Introduction

Financial institutions are considered the backbone of any society, as they play an essential role in economic development. Like other financial corporations, Islamic financial institutions have also surfaced their way into the mainstream of the financial system over the last few decades (Aziz & Afaq, 2018). The development of Pakistan’s banking sector reveals notable changes in conventional banking (CB) vs Islamic banking (IB). According to the State Bank of Pakistan (2017), financial growth has accelerated in recent years, and the CB is regarded as a dominating market participant, holding more than 80 % of the total of the banking industry’s total assets. On the other hand, IB is still at an early stage, comprises five full-fledged banks, and has earned about 6 percent share in the market in the last decades while it has one percent global share in assets all over the world. According to the State Bank of Pakistan (2017), the banking sector continues to invest in infrastructure, which is reflected in the absorption of total assets (PKR-16K Billion), upsurge in total deposits (PKR-12K Billion), escalation in financing and investment (PKR-37K Billion) where Islamic Banking of Pakistan (IBP) expanded to total assets (PKR-2K Billion), increase in total deposits (PKR-1.7K Billion), escalation in financing and investment (PKR-1.5K Billion).

In terms of top jurisdictions for IB worldwide asset shares, Iran maintained its historical position as the largest market, accounting for 32.1 percent of the global IB sector in the second quarter of 2018. Saudi Arabia comes in second with 20.2 percent, Malaysia comes in third with 10.8 percent, the UAE comes in third with 9.8 percent, and Kuwait comes in fifth with 6.3 percent. Qatar, Turkey, Bangladesh, Indonesia, and Bahrain are the other nations in the top ten Islamic banking jurisdictions, in order of size, whereas IBP, with a stake of 1.3 percent, is very low. Given this market share, it is critical to prioritize Islamic banking and finance, which may stimulate improved financial access and lure individuals to the Islamic banking industry rather than conventional banking (IFSB, 2019). Currently, IB operates on two levels. The first are full-fledged Islamic banks (IBs) that operate under Shariah regulations, and the second are Islamic Banking Departments (IBDs) that provide Islamic banking services under the auspices of CB. As a result, IBs compete not only with CBs but also with IBDs. Due to severe competition from other financial institutions, IBs strive to build distinctive marketing tactics in order to retain ties with their clients in order to ensure long-term company viability and profitability (Aziz & Afaq, 2018).

IBP is presently less stable than CB since the former keeps a lower percentage of their deposits. Due to lower asset returns, IB find it difficult to attract deposits at higher rates, resulting in deposit attrition. Furthermore, these institutions lack the benefit of an interest rate corridor, which is provided to CB and allows them to put money at a minimum rate or borrow at a maximum rate from the SBP in times of need. Low levels of financial and customer involvement, along with a tiny percentage of IB market share, are insufficient to acquire consumers’ trust and draw them to IB rather than CB (Ahmed, 2018). Consequently, it must be ascertained how to escalate the number of IB customers by recognizing the factors that affect customer’s perceptions? In this regard, this study takes the lead from the Cue Utilization theory to determine what drives Pakistani consumers to opt for Islamic banking services. Cue utilization argument is grounded on particular evaluative signals that act as replacement quality attributes to the customer and might be functional or non-functional (Devlin, 2011). There are several studies obtained from financial industry, particularly the Islamic Banking Industry of Pakistan, where researchers have investigated the influence of service quality on customer bank selection criteria. Nonetheless, little study has been conducted on the impact of additional quality indicators on customer purchasing decisions. To fill this gap, the present study is an attempt to investigate the influence of non-functional cues and consumer knowledge on consumer purchase decisions.

Literature Review

Cue Utilization Theory

According to cue utilization theory, a product consists of a range of cues that serve as substitute indicators of quality to consumers, either functional or non-functional cues (Zeithml, 1988). Functional cues (FCs) are inherent features of services that cannot be changed without altering the service nature. These cues include service features such as interest rates, overdraft charges, incentives for selecting specific accounts, media reviews, product rankings, and national reputation (Yavas et al., 2014). Non-functional cues (NFCs) are the features of services and can be replaced instantaneously which includes personal referrals (Brady et al., 2005) brand name, organization’s image, services quality, advertisement, country of origin, and price (Yavas et al., 2014; Devlin, 2011).

This study lends the support from cue utilization theory and previous studies that suggested that consumers mostly consider a wide range of cues to add value to preferences in case of complex decision-making. Therefore, this study aims to measure the effect of non-functional cues on consumer purchase decisions in the case of financial services. Four NFCs, i.e., country of origin, bank name, advertising effectiveness, and price/services charges, have been selected for this study and brief discussion is provided in the subsequent sections.

Country-of-Origin (COO) and its Role in Services Evaluation

COO in the context of services can be defined as domestic consumers’ perception and opinion of basic service levels related to any country (Thelen, 2010). Service delivery includes consumers’ communication with personnel, so that standards relating to the service providers’ COO may have a superior influence on consumers’ evaluations of services than tangible products. Moreover, a service provider’s choice criteria depend upon the relationship between consumer and service provider nationality as consumers usually prefer service providers carrying the same nationality as they do (Hien et al., 2020).

COO is an essential carrier of information for consumers while considering services, which affects their assessment of purchase risk and purchase intentions (Morrish & Lee, 2011). The product and service category to which the consumer gets exposure and experience shapes the country’s image for that category with the country under consideration. Once a COO image is developed, it leads to stereotyping, which results in the country’s product evaluation based on the COO image, irrespective of the product’s actual quality. Similarly, the seminal work of Mahmood, Baharun & Khalil (2021) found that service provider’s nationality significantly impacted the consumer choice and purchase decision. The focal point of COO research in the services domain has gradually shifted to consumer evaluation of hybrid (offshore) services in the last few years. Along with the globalization of business enterprises, a firm’s offshore strategy often involves spreading and shifting its service operations to other counties to achieve strategic and competitive edge such as cost efficiency (Tate et al., 2009). Considerable research has been directed about the COO’s belongings. however, the COO effect on consumer decisions in financial services has not been answered satisfactorily.

Bank Name and its Role in Services Evaluation

An attractive brand name can give the company a marketing edge over its competitors which is especially important for service companies. It has also been recognized in services industries that strong brand recognition could be a greater factor with intensifying competition. Consequently, service-based organizations need to build a strong brand image in the marketplace and in consumers’ minds (Hosseini, & Behboudi, 2017). Susilowati & Sari (2008) concluded that when consumers repeatedly purchase a particular brand, they use their experience to assess the performance, quality, and aesthetic appeal of the brand. One of the key components of experience would be the acknowledgment of a brand name. Therefore, when consumers don’t have direct experience with a product and service, the brand name provides them with a certain degree of familiarity. Moreover, consumers who have less knowledge or experience are likely to depend on extrinsic cues such as brand name (Jiang et al., 2018). The findings of Omoruyi and Chinomona (2019) concluded that the brand name presents a rich information source about company to the consumers to make prepurchase evaluation and purchase decision.

Advertising Effectiveness and its Role in Services Evaluation

Corporate branding plays a vital part in financial product and service advertising as financial product advertising is always combined with the corporate brand name. Consumers often identify the financial institutions by their corporate name, rather than the product name. This notion leads to the extensive use of corporate advertising in financial services. The seminal paper of Amoako et al. (2017) explained that advertising is necessary for financial institutions to dispense the pertinent brand information to attain the anticipated brand image in the mind of the consumers. It improves consumers’ overall evaluations and reduces consumers’ perceived risks attached to financial services.

Financial institutions are using advertising as an efficient and effective tool to provide information and reach their target audience. They are spending a huge amount of their budget on advertising to liberate their potential and existing consumers about their products and services. In this regard, the main focus of Islamic banking advertising is to create awareness about their products without contradicting and harming consumers’ religious beliefs and practices (Awan & Azhar, 2014). The presence of high competition among CB and IB has transformed the mindset and perceptions of consumers. Still, this stiff competition has also created a need to evaluate effective advertising strategies and campaigns to reach consumers efficiently and effectively. These strategies’ successful development creates consumer awareness and recognition of banking products and services (Naser et al., 2013). Apart from creating consumer awareness, advertising also plays a significant role in consumer bank choice. It creates consumer attachment towards banks by using celebrity endorsements to inspire them to become a part of the Islamic banks and eventually relating it to generating profit (Awan & Azhar, 2014).

Islamic banking is facing intensive competition from its competitors. To benefit from Islamic financial services, consumer awareness about Islamic banking is necessary (Doraisamy et al., 2011). It is needed to do intensive advertising to inform the target audience about the availability of the banks’ products and services. But Shariah must also be carefully observed in advertising, and it should convey messages about the bank’s products and services effectively without any exaggeration (Hakim et al., 2011). Regardless of the attractiveness of advertising research in the academic field, no prior research was conducted to measure the influence of financial services advertising on consumer behavior in the presence of other quality cues.

Price/Services Charges and its Role in Services Evaluation

Price or Services charges have been deliberately considered an integral element of consumer evaluation (Kardes et al., 2004). Consumers unswervingly use price as a quality indicator, particularly when they don’t possess enough knowledge about products and services (Veale & Quester, 2009). Financial service charges are also essential since consumers’ complex financial services decisions greatly depend on various decision strategies based on available information, i.e., price and brand name (Avlonitis, & Indounas, 2015). Prior consumer research has documented that price impacts consumer perceptions of a product evaluation. It is used as an interpreter of quality particularly when they have inadequate knowledge of product class offerings (Qasem et al., 2016). Consumers deeply accept that the quality of a product and service is related to price range, where high quality products and services are more expensive, and conversely, products and services of lower quality are comparatively inexpensive. This perception can result in two negative consequences for marketers. Firstly, consumers may assume that higher quality products are more expensive, which leads to a restraint on their possible purchase. Secondly, if the consumers believe that quality and price are knotted in, then paying a lower price means they must accept a lower quality product. (Bredahl, 2004). The degree of price influence on consumer perceptions depends upon the product and services category, situation, way of use, and several other quality cues available for evaluation. Prior researchers determined that if a consumer doesn’t have enough knowledge about a product class, at that point, price is possible to be used as a key quality indicator. The use of price as a single quality cue and other quality cues have been well-defined for the tangible nature of consumer goods. However, the existing notion has not been noticeably identified in the financial services. Based on the above literature following hypothesis can be drawn:

H1: Non-functional cues such as COO (H1a), bank name (H1b), advertising (H1c), and price/service charges (H1d) are positively correlated with consumer purchase decisions while consumers opt to avail of Islamic banking financial services.

Consumer Purchase Decision for Financial Services (CPDFS)

A purchase decision is a prolonged procedure of selecting from two or more products and services and optimizing a situation or outcome (Putrawan, 2020). The concept of consumer decision-making has been reframed regarding the perspective of financial services. It is a set of several steps comprised of need arousal where consumers recognize the need or problem for a solution, followed by information utility based on an internal or external source. Internal sources include experience, memory, learning, and subjective knowledge, while external sources comprise marketing communications and personal sources. Subsequently, consumers develop criteria for alternatives and evaluate the final decision to purchase a specific service to solve his/her problem (Milner & Rosenstreich, 2013). Furthermore, CPDFS has been enlightened slightly different than tangible products. It is elaborated that consumer first make an effort to comprehend the difference between anticipated and current state based on external drivers. These drivers comprise environmental and contextual variables, including life events like retirement, employment conditions, marriage, etc., having a significant influence on consumer purchase decisions explicitly in financial services (Devlin, 2011). Still, in case of intangible nature of products or financial services, it is less common that consumers recognize instantaneously that a financial need exists and specific services to use to fulfill the need. Moreover, in financial services, consumers often have inadequate information that they cannot understand and evaluate among available alternatives. Therefore, consumers tend to use a smaller number of attributes for evaluating services. After evaluating available alternatives, consumers decide, but this decision is considered separate to purchase desired services because it is known that consumers may delay their final decision to purchase financial services due to the greater perceived risk and potential losses (Mahmood & Baharun, 2018; Milner & Rosenstreich, 2013).

Consumer Product-Related Knowledge

Consumer knowledge (CK) plays a vital role in marketing research; hence, it is an essential research subject in a related field. Vigar-Ellis et al., (2015) states that consumer knowledge depends on how consumers collect and organize the information pertinent to what products they will purchase and how they use them. Consumer knowledge significantly contributes to consumers’ analysis of the products and services, they want to consume. It explicates the interface between consumer experience and evaluation of information in the establishment of consumer preferences. Devlin (2011) proposed that consumer knowledge consists of three components, i.e., objective knowledge, subjective knowledge, and familiarity. Objective knowledge is referred as real or accurate knowledge and information that the consumers keep in their long-term memory, such as brand information, characteristics, assessments, usage situations, and decision heuristics (Gunne & Matto, 2017). Subjective knowledge is defined as self-assumed knowledge, or simply, the information consumers perceived they store in their memory. It also reflects confidence, and therefore, purchase confidence explains subjective evaluations of consumers’ ability to generate positive experiences in the marketplace (Vigar-Ellis et al., 2015). Familiarity is defined as the number of product and service-related experiences that have been accumulated by the consumer (Devlin, 2011).

Consumer knowledge is crucial at every stage of the decision-making process. A consumer with limited knowledge may find the purchase decision challenging compared to a consumer with a high level of knowledge (Vigar-Ellis et al., 2015). It is considered an important interpreter of consumer behavior while evaluating products and services. Former studies illustrate that consumer knowledge does have a strong impact on the consumer purchase decision. For example, Wang et al. (2019) asserted that consumer product-related knowledge has a significant positive effect on information search intention and consumer purchase intention under different product involvement levels. Similarly, Karimi et al. (2015) concluded that consumers often rely on their product-related knowledge to evaluate the product and service and it would also affect their information search process and attitude. Several studies provide empirical evidence of the consumer knowledge effect on consumer perception in both the tangible and intangible nature of goods. However, this prevailing notion has not been identified with evaluative quality cues in the financial services context. Based on the literature, it would conclude the following hypothesis:

H2: Consumer knowledge, such as subjective knowledge (2a), objective knowledge (2b), and consumer familiarity (2c), are positively correlated with consumer purchase decisions while consumers opt to avail of Islamic banking financial services

Rationales of Moderating Role of Consumer Knowledge

It is renowned that consumers predominantly rely on certain evaluative cues. However, consumers are not constantly able to appropriately evaluate these cues before making a purchase decision, even in a post-purchase evaluation. There are numerous reasons, such as lack of understanding, lack of knowledge, lack of experience, lack of self-confidence, and information misinterpretation, that influence product and service attributes (Kardes et al. 2004). A stream of studies indicates that, among all these individual consumer differences, consumer’s dependence on different quality cues is vastly moderated by consumer knowledge (Veale & Quester, 2009) and product familiarity (Wang et al., 2019). For example, seminal studies of Devlin (2011) suggested that consumers with low objective knowledge are more likely tend to rely on NFCs, such as brand names, while expert consumers consider a specific product or functional cues as they are familiar with the existence and potential importance of these cues. Based on research discussion, it is expected that CK may moderate the relationship of NFCs and CPD. Therefore, according to the above literature, the hypothesis of the study is inferred as follows:

H3: Consumer knowledge moderates the relationship between non-functional cues and consumer purchase decision.

Research Methodology

Target Population

The research target in this study was consumers of Islamic banking services. Pakistan’s banking sector is segregated into eight regions where, Punjab and Sindh regions are the most dominant states having maximum numbers of customers and IB branches, comprise of the multi-ethnic population representing all major cultures or provinces of Pakistan and contributing significantly to the financial sector (SBP, 2017).

Sampling Technique

Considering the complexity and efficiency of the sampling frame, the multistage cluster sampling technique was utilized (Taherdoost, 2016), which comprises the three-level. Stage-1: Two main states i.e., Punjab and Sindh were selected (having the maximum number of IBs branches and the maximum number of account holders). Stage-2: Two cities i.e., Lahore (Punjab) and Karachi (Sindh) were selected (multi-ethnic population, contributing significantly in the financial sector). Stage-3: Islamic banks and branches were selected (market share and number of branches).

Sample Size

To propose an integrated model of the study, and to test the hypothesis, Structural Equation Modelling (SEM) technique was used in this study. Considering the SEM sample size limitations and Ruane’s (2005) guidelines, this study’s sample size was 800. For data collection, questionnaires were circulated among the IB consumers, and online survey software Question-Pro was used for online data collection. Branch managers were contacted, and a link to the online survey questionnaire had provided to them in the email. This study succeeded in achieving a sample size of 813 for the final data analysis.

Questionnaire Design and Measurement Scale

The questionnaire design in this study includes four main parts i.e., i) NFCs, ii) consumer purchase decision, iii) consumer knowledge, and iv) demographics. Questionnaire constructs, their operational definitions, and scale, used in this study. A five-point Likert scale was used to collect the data.

Data Analysis Tools

Preliminary data analysis was done using SPSS while Structural Equation Modelling (SEM) technique was used to propose an integrated model of the study and to test the hypothesis.

Results

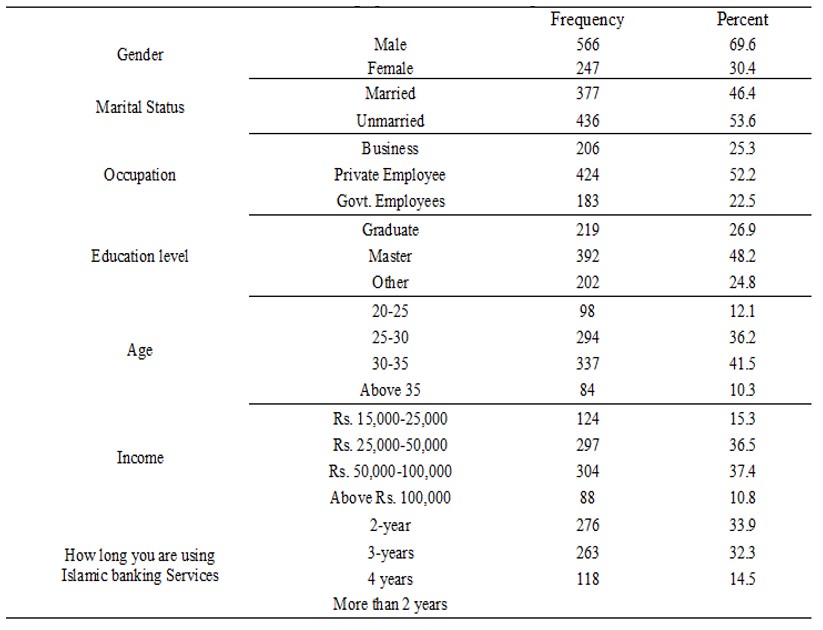

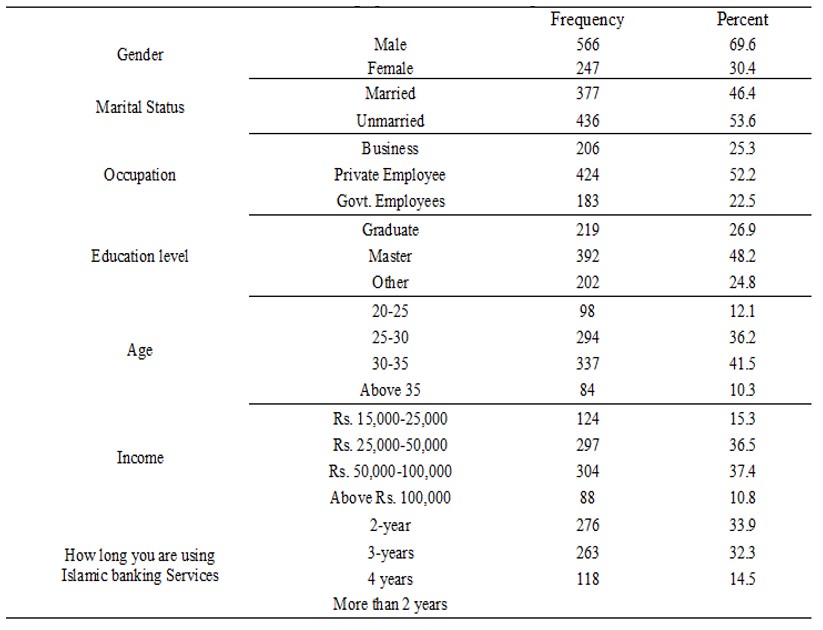

The insignificant MCAR statistic (Chi-Square = 393.477; df =466; Sig = 0.994) revealed that missing values (13) were random, Harman’s single factor test which described that 42.8 percent of variance, the Skewness, Kurtosis values (-1.96 and +1.96), and Shapiro Wilk test (>0.05) for most of the latent variables were within the suggested limit. Demographic information is given (Table 1) to understand survey respondents’ characteristics. Once the adequate dataset for this study (N=813) was obtained after data screening and preliminary analyses, the data were analyzed for hypotheses testing in PLS-SEM.

Table 1: Demographic profile of the respondent

Evaluation of Path Model Through PLS-SEM

Once the adequate dataset for this study (N=813) was obtained after data screening and preliminary analyses, the data were analyzed for hypotheses testing in PLS-SEM.

Assessment of Measurement Model

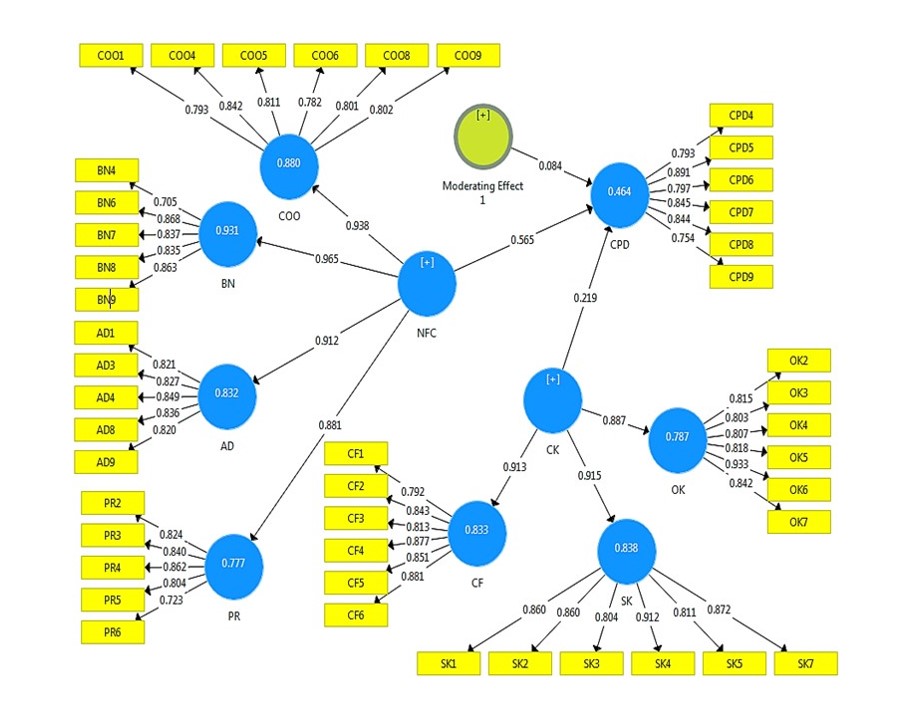

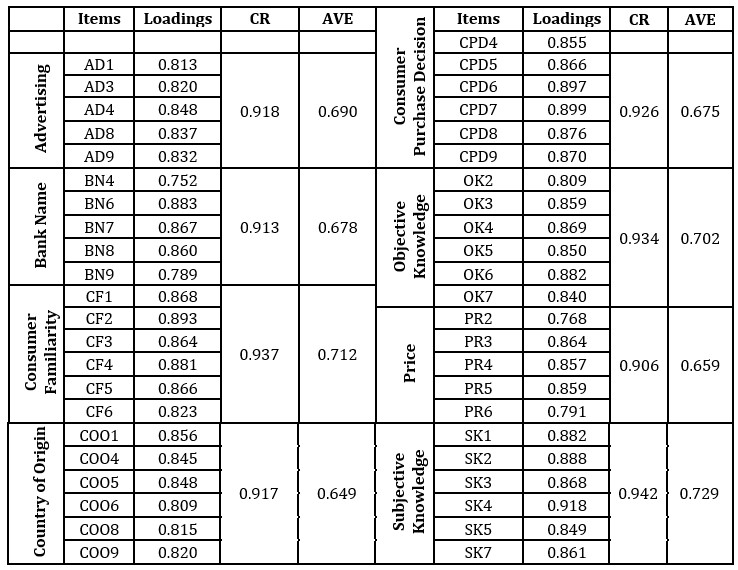

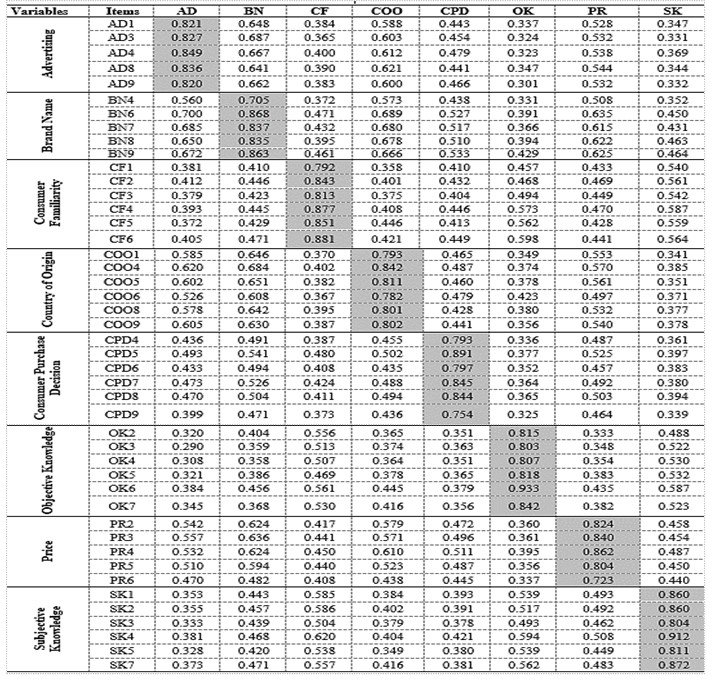

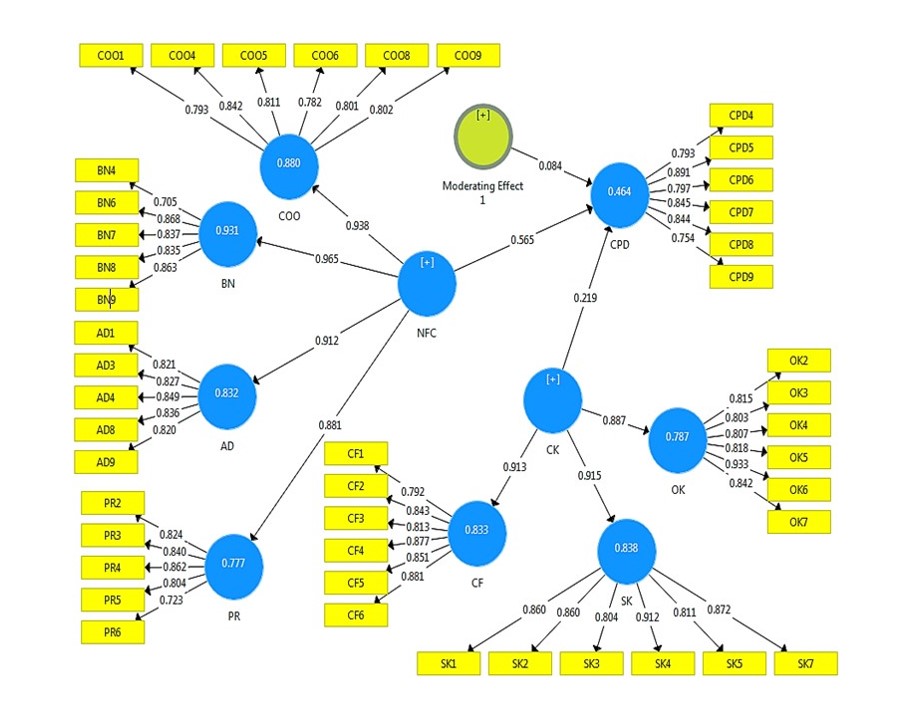

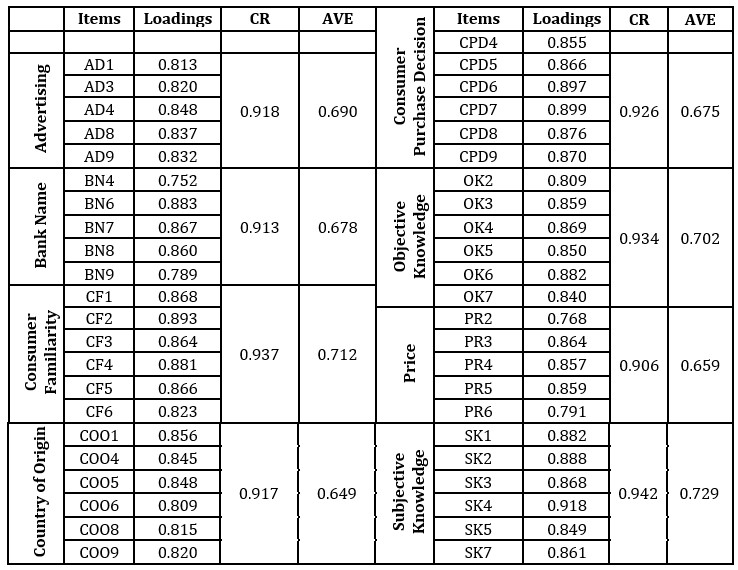

Confirmatory factor analysis (CFA) was conducted by using Smart-PLS and 64 items were used to measure the constructs. All items containing the threshold < 0.70 were dropped. After dropping items (Figure 1), a second CFA by using the retained items was run and the reliability, convergent, and discriminant validity of each construct was examined (Table 2). The convergent validity of the constructs was examined through composite reliability (CR) and average variance extracted (AVE). As shown in Table 2, both CR and AVE values were above the cut-off values. CR values range between 0.942 and 0.906 while AVE values range between 0.729 and 0.649. Moreover, all the CR values are more significant than the corresponding AVE values. Thus, all the above-suggested criteria were contacted to verify the convergent validity of the constructs.

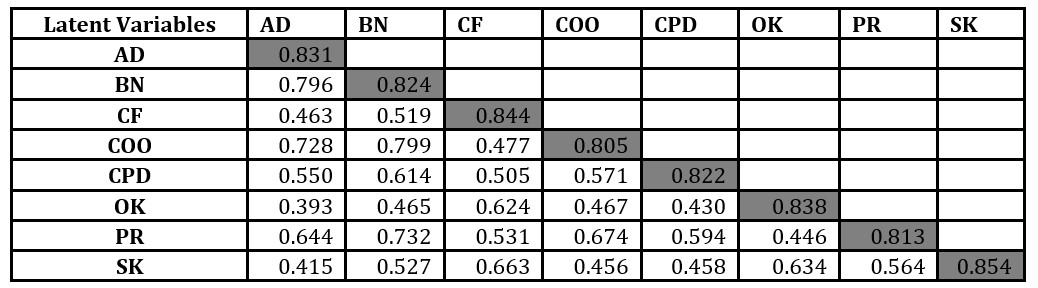

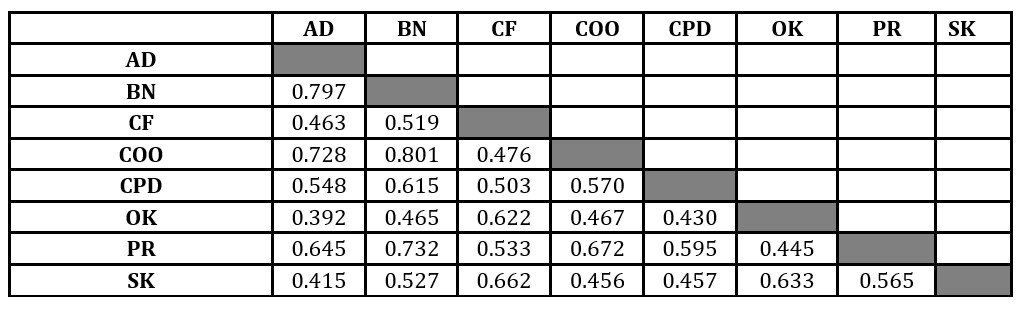

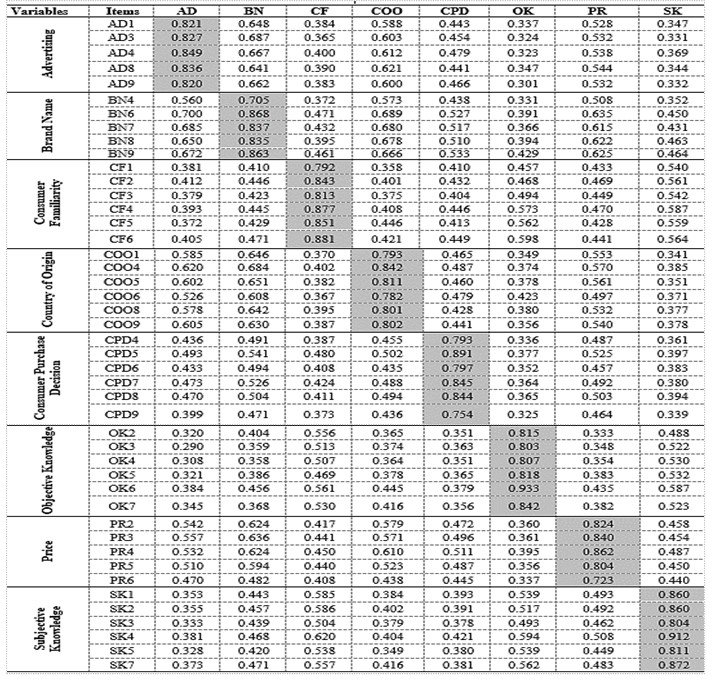

The discriminant validity of the constructs was assessed by using all three recommended criteria as below:

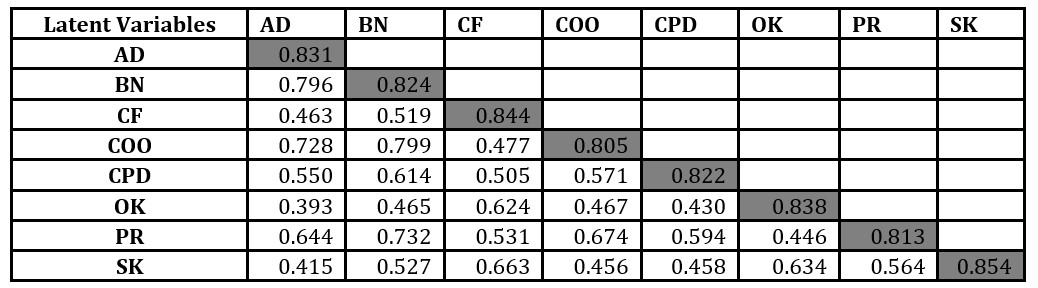

- Fornell and Larcker criterion (1981): Discriminant validity was established by comparing AVE’s square root (bold values in Table 3) with squared correlation coefficients (other values) between each pair of factors. It can be observed from the results that AVE values were greater as compared to squared correlations coefficients of corresponding rows and columns between the constructs.

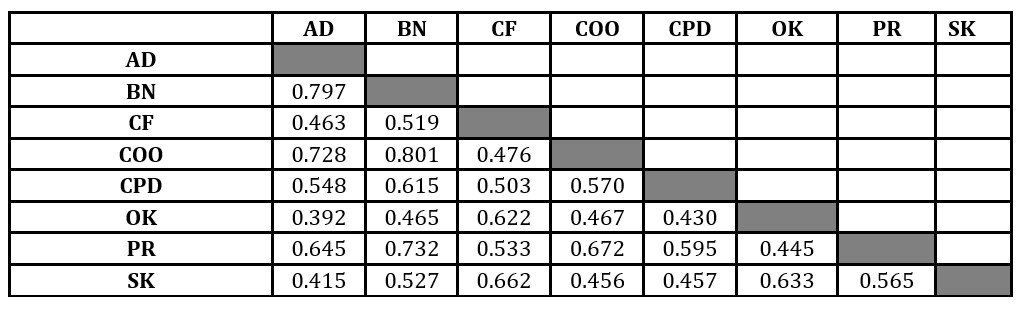

- Heterotrait-Monotrait ratio of Correlations (HTMT) criterion: It is recommended that the value of latent variables’ correlations should be lower than 0.90 as a lenient value (Kline, 2010). In this study, the highest value of correlation among latent variables was 0.799, which is closely below the threshold value of HTMT (Table 4).

- Cross-loadings criterion: All the measurement items were loaded higher to their particular latent variable in the cross-loading criterion than any other variables (Table 5).

Assessing the Validity of the 2nd Order Construct: In this study, two constructs i.e., NFC and CK were measured as second-order constructs (reflective-reflective in nature). Similar to the first-order constructs, the validity and reliability of second-order constructs were examined. The results revealed that convergent validity, discriminant validity at second order through (i) HTMT (<0.85), and (ii) Fornell and Larcker fulfilled the above-required criteria.

Figure 1: Measurement Model for CFA

Table 2: Assessment of Items Reliability and Convergent Validity

Table 3: Discriminant Validity through Fornell and Larcker Criterion

Table 4: Discriminant Validity through Heterotrait-Monotrait ratio of Correlations (HTMT)

Assessment of Structural Models

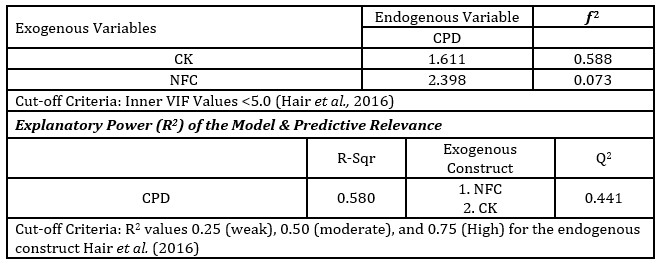

The structural model could be assessed through collinearity issues through VIF before assessing the explanatory power of the model (R2), the significance of path coefficient (β) including moderator analysis, the goodness of fit (GoF), predictive relevance (Q2), and effect size (f 2) (Hair et al., 2016).

Table 5: Discriminant validity Through Cross Loadings

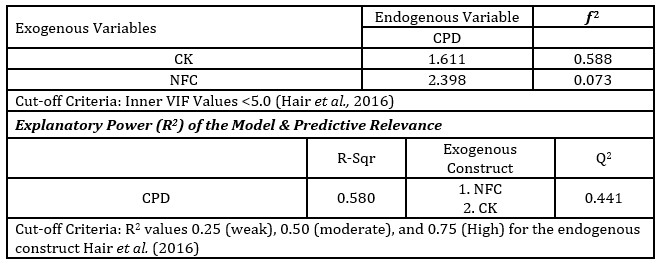

Collinearity Assessment through VIF: The results revealed that VIF values for all the endogenous constructs (CK=1.611, NFC=2.398) remained below the threshold value of VIF<5 (Hair et al., 2016), which indicated that the model did not suffer from any collinearity issues and was suitable for further assessment (Table 6).

The explanatory power of the model (R2): The endogenous construct CPD explains 58% of NFC and CK (exogenous variables) with statistically significant t-values and p-values at a 99% confidence interval (Hair et al., 2016). Thus, the results indicated that the model is parsimonious since R² values for endogenous construct satisfied the minimum requirement of cut-off value (Table 7).

Table 6: Assessment of Structural Models

Predictive relevance (Q 2) and effect size (f 2): This study contained one endogenous construct (CPD) contains the Q2 values 0.441. The values indicated that the structural model had satisfactory predictive relevance since all endogenous construct values were well above the threshold value (Hair et al., 2016). Thus, the structural model has satisfactory predictive relevance for the endogenous constructs of the proposed model. Similarly, CPD was predicted by NFC (f 2 = 0.073), and CK (f 2 = 0.588). The effect size of NFC on the CPD was low, and while the effect size of CK on the consumer purchase decision process was high (Table 6).

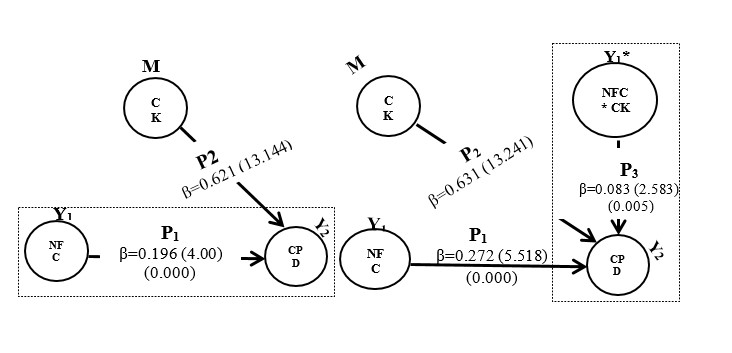

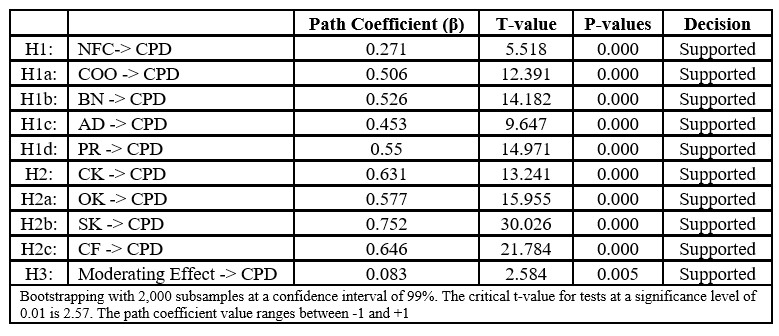

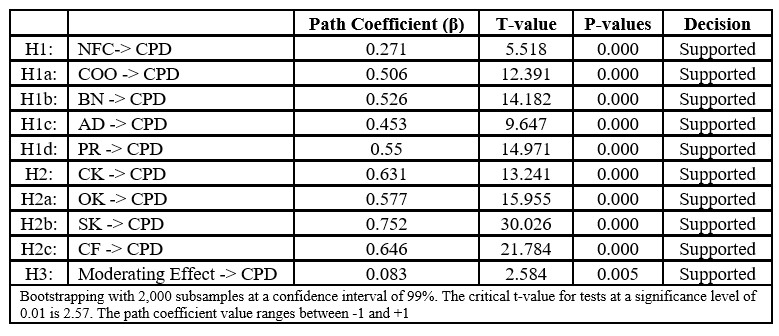

The significance of path coefficient (β): Table 7 demonstrates the influence of NFC on the CPD was significant (β=0.271; t=5.518; p=0.000) that supported H1. In the mainstream, H1 was further categorized into four parts to assess the individual influence of NFC on the CPD. And the results of the study indicate that the influence of COO (β=0.506; t=12.391; p=0.000) supporting H1a, brand name (β=0.526; t=14.182; p=0.000) supporting H1b, advertising (β=0.453; t=9.647; p=0.000) H1b, and price (β=0.550; t=14.971; p=0.000) on CPD was also found significant, supporting H1b. H2 was hypothesized as CK has a strong effect on CPD that was also found significant and supported by the results of the study (β=0.631; t=13.241; p=0.000). Hypothesis H2 is further segregated into three dimensions and the study results found consumer familiarity (β=0.646; t=21.784), subjective knowledge (β=0.752; t=30.026), and objective knowledge (β=0.577; t = 15.955), significant effect on CPD and supporting the H2a, H2b, and H2c. H3 was hypothesized as CK moderates the relationship between NFC and the consumer purchase decision process while dealing with Islamic banks.

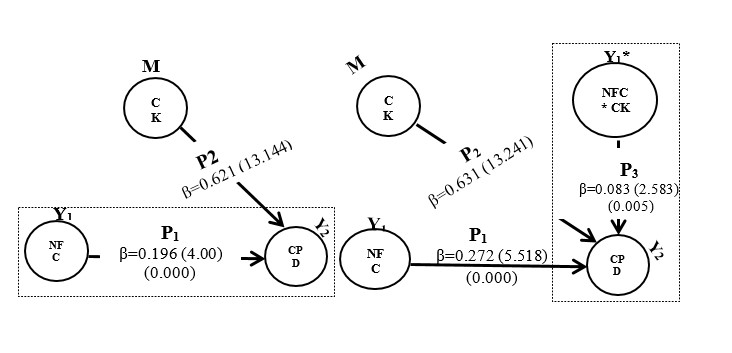

Figure 2: Moderating Modelling by Using Two Stage Approach

Moderation Treatment: In this study, a two-stage approach is used for the creation of the interaction term. To achieve more understanding of how moderating effects are modeled, consider the study’s path model shown in Figure 2. Results indicated that the NFCs (Y1) and CPD (Y2) is moderated by CK (M) (β=0.083; t-value=2.584; p-value=0.005). Meanwhile, NFCs (Y1) effect on consumer purchase decision (Y2), in simple effect P1 (β=0.272; t-value=5.518; and p-value=0.000) and consumer knowledge (M) effect on consumer purchase decision (Y2) in simple effect P2, has been increased due to third construct effect that is consumer knowledge (M). It can be further observed that this study also meets the moderating modeling recommendations given by Henseler & Fassott (2010) that if the level of the moderator variable is increased, the simple effect P1 is expected to change by the size of P3 (See Figure 2).

Table 7: Results of Structural Model and Hypotheses Testing

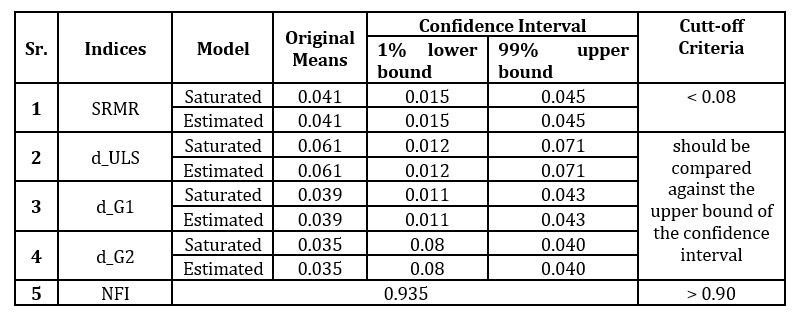

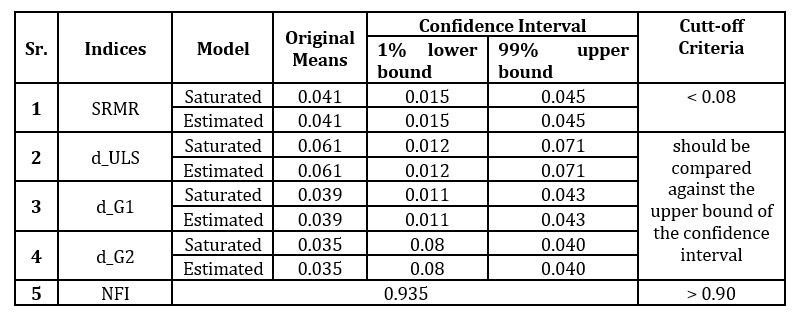

Model Fit: As per recommendations of Hair et al. (2016), this study obtained original means at a 99% confidence interval from consistent bootstrapping and results indicated that the values of SRMR and NFI meet the requirements for model fit (Table 8) and, the original values of indices are less than the upper bound of the confidence interval of 99% which indicated a good model fit.

Table 8: Results of Model Fit Indices

Discussion and Conclusion

Drawing from cue utilization theory, this research set out to determine whether NFCs and CK have an influence on CPD while dealing with Islamic banking services. These three variables were decomposed into their antecedents for an in-depth analysis to ensure the robustness of the research. Measurement and structural models were analyzed in the study revealed that all the hypotheses were supported by the data. The findings revealed that NFC has a significant influence on CPD when consumers in Pakistan use Islamic banking services.

The findings harness and support the previous findings (Devlin, 2011; Essoussi & Merunka, 2007) showing that the level of intangibility provides an expedient means to determine product and services and impact on consumer behavior. However, a consumer may leave with a limited number of evaluative cues that may increase the amount of risk associated with the services. Thus, consumers often use the of quality indicators for making their judgments about the quality of the product and services. Thus, the results can be generalized in the Pakistani Islamic banking financial services context as well.

The current research also sought to investigate the role of COO in taking the Islamic banking financial decisions. IB customers expressed a high level of interest in the COO image and stated that COO prominently matters for them. They consider the COO as the first piece of information to choose the best Islamic banking services and also help them to mitigate the risk of financial transactions (Mahmood, Baharun, & Khalil, 2021; Hien et al., 2020; Sulhaini et al., 2019).

Furthermore, this research set out to find whether the bank name has a positive influence on CPD and it was found that Islamic banking customers often use the brand/bank name as a means of the pre-determined quality of financial services, which develop a better imagination, trust, and confidence about financial services. Bank name helps them minimize the financial risk, and contributes to consumer satisfaction by providing consumers with an assurance of the best quality. It is a premeditated element with a significant influence on consumer assessment because it provides copious information about the bank to the consumers to make purchase decision evaluation. It can be further concluded that bank repute or renowned brand name is the utmost vital factor influencing consumer preferences. These research findings are consistent with the previous findings (Devlin, 2011; Ahmad et al., 2011).

The current research was also pursued to investigate the role of advertising in CPD and study analysis revealed that advertising prominently matters for them while availing financial services. Islamic banking customers considered that although IB ads are not excessively appealing; however, it always gives an optimistic and constructive impression of financial products to the customers. IB’s ads are stimulating, trustworthy, and made it easy to visualize the financial services, which resultantly incite them to use Islamic banking products. These findings further supported by statistics given by the State Bank of Pakistan (2017), where it is affirmed that in the recent decade, the amount spent on advertising for the financial sector in Pakistan is more than Rs. 30 billion, claiming a top share of fifty-eight percent total advertising budget in the country. Thus, it presents important implications for IB managers.

It was also hypothesized that price/service charges have a positive influence on the CPD. The study analysis revealed that customers deliberately considered the service charges as an integral element of consumer evaluation for services, particularly when they don’t possess enough knowledge about products and services. IB customers pondered the price as a good indicator of service quality. Although it seems that most of IB customers responded that their bank services are reasonably priced; however, they further believe that the higher the services charges, the better the Islamic banking services. These findings are supported by previous literature where it has been empirically tested those consumers perceive price as the prime indicator to presume the quality of the product and services (Veale & Quester, 2009).

IB customers proclaimed that making a purchase decision for Islamic banking services is crucial for them; however, they make their financial decision by consulting others and using their experience to make an accurate purchase decision. IB customers make their financial decisions logically and systematically and consider all alternatives before making their financial decisions. It could be observed that consumer objective and subjective knowledge significantly contributes to consumer’s analysis of IB financial services particularly when they have high purchasing frequency financial transactions. The high purchasing frequency of Islamic products enhances their experience and services-related information, which can be used to re-evaluate service quality in the future. The findings complement and support previous findings (Jiang, et.al., 2018; Wang et. al., 2016).

Implications, Limitations, and Future Research Directions

Several research gaps relating to NFC are identified in this study. To fill these research gaps, this study suggested three major contributions to the existing body of the literature: i) validation of operationalization of NFC for financial services; ii) development of an integrated model of NFC and CPD by assimilating two theories; iii) endorsement of CK as a moderator between NFC and CPD. From the managerial perspective, this study’s final model provides an opportunity to recognize the underlying quality cues that consumer consider while dealing with the Islamic banking sector. Moreover, it helps extend the existing body of knowledge related to consumer buying behavior in the Third World Countries by using various national settings.

These findings can serve as a roadmap for the managers and policymakers to figure out how they can retain their customers for a longer period by focusing on these critical factors. Based on the findings of the study, consumers’ indecision could be targeted in order to develop a positive attitude in them. Managers could start by identifying the favorable attitudes that will lead to positive purchase intentions and then designing their promotional materials accordingly. Marketers must keenly observe the consumer decision-making process and recognize the aspects that consumers consider most while making decisions and the type of information used by the consumers to make a purchase decision.

According to the findings of the study, COO is a significant factor for IB customers. As a result, the government should prioritize economic growth and opportunities for foreign investment in the Islamic banking industry. To promote this sector, they must develop and implement offshore policies. According to the study’s empirical findings, marketers can emphasize consumer behavior by taking these factors into account, which ultimately increases the Islamic banking sector’s share of the financial market. As previously stated, the purpose of this study was to look into the impact of NFC on the purchasing decisions of Islamic banking customers. However, functional cues were not taken into account in this study. As a result, it is recommended for futility.

References

- Amoako, G. K., Anabila, P., Effah, E. A., & Kumi, D. K. (2017). Mediation role of brand preference on bank advertising and customer loyalty: A developing country perspective. International Journal of Bank Marketing.

- Avlonitis, G. J., & Indounas, K. (2015). Price management in financial services. The Routledge Companion to Financial Services Marketing, 254-270.

- Awan, A. G., & Azhar, M. (2014). Consumer Behavior Towards Islamic Banking in Pakistan. European Journal of Accounting Auditing and Finance Research, 2(9), 42-65.

- Awan, A. G., & Azhar, M. (2014). Consumer behaviour towards Islamic banking in Pakistan. European Journal of Accounting Auditing and Finance Research, 2(9), 42-65.

- Aziz, S., & Afaq, Z. (2018). Adoption of Islamic banking in Pakistan an empirical investigation. Cogent Business & Management, 5(1), 1548050.

- Berry, L. (2000). Cultivating Service Brand Equity. Journal of the Academy of Marketing Science, 28(1), 128-137.

- Brady, M. K., Bourdeau, B., & Julia, H. (2005). The Importance of Brand Cues in Intangibles Services: An Application to Investment Services. Journal of Services Marketing, 19(6), 401-410. Business and Finance Weekly,

- Devlin, J. (2011). Evaluative Cues and Services: The Effect of Consumer Knowledge. Journal of Marketing Management, 27(13-14), 1366-1374.

- Doraisamy, B., Shanmugam, A., & Raman, R. (2011). A study on consumers’ Preferences of Islamic banking products and services in Sungai Petani. Academic Research International, 1(3), 290.

- Farhana, N., & Islam, S. (2012). Analyzing the Brand Equity and Resonance of Banking Services: Bangladeshi Consumer Perspective. World Review of Business Research, 2(4), 148-163.

- Fornell, C., & Larcker, D. F. (1981). Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Journal of Marketing Research, 382-388.

- Hair Jr, J. F., Sarstedt, M., Matthews, L. M., & Ringle, C. M. (2016). Identifying and treating unobserved heterogeneity with FIMIX-PLS: part I–method. European Business Review.

- Hien,, Phuong, N., Tran, T., & Thang, L. (2020). The effect of country-of-origin image on purchase intention: The mediating role of brand image and brand evaluation. Management Science Letters, 10(6), 1205-1212.

- Hosseini, S. H. K., & Behboudi, L. (2017). Brand trust and image: effects on customer satisfaction. International Journal of Health Care Quality Assurance.

- (2019). Islamic Financial Services Industry Report. The Islamic Financial Services Board (IFSB). https://www.ifsb.org/published.php.

- Ishtiaq, S., & Siddiqui, K. (2016). Branding by Islamic Banks in Pakistan: A Content Analysis of Visual Brand Elements. Journal of Marketing Management and Consumer Behavior, 1(2), 32-43.

- Jiang, K., Luk, S. T. K., & Cardinali, S. (2018). The role of pre-consumption experience in perceived value of retailer brands: Consumers’ experience from emerging markets. Journal of Business Research, 86, 374-385.

- Kadir, A. Y. A., & Al-Aidaros, A. H. (2015). Factors influencing advertising in Malaysia from an Islamic perspective: Case of Kedah state. International Review of Management and Business Research, 4(1), 189.

- Kardes, F., Cronley, M., Kellaris, J., & Posavac, S. (2004). The Role of Selective Information Processing in Price-Quality Inference. Journal of Consumer Research, 31(2), 368-374.

- Karimi, S., Papamichail, K. N., & Holland, C. P. (2015). The effect of prior knowledge and decision-making style on the online purchase decision-making process: A typology of consumer shopping behaviour. Decision Support Systems, 77, 137-147.

- Mahmood, CK, Baharun (2018) Consumer Purchase Decision Models: A Review of Financial Services Context. The European Proceedings of Social and Behavioral Sciences (EpSBS). Future Academy. P: 476-489

- Mahmood, CK., Baharun, R., and Khalil, T. (2021) Country of Origin Effects in Financial Service Evaluation: The Pakistani Consumers’ Perception Towards Foreign Islamic Banks, International Journal of Management (IJM), 12(2), 2021, pp. 505-524.

- Mahmood, CK.., Khalil, T., & Al-Hattami, A. (2013). Competitive Study of Service Quality Based on the Perception of Customers and Management of Islamic Banks in Pakistan. IOSR Journal of Business and Management, 9(3), 73-78.

- Milner, T., & Rosenstreich, D. (2013). A Review of Consumer Decision-Making Models and Development of a New Model for Financial Services. 18(2), 106-120.

- Morrish, S. C., & Lee, C. (2011). Country of origin as a source of sustainable competitive advantage: The case for international higher education institutions in New Zealand. Journal of Strategic Marketing, 19(6), 517-529.

- Omoruyi, O., & Chinomona, E. (2019, September). Examining the Effect of Reverse Logistics, Green Logistics and Green Innovation Practices on Firm Performance: A Case of SMES in Gauteng Province. in 31st annual conference of the Southern African Institute for Management Scientists (saims)(p. 312).

- Putrawan, I. M. (2020). Personality on Green Consumer Behaviour. International Journal of Psychosocial Rehabilitation, 24(2).

- Qasem, A., Baharun, R., & Yassin, A. (2016). The Role of Extrinsic Product Cues in Consumers’ Preferences and Purchase Intentions: Mediating & Moderating Effects. TEM Journal, 5(1), 85-96.

- Rahman, O. (2011). Understanding Consumers’ Perceptions and Behaviors: Implications for Denim jeans. Journal of Textile and Apparel, Technology and Management, 7(1), 1-16.

- Ruane, J. (2005). Essentials of Research Methods: A Guide to Social Science Research. London: Blackwell publishing.

- State Bank of Pakistan. (2017). Quarterly Performance Review of the Banking Sector. State Bank of Pakistan, Financial Stability Assessment Division. Financial Stability Department.

- Susilowati, E., & Sari, A. N. (2020). The influence of brand awareness, brand association, and perceived quality toward consumers’ purchase intention: a case of richeese factory, Jakarta. Independent Journal of Management & Production, 11(1), 039-053.

- Taherdoost, H. (2016). Sampling methods in research methodology; how to choose a sampling technique for research. How to Choose a Sampling Technique for Research (April 10, 2016).

- Veale, R., & Quester, P. (2009). Tasting Quality: The Roles of Intrinsic and Extrinsic Cues. Asia Pacific Journal of Marketing and Logistics, 21(1), 195-207.

- Vigar-Ellis, D., Pitt, L., & Caruana, A. (2015). Does Objective and Subjective Knowledge vary between Opinion Leaders and Opinion Seekers? Implications for Wine Marketing. Journal of Wine Research, 26(4), 304-318.

- Wang, X., Pacho, F., Liu, J., & Kajungiro, R. (2019). Factors influencing organic food purchase intention in developing countries and the moderating role of knowledge. Sustainability, 11(1), 209.

- Yavas, U., Babakus, E., Deitz, G., & Jha, S. (2014). Correlates of Customer Loyalty to Financial Institutions: A case study. Journal of Consumer Marketing, 31(3), 218-227.

- Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: a means-end model and synthesis of evidence. Journal of marketing, 52(3), 2-22.