Introduction

The Audit Expectations Gap (AEG) originates from a mismatch between users’ expectations and the auditor’s obligation. This concept has been evocated by Liggio (1970) and confirmed by Lee et al., (2010). He characterized the expectation gap as the discrepancy between independent accountants’ and users’ expectations. Ruhnke and Schmidt (2014) argue that the expectations gap occurs when the auditors’ performance falls short of public expectations. Melinda et al. (2019) argue that stakeholders’ expectations of the audit profession have increased. They rely on external auditors’ reports to guarantee that financial data are accurate and credible. Several international studies show that users of the auditor’s report have higher expectations for the audit profession than the professional responsibility itself (Paul et al, 2020, Soon et al, 2013). Thus, users of financial statements expect external auditors to identify and disclose fraud or ensure the financial statements are free from mistakes and omissions. However, the audit profession believes that the primary job of an audit is to check that the financial statements meet the requirements of applicable laws, rules, and standards. Thus, the audit expectation gap is shown.

The degree to which financial information is regarded while making decisions typically depends on its reliability. Because personal knowledge and experience affect one’s judgment of the credibility of financial information and hence decision-making. Thus, the reliability of audited financial information for decision-making is closely linked to knowledge and experience. Bank staff often rely on audited financial statements for loan seekers to assess their creditworthiness. An issue to be addressed is whether a bank loan officer’s own expertise and experience affect his or her assessment of the role and function of an external audit and the choice to analyze his loan reliance on audited financial information for decision-making might lead to poor decision quality due to misperception or excessive faith in its trustworthiness. In other words, we should ask: Do the AEG mediates the relationship between the individual knowledge and experience of the banker officer and the quality of a loan decision in Saudi Arabian banks?

The aim of this study is to explore the relationship between bank loan officers’ experience and knowledge and the audit expectation gap. We analyze the role of the expectation gap in explaining the link between individual characteristics and the efficiency of loan decision-making in Saudi Arabian banks. Furthermore, we study the effects of individual knowledge/experience on the audit expectation gap of Saudi banks’ employees and the subsequent effect of this gap on the quality of loan decision performance. To alleviate the audit expectation gap in Saudi banks, this study will also offer an overview of the reasons behind the gap.

Given that there is little known about the audit function in oil-rich regimes in the Arabian Gulf, this study focuses on Saudi Arabia. This research can help academics studying the AEG, as well as practitioners and policymakers in Saudi Arabia and other Middle Eastern and underdeveloped nations.

This study contributes to the existing literature in many ways. First, to the author’s best knowledge, this is the first study that focuses on the relationship between Audit expectation gaps and loan performance in Islamic Saudi banks. Second, we had recourse to three analyses methods: first, we performed an exploratory factor analysis (EFA) using the SPSS 26.0 software in order to ensure the reliability of the related measurement scales. Second, we used the AMOS26 method for the confirmatory analysis. In addition, we focused on the validation of the research hypotheses by opting for the PLS method, the third version.

The main findings of this study show knowledge and experience have a significant negative impact on the audit expectations gap. More importantly, the audit expectation gap was found to negatively influence the loan decision performance. The mediating role of the audit expectations gap is also evidenced.

The remainder of the paper is organized as follows. In the beginning, we present an overview of the Audit expectation gap (GAP). Then we present a summary of the literature. Also, we indicate the methodology. After that, we write down the main results and discussion, and conclusions.

Review of research literature

In this section, we introduce the previous studies that explored the relationship between the audit report and loan decision performance and the impact of individual skills on the AEG.

Most research finds that the public often expects from audit function to make out all frauds and irregular acts and gives confirmation that the financial information published by the companies subject to the audit is correct (Epstein and Geiger,1994; Cohen et al,2017; Masoud 2017). Therefore, bank lenders build their decisions on the company’s credit concerning audited financial information (Blackwell, Noland, and Winters, 1998; Bamber and Stratton, 1997).

Therefore, the Bank’s lender will interpret the message envisaged in the auditor’s report in line with his understanding of the role of the auditor, Thus, he will decide the extent to which he relies on this information to decide to grant credit. If auditors and users of the audit report have different perceptions of the duties of the auditor, then the opinion expressed in the audit report will be misunderstood (Libby, 1979). High faith in the audit function can lead to overconfidence in financial facts reported by corporations, resulting in incorrect decisions. In this situation, the AEG may influence loan appraisal determinations.

Knowledge and experience, according to Bolisani and Scarso (1999) and Mansori (2012), impact judgment and attitude. They consider knowledge to be a mix of facts, ideas, actions, and recognition that shapes one’s attitude and hence decisions. Individuals perceive environmental cues based on their vast knowledge and experience (Harding, 2010). Maheswaran and Pinder (2010) find that experience and education influence decision-making.

Little is known about the discretionary nature of the financial audit process, so users of financial statements, therefore, are likely to make unreasonable demands on the auditing service. Also, their ignoring of professional standards and provision law creates a gap between what they expect and what is defined in law and standards.

Many studies find that the knowledge and experience may reduce the degree of the AEG.

For example, Bailey et al. (1983) show that more informed users place less responsibility on auditors than those who are less knowledgeable. Other researchers believe that education affects how to read and analyze the audit result. Monroe and Woodliff (1993) find that education significatively enhances the student’s interpretation of the audit report. In their study, Fadzly and Ahmad (2004) found that knowledge and experience in auditing are factors that affect the user’s perception of the audit reports and decrease the gap. The auditor’s report determines the perceived authenticity of financial information and the degree of confidence that the bank provides financial statements. The accounting expertise and experience of bank personnel affect this level of confidence.

Based on prior studies, knowledge and experience may minimize the AEG in Saudi banks. According to previous work, the knowledge and experiences of individuals have an impact on decision-making (Libby1979; Paul et al,2020; Melinda et al;2019). In this sense, a credit officer who has a little knowledge, a bit of experience in the accounting field in his current position, can expect from the audit function and auditors’ responsibilities more from those defined by the law and existing standards, thus giving rise to the AEG. In addition, this can lead the officer bank to misunderstand the message conveyed in the audit report. As a result, the decision to evaluate the loan based on audited financial statements would be unduly biased due to misinterpretation. For example, a bank agent, who has no experience or knowledge, will not have the ability to distinguish the difference between the different audit reports, and therefore he may believe that an unqualified report of audit implies an absolute assurance of the accuracy of the financial information of the company. As a result, the credit officer will credit the firm with a rate of interest more than that recommended if he understands the contents of the audit report. So, the scarcity of knowledge and experience will lead to undermining the quality of the decision to grant credit. The literature documented the positive impact of knowledge and experience on decision quality (Humphrey et al., 1992; Collan and Lainema, 2005; Epstein and Geiger, 1994; Maheswaran and Pinder, 2010; Mansori, 2012; Wu, 2011; Noghondari et Soon 2009; 2013). Noghondari et al (2009) study the effect of accounting knowledge and experience on the AEG. They find a large AEG among bank loan officers in Iran; they find also that accounting knowledge mitigates the extent of the AEG, but not accounting experience, and finally they proved that there is a negative relationship between the AEG and loan decision performance. Based on prior research, it is postulated that knowledge and experience can reduce the extent of the AEG of the bank loan officers of Saudi banks.

In this study, we predict that accounting knowledge and work experience will affect loan officers’ AEG in Saudi banks, which, in turn, would affect his/her loan decision quality.

Hence, the AEG plays a mediating role in the relationship between the loan officer’s accounting

knowledge and work experience and his/her loan decision quality.

According to this review of the literature, the research hypotheses are as follows:

H1: The Audit Expectation Gap is negatively related to individual factors.

H2: The Audit Expectation Gap and loan decision performance are related.

H3: The individual factors and loan decision performance are related.

H4: The Audit Expectation Gap links individual factors and loan decision performance.

Methodology

Research method and sampling

Saudi Arabian banks provide Islamic financial services. The survey included bank loan officers from Saudi Arabia’s top 10 Islamic banks (National Commercial Bank, Al-Ahli Bank, Al Rajhi Bank, Riyad Bank, Samba, Bank Saudi France, Saudi Britch Bank, Arab National Bank, Saudi investment Bank, Saudi Hollandi Bank, Al-Jazeera). A prepared questionnaire was sent to 300 human resource departments of these banks through email and WhatsApp, because of their effectiveness in contacting these banks. A total of 159 completed questionnaires were gathered for data analysis. The structured questionnaire was adapted from Noghondari and Foong (2009, 2013).

Using a Likert scale, each item was rated from 0 (not at all/strongly disagree) to 5 (very much/strongly agree). The responsibility and reliability dimensions were used to measure the expectation gap variables (Fadzly and Ahmad, 2004Best, Buckby and Tan, 2001; Dixon, Woodhead, and Soliman, 2006; Noghondari et Soon, 2013). Quality indicators for loan decisions were adopted from Noghondari et Soon study (2009, 2013). The questionnaire was pre-tested on several Saudi bank executives to verify the items used to measure each variable were legitimate and that the questions were intelligible. Based on pre-test results, certain questions were altered or reformulated. The questionnaire was translated into Arabic and tested. Out of 300 issued surveys, 159 were completed and accepted.

Variable Measurements

Audit Expectation Gap

The audit expectation gap has two dimensions: responsibility and reliability. Previous research was utilized to examine the two aspects (Dixon, Woodhead, and Sohliman, 2006; Best, Buckby, and Tan, 2001; Fadzly and Ahmad, 2004;). The level of each gap dimension was established by the respondent’s interpretation of the IAS 240 and ISA 700 definitions. The gap was rated on a scale of 0 (not at all/strongly disagree) to 5 (very much/strongly agree).

The statements for assessing the auditor’s responsibility or the audited statements’ reliability were not stated as stipulated in the applicable professional standards. According to the responses, a ‘not at all/strongly disagree’ answer showed no gap or misconception, while a ‘very much so/strongly agree’ response implied a very substantial gap or misperception (Noghondari et Soon, 2013).

Loan Decision Performance

The performance of the bank loan officer was measured in three aspects. The three dimensions were: percent of bad and dubious debts, percent of first three installment defaults, and percent of more than three installment defaults (Noghondari et Soon, 2013).

Individual factors

Individual factors were: Academic qualification, specialties, accounting experience, and occupational experience of a banker.

Academic qualification was a dummy variable: 1 for a high diploma, 2 for a degree, and 3 for a post-graduate.

The specialty variable was also a dummy variable: 1 for accounting specialty, 2 for non-accounting specialty, 3 for financial specialty, 4 for management specialty, and 5 for economics specialty.

Accounting experience: 0 for no experience, 2 for 1-4 years, 3 for 5-9 years, 4 for 10-29 years.

Finally, occupational experience, the number of years as a bank loan officer was used to assess job experience: 0 for no experience, 2 for 1-4 years, 3 for 5-9 years, and 4 for 10-29 years.

Results and discussion

Factor analysis

The objective of the next section is to purify all the measurement scales of the variables of our model. We proceed to the purification of the measurement scales through factor analysis (principal component analysis: PCA) and reliability analysis (Cronbach’s alphas).

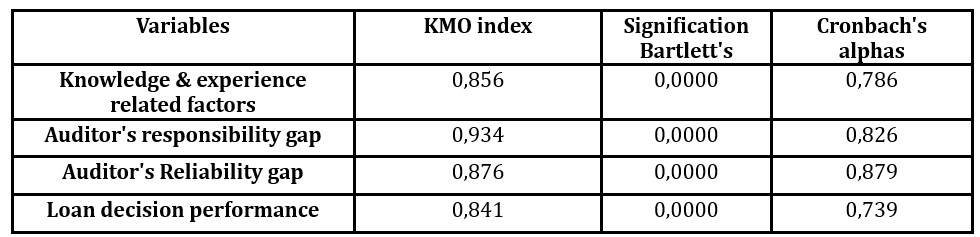

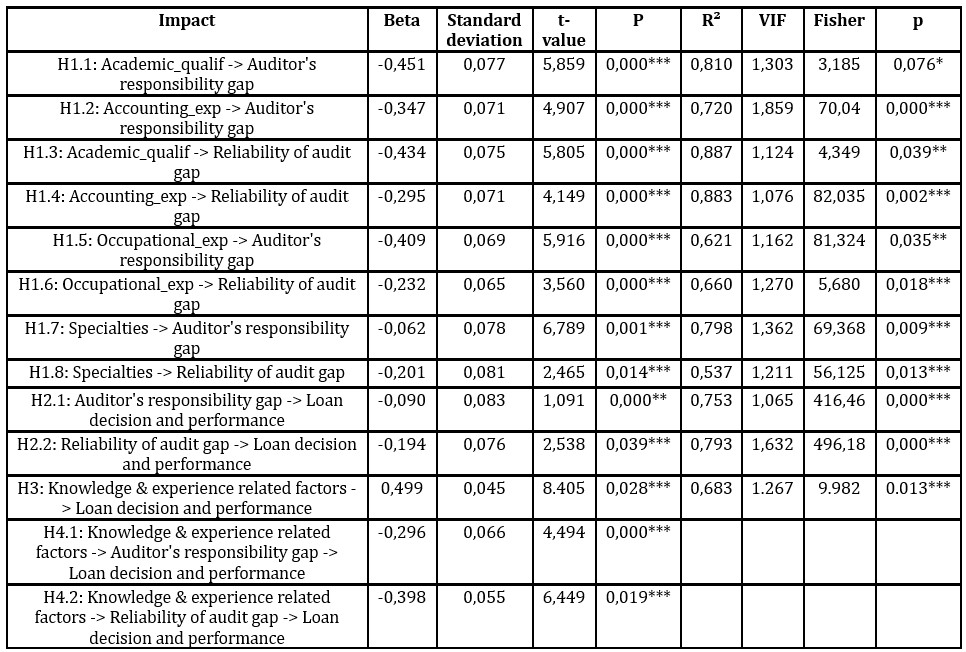

Table1: Sampling Adequacy Measurement (KMO) and Bartlett’s Sphericity Test

Source: Output SPSS 26

Source: Output SPSS 26

From table 1 we notice that the value of all the coefficients is greater than 0.7 which is excellent since it exceeds the minimum required threshold of 0.70 (Nunnaly, 1978). This method is arbitrary but widely accepted by researchers Analyses confirmatory; in our case, the results of the alpha Cronbach vary between 0.739 and 0.879. It can be interpreted that the model variables are reliable.

Testing The Research Model

In this section, we will analyze the psychometric quality of the measurement scales. Then, we will first validate the research model through the effect of mediation, then we will discuss the obtained results.

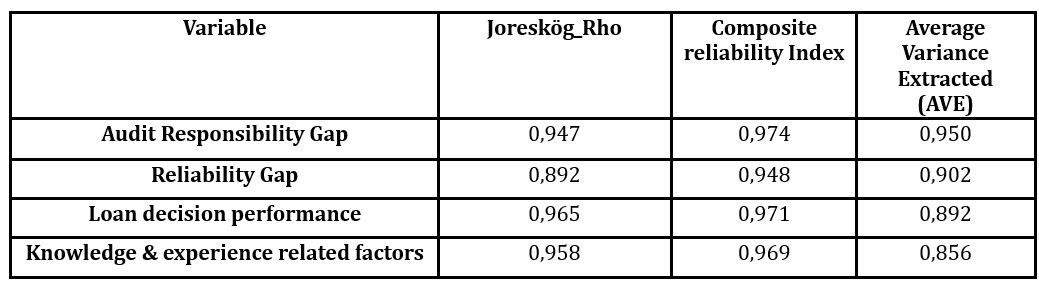

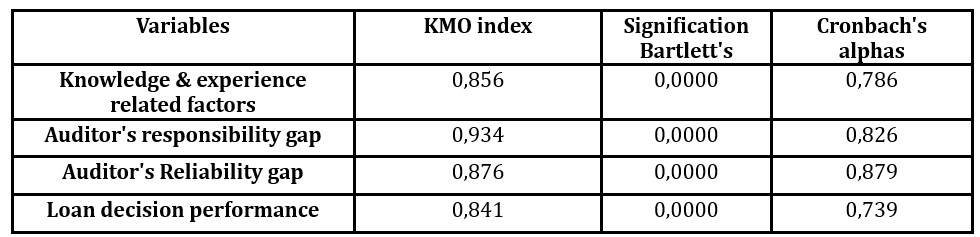

Table2: Reliability and validity of the second-order construct

Source: Output AMOS 26

Table 2 reports the Reliability and validity of the second-order construct test. The index of Joreskog’s Rho assesses the reliability of the internal consistency of each construct through a measure of the factorial contributions of the items and for which the acceptance threshold is 0.7. The study of these two indices shows that the norm is respected since the Joreskog’s Rho is between 0.8 and 0.9, and the convergent validity Rho is between 0.892 and 0.965 as shown in table 6.

As suggested by Fornell and Larcker (1981), convergent validity was assessed by the Average Variance Extracted (AVE). As shown in table 2, all of the AVE measures exceed the threshold of 0.50, suggesting that the convergent validity of each factor used in this model is acceptable. Constructs share more variance with their respective indicators than with their measurement errors. We found that the values of Average Variance Extracted AVE are respectively acceptable 0.950, 0.902, 0.892, and 0.856.

All the constructs have composite reliability values greater than 0.974. According to the most widely accepted standards (Gefen, Straub, et al. 2000; Boudreau, Gefen, et al. 2001), the reliability of the reflective constructs present in our instrument is therefore very good. We found the reliability coefficients are respectively acceptable 0.974, 0.948, 0.971, and 0.969.

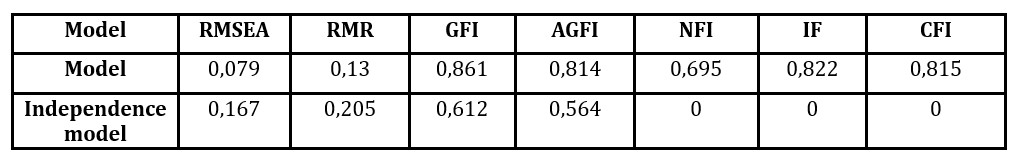

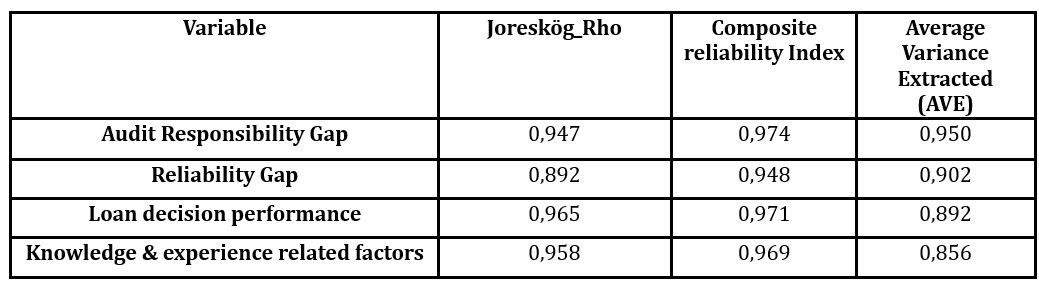

To improve the fit of the model, we tested the incremental indices and the adjustment indices. The test results are reported in table 3. The adjustment indices for the remaining items are acceptable as shown in table 3. The RMSEA declares a value of 0 and can be rated as excellent. The GFI and AGFI are equal to 0.814 and exceed the threshold of 0.8. The RMR is equal to 0.130, so the CFI of 0.815, the IFI is equal to 0.822 and the NFI is equal to 0.695, are excellent with values close to 1.

Table 3: Incremental indices and Adjustment indices absolute

Source: Output AMOS 26

Source: Output AMOS 26

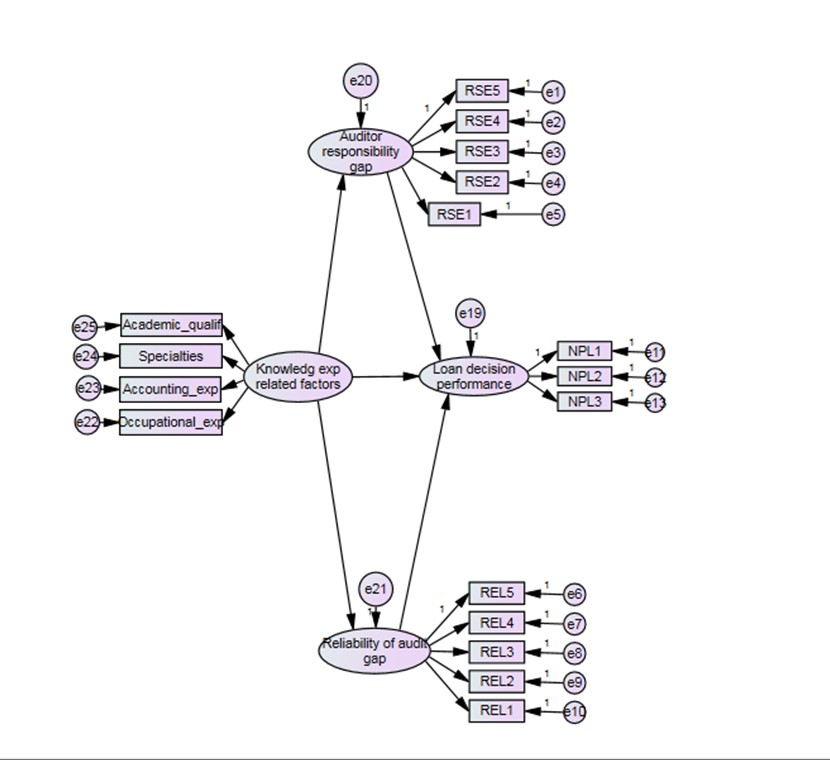

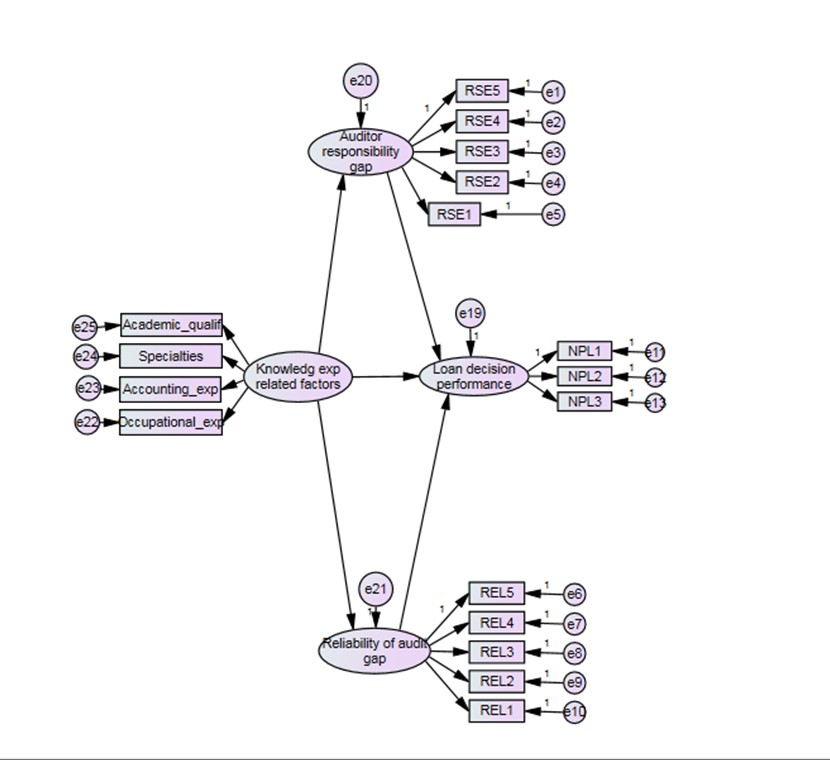

Fig1: Structural Model

Fig.1 presents the path analysis of the latent constructs in three structural models: mediation structural model (Model 1), indirect structural model (Model 2), direct structural model (model 1) as presented in Fig. 1. Model 1 presents all relationships between the variables. The relationships are those among the independent variables (academic qualifications, accounting experience, occupational experiences, and specialties), those between the two components of the EAG (the Audit responsibility gap and the audit reliability gap), and loan decision performance (dependent variable), as well as the relationship between the AEG and the loan decision performance. Model 2 explores the relationship between the independent variables and the AEG, as well as the relationship between the AEG and the loan decisions performance; the relationship between the dependent variables and the loan decision performance is excluded. Model 3 assesses only the relationship between the dependent variables and loan decision performance; all other relationships are excluded from the model.

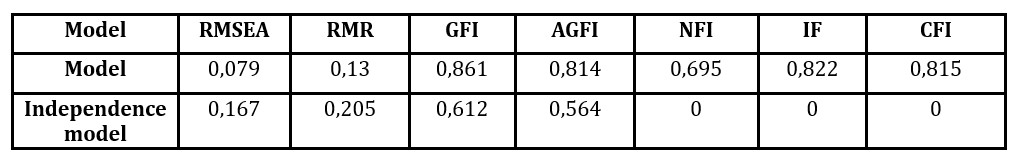

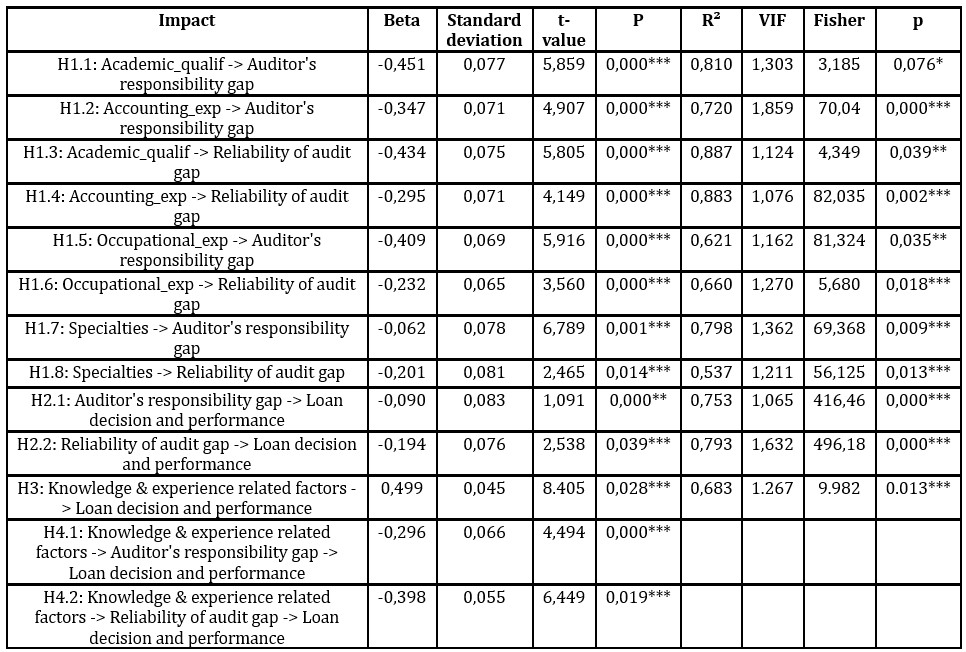

Table 4: Mediation Results

Source: Output AMOS 26

Table 4 reports the results of the relationship between the four individual factors and the audit expectation gap and loan decision performance via the PLS. From the results, the fit of the model to the data being satisfactory, we can move on to the analysis of the factor contributions. This analysis allows us to see that the factorial weight of each indicator as well as the associated t-test (t> 1.96 at the 5% error threshold) are significant. Therefore, this result confirms the existence of an acceptable link between the indicators and the latent variables.

Verification of hypotheses

The hypothesis H1 was subdivided into 8 hypotheses according to the four individual factors of the employer’s bank (academic qualification, accounting experience, occupational experience, and specialties), and the two components of the Audit Expectation Gap (Audit Responsibility Gap and Audit Reliability Gap), for further explanation.

The model results reported in table 4 indicate that the estimated coefficients are negative and significant; according to the results obtained from the mediation model, we notice that the impact of academic qualification on auditor responsibility gap is significantly negative as explained by the estimated value of beta (p=0.000 <1%). The value of R² tends to be 1 (0.810) which informs us about a good determination of the impact and the VIF=1.303 (variance inflation factors) found is less than 10, which means an absence of multicollinearity problem in the model; the model is globally significant since the fisher test F = 3.185, p = 0.076 significant. We accept the hypothesis (H1.1), therefore the Auditor’s responsibility gap is negatively related to the academic qualification.

Moreover, the results obtained from the mediation model indicate that the impact of accounting experience (Accounting_exp) on the Auditor’s responsibility gap is negative and highly significant as explained by the value of beta (p=0.000 <1%.). The value of the R² tends to be 1 (0.720), which informs us about a good determination of the impact, and the VIF =1.859 indicated is less than 10 explains an absence of multicollinearity problem in the model; the model is globally significant since the fisher test F = 70.04, p = 0.000 significant. Thus, we accept hypothesis H1.2. suggesting that the Auditor’s responsibility gap is negatively related to accounting experience.

According to the results obtained from the mediation model, we notice that the impact of academic qualification on the Reliability of the audit gap is negative and significant as explained by the value of beta equal (p=0.000 <1%.). The estimated value of R² tends to be 1 (0.887) which informs us about a good determination of the impact and the VIF indicated is less than 10 which explains an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 4.349, p = 0.039 significant. We accept hypothesis H1.3. suggesting that the Reliability of the audit gap is negatively related to an academic qualification.

Results from table 4 indicate that the impact of Accounting_experience on the Reliability of the audit gap is significantly negative as explained by the value of beta (p=0.000<1%.); the estimated coefficients are positively significant. The R² tends to be 1 (0.883) which informs us about a good determination of the impact and the VIF =1.076 indicated is less than 10 which explains an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 82.035, p = 0.002 significant. We accept hypothesis H1.4. Therefore, the Reliability of the audit gap is negatively related to accounting experience.

According to the results obtained from the mediation model, we notice that the impact of Occupational experience on the Auditor’s responsibility gap is negative and highly significant as explained by the value of beta equal (p=0.000 <5%.) The R² tends to be 1 (0.621) which informs us about a good determination of the impact and the VIF =1.162 indicated is less than 10 which explains an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 81.324**, p = 0.035 significant. We accept hypothesis H1.5: The Auditor’s responsibility gap is negatively related to occupational experience.

The results obtained from the mediation model show that the occupational_experience has a significant and negative impact on the Reliability of the audit gap as explained by the value of beta equal (p=0.000 <1%). The estimated value of the R² coefficient tends to be 1 (0.660) which informs us about a good determination of the impact and the VIF=1.27 indicated is less than 10 indicates explaining an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 5.680***, p = 0.018 significant. We accept the hypothesis H1.6: The Reliability of audit gap is negatively related to job experience.

According to the results obtained from the mediation model (table 4), we notice that the impact of specialties on the auditor responsibility gap is significantly negative as explained by the estimated value of beta (p=0.001 <1%). The R² tends to be 1 (0.798) which indicates a good determination of the impact and the VIF=1.362 estimated is less than 10 which explains an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 69.368***, p = 0.009 significant. We accept the hypothesis H1.7T, therefore the Auditor’s responsibility gap is negatively related to specialties.

Furthermore, the results obtained from the mediation model highlight that the impact of Specialties on the reliability of the audit gap is negative and highly significant; this impact is explained by the value of beta (p=0.014 ≤1%.). The R² tends to be 1 (0.5370) which highlights a good determination of the impact and the VIF= 1.211 indicated is less than 10 indicating an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 56.125***, p = 0.013 significant. We accept hypothesis H1.8, therefore, the Reliability of the audit gap is negatively related to specialties.

The results above mentioned prove that individual factors of a bank’s employee can mitigate the AEG, which indicates that H1 is supported. This means that employees in Saudi banks are chosen very carefully in terms of specialization and experience and are given continuous training courses, which is reflected in the correct understanding of the role and responsibilities of the auditor.

According to the results obtained from the mediation model, we notice that the impact of the Auditor’s responsibility gap on Loan decision performance is negative and significant, this impact is explained by the value of beta (p=0.006 <1%). The estimated value of the R² coefficient tends to be 1 (0.753) indicating a good determination of the impact; the VIF =1.065 indicated is less than 10 which indicates an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 416.469***, p = 0.000 significant. We accept hypothesis H2.1: The Audit responsibility gap and loan decision performance are related.

We test the relationship between the Audit Reliability gap and Loan decision performance. The obtained results from the mediation model show that the impact of the Audit Reliability gap on Loan decision performance is negative and significant as explained by the value of beta equal (p=0.039<5%). The R² tends to be 1 (0.793) indicating a good determination of the impact, and the VIF =1.632 indicated is less than 10 indicates highlighting an absence of multicollinearity problem in the model. The model is globally significant since the fisher test F = 496.183, p = 0.011*** significant. We accept hypothesis H2.2 suggesting that The Reliability of the audit gap and loan decision performance are related.

There is a significant and negative relationship between the AEG and loan decision performance, which means that H2 is supported. This shows that the AEG is a significant negative foreteller of the quality of loan decision taken by bank officers.

The results of the direct effect between individual factors and loan decision performance in the model indicate that the estimated coefficients are positive and significant, as shown in table 4. According to the obtained results from the mediation model, we notice that the impact of individual factors on Loan decision performance is positive and significant as explained by the value of beta (p=0.028 <5%.). The estimated value of the R² coefficient tends to be 1 (0.683) which informs us about a good determination of the impact, and the VIF =1.267 indicated is less than 10 which explains the absence of a multicollinearity problem in the model. The model is globally significant since the Fisher test F = 9.982, p = 0.013 significant. So H3 is supported.

This result can reveal evidence of a perfect mediation of the relationship between individual factors (the independent variable) and decision loan performance (dependent variable) by the audit expectation gap (mediator).

Therefore, the results show the existence of a significant and negative relationship (-0.296***) between individual factors and Loan decisions and performance mediated by the Audit responsibility gap (p = 0.000 <0.01). So, we accept hypothesis H4.1 The Audit responsibility gap links individual factors and loan decision performance.

The results reveal also the existence of a significant and negative relationship (-0.398***) between individual factors and Loan decision performance mediated by the Reliability Audit gap (p = 0.019 ≤0.01). We accept hypothesis H4.2; the Reliability Audit gap links individual factors and loan decision performance.

Individual factors (the independent variable) are found to have no significant effect on loan decision performance (dependent variable) when the component of AEG (Audit responsibility gap and audit reliability gap) is controlled.

This result reveals evidence of a perfect mediation of the relationship between individual factors (the independent variable) and decision loan performance (dependent variable) by the audit expectation gap (mediator). We accept hypothesis H4 suggesting that the audit expectation gap mediates the individual factor- loan decision performance relationship.

Conclusion and Discussion

The objective of this study is to investigate the mediation role of the Audit Expectation Gap (AEG) between the individual factor of bank employees and loan decision performance in Saudi Banks. To validate our hypotheses, we sent a questionnaire to a set of 159 bank employees.

The empirical study includes two steps. First, we did an exploratory analysis. We then carried out a confirmatory analysis. Indeed, these two steps allowed us to certify the reliability and validity of the measurement scales. Through the methods of structural equations, we tested our research model. All the hypotheses are validated. Thus, we have answered our central question and specific questions. Finally, we discussed the results obtained.

Our results show that individual-related factors (academic qualification, accounting and occupational experience, specialties) can narrow and even eliminate the AEG. It shows also that the AEG can mitigate the relationship between individual factors and loan decision performance. In other words, we confirm the absence of AEG in Saudi banks. This comes down to the recruitment conditions which are very strict and the continuous training of employees.

Our findings have important implications for banks, especially for the human resources department. This study gives clues about the qualifications of the employees to be recruited. This study can be important for students and accounting academics to more understand the audit function and duty. It can be also necessary for the community to reduce pressure on the auditor.

Future research can study another context and search for the determinants to narrow the gap between auditors and the public.

References

- Bailey, K. E., Bylinski, J. H., & Shields, M. D. (1983). `Effects of audit report wording changes on the perceived message`. Journal of Accounting Research, 355-370.

- Bamber, E. M., & Stratton, R. A. (1997). `The information content of the uncertainty-modified audit report: Evidence from bank loan officers`. Accounting Horizons, 11(2), 1.

- Blackwell, D. W., Noland, T. R., & Winters, D. B. (1998). `The value of auditor assurance: Evidence from loan pricing`. Journal of accounting research, 36(1), 57-70.

- Bolisani, E., & Scarso, E. (1999). `Information technology management: a knowledge-based perspective`. Technovation, 19(4), 209-217.

- Cohen, J., Ding, Y., Lesage, C., & Stolowy, H. (2017). `Media bias and the persistence of the expectation gap: An analysis of press articles on corporate fraud`. Journal of Business Ethics, 144(3), 637-659.

- Coleman, L., Maheswaran, K., & Pinder, S. (2010). `Narratives in managers’ corporate finance decisions.` Accounting & Finance, 50(3), 605-633.

- Collan, M., & Lainema, T. (2005, July). `On teaching business decision-making in complex domains`. In Fifth IEEE International Conference on Advanced Learning Technologies (ICALT’05) (pp. 633-635). IEEE.

- Coram, P. J., & Wang, L. (2021). `The effect of disclosing key audit matters and accounting standard precision on the audit expectation gap.` International Journal of Auditing, 25(2), 270-282.

- Dewing, I. P., & Russell, P. O. (2002). `UK fund managers, audit regulation and the new accountancy foundation: towards a narrowing of the audit expectations gap?.` Managerial Auditing Journal.

- Farouk, M. A., & Hassan, S. U. (2014). `Impact of audit quality and financial performance of quoted cement firms in Nigeria`. International Journal of Accounting and Taxation, 2(2), 1-22.

- Frank, K. E., Lowe, D. J., & Smith, J. K. (2001). `The expectation gap: Perceptual differences between auditors, jurors, and students.` Managerial Auditing Journal.

- Fulop, M. T., Tiron-Tudor, A., & Cordos, G. S. (2019).` Audit education role in decreasing the expectation gap.` Journal of Education for Business, 94(5), 306-313.

- Fossung, M. F., Fotoh, L. E., & Lorentzon, J. (2020). `Determinants of audit expectation gap: the case of Cameroon.` Accounting Research Journal.

- Geiger, M. A. (1994). `Investor views of audit assurance: Recent evidence of the expectation gap.` Journal of accountancy, 60.

- Gold, A., Gronewold, U., & Pott, C. (2012). `The ISA 700 auditor’s report and the audit expectation gap–Do explanations matter?.` International Journal of Auditing, 16(3), 286-307.

- Haniffa, R., & Hudaib, M. (2007). `Exploring the ethical identity of Islamic banks via communication in annual reports.` Journal of Business Ethics, 76(1), 97-116.

- Harding, N. (2010). `Understanding the structure of audit workpaper error knowledge and its relationship with workpaper review performance.` Accounting & Finance, 50(3), 663-683.

- Humphrey, C., Moizer, P., & Turley, S. (1992). `The audit expectations gap—plus ca change, plus c’est la meme chose?.` Critical perspectives on accounting, 3(2), 137-161.

- Humphrey, C.G., Moizer, P. and Turley, W.S. (1992) ‘The audit expectations gap plus ça change, plus c’est la même chose`, Critical Perspectives on Accounting, Vol. 3, pp.137161.

- Jennings, M. M., Reckers, P. M., & Kneer, D. C. (1991). `The auditor’s dilemma: The incongruous judicial notions of the auditing profession and actual auditor practice.` Am. Bus. LJ, 29, 99.

- Lee, T. H., Gloeck, J. D., & Palaniappan, A. K. (2007). `The audit expectation gap: an empirical study in Malaysia.` Southern African Journal of Accountability and Auditing Research, 7(1), 1-15.

- Lee, T. H., Md Ali, A., & Gloeck, J. D. (2009). `The audit expectation gap in Malaysia: an investigation into its causes and remedies`. Southern African Journal of Accountability and Auditing Research, 9(1), 57-88.

- Lee, T. H., Md Ali, A., & Gloeck, J. D. (2009). `The audit expectation gap in Malaysia: an investigation into its causes and remedies.` Southern African Journal of Accountability and Auditing Research, 9(1), 57-88.

- Liggio, C. D. (1974).` Expectation gap-accountants legal Waterloo`. Journal of contemporary business, 3(3), 27-44.

- Litjens, R., van Buuren, J., & Vergoossen, R. (2015). `Addressing Information Needs to Reduce the Audit Expectation Gap: Evidence from Dutch Bankers, Audited Companies, and Auditors.` International Journal of Auditing, 19(3), 267-281.

- Mansori, S. (2012). `Impact of religious affiliation and religiosity on consumer innovativeness; the evidence of Malaysia.` World Applied Sciences Journal, 7(3), 301-307.

- Masoud, N. (2017). `An empirical study of audit expectation-performance gap: The case of Libya.“ Research in International Business and Finance, 41, 1-15.

- McEnroe, J. E., & Martens, S. C. (2001). Auditors’ and investors’ perceptions of the “expectation gap”. Accounting Horizons, 15(4), 345-358.

- Mohamed, N. F., & Zauwiyah, A. (2004). `Audit expectation gap. The case of Malaysia. `Managerial Auditing Journal, 19(7), 897-915.

- Mohamed, N. F., & Zauwiyah, A. (2004). `Audit expectation gap. The case of Malaysia`. Managerial Auditing Journal, 19(7), 897-915.

- Monroe, G. S., & Woodliff, D. R. (1993). `The effect of education on the audit expectation gap.` Accounting & Finance, 33(1), 61-78.

- Monroe, G. S., & Woodliff, D. R. (1993). `The effect of education on the audit expectation gap.` Accounting & Finance, 33(1), 61-78.

- Noghondari, A. T., & Foong, S. Y. (2009). `Audit expectation gap and loan decision performance of bank officers in Iran.` International Journal of Accounting, Auditing and Performance Evaluation, 5(3), 310-328.

- Noghondari, A. T., & Foong, S. Y. (2013). “Antecedents and consequences of audit expectation gap: Evidence from the banking sector in Malaysia. Managerial Auditing Journal.

- Olojede, P., Erin, O., Asiriuwa, O., & Usman, M. (2020). `Audit expectation gap: an empirical analysis.` Future Business Journal, 6(1), 1-12.

- Porter, B., Ó hÓgartaigh, C., & Baskerville, R. (2012). `Audit Expectation‐Performance Gap Revisited: Evidence from New Zealand and the United Kingdom. Part 1: The Gap in New Zealand and the United Kingdom in 2008`. International Journal of Auditing, 16(2), 101-129.

- Porter, B., Simon, J., & Hatherly, D. (2003). `Principles of external auditing. John Wiley & Sons.

- Power, M. (1997). The audit society: Rituals of verification. OUP Oxford.

- Quick, R. (2020). `The audit expectation gap: A review of the academic literature.` Maandblad Voor Accountancy en Bedrijfseconomie, 94, 5.

- Ruhnke, K., & Schmidt, M. (2014). `The audit expectation gap: existence, causes, and the impact of changes.` Accounting and business research, 44(5), 572-601.

- Salehi, M., & Arianpoor, A. (2021). `The consequences of the auditor’s choice in group companies and expectations gap.` Management Research Review.

- Salehi, M., Jahanbin, F., & Adibian, M. S. (2019). `The relationship between audit components and audit expectation gap in listed companies on the Tehran stock exchange.` Journal of Financial Reporting and Accounting.

- Shbeilat, M., Abdel-Qader, W., & Ross, D. (2017). `The audit expectation gap: Does accountability matter.` In Proceedings of ISERD International Conference, Stockholm, Sweden (pp. 7-16).

- Sikka, P., Puxty, A., Willmott, H., & Cooper, C. (1998). `The impossibility of eliminating the expectations gap: some theory and evidence.` Critical perspectives on accounting, 9(3), 299-330.

- Taslima, A., & Fengju, X. (2019). `Stakeholders’ trust towards the role of auditors: a synopsis of the audit expectation gap.` J Manag Sci, 6(1), 43-49.

- Toumeh, A. A., Yahya, S., & Siam, W. Z. (2018). `Expectations gap between auditors and user of financial statements in the audit process: an auditors’ perspective.` Asia-Pacific Management Accounting Journal (APMAJ), 13(3), 79-107.

- Tricker, R. I. (1980). `Corporate accountability and the role of the audit function.` Corporate Policy Group.

- Van Liempd, D., Quick, R., & Warming‐Rasmussen, B. (2019). `Auditor‐provided non-audit services: Post‐EU‐regulation evidence from Denmark.`International Journal of Auditing, 23(1), 1-19.

- Wolf, F. M., Tackett, J. A., & Claypool, G. A. (1999). `Audit disaster futures: antidotes for the expectation gap?.` Managerial Auditing Journal.