Introduction

Accounting exists primarily to provide relevant information to the various stakeholders, which is dependent on the type of relationship that exists between the company and the stakeholder. Accounting, which is also the language of business, informs the various stakeholders of a business the summary of all the various activities that transpired in the business entity during a given period of time in a quantitative manner (Chih-Fong & Yen-Jiun, 2009). Accounting is the channel of communication in a business enterprise, through which the managers of the business relate with the owners and other stakeholders in the business.

The stakeholders of a business enterprise are the users of the financial report of a business enterprise or anyone who has interest either directly or indirectly in a business enterprise (Murya, 2010; Appalachian, 2006; Freeman, Wicks, & Parmar, 2004), while financial reports are the end products of the accounting activities of a business entity (Universal College of Accountancy, 2004). The contents of these reports however are financial data which if properly analyzed is transformed into accounting information that is used for economic decision-making by the users (Murya, 2010; Chih-Fong & Yen-Jiun, 2009).

The ability of the financial reports to meet the needs of its users is what informs its usefulness and the level of reliability (Uadiale, 2012) placed on it by its users (Kothari, Karthik & Skinner, 2010). Thus when a financial report is unable to meet the needs of its users, it becomes of little or no value. The value of financial data is subject to the quality of report presented, which is subject to the rate at which the users rely on the information it gives (Kothari, Karthik, & Skinner, 2010). If the content of the financial data is faulty, it gives a wrong picture of the business enterprise, which also affects the level of reliability of such documents, thus faulting the credibility of the financial report (Uadiale, 2012). To enhance the value of financial statements, the various information needs of the various users must be met.

Due to the inadequacies of the contents of the various documents in ensuring proper disclosure from the preparers of financial reports and the identification of the need for effective governance practices, the international financial and corporate environment adopted the code of corporate governance. In Nigeria, the financial regulators also published this code in 2003, which was further amended in 2011. This code is expected to regulate the excesses of the executives and ensure effectiveness of the non-executive directors in the company. The code stipulates the need for adequate disclosure of the level of adherence of the company to the contents of the code.

However, to what extent have Nigerian companies adhered to the contents of this code with respect to disclosure? What is the role of firm performance in the level of disclosure of Nigerian companies? What is the role of firm size in the disclosure of corporate governance in Nigerian companies? This study therefore attempts to determine the type of relationship that exists between the financial performance of companies and corporate governance disclosure as well as evaluate the relationship that exist between firm size and corporate governance disclosure. The following research hypotheses are posited:

H1: There is a negative relationship between firm performance and corporate governance voluntary disclosure in Nigeria

H2: There is a negative relationship between firm size and corporate governance voluntary disclosure in Nigeria

Review of Literature

Corporate Governance in Nigeria

The collapse of notable industrial and financial giants like Enron, Worldcom, Parmalat, etc as well as the rate of earnings restatements and claims of earnings manipulation by chief executives of failed corporations resulted in a number of Corporate Governance reforms and enactments all over the world. Some of the enactments include; the Blue Ribbon Committee 1999; Sarbanes-Oxley Act, United State House of Representatives 2002; Securities and Exchange Commission 2002; Business Roundtable 2002; SAS No. 89, AICPA 1999; SAS No. 90, AICPA 1999). In Nigeria, rules like the Prudential guidelines of 1990, Corporate Governance Codes of SEC, 2003, CBN, 2006, Insurances code of 2009 and SEC Code 2011, were some of the efforts to checkmate and correct the governance activities and structure of corporate bodies in the country (Bello, 2011). These codes and pronouncements/documents were enacted to give a lasting solution to the problems at hand and has been viewed as the antidote for the prevention of the reoccurrence of such problems experienced in the past. The Enron scandal, the Worldcom collapse, collapse of 26 banks in Nigeria in the year 1997 as well as the Cadbury Nigeria Plc case of falsification of report in 2006 have been linked to misinformation on the part of the financial report preparers and the board of directors. This has been said to be as a result of unavailability of reliable accounting information (Adeyemi & Asaolu, 2013).

Corporate governance, has been said to be a major issue of concern of all the pronouncements and codes and has received wide acceptance by all across the globe, with individual countries enacting country targeted codes of corporate governance to curb the reoccurrence of the past dilemma. Effective corporate governance however, hinges on transparency, accountability, and corporate control. corporate governance has been identified as an instrument that will improve investors’ perception of the reliability of a firm’s performance, as calculated from the reported earnings (Bugshan, 2005).

The code of governance and best practices was first published in Nigeria in the year 2003. This code is expected to control the authority of those saddled with the responsibility of directing the affairs of the enterprise, supervise the actions of the executives, ensure transparency and accountability in company governance within the regulatory framework and other purposes as listed in the code (Security & Exchange Commission, 2003).

However, the bodies saddled with the supervisory, regulatory and enforcement roles should have the authority, integrity and resources to carry out their duties in a professional and objective manner (OECD, 2004), so as to enforce the laws enacted by them and other regulatory bodies. The inconsistencies and lack of harmonization of the various regulations guiding financial reporting in Nigeria (Microfinance Africa, 2010; Okoye & Alao, 2008), and the lack of regulatory uniformity in the time allowed for annual returns of financial statements, have affected the financial reporting culture in Nigeria (Microfinance Africa, 2010). This has been a major issue in the Nigerian business environment, where companies publish financial reports of five years once in every five years, giving room for misappropriations and creative accounting. Also, some companies present theirs once in two years, while some once in three years. In a country like Nigeria, it is difficult to get the financial reports of companies for the year 2012 in June 2013, even when some sectors have mandated a change in financial year to December every year.

In Nigeria, there is also the problem of duplication of authority, and overlapping authority, whereby two or more regulatory bodies are in charge of a single aspect of the business and reporting requirements. While the Company and Allied Matters Act required that companies make returns to Corporate Affairs Commission (CAC) after presentation at the Annual General Meeting, which should not be more than 9 months after its preparation, the Insurance companies law stipulates that insurance companies make their returns not later than 30th September of every year. For banks, their returns are required to be made not later than 4 months after its financial year end. This therefore brings conflict on when the report should be presented and which of the laws is supreme and should be followed. A company therefore hides under the umbrella of the law that is most favourable. Penalties and sanctions are however not strictly meted on defaulters, while the penalties are trivial compared to the offence committed, thus a gap in the Nigerian business law.

Compliance with CAMA is not strictly monitored by CAC, which may be as a result of the overlapping rules and regulations of the various regulatory bodies, while some of the provisions of CAMA are not consistent with the International Financial Reporting Standards (Okoye & Alao 2008). With the assumption that the objective of accounting standards, principles or regulations are to facilitate the use of financial statements in the efficient allocation of resources in an economy, without missinforming the average, unsophisticated investor, which thus reflect SEC’s mission of promoting fairness (Kothari, Ramanna, & Skinner, 2010), the Nigerian investor has not fared well as a result of the lack of harmonization of the various laws and regulations in the Nigerian financial reporting environment.

Corporate Governance and Voluntary Disclosure

Financial reporting disclosures are major instruments adopted by investors in making informed financial decisions on whether to invest in a company or not. Financial reporting disclosures are essential to the stakeholders of companies, since they use these disclosures for economic decision making about their investment in the company (Hasan, Hossain, & Swieringa, 2010). The accounting principles of disclosure requires that financial statements should present all relevant information which will not mislead the users of the report in decision making (Adeyemi & Asaolu, 2013).

A meta-analysis of 29 studies (Kamran & John, 1999), shows that there is a significant and positive relationship between the disclosure levels and the corporate size of the sampled studies. This therefore shows that prior studies conducted outside Nigeria revealed that firm performance has a positive effect on the disclosure level of companies. This is a pointer to the fact that a company with good financial report is likely to disclose detailed information about the company, while a company with losses may likely hide important information about the company. Also, from the study it can be inferred that the bigger the size of companies, the higher their disclosure level, which suggests that big companies disclose more than the small companies. A study on the role of firm size on voluntary disclosure of Nigerian companies by (Ismail, 2011), concluded that there is a significant positive relationship between voluntary disclosure of Nigerian firms and their size. It was also stated that there is a positive significant relationship between firm performance and voluntary disclosure in financial reports. However, (Ismail, 2011) considered other disclosure parameters, while this study is considering the corporate governance disclosure of the sampled companies.

The code of corporate governance as published is expected to ensure greater transparency and fairness on the part of the executive directors, ensuring that all the detailed information relating to the company is disclosed. As asserted, corporate governance is significantly associated with the overall financial reporting disclosure index (Hasan, Hossain, & Swieringa, 2010). Adeyemi & Asaolu (2013) noted the transparency and adequate disclosure of information are key attributes of good corporate governance. It is also expected that the code if effectively complied with holds the management of the organization accountable to the shareholders and other stakeholders in the company. However, disclosure of all types of information is influenced by corporate governance attributes, ownership structures and corporate characteristics (Barako, 2007; Chau & Gray, 2002).

Voluntary Disclosure and Firm Performance

Research has shown that one of the factors responsible for the level of voluntary disclosure of companies is performance. The level of profitability of a company has been associated to the level of voluntary disclosures of companies, (Hasan, Hossain, & Swieringa, 2010) in a study conducted in Bangladesh concluded that the profitability level of companies is significantly associated with the overall financial reporting disclosures index. Also Adeyemi & Asaolu (2013), adopting the use of panel data for the period 2005-2009 for 13 banks in Nigeria, concluded that financial reports disclosure is an important indicator of potential performance of the sampled banks in Nigeria. Umoren & Okougbo (2011) noted that corporate managers are usually reluctant to give detailed information about a non-profitable outlet or product, which may result into partial disclosure of a lump profit attributable to the whole company. This therefore leads to the question: what is the relationship between firm performance and corporate governance voluntary disclosure in Nigeria?

Voluntary Disclosure and Firm Size

The size of a business enterprise affects different things in the business, such as the goodwill, customer loyalty, patronage as well as its level of responsiveness to the stakeholders. The size of the business will determine the shareholder base as well as the capital base of the business which informs the level of stewardship expected from the managers of the business and the board of directors. Small size company may not necessarily publish its reports and when this is done, it may be as a result of the statutory requirements. However, large companies because of the large number of shareholders and the diverse background of its shareholders will be forced to disclose all necessary information, so as to retain and enhance its goodwill, investment and attract more investors to the company. Past studies have shown that large firms usually adopt voluntary disclosures more often than smaller ones (Khodadadi, Khazami, & Aflatooni, 2010; Barako, 2007). This therefore propels the need to identify the type of relationship that exists between firm size and corporate governance voluntary disclosure in Nigeria.

Methodology

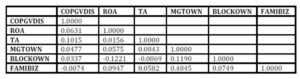

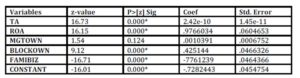

This study adopts the weighted logistic regression method to determine the type of relationship that exists between firm performance, firm size and corporate governance voluntary disclosure in Nigerian companies. This study adopted the use of panel data for 137 companies for the period 2003 to 2010. This data was subjected to the heteroscedasticity test, which shows that the data was heteroscedastic, thus the need to apply weight on company basis (Kim & Imai, 2012). The heteroscedasticity of the data is as a result of the varying sizes of companies in the sample as well as the performance. The logistic regression method was adopted because of the binary nature of the dependent variable. Dummy variables were used to capture corporate governance voluntary disclosure. Companies that voluntarily disclose their level of adherence to the code of corporate governance in a separate section in the financial statements are coded 1, while companies that do not were coded 0 as appropriate. The study used return on assets (ROA) as a proxy for measuring financial performance, total asset (TA) for measuring size, while corporate governance disclosure information was retrieved from the financial statements of the sampled companies for the period of study. Ownership structure was however used as control variables for the model. The control variables used are the percentage of management ownership in the business, presence of block ownership as well as the involvement of family members on the board of the companies.

Model Specification

COPGVDISit = TAit + ROAit + MGTOWNit + BLOCKOWNit + FAMIBIZit + eit………. Equation (1)

Where:

COPGVDISit is Corporate governance disclosure of company i in year t

TAit is the total asset of company i in year t

ROAit is the return on assets of company i in year t

MGTOWNit is the percentage of management ownership in company i in year t

BLOCKOWNit is the block ownership of company i in year t

FAMIBIZit is the status of family ownership of company i in year t

e is the residual

Results

This section presents the data used in the course of this study, using the research methods as enumerated in the previous section.

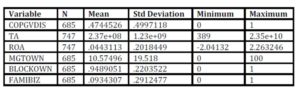

Table 1: Descriptive Statistics

References

1. Adeyemi, A. A., and Asaolu, T. (2013), ‘An empirical Investigation of the Financial Reporting Practices and Banks’ Stability in Nigeria,’ Kuwait Chapter of Arabian Journal of Business and Management Review 2(5), 157-180.

Google Scholar

2. Appalachian, S U., (2006), ‘Theories Used in IS Research: Stakeholder Theory.’ York University. [Online], [Retrieved September 1, 2011], http://www.istheory.yorku.ca/stakeholdertheory.htm

3. Barako, D. G. (2007) ‘Determinants of Voluntary Disclosures in Kenyan Companies Annual Reports,’ African Journal of Business Management, 113-128.

Google Scholar

4. Bello, A. (2011) ‘Corporate Governance and Accounting Ethics in Nigeria,’ International Conference on Management, 1591-1608.

5. Bugshan, T. (2005) ‘Corporate Governance, Earnings Management, and the Information Content of Accounting Earnings: Theoretical Model and Empirical Tests,’ Queensland: Bond University.

6. Chau, G. K., and Gray, S. J. (2002), ‘Ownership Structure and Corporate Voluntary Disclosure in Hong Kong and Singapore’ The International Journal of Accounting, 37( 2), 247-265.

Publisher – Google Scholar

7. Chih-Fong, T., and Yen-Jiun, C. (2009), ‘Earnings management prediction: A pilot study of combining neural networks and decision trees’, Expert Systems with Applications, 36, 7183-7191.

Publisher – Google Scholar

8. Freeman, R. E., Wicks, A. C., and Parmar, B. (2004), ‘Stakeholder Theory and The Corporate Objective Revisited.’Organization Science, 364-369.

Publisher – Google Scholar

9. Hasan, M. S., Hossain, S. Z., and Swieringa, R. J. (2010), ‘Corporate Governance and Financial Reporting Disclosures: Bangladesh Perspective.’ European Journal of Developing Country Studies, 2668-3687.

10. Ismail, A. (2011), ‘Voluntary disclosure practices amongst listed companies in Nigeria.’ Advances in Accounting, 27(2), 338-345.

Publisher – Google Scholar

11. Kamran, A., and John, K. C. (1999), ‘Associations between corporate characteristics and disclosure levels in annual reports: A meta-analysis.’ The British Accounting Review, 35-61.

Google Scholar

12. Khodadadi, V., Khazami, S., and Aflatooni, A. (2010), ‘The Effect of Corporate Governance Structure on The Extent of Voluntary Disclosure in Iran.’ Business Intelligence Journal, 151-164.

Google Scholar

13. Kim, K., and Imai, I. S. (2012), ‘On the Use of Linear Fixed Effects Regression Models for Causal Inference.’ Princeton.edu. [Online], [Retrieved May 16, 2013],

Google Scholar

14. http://imai.princeton.edu/research/files/FEmatch.pdf

15. Kothari, S., Ramanna, K., and Skinner, D. J. (2010), ‘Implications for GAAP from an analysis of positive researchinaccounting.’ Journal of Accounting and Economics, 246-286.

Google Scholar

16. Microfinance Africa. (2010), ‘Former Chartered Institute of Bankers of Nigeria boss urges consistency in financial regulation policies.’ Nigerian Compass [Online], [Retrieved May 18, 2013], http://microfinanceafrica.net/tag/increase-in-nigerian-microfinance-capital-base/.

17. Murya, H. (2010), ‘The Effectiveness of Corporate Governance and External Audit on Constraining Earnings Management Practice in the UK.’ Durham: Durham University.

Google Scholar

18. OECD. (2004), ‘Principles of Corporate Governance.’ Paris Cedex 16, France: Organisation for Economic Co-oporation and Development.

19. Okoye, I. E., and Alao, B. (2008), The Ethics of Creative Accounting in Financial Reporting: The Challenges of Regulatory Agencies in Nigeria.’ The Certified National Accountant 16(1), 45-55.

20. Security & Exchange Commission. (2003), ‘Code of Corporate Governance in Nigeria.’ Lagos: Corporate Affairs Commission.

21. Uadiale, O. M. (2012), ‘Earnings Management and Corporate Governance in Nigeria.’ Research Journal of Finance and Accounting.

Google Scholar

22. Umoren, A., and Okougbo, P. (2011), ‘Corporate Governance, Company Attrributes And Voluntary Disclosures: A Study Of Nigerian Listed Companies.’ International Journal of Research in Computer Application and Management.1(2), 20-29.

Google Scholar

23. Universal College of Accountancy. (2004), ‘Study Pack on Basic Accounting for ATS 1’ Lagos: Philglad Nigeria Limited.