Introduction

The value of a company consists of both tangible and intangible assets. In the conditions of knowledge-based economy and technological progress, intangible aspects, which are difficult to quantify, gain more and more importance. Intangible value generators are directly related to research and development activities.

This topic is of interest to academics and practitioners in accounting, finance and strategic management. The “new generation” companies that use intangible assets and highly developed technologies in their activities obtain higher valuations compared to traditional companies that do not invest in innovative projects. The higher valuation of innovative entities is primarily due to their potential to gain competitive advantage and flexibly adapt to current market conditions, which often change in a turbulent environment. Therefore, it can be considered reasonable to state that intangible factors significantly determine the value of the company, in other words, the role of intangible aspects in relation to tangible ones is much greater.

The main goal of the paper is to critically review the concepts of studying the impact of the implementation of innovation projects on the value of the company and their critical assessment, as well as to identify the conditions affecting the choice of an appropriate method for valuing innovation projects.

The specifics of innovative projects

Research and development works (GUS, 2018), defined as creative work, are undertaken on a continuous basis in order to develop knowledge resources. The R&D area includes organizational units which conduct industrial research and development works resulting in a new product, new technology or service as well as a new organizational or marketing solution (Sosnowska, 2001, p.18).

Within the framework of scientific research, various concepts can be distinguished to divide the categories of research and development activities. For the purposes of management, the research conducted as part of R&D may be divided into the following types:

- incremental research, includes “small” R (basic research) and “big” D (development and implementation);

- radical research, includes “big” R and “big” D;

- fundamental research, includes “big” R and “small” D (Roussel et al., 1991, p.15).

According to the Technology readiness levels (TRL) model, developed by NASA, basic research, industrial research and development work are distinguished (Mankins, 1995, p.1). Fundamental research is defined as original, experimental, or theoretical research work whose purpose is to acquire new knowledge of fundamental phenomena and facts that are not necessarily applicable in practice (TRL I). The purpose of industrial research (TRL II-VI) is to acquire new knowledge and skills that will allow to create new products, processes and services or to introduce significant improvements to existing products, processes, services. Development works (TRL VII – IX) consist in acquiring, combining, shaping and using currently available knowledge and skills in the field of science and technology and business activities to develop and design new, changed or improved products, processes and services (NCBiR, 2016).

Research and development activities can be one of the main sources of innovation. This thesis is confirmed by the models of innovation creation presented in the literature, such as: the supply model of innovation and the demand model of innovation, the demand-supply model, integrated models and open innovation models (Wiśniewska, 2011, p. 101).

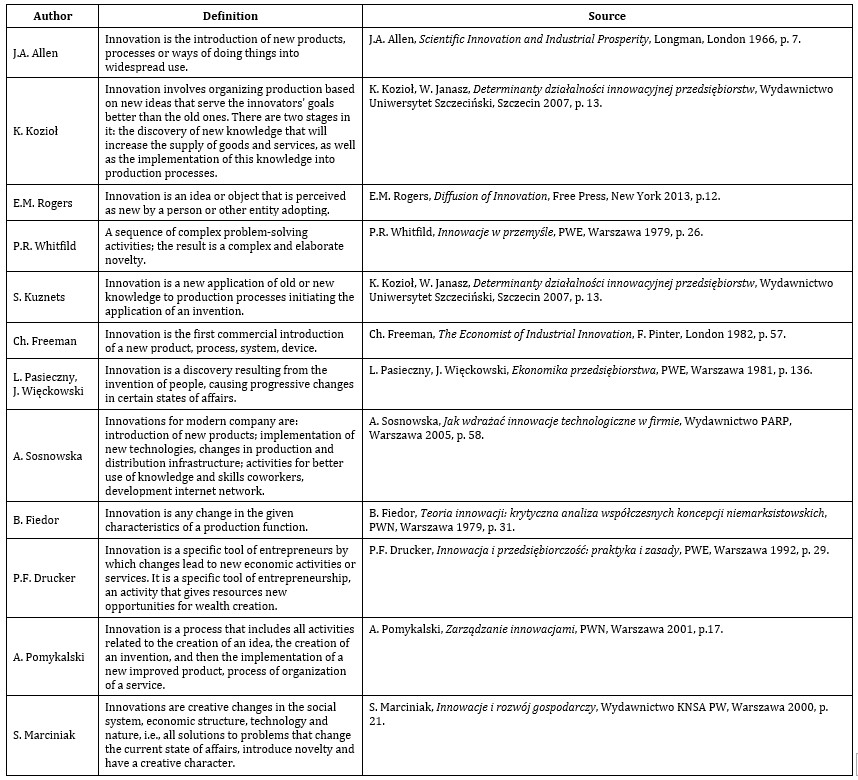

Based on the proposals of I. Schumpeter, further explanations of the essence of innovation were developed. Table 1 presents an overview of the definitions of innovation.

Table 1: Overview of innovation definitions

Source: Authors’ own elaboration based on the indicated references

Based on the definitions presented in Table 1, it can be concluded that the concept of innovation is considered in either a narrow or a very broad sense. Despite the differences, these definitions point to the common features of innovation, which include:

- an intentional beneficial change planned by a person;

- the change must have a practical application;

- first application;

- it may concern a product, service, manufacturing method;

- innovation accelerates technical progress and brings economic benefits;

- the requirement of a specific type of technical, economic, market knowledge resource (Baruk, 2006, p. 102).

On the basis of the above considerations, it has been assumed that the innovation project means a sequence of unique, complex and interrelated tasks with a common objective, intended to be used within a specified period of time, without exceeding the specified budget, in accordance with the assumed requirements, and the purpose of the project is to introduce a novelty on the market, which has so far been unknown and unused. The creation of innovation is a process whose final effect should be the implementation of a new solution. Therefore, the condition for recognizing a given project as an innovative project is its completion in such a way as to introduce a given solution on the market.

Trends in methods for studying the impact of innovation on enterprise value

The development of a knowledge-based economy, dynamically changing competitive environment and increased accessibility to financial capital result in the emergence of many new enterprises, are characterized by high innovation potential. Researchers are trying to develop methods to determine the impact of innovation on enterprise value. Research work is carried out in two main streams, which can be described by questions:

- how to assess whether a project planned for implementation is innovative?

- how to determine the impact of the implementation of an innovative project on the value of the company?

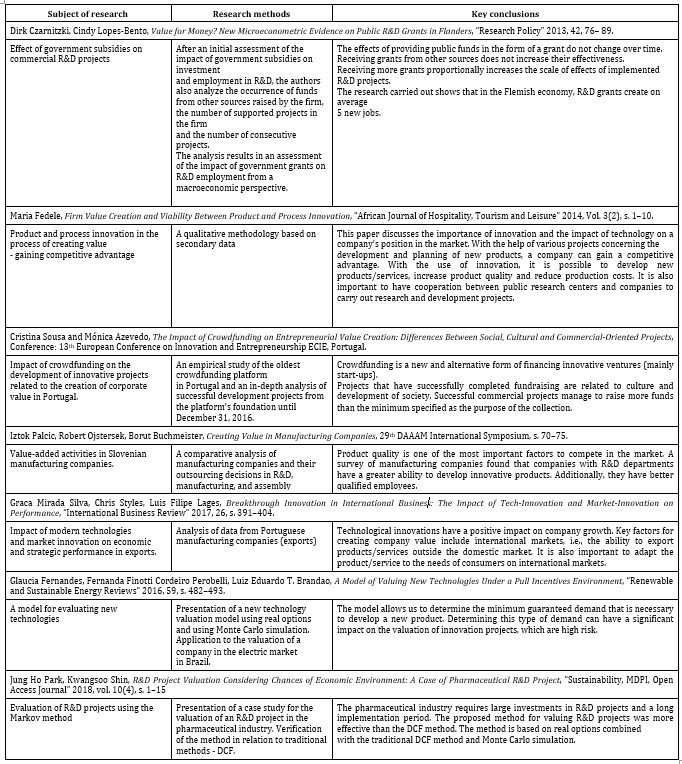

Table 2 presents methods for evaluating, ranking and selecting innovations and the commercialization potential of an innovation project. They are an attempt to answer the question posed in the first research stream, concerning the assessment of the degree of innovation of the project and to determine whether it should be implemented by the company.

Table 2: Classification of methods for evaluating, ranking and selecting innovations and the commercialization potential of an innovation project

Source: Authors’ own elaboration based on K. Klincewicz, A. Manikowski, Ocena, rankingowanie i selekcja technologii, Wydawnictwo Naukowe Wydziału Zarządzania Uniwersytetu Warszawskiego, Warszawa 2013, s. 45–58, 124; E. Gwarda, op. cit., pp. 93–105.

Source: Authors’ own elaboration based on K. Klincewicz, A. Manikowski, Ocena, rankingowanie i selekcja technologii, Wydawnictwo Naukowe Wydziału Zarządzania Uniwersytetu Warszawskiego, Warszawa 2013, s. 45–58, 124; E. Gwarda, op. cit., pp. 93–105.

The main difficulty in applying the methods listed in Table 2 is the selection of individual evaluation criteria and the use of subjective knowledge of evaluators. Moreover, these models are not adjusted to the specificity of projects, i.e., the type of innovative project (process, product, organizational, marketing innovation) and the situational conditions of the industry in which they can be applied (Jajuga, 2011, p. 10).

A second important area in the analysis of the impact of innovation on enterprise value is research on the adaptability of traditional methods to innovative ventures. The following methods are discussed in the literature:

1) risk adjusted NPV (rNPV) method,

2) real options valuation method,

3) Venture Capital method.

Risk-adjusted NPV method

Researchers point to the rNPV (risk-adjusted NPV) method as one of the methods for valuing innovation projects – risk-adjusted NPV (Žižlavský, 2014, p. 508). This method requires estimating the revenues, costs, risks, and timing of the cash flows involved within the project. According to the rNPV method, cash flows are estimated, which are then adjusted by the probability of their occurrence with respect to the project development process and the ability to generate cash flows (Bebel, 2015, p. 131).

Real Options Valuation Method

The real options valuation method can provide information on the profitability of R&D investments and also identifies the value of ongoing R+D work currently being carried out in the company (Wanicki, 2015, p. 256). Research and development projects are characterized by high uncertainty and lack of direct financial effects of their implementation. Therefore, classical models do not allow for an accurate estimation of the value (Janasz, 2014, p. 175). Research and development projects alone are not expected to bring financial benefits, only the effect of this work is expected to create investment opportunities that will bring income. When preparing an analysis of the profitability of research and development work, one should take into account the entire process and all decisions related to it – the research phase, the implementation phase and the commercialization phase (Urbanek, 2008, pp. 200-201).

- Myers (1984) was the first to state that the classical DCF model is not appropriate for the valuation of research and development projects, because it does not take into account the option value associated with the possibility of making different decisions within the framework of the project. On the other hand, T. Faulkner (1996) shows on the example of a decision tree why the option method is better than the classical DCF method. The option valuation method is more effective because of the long-term management efficiency.

Venture Capital Method

The method was developed by institutional investors who commit financial resources to higher risk ventures. This method examines the value of a company from the point of view of post money and pre money values. The method assumes that first the so-called post money value is estimated, i.e., the value of the company in a few years (the moment of the institutional investor’s exit from the investment). In this phase, a financial model is prepared on the basis of a properly defined value carrier (number of users, etc.). Post money value is calculated as a quotient of the forecast result at the end of period n of the planned capital allocation and the required rate of return, increased by unity and raised to a power equal to the period of capital employed. Then, the value of pre money is calculated as the difference between the post money value and the initial capital employed (Rogoziński, 2011, pp. 16-17).

The presented trends in studies on the assessment of the impact of innovative projects on the value of the company indicate an increasing role of innovative projects in the process of creating value. There is a change in the methods traditionally used and new varieties of these models appear, taking into account the specifics of innovative projects. However, due to the complex nature of innovation projects, the application of these models is complicated, additionally burdened with high uncertainty due to the subjective evaluation of projects, as well as the turbulent environment (Szczepankowski, 2013, p.153).

A Review of Empirical Studies on The Evaluation of The Impact Of The Implementation Of Innovation Projects On The Value Of The Company

The importance of competitive advantage in recent years is one of the most important factors shaping the value of the company. One of the ways to achieve competitive advantage is to carry out research and development work aimed at developing new or improved products and technologies. The trend associated with innovation and its impact on enterprise value management has led researchers to take an interest in this research area. The main research questions can be defined as follows:

- How does innovation affect the value of a company?

- How to effectively finance research and development projects?

- How to create enterprise value through innovative projects?

- Does an innovative project have the same value for each enterprise?

In order to answer the questions posed above, a critical literature review was conducted.

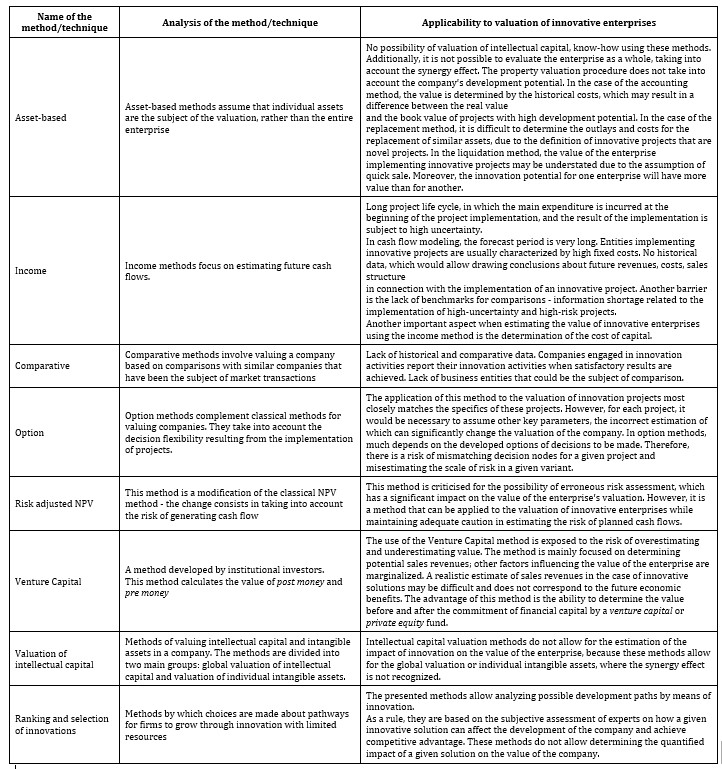

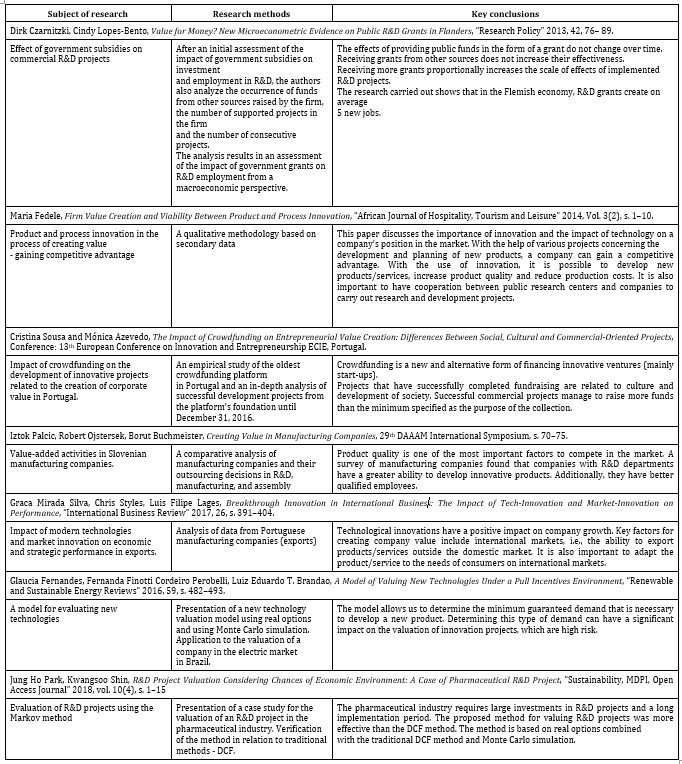

The first step was to define the keywords that were used to review the database. The following keywords were selected: value creation, innovation, R&D, value chain, crowdfunding, impact innovation on performance, real option, R&D project valuation.[1] As a result of searching electronic databases (EBSCO, BazEkon, Lower Silesia Digital Library), more than one hundred records were obtained, but after reviewing their content, seven publications describing the conducted considerations on the initially formulated research questions were specified. Table 3 presents the results of the analysis of publications, including the subject of research, research methods and key conclusions.

Table 3: Overview of leading studies on assessing the impact of innovation project implementation on enterprise value

Source: Authors’ own elaboration based on cited sources.

As a result of the analysis of the research results disseminated in the papers cited in Table 3, the following conclusions can be drawn:

- the growth of research and development activity in enterprises allows to achieve competitive advantage;

- companies that are innovative perform better in the market in case of changing market conditions, e.g., during a financial crisis;

- unconventional methods of financing innovation, such as crowdfunding, are not fully used by enterprises. Over time, the role and importance of crowdfunding in the way of financing innovative ventures is growing;

- the conducted research has been presented in the context of a particular industry or a particular country, according to the place where the research was conducted;

- the analysis of the literature shows that the problem of valuation of innovative enterprises in the context of assessing the impact of innovation on the value of the company is a rare subject of empirical research, as indicated by the scarcity of scientific research papers on this topic.

The results of the conducted literature review indicate the existence of a cognitive gap in the field of unconventional sources of financing, the way of evaluating innovative projects, their impact on the value of the company. Thus, there is a wide field for empirical research identifying the above research problems.

Critical Evaluation of The Existing Concepts of Researching the Impact of The Implementation Of Innovative Projects On The Value Of The Enterprise

On the basis of the conducted considerations relating to the specifics of innovative projects, it can be indicated that they are innovative projects with a high level of risk, and they are also difficult to model financially at the stage of project conception. Traditional methods of company valuation do not reflect the real market value of the company. This is due to the following conditions:

- Cash flow modeling is difficult at the conceptual stage of a given project due to the fact that every innovative project is a novelty; there is no available comparative data and reliable historical data. As a rule, if a competitor conducts R&D activities, it informs about their results only after obtaining satisfactory effects and the launch of a new product on the market.

- The value of companies implementing innovative projects is determined by the presence of intellectual capital or know-how, which are not reflected in the book value of the company.

- The project life cycle is long. This is mainly due to the ongoing research and development work, the duration of which is difficult to estimate. It may take a long time from the beginning of the works to the introduction of a product/technology on the market. It is connected with the problem of estimating the demand for a new solution, due to frequent changes in the market demand, which is conditioned by changes in consumer needs.

- Innovative projects are connected with incurring high costs at the initial stages of developing a new product/technology. Due to their uncertain character, there is no assurance that the implementation of the project will contribute to the achievement of the initially assumed effect. It may also turn out that the continuation of the project is not justified, due to the lack of satisfactory results of research works.

- For highly innovative projects, a long cash flow modeling period should be adopted due to the long-time horizon of project implementation.

- There is a problem as to whether individual projects should be valued and then the value of the enterprise should be treated as the sum of implemented projects. It should be clarified whether the enterprise implementing more than one innovative project does not use the additional synergy effect, which should also be estimated in the enterprise value.

- Advanced, specialized knowledge is needed to value innovative projects.

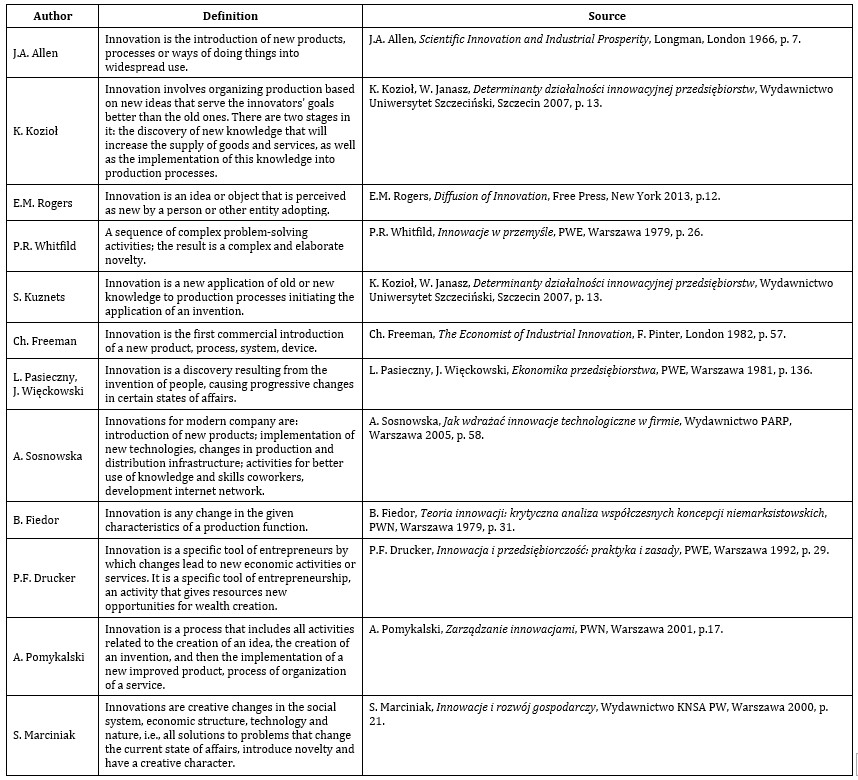

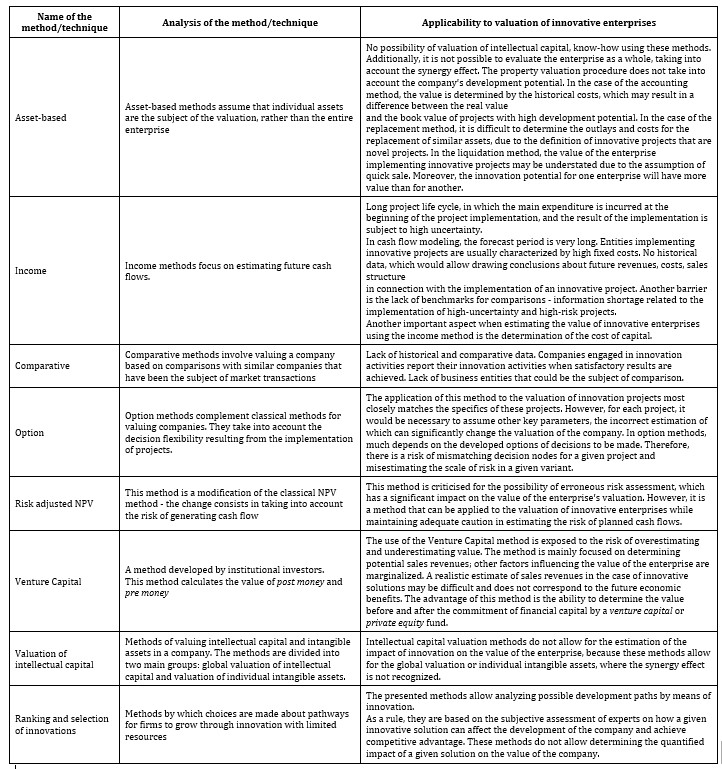

A detailed comparison and analysis of the concepts presented in this chapter is included in Table 4.

Table 4: Comparison and analysis of conceptual methods for the impact of innovation on enterprise value

Source: Authors’ own elaboration.

Source: Authors’ own elaboration.

Many methods can be used to value innovative ventures, and as indicated in Table 3, they have numerous imperfections. In the case of innovative projects, risk plays a very important role in the process of assessing value creation. It should be considered from four perspectives:

- the project implementation effect – when implementing innovative projects, one should take into account a risk of failure to achieve the assumed objective of the works carried out, which will result in the lack of implementation possibilities or failure to achieve the assumed cash flows resulting from project implementation;

- identification of risk factors of the project – an indication of all possible causes of failure of the project and a proposal to identify measures aimed at mitigating them;

- defining the scope of variation of the economic effect of project execution in relation to the assumed effect of project implementation;

- determining measures of the probability of occurrence of a given risk (Bijańska, 2015, p. 44).

Identification of determinants influencing the choice of valuation method for enterprises implementing innovative projects

The following considerations should be taken into account when selecting the appropriate method:

- Income methods are more applicable to the valuation of innovation projects than asset-based methods. The latter do not reflect the impact of intellectual capital on the value of the company, which from the point of view of an innovative company is one of the key value generators.

- The only method from the group of asset-based methods that can be applied to innovative projects is the replacement method. It allows including intangible factors, which have an impact on the enterprise value. It can be applied to organizations, which at the moment and in the short time horizon, do not generate economic benefits.

- The most commonly used methods for valuation of innovation projects are methods that require discounting of cash flows and those that take into account real options. The use of both of these methods allows the real valuation to take into account the value of intangible assets, which are important in the process of valuation of innovative organizations. With the help of these methods, it is possible to take into account changes in the dynamic environment of the entity that is the subject of valuation.

- Unconventional methods should be used for valuation of enterprises that develop based on innovative solutions, which will increase their importance in the valuation process. Their advantage is the inclusion of intellectual capital and obtaining additional cash flows, due to the development of competitive advantages.

- There is no single, ideal method that can be used in the valuation process of innovative company. When making a valuation, one should take into account the conditions and the purpose of valuation, additionally one should consider important factors that generate value and assign them an appropriate rank.

- Valuation process of innovative organizations requires constant updating due to the fact that the life cycle of technology or new products is getting shorter. In addition, the frequent change in consumer behavior has a significant impact on the achievement of competitive advantage by companies, and the achievement of competitive advantage itself is very important in the valuation process of innovative entities.

Summary

In practice, there are many methods for determining the value of a business. The use of different methods for valuation may result in obtaining divergent results. The reasons for this situation are both methodological and procedural conditions, as well as the type of the valued company. The quality of decisions depends on the type of information, so different results may determine different decisions by managers. The most important aspects affecting the process of valuation of the company include: the preparation of reliable cash flow projections, risk assessment, determination of the discount rate and the correct calculation of the final value.

In the procedure of assessing the impact of the implementation of an innovative project on the value of the company, it is important that the analysis is carried out from the point of view of the company implementing the project. Consideration of the project without taking into account the method of commercialization of the results of research and development work does not allow determining its value. It is the commercialization method that will allow determining future sales’ revenue in the context of the current market position of the enterprise.

References

- Allen J.A. (1966) Scientific innovation and Industrial Prosperity, Longman, London.

- Baruk J. (2006) Zarządzanie wiedzą i innowacjami, Adam Marszałek, Toruń.

- Bebel A. (2015) ‘Wybrane aspekty wyceny spółek biotechnologicznych – analiza teoretyczna i praktyczna,’ Studia i Prace Kolegium Zarządzania i Finansów, 144.

- Bijańska J. (2015) ‘O pewnych problemach w ocenie ekonomicznej efektywności projektów rozwojowych przedsiębiorstw produkcyjnych’, Zeszyty Naukowe Politechniki Śląskiej Organizacja i Zarządzania, seria: Organizacja i Zarządzanie, 78.

- Chen Ch.-J., Chung M.-Ch. and Wei Ch.-H. (2006) ‘Government policy of technology selection for advanced traveler information systems’, R&D Management, 36 (4).

- Czarnitzki D. and Lopes-Bento X. (2013) ‘Value for Money? New Microeconometric Evidence on Public R&D Grants In Flanders’, Research Policy, 42.

- De Coster R. and Butler C. (2005) ‘Assesment of proposals for new technology ventures in the UK: characteristics of university spin-off companies’, Technovation, 25.

- Drucker P.F. (1992) Innowacja i przedsiębiorczość: praktyka i zasady, PWE, Warszawa.

- Faulkner T. (1996) ‘Applying Options Thinking to R&D Valuation’, Research

– Technology Management.

- Fedele M. (2014) ‘Firm Value Creation and Viability Between Product and Process Innovation’, African Journal of Hospitality, Tourism and Leisure, 3 (2).

- Fernandes G., Finotti Cordeiro Perobelli F. and Brandao L.E.T. (2016) ‘A Model of Valuing New Technologies Under a Pull Incentives Environment’, Renewable and Sustainable Energy Reviews, 59.

- Fiedor B. (1979) Teoria innowacji: krytyczna analiza współczesnych koncepcji niemarksistowskich, PWN, Warszawa.

- Freeman Ch. (1982) The Economist of Industrial Innovation, F. Pinter, London.

- Graca M.S., Styles Ch. and Lages L.F. (2017) ‘Breakthrough Innovation in International Business: The Impact of Tech-Innovation and Market-Innovation on Performance’, International Business Review, 26.

- GUS (2018) ‘Pomiar działalności naukowo technicznej i innowacyjnej. Podręcznik Frascati 2015. Zalecenia dotyczące pozyskiwania i prezentowania danych z zakresu działalności badawczo-rozwojowej’, Warszawa.

- Ho Park J. and Shin K. (2018) ‘R&D Project Valuation Considering Chances of Economic Environment: A Case of Pharmaceutical R&D Project’, Sustainability, MDPI, 10 (4).

- Hsu Y.-G., Tzeng G.-H. and Shyu J.Z. (2003) ‘Fuzzy multiple criteria selection of government-sponsored frontier technology R&D projects’, R&D Management, 33.

- Jajuga G. (2011) ‘Start-up a dojrzałe przedsiębiorstwo-różnice w wycenie’, [in:] ‘Najlepsze praktyki w pozyskiwaniu zewnętrznego finansowania dla innowacyjnych przedsiębiorstw w Polsce. Raport’, Dolnośląski Park Technologiczny.

- Janasz K. (2014) ’Dylematy ryzyka w zarządzaniu projektami’, [in:] ‘Zarządzanie projektami w organizacji’, Janasz and J. Wiśniewska (ed.), Wydawnictwo Difin, Warszawa.

- Jolly D.R (2003) ‘The issue of weightings in technology portfolio management’, Technovation, 23.

- Klincewicz K. and Manikowski A. (2013) Ocena, rankingowanie i selekcja technologii, Wydawnictwo Naukowe Wydziału Zarządzania Uniwersytetu Warszawskiego, Warszawa.

- Kozioł K. and Janasz W. (2007): Determinanty działalności innowacyjnej przedsiębiorstw, Wydawnictwo Uniwersytet Szczeciński, Szczecin.

- Lucheng X., Xin L. and Wenguang L (2010) ‘Research on emerging technology selection and assessment by technology foresight and fuzzy consistent matrix’, Foresight, 12 (2).

- Łunarski J. (2009) Zarządzanie technologiami. Ocena i doskonalenie, Wydawnictwo Politechniki Rzeszowskiej, Rzeszów.

- Marciniak S. (2000) Innowacje i rozwój gospodarczy, Wydawnictwo KNSA PW, Warszawa.

- Myers S. (1984) ‘Financial Theory and Financial Strategy’, Interfaces,

- Palcic I., Ojstersek R. and Buchmeister B. (2018) ‘Creating Value in Manufacturing Companies’, 29th DAAAM International Symposium.

- Pasieczny L. and Więckowski J. (1981) Ekonomika przedsiębiorstwa, Wydawnictwo PWE, Warszawa.

- Pomykalski A. (2001) Zarządzanie innowacjami, Wydawnictwo PWN, Warszawa.

- Rogers E.M. (2013) Diffusion of Innovation, Free Press, New York.

- Rogoziński S. (2011) ‘Jak przeprowadzić wycenę start-up?’, [in:] ‘Najlepsze praktyki

w pozyskiwaniu zewnętrznego finansowania dla innowacyjnych przedsiębiorstw

w Polsce. Raport’, Dolnośląski Park Technologiczny, Wrocław.

- Roussel P.A., Saad N.K. and Erickson T.J. (1991): ‘Third Generation R&D’, Arthur D. Little Inc., Harvard Business School Press, Boston.

- Shen Y.-Ch., Lin G.T.R. and Tzeng G.-H. (2011) ‘Combined DEMATEL techniques with novel MCDM for the organic light emitting diode technology selection’, Expert Systems with Applications, 38.

- Sosnowska A. (2001) ‘Formy powiązań sfery B+R ze sferą produkcji’, [in:]

Poznańska (ed.), ‘Sfera badawczo-rozwojowa przedsiębiorstwa w działalności innowacyjnej’, Instytut Funkcjonowania Gospodarki Narodowej, Szkoła Główna Handlowa.

- Sosnowska A. (2005) Jak wdrażać innowacje technologiczne w firmie, Wydawnictwo PARP, Warszawa.

- Sousa C. and Azevedo M. (2018) ‘The Impact of Crowdfunding on Entrepreneurial Value Creation: Differences between Social, Cultural and Commercial-Oriented Projects’, Conference: 13th European Conference on Innovation and Entrepreneurship ECIE, Portugal.

- Szczepankowski P. (2013) Determinanty wartości rynkowej spółek kapitałowych wczesnej fazy rozwoju, Vizja Press&It, Warszawa.

- Urbanek G. (2008) Wycena aktywów niematerialnych przedsiębiorstwa, Polskie Wydawnictwo Ekonomiczne, Warszawa.

- Wanicki P. (2015) ‘Metody wyceny efektów prac badawczo-rozwojowych’, Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, 390.

- Whitfild P.R. (1979) Innowacje w przemyśle, Wydawnictwo PWE, Warszawa.

- Žižlavský O. (2014) ‘Net Present Value Approach: Method for Economic Assessment of Innovation Projects’. Ryga: 19th International Scientific Conference; Economics and Management.

[1] Keyword selection was based on specific research questions.