Introduction

In large organizations, the published financial reports are important reservoirs of information about the organization’s performance which is available to external user groups. According to Arnold, Hope, South-worth, & Kirkham (1994), there are at least two reasons why management should not be given the complete freedom to determine what accounting information should be included in the published financial statement despite the fact that they have access to information about all aspects of organizational activities. The first of the reasons has to do with information asymmetry. That is the possibility of managers exploiting their privileged position within the organization to further their own course at the expense of others. The second reason is that of comparability. Thus if managers were given the complete freedom to determine the content of the financial reports, the external users of the accounts would be unlikely to receive the necessary and sufficient information to make rational decision and hence the necessity for accounting standards.

Prior to the introduction of IFRS / IAS, what prevailed all over the world was nation’s specific adaptation of the Generally Accepted Accounting Practice (GAAP), which was rooted in cultural, legal, economic and regulatory peculiarities of the countries. In Nigeria, for instance, the Nigerian Accounting Standards Board (NASB) (now designated as Financial Reporting Council of Nigeria (FRCN)) came into being on September 9, 1982. It is the only recognized independent body in Nigeria, responsible for the development and issuance of Statements of Accounting Standards (SAS) for users and preparers of Financial Statement, investors, commercial enterprises and regulatory agencies of Government.

Considering the current atmosphere of globalization of commercial enterprises and financial market, and the unremitting internationalization of business deals, it has become apparent that financial entropy prepared in concordance with national accounting system of rules, may no longer passably meet the desires of users, whose decisions have become progressively more international in scope (Zeghal and Mhedhbi 2006). Business has become more international in nature and so, it is obvious that accounting has to become more international in nature in order to keep pace.

In December 2010, following the authorization of the Federal Executive Council of Nigeria, the Nigerian Accounting Standards Board (NASB), and now Financial Reporting Council of Nigeria (FRCN) issued an implementation roadmap for Nigerian’s adoption of IFRS which set a January 2012 date for compliance for publicly quoted companies and banks in Nigeria. The Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) also adopted this date for compliance and has issued guidance compliance circulars to ensure full implementation of IFRS in Nigeria.

Though this might be regarded as a praiseworthy development, the question that begs for answer is, does Nigeria have strong institutional infrastructure to make the transition to IFRS effective and rewarding? The question is pertinent because IFRS is an innovation which requires sound institutional infrastructure to succeed not only at the development phase, but also during the implementation phase (Iyoha and Jafaru 2011).

Thus, it can be said that unless there is convergence in the institutions shaping managers’ reporting incentives, convergence in financial reporting is unlikely. Therefore, the objective of this paper is to investigate, whether Nigerian institutions are strong enough to support the ongoing mandatory adoption of IFRS

The remainder of this paper is organized as follows: Section 2, Provides a review of the existing literature on Accounting standards and institutions, and theoretical framework. In Section 3, we dealt with hypothesis formulation, model specification, questionnaire analysis, data collection and analytical procedures. In section 4, we focused on the findings of the study, while section 5 was dedicated to the concluding remarks.

Literature Review and Theoretical Framework

The literatures on the adoption of IFRS can broadly be classified along two principal schools of thoughts. The First is the argument that a single global set of accounting standards helps to reduce information dissymmetry or imbalance, lowers the cost of capital, and enhances capital flow across borders. The opponents of this school of thought argue that the characteristics of local business environments and institutional frameworks mould the course and substance of accounting standards (Chen, Tang, Jiang, and Zhijun, 2010). For example, Armstrong, Barth, Jagolizer and Riedl (2008) did a study titled “Market Reaction to Events Surrounding the Adoption of IFRS in Europe”, with the object of unraveling European stock market reaction to events associated with the adoption of IFRS in Europe. A sample of 3,265 European firms was employed over the period 2002 and 2005. The result of the study revealed that investors in European firms noticed that the expected benefits associated with IFRS adoption will outweigh the expected costs. The study left it to further research to determine whether the expectations were fulfilled.

Similarly, Barth, Landsman, and Land (2008) conducted a study on “International Accounting Standards and Accounting Quality”. The intent of the study was, to determine whether IAS was affiliated with financial reporting quality. A sample of 21 countries over a period 1994 and 2003 was engaged. The result evinced that companies that apply IAS were of higher quality than non US companies that do not. Additionally, Luzi Hail, Christian Leuz, and Peter Wysocki in 2010, conducted a research to observe issues surrounding IFRS adoption in the United States. The working paper summarized the potential benefits of IFRS adoption as “greater market liquidity, a lower cost of capital and a better allocation of capital.” The research also reveals that financial reporting will likely be enhanced and multinational firms will receive a cost advantage as they will no longer have to report under numerous sets of standards.

On the demerit side, the study evokes that a major impact will be the cost of transition to IFRS. Accordingly, the benefits to U.S. investors may not exceed costs. Furthermore, due to U.S. high quality standards GAAP, financial reporting improvement will be minor. It also suggested that these costs and benefits will vary across firms and will be difficult to trace upon adoption (Hail,Leuz, and Wysocki, 2010).

Additionally, Jeajean and Stolowy (2008) in their study entitled “Do accounting standards matter?” arrived at the following conclusion:

Our findings confirm that sharing rules is not sufficient in itself to create a common business language. This is consistent with the idea that management incentives and national institutional factors play an important role in framing financial reporting characteristics, probably more important than accounting standards alone. We therefore suggest that the IASB, the SEC and the European Commission should now devote their efforts to creating common goals rather than harmonizing accounting standards. In particular, harmonization of legal enforcement systems, competition rules, market access conditions, and effectiveness of the legal system are factors that appear better able to guarantee comparable accounting practices across countries.

Complementarily, Armstrong, Barth, Jagolinzer, and Riedl, (2008), maintained that Cultural, political and business differences may also continue to impose significant obstacles in the progress towards single global financial reporting system, since a single set of accounting standards cannot reflect the differences in national business practices, arising from differences in institutions and cultures. Also, Soderstrom and Sun (2007) argue that cross – country differences in accounting quality are likely to remain, sequel to IFRS adoption, because accounting quality is a function of the firm’s overall institutional infrastructure, including the legal and political system of the country where they reside.

According to North (1990), institutions are both formal and informal mechanisms that guide economic and social exchanges and interactions. Thus, institutions therefore, are the framework within which human dealings take place. That is they consist of official written regulations as well as typically unwritten codes of conduct that underlie and supplement formal rules, Douglas (1986), in “How Institutions Think”, stressed that individuals within particular communities draw upon a shared basis of knowledge and moral standards in making decisions which develops legitimized social group. Such legitimized social groups and social process are referred to as institutions.

According to Wysocki (2010), There are five basic elements to the suggested framework for analyzing the determinants and outcomes of both accounting institutions and non-accounting institutions: (I) Institutional structure (formal versus informal); (II) Level of analysis (macro institutions and micro institutions); (III) Causation (exogenous versus endogenous institutions); (IV) Interdependencies (complementarities); (V) efficient versus inefficient outcomes. Wysocki also highlighted three of these five elements to very key to the operation of financial reporting, namely: (a) Institutional structure (formal versus informal); (b) Level of analysis (macro institutions and micro institutions); and (c) Causation (exogenous versus endogenous institutions).

Institutional Change Theory

Croix and Kawaura (2005) viewed institutions as “organizations that play prominent role in society, e.g. First Bank of Nigeria, Covenant University, or it could refer to the sets of rules, norms and expectations which guide our behavior”. In order to understand institutions and institutional change, we must draw the dividing line between institutions and organizations. As stated above, institutions are the rules of the game and organizations are the players. As stated above, institutions are the rules of the game and organizations are the players. In an attempt to answer the question of what makes organizations homogeneous, Dimaggio and Powel (1983) identified three mechanisms of institutional change namely; Coercive, Mimetic and Normative Isomorphism.

Coercive Isomorphism

This is a product of political influence and problems of legitimacy. Formal and informal pressures will be exerted on organizations by other organizations or by cultural and regulatory exigencies in the society in which the organization belongs. The action of European Union when they mandated all registered companies within their jurisdiction to migrate to International Financial Reporting Standards with effect from 1st January 2005 can be referred to as coercive isomorphism.

Mimetic Isomorphism

Mimetic isomorphism is a situation where organizations model themselves after others (Carpenter and Feroz 1992). Here, companies follow earlier adopters from the same sector as a consequence of uncertainty about organizational technology.

Normative Isomorphism

Normative isomorphism stems directly from the establishment of patterns by a determined professional community with a view to cognitively founding and giving legitimacy to its developed activity. Universities and professional associations are two important sources of Isomorphism in this respect.

Institutional change theory touches most on the core issues of institutions and the propensity for changes in institutions (in our case, the driving force behind changes in financial reporting standards). Scott, (2004) puts it very apt when he said:

Institutional change theory attends to the deeper and more resilient aspects of social structure. It considers the processes by which structures, including schemas; rules, norms, and routines, become established as authoritative guidelines for social behavior. It inquiries into how these elements are created, diffused, adopted, and adapted over space and time; and how they fall into decline and disuse. Although the ostensible subject is stability and order in social life, students of institutions must perforce attend not just to consensus and conformity but to conflict and change in social structures.

The alternate names of institutional change theory are Institutionalism and Adaptation theory. The main dependent constructs/factors are: Institutional emergence, consensus, conformity, conflict, change. While the main independent construct / factors are: Processes which establish schemas, rules, norms and routines. The originating authors of Institutional change theory are: Philip Selznick, Paul Dimaggio, and Walter Powell.

Hypothesis and Model Specification

The Research Hypothesis

The following hypothesis was tested in the course of the study.

Ho: Nigerian Institutional Infrastructures are not significantly developed to support the mandatory adoption of IFRS.

The Institutions of Interest in this Study

As earlier stated at the introductory stage of this paper, we studied five institutions with a view to finding out their strengths and readiness for the mandatory adoption of IFRS in Nigeria. The choice of the five institutions is rooted in the fact that we considered them key to the adoption process, and at the vanguard of the implementation of the new standards.

Tertiary Educational Institutions (TEDI)

Education is the pillar for current multifaceted accounting systems. It has been established that there is a positive association between education and the competence of professional accountant (Gernon, Meek & Mueller, 1987). The adoption of IFRS is a very strategic and critical decision; it requires a high level of education, competence, and expertise to be able to understand, interpret, and then make use of these standards (IFRSs). According to Izuagba &Afurobi (2009:605), it is expected that, in countries where the education level is low, and expertise is weak, there is likely going to be a real barrier to the adoption of IFRS.

Legal Framework (LEFW)

There are a plethora of laws and regulations that provide legal basis for accounting and financial practices in Nigeria. However, the main legal framework for corporate reporting and auditing practice is the Companies and Allied Matters Act (1990). Indeed, as noted by Iyoha and Oyerinde (2010:366), “Nigeria does not lack the required legal backing for her financial transactions”. However, as observed by Okaro (2004:50), the challenge with Nigerian legal frameworks is in the archaic nature of the financial rules and regulations in force in the country. The position of Okaro, is further reinforced by the assertion of Iyoha and Oyerinde, which suggests that Nigerian laws suffer from severe weakness in enforcement, compliance and regulation. This weakness was noted by World Bank (2004) which observed that “the process of adjudication on cases in Nigerian court is so slow that regulators are discouraged from seeking support from the courts and law enforcement agencies in enforcing sanctions”.

Financial Reporting Council of Nigeria (FRCN)

FRCN hitherto known as The Nigeria Accounting Standard Board (NASB) sets local accounting standards under the Nigerian Accounting Standards Board Act of 2003. According to the World Bank, (2004), “Although the NASB’s issued standards have statutory backing, the body itself, operated without an enabling legal authority until the 2003 enactment of the NASB Act”.

The World Bank further observed that NASB lacks adequate resources to fulfill its mandate. As a government agency, NASB has relied on government subventions and has been exposed to serious budgetary constraints that hinder its performance. With these arrays of issues there becomes the need to find out the extent to which the FRCN can push for the realization of the objective of adoption of IFRS.

Professional Accounting Bodies (PAB)

The statutory frameworks for the accounting profession in Nigeria include the Institute of Chartered Accountants of Nigeria (ICAN) and the Association of National Accountant of Nigeria (ANAN). The two bodies are responsible for the production of professional accountants in Nigeria. When non-qualified personnel are in charge of accounting functions and positions, the effect would certainly be ‘accountability blindness’ (Iyoha and Oyerinde, 2010). A well-developed accounting profession and system of accounting education in a given country “lead to a tradition and/or effort of providing reporting and disclosure” ( Belkaoui, 1983).

According to World Bank (2004:8), the qualifying examinations processes of ICAN and ANAN differ. For example, it is possible in just three years after graduation for a non-accounting graduate to become a registered ANAN member. This study therefore, is out among other things to find out how much this institution (Professional Accounting Bodies) can contribute to the actualization of IFRS objectives in Nigeria.

The Securities and Exchange Commission (SEC)

The Securities and Exchange Commission Nigeria is the apex regulatory institution of the Nigerian capital market. On behalf of SEC, the Nigeria Stock Exchange reviews submissions by companies for compliance with the listing requirements, which include accounting standards and disclosure requirement under CAMA. The audited financial statements of a listed company are only published after approval of the Stock Exchange and de-listing is the only sanction for noncompliance. The World Bank (2004) also opined that the Securities and Exchange Commission is not yet effective in monitoring compliance with financial reporting requirements and enforcing action against violators. SEC therefore constitutes our fifth variable in testing our hypothesis.

Measurement of the Variables

In this study, each of the variables (dependent and independent) was measured by requiring the respondents to answer 5 multi-items questions. The composite scores derived from the multi-items likert scale questionnaire were then used for our regression analysis. Similar method was adopted by Foo (2008) and Iyoha (2010).

Model Specification

Mandatory adoption of international financial reporting standards (IFRS) and Nigerian institutional infrastructure can be written in a mathematical manner as follows:

IFRS = f (TEDI, LEFW, NASB, PAB, SEC)……………………………. (1)

Assuming a linear relationship between the variables in equation one, the explicit form of Equation 1 is therefore represented as follows:

IFRS = 0 + 1TEDI + 2LEFW + 3NASB + 4 PAB + 5SEC + …..(2)

Where:

IFRS : International Financial Reporting Standards;

TEDI : Tertiary Educational Institution;

LEFW : Legal Framework;

NASB : Nigerian Accounting Standards Board;

PAB : Professional Accounting Bodies;

SEC : Security Exchange Commission; and

: the error term.

The Statistical Product Service Solution Package (SPSS) was employed in performing the statistical test. More so, the foregoing variables in respect of hypothesis one (H1) were measured using the indicator generated from the enabling instrument in deference of each of the variable. All variables were measured utilizing a five-item Likert-type scale.

Questionnaire Analysis

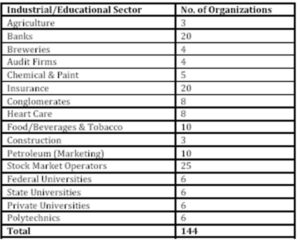

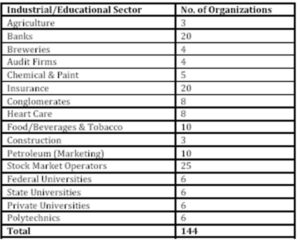

A total of one thousand five hundred (1,500) well-structured multi-item scale questionnaire were administered to the finance directors, preparers and users of financial reports in the (120) sampled listed companies and Accounting preceptors in (24) tertiary educational institutions. A total of (1,296) were returned, giving rise to external decline rate of 13.6%. Of the (1,296) returned, only (1,067) were found useable which gave us internal decline rate of 17.7%. In all, the combined respond rate, undermining the non-useable responses (i.e. internal decline) is 71.1%. This response rate is considered adequate for the purpose of this study. The table below shows the sectorial distribution of the companies and the tertiary educational institutions we administered the questionnaire.

Table 1: Industrial Sector and Organizations

We administered the well-structured questionnaire to lecturers of tertiary educational institutions that offer Accounting programs in three of the six geopolitical zones in Nigeria. As evinced in Table 1, the tertiary educational institutions were (6) Federal, (6) State, and (6) Private Universities and (6) Polytechnics that offer Accounting as Discipline. Additionally we also administered questionnaire to (91) companies, 25 Stock Market operators (i.e Investment/firms of stock brokers) and the big four audit firms. Thus giving us a total of 144 sectors, that responded to the questionnaire. The Statistical Product Service Solution Package (SPSS) was employed in performing the statistical test. More so, the foregoing variables in respect of the hypothesis (H1) were measured using the indicators generated from the enabling instrument in deference of each of the variable. All variables were measured utilizing a five-item Likert-type scale.

Test of Hypothesis and Analysis of Results

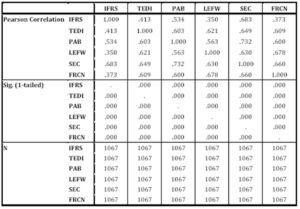

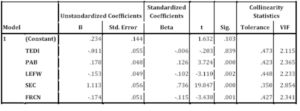

The tables below show the output of the standard multiple regression technique employed in resolving the hypothesis. The model for the regression has Mandatory adoption of International Financial Reporting Standards (IFRS) as dependent variable, while the independent variables are: Tertiary Educational Institution (TEDI), Professional Accounting Bodies (PAB), Legal Framework (LEFW), Securities and Exchange Commission (SEC) and Financial Reporting Council of Nigeria, hitherto known as Nigerian Accounting Standards Board (NASB).

Table2: Correlations

Table 2 above gives details of the correlation between each pair of variables. It can be seen that our independent variables have some degrees of (positive) relationship with our dependent variable. According to Palant (2001:143), a correlation level of a minimum of 0.3, is ideal. In our result, the variables are sufficiently correlated. However, the most appealing correlation is the one between PAB and IFRS (i.e. 0.534), followed by PAB and LEFW (0.563). Whereas the lowest correlation is that between IFRS and LEFW (0.350), the highest exist between SEC and PAB (0.732).

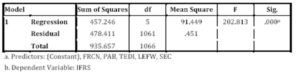

Table 3: ANOVAb

a. Predictors: (Constant), FRCN, PAB, TEDI, LEFW, SEC

b. Dependent Variable: IFRS

The table above reports an ANOVA, which assesses the overall significance of our model and hence, test the null hypothesis that “Nigerian Institutional Infrastructures are not significantly developed to support the mandatory adoption of IFRS” Thus, our model in this example reaches statistical significance (Sig=.000, at p<0.005).

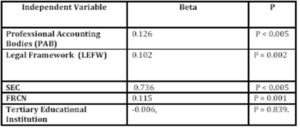

Tertiary Educational Institution was found not to be Significant. With Beta = -0.006, and P = 0.839

Table 4: Summary of Regression Result

Table 5: Standardized Beta Coefficients

The table above gives a measure of the contribution of each variable to the model. Our result shows that SEC has the highest impact on IFRS, followed by PAB, NASB, and LEFW. TEDI has an insignificant impact on IFRS.

Overall, the result of the standard multiple regression analysis, employed in the test of hypothesis 1, shows that:

Firstly, the null hypothesis has to be rejected in favor of the alternative hypothesis, which states that “Nigerian Institutional Infrastructures are significantly developed to support the mandatory adoption of IFRS”. This result is evident from table 5 on ANOVA.

Secondly, the result of the evaluation of each of the independent variables revealed a significant model (F5.1061 =202.813, P< 0.005). Adjusted R square = 0.486. Significant variables are as shown below:

Conclusions and Recommendation

This research studies the relationship between the mandatory adoption of International Financial Reporting Standards (IFRS) and Nigeria institutional infrastructure. The result of the standards multiple regression analysis employed in testing the hypothesis, shows that overall, Nigerian institutional infrastructure, are potentially strong enough to support the ongoing mandatory adoption of IFRS. Our result indicates that Securities and Exchange Commission (SEC) has the highest potential impact on IFRS, followed by Professional Accounting Bodies (PAB), Nigerian Accounting standards Board (NASB), (though now designated as Financial Reporting Council of Nigeria (FRCN)), and Legal Frameworks (LEFW). On the other hand, Tertiary Educational Institutions (TEDI) had an insignificant impact on IFRS that is, it is not potentially developed enough to support the ongoing mandatory adoption of IFRS.

Despite this seeming laudable outcome, we recommend that steps must be taken to improve the statutory framework of accounting and auditing practice in Nigeria, to make it oriented towards the protection of public interest public interest, and outdated and obsolete sections should be obliterated. Essentially, the various laws and regulations should be harmonized to conform to the demands of IFRS.

Additionally, IFRS must as a matter of urgency, be incorporated into universities, polytechnics and Professional Accounting institutions’ curricula so as to build human capacity that will support the preparation of IFRS financial reports in the organizations. Much more, the preceptors in these institutions must firstly be schooled in the dynamics of IFRS, since the blind has never been known to successfully lead the blind.

Beyond International Financial Reporting Standards, all other global accounting and financial reporting structures that are equally imperative to the economic development of any nation, such as: Appreciably high quality auditing standards; operational Quality Assurance (i.e. audit firms and profession-wide); all-encompassing Corporate Governance; and comprehensive Regulatory Oversight, must be pursued with the same zest Nigeria is pursuing the adoption of IFRS. Otherwise the promised or anticipated benefits of IFRS will be a mirage.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Anold, J., Hope, T., South worth, A. & Kirkham, L. (1994). Financial accounting (2nd ed.) Prentice Hall Inc. New York

2. Armstrong, C., Barth, M.E., Jagolinzer, A. and Riedl, E.J. (2008),’ Market reaction

to theadoption of IFRS in Europe’. Unpublished research paper, Stanford University, June2007 [Accessed 10th July 2010] Available: http://www.hbs.edu/research/pdf/09-032.pdf

3. Belkaoui, A. (1983). ‘Economic, political, and civil indicators and reporting and disclosure adequacy: Empirical investigation’, Journal of Accounting and Public Policy (Fall): 207-219.

Publisher – Google Scholar

4. Ball R., (2006). ‘International Financial Reporting Standards (IFRS): pros and cons for investors, Accounting and Business Research’. International Accounting Policy Forum, p.5-27

Google Scholar

5. Barth, M., Landsman, W.R. and Lang, M. (2008).’International accounting standards and accounting quality’, Journal of Accounting Research, 46(3), 467- 498.

Publisher – Google Scholar

6. Carpenter, V.L. & Feroz, E. H. (1992). ‘ GAAP as symbol of legitimacy: New York State’s decision to adopt generally accepted accounting principles’. Accounting Organizations and Society, 17 (7), 613 – 643.

Publisher – Google Scholar

7. Chen, H., Tang, Q., Jiang, Y., and Lin, Z.( 2010). ‘The Role of International Financial Reporting Standards in Accounting Quality: Evidence from the European Union’, Journal of International Financial Management & Accounting, 21, (3) , 220-278.

Publisher – Google Scholar

8. Croix, J. L and Kawaura, A (2005) ‘Institutional Change in Japan: Theory, Evidence, and Reflections. East-West Working Papers Economics Series No.82, June 2005’ Retrieved on 2nd July 2009.from http://www.eastwestcenter.org/filead/stored/pdf/ECONwp082.pdf

9. DiMaggio, P. & Powel, W. (1983), ‘The iron cage revisited: institutional isomorphism and collective rationality in organizational fields’, American Sociological Review,48 (2), 147- 160

Publisher – Google Scholar

10. Douglas, M. (1986). ‘How institutions think’, Syracuse University Press: Syracuse New York

Google Scholar

11. Ezejelue, A. C. (2001). Primer on International Accounting. Educational Books and Investment Nigeria, Ltd.

12. Foo, Y. F. (2008) A cross-cultural study of accounting concepts applied in international financial reporting standards. PhD thesis thesis, Victoria University.

13. Gernon, H., Meek, G., & Mueller, G. (1987). Accounting: An International Perspective Homewood, II: Irwin.

14. Hail, L., Leuz, C., Wysocki, P. (2010). Global accounting convergence and the potential adoption of IFRS by the United States: an analysis of Economic and policy .Working paper. Available: http://ssrn.com/abstract=1357331S. Accessed on 10th July 2010.

Google Scholar

15. Iyoha, F.O. and Jafaru, J. (2011). ‘Institutional infrastructure and the adoption of International Financial Reporting Standards (IFRS) in Nigeria’. School of Doctoral Studies European Union Journal, (3), 17-24.

Google Scholar

16. Iyoha, F. O. & Oyerinde, D. (2010). Accounting infrastructure and accountability in the management of public expenditure in developing countries: A focus on Nigeria. Critical Perspective on Accounting,( 21) 361-373

Google Scholar

17. Iyoha, F. O. (2010). State agencies, industry regulations and the quality of accounting practice in Nigeria. Unpublished Ph.D Thesis Covenant University, Nigeria.

18. Izuagba, A. C. & Afurobi, A. O. (2009). Quality Education through innovation: Examples of Tertiary Institutions in Nigeria. European Journal of Social Sciences, 10 (4), 605-613.

Publisher – Google Scholar

19. Jeanjean, T & Stolowy, H (2008), Do accounting standards matter? An exploratory analysis of earnings management before and after IFRS adoption, Journal of Accounting and Public Policy, 27(6): 480-494.

Publisher – Google Scholar

20. North, D. (1990), Institutions, institutional change and economic performance Cambridge: Cambridge University Press. Available online at http://www.usmsl.edu/mk6c3/paper/reviewnorth.pdf Accessed on 12 June 2010

Google Scholar

21. Okaro, S., (2004). Bank failure in Nigeria: an early warning models of corporate distress. The Nigeran Accountant, 37(4)

22. Pallant, J. (2005) SPSS Survival Manual: A Step By Step Guide to Data Analysis Using SPSS Version 12. Berkshire: Open University Press

23. Scott, W.R. (2003). Financial Accounting Theory (3rd ed.).USA Prentice Hall

24. Soderstrom, N., and Sun K.(2007). “IFRS adoption and accounting quality: a review.” European Accounting Review, (16), 675-702.

Publisher – Google Scholar

25. Wysocki, P. 2010. IFRS and national institutions. Working paper, University of Miami

26. World Bank (2004). Report on the Observance of Standards and Codes (ROSC)Nigeria ,Accounting and Auditing. Retrieved May 1, 2013, from http://www.worldbank.org/ifa/rosc_aa_nga.pdf.

27. Zeghal, D. & Mhedhbi, K. (2006). An Analysis of the Factors Affecting the Adoption of International Accounting Standard by Developing Countries. The International Journal of Accounting, 41(2006), 373-38

Publisher – Google Scholar