Based Management (VBM) approach, since the company increases cash flows by leasing specialised surplus and non-core property. The principles and methods of VBM are widely used in many corporations in different countries. The works of the founders of two consulting companies (Stewart, 1991; Rappaport, 1999) were main catalyst for the development of the VBM approach. In these works, an attempt is made to rethink the main role of hired managers of the company, which, according to the authors’ opinion, is to create and increase the value of the company in the interests of its owners. Recognition of this purpose means the need for the next review of corporate strategic guidelines, as well as criteria for assessing the efficiency of the fixed assets in-use that are at the disposal and control of company’s managers (Izmaylov and Kobzev, 2019).

Surplus and non-core assets without management outflow the company’s resources, while the option of leasing such assets will solve this problem.

Works by Damodaran (1996; 2002) raise the issue of increasing the cost of equity through the management of excess assets. Such assets may generate additional rental income. However, the author does not consider the issue of setting a market rental rate for such assets of the enterprise.

In the book by Ozerov and Pupentsova (2015), an algorithm for calculating the rental rate of the real estate is given. This algorithm is applicable to commercial real estate objects in the established rental market.

Pupentsova and Livintsova (2018) in a research propose an algorithm for determining the market rental rate of the commercial real estate in a developed market with a sufficient number of analogous objects.

In the Federal valuation standard (FSO No. 10, 2015), it is proposed to apply the methods of the cost approach to assess specialised property.

In the methodology of Gazprom, PJSC (Yatsenko, 2012), when determining the rental payment of excess property, only the lessor’s costs and the rate of profit are taken as the basis. Moreover, the rate of profit is justified by federal and domestic norms of the enterprise.

In the works of the above-mentioned authors, not enough attention is paid to the procedure of assessment of the rental income from the specialised assets in an underdeveloped market.

It should be noted that the issue of assigning market rental payment for such specialised assets, despite its relevance, is not disclosed in the normative documents on property valuation and in the works of the authors (Grigoryev and Kozin, 2006; Rhaiem et al., 2007; Bukharin et al., 2011; Bakhvalov et al., 2015; Shabrova et al., 2017; Kozlov et al., 2017; Fitz-Gibbon, 2018; Konowalczuk, 2018).

Jansen van Vuuren (2016) argues that the profits method, specifically a discounted cash flow (DCF) based profits method, should be the preferred method of valuation when valuing specialised property than the cost approach in taking into account systematic and unsystematic risk.

A description of the methodology

The specialised assets of an enterprise are limited to a specific type of functional use and have a closed, non-competitive, passive or asymmetric market, or none at all. When evaluating such assets, a limited set of approaches, methods and valuation techniques can be applied. They often require modification or revision.

According to the valuation methodology, the market property rental rate is determined by the methods of comparative, cost and income approaches. In practice, the most commonly used comparative approach is based on information about similar transactions (offers to rent transactions), which implies the existence of a well-developed market. If there are no data on the rental rates typical for the lease of specialised excess and non-core property of the enterprise, the comparative approach is not applicable.

From the point of view of the cost approach when determining the rental rate, the lessor intends to ensure the return of capital and income on capital invested in the creation of the object. To determine the rental rate, it is necessary “at the first step to assess the market value of the rented object by the methods of the cost approach (of course, taking into account the profit of the developer’s project and the value losses due to wear and obsolescence). If the new owner has purchased an object for use as a financial asset, then as a property owner he will accept the evaluation of the object by the method of comparative analysis of transactions. For a typical lessor, it is advisable to determine the market value at this first step using both cost-based and comparative approaches. At the second step, the appraiser finds the potential total income and rental rate at the known value of the object and the market rate of return on capital” (Ozerov and Pupentsova, 2015, pp. 291-292).

To determine the market rental rate by using the income approach, it is necessary to determine the maximum allowable for the tenant “the value of the rental rate, based on his ideas about the permissible value of the expected business income, which he would consider possible to give for the use and ownership of the rented property extracting these revenues. Here the annual income from the business of a typical tenant is necessary to distribute between all types of factors of production, isolating the amount “generated” by the rented specialised property, that is, determining the “additional productivity” of improvements on the residual principle. This amount (“additional productivity”) will determine the amount of market rental rate of a typical tenant for the use of the object during the relevant period” (Ozerov and Pupentsova, 2015, p. 292). As a rule, the income approach is not used for determining the market rental rate, since the allocation of the total amount of income and expenses of the part that is directly related to the estimated specialised asset is associated with a large error.

Let us consider the algorithm for calculating the market value of rental rate for specialised property, including real estate and technological equipment, which is excessive for business. The implementation of the algorithm includes iterative calculations, that is, multiple calculations on the argument x (rental rate). The iterative process of solving the equation f(x) = 0 consists in a sequential refinement of some initial approximation of x0. The sequence of approximate values of the root: x1, …, xn, is a result of iterations. If these values with an increase in the number of n iterations approach the exact value of the root x* (that is ), it is said that the iterative process of the solution converges, otherwise, it diverges (Bakhvalov et al., 2015, p. 326).

Calculation steps will be considered further:

- First of all, the full cost of the expenses of reproduction (replacement) of rented specialised production assets must be calculated in order to determine the market value of the rental payment rate of specialised objects. Next, the presence or absence of external wear should be identified. The value of the costs of creating the entire production complex needs to be determined.

The cost of reproduction (replacement) of leased specialised assets is determined by the methods of comparative and / or cost approaches. Physical and functional wear is assumed to be zero, since, most often, under rent agreements, all expenses associated with the payment of current and capital repairs are paid by the tenant independently. The reproduction costs should be adjusted by the amount of external wear, if any.

- The discount rate (the rate of return on capital) is determined. As a rule, the rate of return of rental cash flows will be lower than the rate assessed for the enterprise industry due to a lower risk premium and a different capital structure from the business.

- The value of rental income is entered in the initial approximation of x0.

- The amount of operating expenses (at least, property tax and management expenses) is calculated.

- The cash flow is constructed for the assigned approximate rental income.

- The minimum and maximum values of the main factors in the model are forecasted.

- Scenarios are formed and the calculation of the preliminary current rental payment is made.

- An iterative calculation of the rental income is made, in which the present value of cash flows is equal to the market value of the specialised property of the enterprise for each scenario.

- The market rental rate range is determined and the rental value distribution is constructed.

Results and Discussions

Based on the experience of assessing the assets of enterprises, the revalued value of non-current assets may exceed its book value several times. The owner needs to compensate for the return of capital on the reproduction of assets, so the use of book value as a basis for determining the amount of rental payment for specialised property is not acceptable. First, it is necessary to calculate the full cost of the reproduction or replacement of rented specialised production assets due to determining the market value of the rental payment of specialised objects. Next, the presence or absence of external wear should be identified. It is necessary to determine the value of the cost of creating the entire production complex. The methodology of determining the cost of reproduction (replacement) with the use of comparative and cost approaches, as well as methods for identifying and calculating the amount of external wear are not considered in the current study. Detailed approaches and methods of assessing the market value of assets can be found in any methodological publication on the valuation of assets, for example, in (Ozerov and Pupentsova, 2015; Bakhvalov et al., 2015; Damodaran, 1996 & 2002; Rhaiem et al., 2007; Bukharin et al., 2011; Yaskevich, 2005; Zelenski, 2008; Grijalva et al., 2018; Sharov & Schneiderman, 2015; Giglio et al., 2015; Gloukhov et al., 2014; Bril et al., 2019; French, 2004; French and Gabrielli, 2018; Demidenko & Malevskaia-Malevich, 2020).

The discount rate is determined for the invested capital according to the WACC (weighted average cost of capital) model (Damodaran, 1996 & 2002; Rhaiem et al., 2007; Bukharin et al., 2011; Magni, 2015; Zhukov, 2018):

where

YO – the weighted average rate of return on invested capital;

Ym – the rate of return on borrowed capital;

M – the share of borrowed capital;

Yerur – the rouble rate of return on equity.

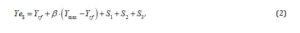

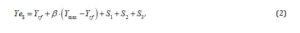

The rate of return on equity is determined by the modified САРМ model (capital assets price model). The algorithm for calculating the rate of return on equity is given in (Sharpe, 1970; Bukharin et al., 2011; Galevsky, 2019; Qoqiauri & Qoqiauri, 2019):

where

Ye$ – investor’s expected rate of return on equity;

Yrf – the risk-free yield (in the US);

β – the beta-ratio;

(Ymax – Yrf) – the market premium for equity risk (in the US);

S1 – the premium for country risk (for example, Russia compared with the US);

S2 – the premium for a small capitalisation;

S3 – the premium for the specific risk of the assessed company.

Despite the fact that a large share of the property falls on specialised equipment, the size of the beta-ratio (β) is chosen for the “Real Estate (Operations & Services)” industry. Such choice is because when renting equipment, the industry (chemical, coal, oil & gas and etc.) risks are minimised and become the most similar to the risks when renting real estate.

The specific risk is assumed to be 0 %, since the object of the study is the property complex, which has no specific risks.

The transition to the rouble norm is carried out, taking into account the assumption that the excess of the absolute value of the rouble cost of capital (Yerur) over the US dollar (Ye$) is equal to the excess of the yield of Russian government long-term bonds denominated in roubles (Rrur) over the yield of Eurobonds (R$), and is made according to the formula:

The cost of borrowed capital is determined at the level of interest rates on loans issued by banks to non-financial organisations for a period of more than three years.

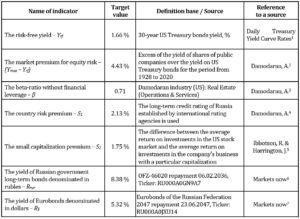

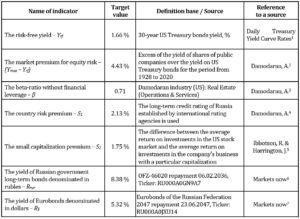

The initial data for calculating the rate of return on equity are given in Table 1.

Table 1: Indicators for calculating the discount rate on the CAPM model (January 2021)

Source: Compiled by the authors.

The transition from the beta-ratio excluding financial leverage to the beta-ratio taking into account the financial leverage is not performed, as the cash flows of the model are built before taxation. The rate of return for the currency cash flow on the CAPM model, calculated before tax, will be:

Ye $ = 1.66% + 0.71 × 4.43% + 2.13% + 1.75% = 8.69 %.

Then, the rouble rate of return on equity on the CAPM model for cash flow calculated before taxation will be equal to:

Ye rur = (1 + 8.69%) × (1 + 8.38%) / (1 + 5.32%) – 1 = 11.84 %.

The following input parameters are accepted for the WACC investment rate:

– the cost of borrowed capital is determined on the basis of interest rates on loans for more than 3 years issued in roubles. According to the Central Bank of the Russian Federation, it is equal to 6.48 % (Banking Bulletin, 2021);

– the target capital structure for the Real Estate (Operations & Services) industry according to (Damodaran, 20214) is 40.79 %. As mentioned above, the choice is due to the fact that when renting the risks of the industry (chemical, coal, oil, etc.) are minimized, and become most similar to the risks of renting real estate. Then the optimal share of the debt capital for the selected industry corresponds to 28.97 %.

Thus, the rate of return on invested capital under the WACC model for pre-tax cash flow, as a weighted average of the capital structure, is:

Yo = 11.84% × (1 – 28.97%) + 6.48% ×28.97% = 10.29 %.

Operating expenses of an enterprise that leases specialised property include property tax and management costs. In the framework of the study, an assumption is introduced that under the terms of the lease agreement the tenant carries out the current and major repairs. Therefore, the repair costs are not taken into account in the construction of cash flows.

Property tax according to the Tax code of the Russian Federation is 2.2 % of the average annual value of the property (Article 380 of the Tax code of the Russian Federation).

Management costs are usually determined by the level of expenses of management companies, which for real estate are from 4 % to 25 % of the revenue. Large values of management costs are associated with the need for advertising, searching for tenants and the organisation of public services.

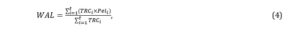

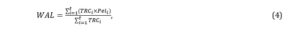

To calculate the depreciation, weighted average period of economic life (WAL) is determined according to the formula (Pupentsova et al., 2017):

where

TRC – the total cost of reproduction or replacement of property and equipment;

t – the number of property and equipment;

Pel – the period of the economic life of the property.

Cash flows for the entire forecast period are calculated. The amount of rent is entered in the first approximation, for example, 10 % of the market value of the leased objects. An annual increase in rental payment at the level of inflation is planned to lay in the lease agreement. Inflation is accepted according to the data of the Ministry of economic development of the Russian Federation (Forecast of social and economic development, 2019).

At the next step, the range of the following factors is determined:

– the market value of a property: from 90 to 110 million c. u. (1 с. u. = 1 Euro);

– average property amortization period: from 25 to 35 years;

– forecasted growth rate of cash flows: from 4 % to 4.5 %;

– property management costs: 4 % to 5 % of effective gross income.

The specified ranges are entered based on market monitoring. It should be noted that within the given ranges, the factor can take any value with the equal probability. Therefore, when modeling, a uniform discrete distribution is chosen.

Simulation modeling is applied using the Monte Carlo method (Gromova & Pupentsova, 2020; Chen et al., 2018). For the analysis, 10,000 scenarios are generated. The source data of the model in the scenario corresponds to a random value selected using the random number generator function in MS Excel from the specified above ranges. For each scenario, the present value of cash flows is calculated using the formula:

Where

Ioj – the cash flow of the j-th forecast period;

Von – the property value at the end of the forecast period (reversion value);

Yo – the discount rate determined by the WACC model;

n – the forecast period, years.

Gordon’s model is used to calculate the reversion (Bukharin et al., 2011; Shabrova et al., 2017; Giglio et al., 2015; Michaletz & Artemenkov, 2019). The value of the property at the end of the forecast period is determined by the ratio of cash flow in the n+1 period to the capitalisation ratio, which is equal to the difference between the discount rate and the growth rate of cash flows in the post-forecast period (Ozerov et al., 2018).

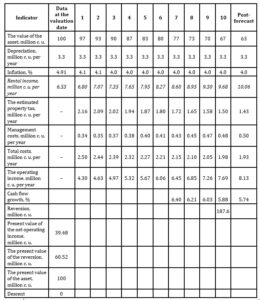

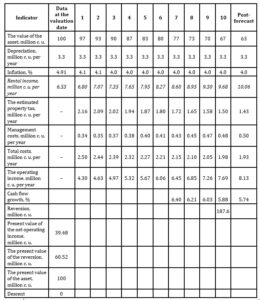

Since the market rent is determined on the basis of the condition that the invested capital should not only pay off, but also bring a regular income, the resulting current value of cash flows is reduced to the market value of the lease objects by selecting the market rental payment by iterative calculations. Table 2 shows an example of calculation of cost of rental payment of the specialised assets based on the assumption that the cost of reproduction or replacement is equal to the market value of a property in range from 90 to 110 million c. u., the average percentage of depreciation is equal to 1/Pel (Pel is taken from the range of 25 to 35 years), the rate of return is 10.29 %. The rate of return includes inflation and is adopted constant for the entire forecast period. Management costs are taken at the range from 4 % to 5 %. The average annual growth of cash flows for the last 2 years of the forecast period was in the range from 4 % to 4.5 %. This level is also adopted for the post-forecast period.

Table 2: The determination of the market rent by an iterative calculation method (scenario 1)

Source: Authors’ own study.

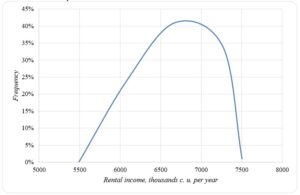

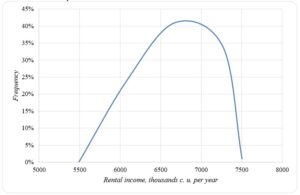

For each scenario, an iterative calculation of the rental income is performed at which the present value of the cash flows is equal to the market value of the specialised and non-core property of the enterprise. The distribution of the obtained values of the market rental rate for such property is shown at Figure 1.

Fig. 1: The distribution of the market rental income from fixed assets of an enterprise in an undeveloped market

Source: Authors’ own study.

Simulation modeling of the calculation of the market rental rate made it possible to obtain a rental income range from 5.5 to 7.5 million c. u. per year. Therefore, provided that if “the invested capital should not only return, but also bring a regular expected income” (Ozerov & Pupentsova, 2015; Ozerov et al., 2018), then on the valuation date the market rental payment for specialised property with a probability of 68 % will be in a range from 6 to 6.9 million c. u.

Conclusion

The step-by-step algorithm for determining the rental income for defining the market rental payment for fixed assets of the enterprise in the market segment with a limited number of offers was proposed. The paper solves the problem of justifying the market rental rate for leased specialised surplus and non-core property using methods of the iterative calculation and the simulation modelling as part of the cost approach.

The simplicity of use of the developed algorithm for calculating the rental payment rate for the considered property will allow a company’s managers to offer an economically reasonable result. The logic of the calculation is clear and understandable to managers at all levels. The rental payment rate is selected depending on the market value of such property, the rate of return on capital and the payback period of capital investments. Tax payments and management costs should be taken into account when building cash flows for the rental business.

The result of the rental payment rate is sensitive to the rate of return on capital. Therefore, this paper focuses on the justification of the discount rate. The authors note that the discount rate is modelled for the Real Estate (Operations & Services) market. Such a choice is due to the fact that when renting specialised property, the risks of the industry are minimized and become most similar to the risks when renting the real estate.

In addition, within the framework of the paper, the discount rate has been determined by using the models of the САРМ and WACC for the Real Estate (Operations & Services) industry as of January 2021:

– the rouble rate of return on equity on the model of the САРМ for cash flow calculated before taxation was 11.84 %;

– the rate of return on invested capital on the WACC model was obtained at the level of 10.29 %.

The resulting value of the rate of return on equity for cash flow in roubles can be used to calculate the current value of cash flows of the rental income.

It should be noted that the Monte Carlo simulation helps to predict the future state of the external environment with a given accuracy. This can be the basis for managerial decisions made in crisis conditions, when everything is changing rapidly. The method can be adapted for modelling any tasks from any industry. The main difficulty of this method lies in forecasting with sufficient accuracy the future values of the considered variables.

Foot Notes

[1] U.S. Department of the Treasury. Daily Treasury Yield Curve Rates [Online]. Available: URL: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx?data=yieldYear&year=2021 (accessed 22.02.2021).

[2] Damodaran, A. Analytical materials on the main market indicators. [Online]. Available: URL: http://pages.stern.nyu.edu/~adamodar/pc/datasets/histretSP.xls (accessed 22.02.2021).

[3] Damodaran, A. Analytical materials on the main market indicators. [Online]. Available: URL: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html (accessed 22.02.2021).

[4] Damodaran, A. Analytical materials on the main market indicators. [Online]. Available: URL: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html (accessed 22.02.2021).

[5] Ibbotson, R. G. & Harrington, J. P. Stocks, Bonds, Bills and Inflation. [Online]. Summary Edition 2020 Yearbook. Duff & Phelps. Available: URL: https://www.cfainstitute.org/-/media/documents/book/rf-publication/2020/rf-sbbi-summary-edition.ashx (accessed 22.02.2021).

[6] Bonds. Markets now. [Online]. Available: URL: www.quotenet.com (accessed 22.02.2021).

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Banking Bulletin of the Central Bank of the Russian Federation. [Online]. (Аccessed 22.03.2021) Available: URL: http://www.cbr.ru/eng/statistics/bbs/.

- Bril, A., Kalinina, O., Kankovskaya, A. and Vilken, V. (2019), ‘Operational risk management in financing environmental activities and personnel management projects’, E3S Web of Conferences, 110, 02018.

- Bukharin, N.А., Ozerov, Ye.S., Pupentsova, S.V., Shabrova, О.А. (2011), Otsenka i upravleniye stoimost’yu biznesa [Business value assessment and management], Polytechnic University, St. Petersburg.

- Chen, X., Christensen, T., and Tamer, E. (2018), ‘Monte Carlo Confidence Sets for Identified Sets’, Econometrica, 86(6), 1965-2018.

- Damodaran, A. (2002), Investment valuation: Tools and Techniques for Determining the Value of Any Asset,

Mc-Graw-Hill. URL: https://www.twirpx.com/file/357301/.

- Damodaran, A. (1996), Investment Valuation, John Wiley & Sons Inc., New York.

- Demidenko, D. & Malevskaia-Malevich, E. (2020), ‘Features of the investments effectiveness evaluating in innovative products of industrial business system’. In ECIE 2020 16th European Conference on Innovation and Entrepreneurship, 212-216. Academic Conferences limited.

- Fitz-Gibbon, D. (2018), Marketable Values: Inventing the Property Market in Modern Britain, University of Chicago Press, Chicago.

- Forecast of social and economic development of the Russian Federation for the period up to 2024 (2019). Ministry of economic development of the Russian Federation. [Online]. [Accessed 02.2021]. URL: https://www.economy.gov.ru/material/directions/makroec/prognozy_socialno_ekonomicheskogo_razvitiya/prognoz_socialno_ekonomicheskogo_razvitiya_rf_na_period_do_2024_goda_.html.

- French, N. (2004), ‘The valuation of specialised property: A review of valuation methods’, Journal of Property Investment & Finance, 22 (6), 533-541.

- French, N. and Gabrielli, L. (2018), ‘Pricing to market: Property valuation revisited: The hierarchy of valuation approaches, methods and models’, Journal of Property Investment & Finance, 36 (4), 391-396. https://doi.org/10.1108/JPIF-05-2018-0033.

- FSO No. 10 (2015) Federal Valuation Standard ‘Valuation of machines and equipment’ (approved by Order No. 328 of the Ministry of Economic Development and Trade of Russia dated 01.06.2015, the document effective since 30.09.2015).

- Galevsky, S. G. (2019), ‘CAPM Modification for correct risk assessment in discounted cash flow method’, Petersburg State Polytechnical University Journal. Economics, 75(1), 201-212.

- Giglio, S., Maggiori, M. and Stroebel, J. (2015), ‘Very Long-Run Discount Rates’, Quarterly Journal of Economics, 1 (130), 1-53, doi:10.1093/qje/qju036.

- Gloukhov, V.V., Ilin, I.V., Koposov, V.I. and Levina, A.I. (2014), ‘Market risk neutral strategies: modeling and algorithmization’, Asian Social Science, 10 (24), 209-216.

- Grijalva, T.C., Lusk, J.L., Rong, R. et al. (2018), ‘Convex Time Budgets and Individual Discount Rates in the Long Run’, Environmental and Resource Economics, 71, 259-277, doi: 10.1007/s10640-017-0149-0.

- Grigoryev, A. and Kozin, P. (2006), ‘Rynochnaya stavka arendnoy platy dlya spetsializirovannoy nedvizhimosti [Market rental rate for the specialised real estate]’, Finansovaya gazeta, 50.

- Gromova, A. and Pupentsova, S. V. (2020), ‘Simulation modelling as a method of risk analysis in real estate valuation’, IOP Conference Series: Materials Science and Engineering, 898 012048.

- Izmaylov, M.K. and Kobzev, V.V. (2019), ‘Problems and prospects of implementation of value based management at domestic industrial enterprises’, Petersburg State Polytechnical University Journal. Economics, 12 (5), 199-208, doi: 10.18721/JE.12516.

- Jansen van Vuuren, D. (2016), ‘Valuing specialised property using the DCF profits method’, Journal of Property Investment & Finance, 34 (6), 641-654. doi: 10.1108/JPIF-06-2016-0047.

- Konowalczuk, J. (2018), ‘Fair Value in the Valuation of Damage to Property Caused by Indirect Nuisance Created by Companies’, Real Estate Management and Valuation, 26 (3), 60-70.

- Kozlov, A.V., Teslya, A.B. and Zhang, X. (2017), ‘Principles of assessment and management approaches to innovation potential of coal industry enterprises’, Zapiski Gornogo instituta, 223 (eng), 131-138.

- Magni, C. A. (2015), ‘Investment, financing and the role of ROA and WACC in value creation’, European Journal of Operational Research, 244 (3), 855-866, doi: 10.1016/j.ejor.2015.02.010.

- Michaletz, V.B. and Artemenkov, A. (2019), ‘The transactional asset pricing approach: Its general framework and applications for property markets’, Journal of Property Investment and Finance, 37 (3), 255-288, doi: 10.1108/JPIF-10-2018-0078.

- Order of the Government of the Russian Federation of 10.05.2017 №894-r “On Approval of Methodological Recommendations for the Identification and Sale of Non-core Assets”.

- Ozerov, Ye.S. and Pupentsova, S.V. (2015), Upravleniye stoimost’yu i investitsionnym potentsialom nedvizhimosti [Property and investment potential management], Polytechnic University, St. Petersburg.

- Ozerov, E.S., Pupentsova, S.V., Leventsov, V.A. and Dyachkov, M.S. (2018), ‘Selecting the best use option for assets in a corporate management system’, 6th International Conference on Reliability, Infocom Technologies and Optimization: Trends and Future Directions, ICRITO, 162-170.

- Pupentsova, S. and Livintsova, M. (2018), ‘Qualimetric assessment of investment attractiveness of the real estate property’, Real Estate Management and Valuation, 26 (2), 5-11, doi: 10.2478/remav-2018-0011.

- Pupentsova, S.V., Shabrova, O.A. and Leventsov, V.A. (2017), ‘Determining the control premium in business valuation of shares’, Petersburg State Polytechnical University Journal, 10 (5), 125-132, doi: 10.18721/JE.10511.

- Qoqiauri, L. & Qoqiauri, N. (2019), ‘Main Regulations of CAPM Model and Its Modern Modification’, Management, 7(1), 15-32.

- Rappaport, A. (1999), Creating shareholder value: a guide for managers and investors. Simon and Schuster, New-York.

- Rhaiem, N., Ben, S., and Mabrouk, A. B. (2007), ‘Estimation of Capital Asset Pricing Model at Different Time Scales’, The International Journal of Applied Economics and Finance, 1, 79-87, doi: 3923/ijaef.2007.79.87.

- Shabrova, О.А., Pupentsova, S.V. and Alekseeva, N.S. (2017), ‘Usloviya vypolneniya aksiomy ravenstva rezul’tatov pri opredelenii stoimosti aktivov [The conditions of occurrence axiom of equality for valuation results]’, Economics and entrepreneurship, 1 (78), 906-913.

- Sharov, S.Yu. and Schneiderman, I.M. (2015), ‘Three approaches to residential buildings valuation as an element of the national wealth’. Voprosy statistiki, 1, 23-28.

- Sharpe, W. (1970). Portfolio theory and capital markets. New York: McGraw-Hill.

- Stewart, G. B. (1991), The quest for value: a guide for senior managers. Harper Business, New-York.

- Yaskevich, E.E. (2005), Metodika otsenki velichin arendnykh stavok ob’yektov nedvizhimosti s pomoshch’yu zatratnogo podkhoda [The methodology for assessing the rental rates of real estate using the cost approach], NPTSPO, Moscow. [Online]. [Accessed 21.02.2020]. URL: http://www.ocenchik.ru/method/realty/66.

- Yatsenko, V.M. (2012), ‘Metodichskie osnovy formirovaniya arendnoy platy v “GAZPROM” [Methodical grounds of rent payment formation in JSC “Gazprom”]’, Problems of Economics and Management of the Oil and Gas Complex 4, 8-12.

- Zelenski, Y.V. (2008), ‘Estimating rental payments for use of specialised property’, Voprosi ocenki, 3, 38-48.

- Zhukov, P. (2018), ‘The impact of cash flows and weighted average cost of capital to enterprise value in the oil and gas sector’, Journal of Reviews on Global Economics, 7, 138-145.