Introduction

Taxes on land and property contribute to one of the revenue sources in all countries. Notably, there are countries, which do not rely on property taxation as a source of revenue such as Kingdom of Saudi Arabia (henceforth KSA). The main revenue of KSA derives from oil, which constitutes 73% of the total government’s revenue. On 23rd March 2015, the government has announced a 2.5% rate of “white land tax” under the Royal Decree M/4, dated November 2015, which may change the landscape of property market in KSA. Ideally, it will be imposed on vacant land designated for residential and commercial use that is located in the city area of KSA. Unlike other countries, the notion of white land tax is unique as it acts like a penalty for those vacant lands. This action is expected to increase the supply of developed land in order to better address shortages, to make residential land available at reasonable prices and to protect competition and curb the monopolistic practices (Zaid, 2016). According to Ernst and Young (2016), the revenue from the land taxation in KSA allows the government to undertake additional housing projects. Notably, it is aligned with suggestion made by Miley (1977) where land tax should also be viewed as an instrument for promoting sound development as well as stimulating market forces rather than just as a source of revenue. In a similar vein, land tax provides beneficial effects for urban development and lead to more efficient use of land, compliant to zoning and urban planning designations (Wenner, 2016). Therefore, it is expected that the announcement of land tax would benefit the real estate and construction companies as more demand for the development is expected in the future. With the implementation of land taxation, there is a tendency for landowners to sell their sites to the developers in order to avoid the additional tax burden. This decision will encourage the reduction in land values, which have been soaring over the last few years (Arab News, 2016).

Therefore, this research is motivated to provide a theoretical understanding of the uniqueness of “land tax application” in the Kingdom of Saudi Arabia both principles and practices in comparison with other countries. Also, this study is motivated to provide some evidence by discovering how the market reacts to the announcement of White Land Tax during the period surrounding the announcement date.

This paper is organized in six sections; section one as an introduction, followed by section two which discusses the land taxation and property taxation concepts and practices in democratic countries and KSA. Section three provides the background to the Saudi Arabia Stock Market (henceforth Tadawul) and its expansion; and works of literature pertinent to the area. Section four discusses the research methodology and data analysis; section five unveils the empirical findings and discussion, and lastly, section six concludes the paper.

Literature Review

Land and Property Taxation: Concepts and Practices

Land taxation can be defined as “the appropriation of economic rent, and any increase in value which accrues as a result of improvements to land undertaken with public funds” (Miley, 1977). There are two components of land taxation: economic rent and improvement. According to Ricardian Rent Theory, “economic rent” can be considered as a payment for the use of land. The notion of “improvement” refers to the structures provided by the public agency such as streets and infrastructures to the land (Miley, 1977).

Conventional Concepts and Practices

Notably, the revenues produced from the land and property taxation are often an important source of finance for governments especially in the democratic countries (Callan et al. (2010), McCluskey et al. (1998), Malme and Youngman (1997), Kelly (1994), and Miley (1977)). According to Bird and Slack (2005), property taxes contribute to sub-national revenues in developing countries compared to developed countries. McCluskey et al. (1998) stated that property tax represents the most important stable source of revenue especially for local governments. Interestingly, property taxation has been acted as a mechanism to minimize fiscal deficits, which were experienced, by Ireland and Greece few years ago (Callan et al., 2010). Also, it has become as a source of financing to the transition of a newly reformed government of former communist countries of Central and Eastern Europe to democratic countries (McCluskey et al., 1998).

The diversity in the application of land and taxes is unique. Different countries depict different practices in taxing the land and property. Evidence in the literature indicates that there are differences in the determination of tax base, the setting of tax rates and including the tax collection. By definition, the tax base is levied based on the land value, thus the term land tax is more appropriate to be used in the present study. Ideally, taxation of land only may potentially improve the efficiency of land use. It has been practiced in countries such as Western Australia, New South Wales in Australia, Denmark, Russia and Estonia. The property tax that levied based on land values and improvements is more important in rich countries such as Canada, US, Australia and some others.

Land Administration Concepts and Practices in KSA

Following the Sharia law, where Al-Quran, Sunnah, and Interpretation of scholars were acted as the main references; the government is responsible to administer land efficiently and fairly according to God’s laws (Sait and Lim, 2006). Since 1932, the KSA authorities in taxing land and property with some modifications at some extent, without neglecting the Islamic concepts, adopted The Ottoman Land Code of 1858.Unlike other countries, the white land tax of 2.5 percent is only targeted to the undeveloped land in the urban areas. This tax acts as a fee or penalty to the landowners for not developing the land. Notably, there are four billion square metres of land across KSA subject to land taxation; which would generate astonishing revenues to the government; that could be used to build more affordable houses for Saudi citizens.

According to Islamic Law, property rights are divided into three categories: public, state and private. Public property such as forests, pastures and rivers are under the supervision of the state in order to ensure that no exploitation of it occurs contrary to the public benefits (Sait and Lim, 2006). State owned land (emir) include those lands that belong to the state, whether they are occupied or not, and the state has the rights to give access and usufruct rights for individuals. The private ownership (mulk), on the other hand, carries a similar notion to western terminology of “freehold”.

Saudi Arabia Stock Market

The formation of Tadawul has been approved about a decade ago, on 19th March 2007. To date, it becomes the sole entity authorized in Saudi Arabia to act as Securities Exchange and the Securities Depository Centre (Tadawul.com). The Tadawul’s main roles are: listing and trading in securities, deposit, transfer, clearing, settlement, and registry of ownership of securities traded on the Exchange. The legal status, duties, and responsibilities of the Exchange and Depository Center are explicitly defined in the Capital Market Law of 2003. Like other stock markets, the Tadawul is also the official source of all market information.

Saudi Arabia’s Stock Exchange experienced a major change in most recent years. On 1st June 2015, the Capital Market Authority (CMA) allowed foreign financial institutions to buy and sell shares in companies listed on Tadawul as an effort to extend its market participants. Previously, international investors had limited access to Saudi Stock Exchange through instruments such as swaps and they only owned 7.74% of the Saudi Arabian share market’s value (Bloomberg, 2016).

Literature on Announcement Effects

Much of the recent literature suggests that the market is less than perfectly semi-strong form efficient. This suggests that there are abnormal return opportunities that can be exploited by investors.

To provide an indication of market inefficiency, the great majority of modern event studies literature is focused on investigating the share price reactions during the period following an announcement date. This section now contrasts the two different sets of market reactions to new information announcements, as part of the evidence against semi-strong efficiency. First, evidence of market inefficiency occurs when there is a gradual abnormal increase (in response to positive news) or decrease (in response to negative news) in share prices over a certain period following the dissemination of new information. This indicates that there is post-announcement drift, which is exploitable for investors to purchase and sell shares after the information has been made public, thereby allowing them to outperform the average market returns.

Second, evidence of market inefficiency could also occur when the share prices react immediately to the information announcements, but correct themselves in the days following. This suggests that the initial price changes as an indication of over-reaction to the new information. Shorting after the information is announced could possibly yield abnormal returns above market averages as a consequence of price correction.

Notably, little attention has been given to the performance of shares following the government policy’s announcement, in particular land and property taxation, reminding us that the announcement effect over the short-run period of, say, forty-days, is worth to investigate in KSA. A study by Lin and Zeng (2005) found that investors perceived the lifetime capital gains tax exemption announced by the Canadian Federal Government in 1985 as negative news. The stock price has been decreased dramatically even three days prior to the announcement.

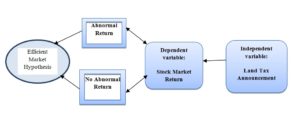

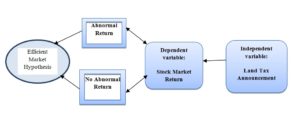

Given that fact, the present study presents the theoretical framework for the share return performance of real estate development and construction companies and its relation to efficient market hypothesis (EMH) (see Figure 1).

Figure 1: The relationship of Efficient Market Hypothesis (EMH) and returns of real estate development and construction companies.

Source: Author’s Creation

Methodology

The identities of 26 real estate development and construction companies on the TADAWUL are obtained from its website: http://www.tadawul.com. To be included in the final sample, the chosen both real estate development and construction companies had to satisfy the following criteria: (1) the company from real estate and development sector; and construction sector listed on the Tadawul following the announcement of White Land Tax on the 23rd March 2015; and (2) the availability of returns data during the event period or observation period; 20 days before and after the announcement date. The final sample comprised of 24 companies from both sectors. Of the 24 companies, 8 are listed under the real estate development sector and the remaining 16 companies are listed under building and construction sector. Two companies are excluded from the sample due to unavailability of data during the event period or observation period.

Following Brown and Warner (1985), we employ the market-adjusted return model by subtracting the daily returns of market indices from the daily returns of individual stocks of the real estate development and construction companies. The choice of market-adjusted return model with daily or monthly returns is appropriate as its methodology is as powerful as the market-risk-adjusted model (Brown and Warner (1985), Dyckman et al.(1984) and Chandra et al.(1990)). Also, these studies conclude that event studies with daily returns perform at least as well in practice as those with monthly returns. That is, any potential problems with daily returns (such as non-normality of returns; effects of non-synchronous trading on the estimation of parameters and abnormal returns; and biased estimation of standard deviations of average abnormal returns) are unimportant or easily corrected in the standard event study and when the event date is known.

Ritter (1991) advocates that in minimizing the problem related to measuring portfolios, benchmarking those portfolios is vital. Therefore, we apply two market indices: equal-weight Index (EWI) and value weight index (VWI). Both benchmarks include all companies on the Tadawul. Equal weight index gives the same weight or importance to each share listed on the Tadawul. Similarly, using this approach, the smallest companies are also given equal weight to that of the largest companies. On the other hand, value weight index refers to each share listed on the Tadawul that is weighted according to the total market value of their outstanding shares. In other words, the weights of individual shares are proportionate to their market capitalization. According to Xiao and Arnold (2008), both EWI and VWI allow researchers to analyze the sensitivity of the results to the choice of the market. As at 30th April 2015, there are 176 companies listed on the Tadawul. To compute market indices, the share price data for each company traded on Tadawul was collected from the Thompson Reuters Datastream database, one of the major and authoritative financial information providers.

Daily data are used to identify the abnormal returns of real estate development and construction companies relative to the market benchmarks during the few days surrounding the announcement date. Following Brown and Warner (1985), this study defines t = 0 as the announcement date of White Land Tax, t = -20 days to t = +20 days as the event period or observation period. Returns for every stock including dividends were adjusted for changes in the share split, rights issues and share repurchases were obtained from Thompson Reuters Datastream, one of the primary and authoritative financial information providers.

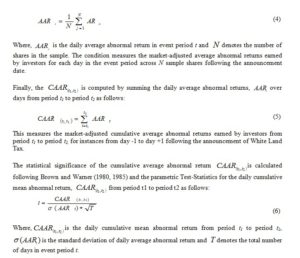

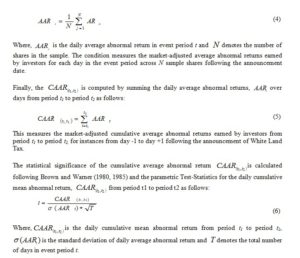

To examine the abnormal performance of sample companies relative to the market benchmarks, the actual return for each sample companies and all companies included in Saudi Arabia All-Shares Equal Weight Index (henceforth SAS-EWI) as well as in Saudi Arabia All-Shares Value Weight Index (hence forth SAS-VWI) are calculated as follows:

Where,CAAR (T1,T2) is the daily cumulative mean abnormal return from period t1 to period t2,σ(AARt) is the standard deviation of daily average abnormal return and T denotes the total number of days in event period t.

Results and Discussions

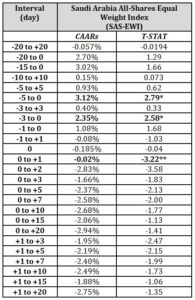

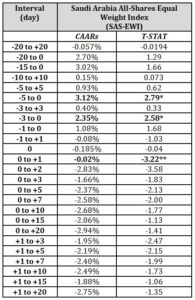

The results of the analysis are summarized below in Table 1 and Table 2, which show the percentage daily abnormal returns for 24 real estate development companies listed on Tadawul from day -20 through day +20 against the SAS-EWI (Table 1) and SAS-VWI (Table 2) benchmarks. The share price data were last collected on 30th April 2015. Note that, the White Land Tax was announced on the 23rd March 2015. Column 1 of Table 1 shows the interval period surrounding the announcement date. Column 2 presents the cumulative mean abnormal returns (CAARs) against the SAS-EWI with the associated t-statistics in column 3.

Table 1: Announcement Period: Share Returns Performance of the Firms over a Short-Run Adjusted for Saudi Arabia All-Shares Equal Weight Index (SAS-EWI)

Source: Authors’ own compilation

Note:

0 denotes the announcement date of the White Land Tax. Asterisks indicate statistical significance at the 10% (*), 5% (**) and 1% (***) levels using a two-tailed test. Cumulative mean abnormal returns (CARs) are calculated against the Saudi Arabia All-Shares Equal Weight Index (SAS-EWI) with associated t-statistics during the period surrounding the announcement.

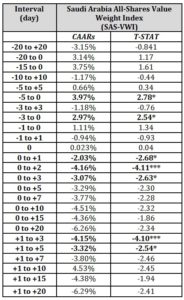

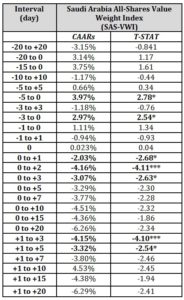

Column 1 of Table 2 shows the interval period surrounding the announcement date. Column 2 presents the cumulative mean abnormal returns (CAARs) against the SAS-VWI with the associated t-statistics in column 3.

Table 2: Announcement Period: Share Returns Performance of the Firms over a Short-Run Adjusted for Saudi Arabia All-Shares Value Weight Index (SAS-VWI)

Source: Authors’ own compilation

Note:

0 denotes the announcement date of the White Land Tax. Asterisks indicate statistical significance at the 10% (*), 5% (**) and 1% (***) levels using a two-tailed test. Cumulative mean abnormal returns (CARs) are calculated against the Saudi Arabia All-Shares Value Weight Index (SAS-VWI) with associated t-statistics during the period surrounding the announcement.

Table 1 shows the results of market-adjusted cumulative mean abnormal returns (CAARs) on Tadawul in several event windows from days -20 through days +20. The results were analyzed separately based on the two indices: equal weight index (EWI) – Table 1 and value weight index (VWI) – Table 2. The presence of significantly negative cumulative mean abnormal returns (CARs) during the few days following the announcement date is of interest, indicating that the market anticipates the announcement of White Land Tax as negative news. Notably, both equal-weighted index (EWI) and value-weighted index (VWI) demonstrated negative cumulative mean abnormal returns in one-day event window, from day 0 through day +1. The results show that the cumulative mean abnormal returns (CAARs) for both SAS-EWI and SAS-VWI benchmarks are -0.02 percent (t-statistic = -3.22, significant at 5 percent) and -2.0 percent (t-statistic = -2.68, significant at 10 percent), respectively. It is evidence that the results are more pronounced when the cumulative mean abnormal returns are measured against the SAS-EWI benchmark relative to SAS-VWI benchmark. This indicates that investors experienced a remarkably larger amount of losses when equal-weight index (EWI) is used as a benchmark. Despite that, the results of share portfolios from the VWI revealed interesting findings. The outcomes of this study provide evidence that larger real estate development and construction companies perform less well than smaller real estate development and construction companies on the Tadawul during the period of study. However, as noted by the Fama (1998), the choice of weighting scheme, either value weighted or equal-weighted, depends on the hypothesis of interest of the researcher.

It is worth to note that investors continue to react negatively to the announcement of White Land Tax in two-day and three-day event window, particularly when the cumulative mean abnormal returns are adjusted to value-weighted index (VWI) as shown in Table 2. Notably, we find that investors experienced a considerably larger loss of -3.07 percent (t-statistic = -4.11, significant at 10 percent) during the two-day event window (day 0 through day +1) relative to -4.16 percent (t-statistic = -2.63, significant at 1 percent) in the three-day event window (day 0 through day +2). Similarly, evidence also indicates that investing in the real estate development and construction companies from day +1 through day +3 generates a negative cumulative mean abnormal return of -4.15 percent (t-statistic = -4.10, significant at 1percent). A larger wealth destruction of -3.32 percent (t-statistic = -2.54, significant at 10 percent) can be observed during the five-day event window (day +1 through day +5).

The underperformance of real estate development and construction companies during the few days following the announcement date indicates that local individual investors in particular “overreact” to the White Land Tax announcement. Investors might perceive that the government’s decision to approve a 2.5 percent annual tax on millions of acres of so called white land lie for years in the city, in particular Riyadh, as negative news. Through a case-by-case review from financial press announcement about 40 percent of the land in the capital, Riyadh, is vacant and not being developed by its owners. This action would help the government to minimize a severe housing shortage in the kingdom and as well as to prevent the landowners from speculating on a rising of land values. Unlike other markets, local individual investors largely dominate Saudi Arabia share market; who could be the landowners, rather than institutional investors. This might explain the poor performance of the real estate development and construction companies during the few days following the event date. In addition to that, Tadawul imposed stringent restrictions for international investors to participate in its market. Prior to 1st June 2015, international investors had only limited indirect access to Saudi market through instruments such as swaps. On 1st June 2015, the Capital Market Authority of Saudi Arabia (CMA) allows foreign financial institutions to buy and sell shares in companies listed on Tadawul (The Wall Street Journal, 2015). To date, non-Saudis only own 7.74 percent of the Saudi Arabian share market’s value (Bloomberg, 2016).

Conclusion

The White Land Tax introduced by the Saudi government has different concept compared to the land taxation introduced by the democratic countries. The concept is considered as a penalty being imposed by the government for those who failed to develop their land within certain period of land acquisition. The idea is to prevent land speculation and encourage development in the urban areas.

Recognizing such situation, this study is motivated to provide some evidence by discovering how the market reacts to the announcement of White Land Tax during the short-run period, from day -20 through day +20. The argument put forward by Ritter (1991) on what constitutes an appropriate benchmark portfolio is addressed. The short-run performance of real estate development and construction companies are measured against own created market indices, SAS-EWI and SAS-VWI. Daily data are used to identify abnormal performance of real estate development and construction companies relative to market benchmarks during the few days surrounding the announcement date.

Overall, evidence indicates that real estate development and construction companies significantly underperformed both equal-weighted and value-weighted market benchmarks from day -20 through day +20 surrounding the announcement date. The results imply that investors show less favourable reactions to the Saudi government’s decision to introduce White Land Tax during the few days surrounding the announcement date. Perhaps, investors in Saudi Arabia perceive that the government’s decision to approve a 2.5 percent annual tax as unfavourable news, probably because the announcements might not be coupled with viable future strategies on how it will be implemented. The results also imply that size of companies does have effects as different results were produced when this study switches from equal-weighted index to value weighting. Our empirical evidence shows that small capitalization real estate development and construction companies outperformed their counterpart in large capitalization companies. As such, the present study has produced evidence that might provide valuable insight for practitioners, especially fund managers and other investors. As there is no national evidence on the influence of company size effect in the Saudi Arabian capital market, the present study adds to a growing body of international evidence. However, this study has its own limitation such as small sample size. A similar study could be conducted in other Middle East countries to validate the results and provide a comprehensive knowledge of how the market behaved following a similar announcement in less mature economies.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Akhigbe, A. and Madura, J. (1996) ‘Dividend policy and corporate performance’. Journal of Business Finance and Accounting, 23 (9-10), 1267-1287.

- Arab News. (2016) ‘White land tax to spur KSA real estate market: JLL’. [Online]. 16 June. Available from: http://www.arabnews.com/ [Accessed 23 September 2017]

- Bird, R. and Slack, E. (2005) Land and Property Taxation: A Review. [Online]. Available from: http://www1.worldbank.org/publicsector/decentralization/June2003Seminar/LandPropertyTaxation.pdf[Accessed 23 September 2017]

- Bloomberg (2016) Bloomberg Professional Services. [Computer Program]. Bloomberg.

- Brown, S. J. and Warner, J. B. (1980) ‘Measuring security price performance’. Journal of Financial Economics, 8(3), 205-258.

- Brown, S. J. and Warner, J. B. (1985) ‘Using daily stock returns: The case of event studies’. Journal of Financial Economics, 14(1), 3-31.

- Callan, T., Keane, C. and Walsh, J. (2010) ‘Policy Paper: What Role for Property Taxes in Ireland?’ The Economic and Social Review, 41(1), 87–107.

- Chandra, R., Moriarity, S. and Willinger, G. (1990) ‘A Re-Examination of the Power Alternative Return-Generating Models and the Effect of Accounting for Cross-Sectional Dependencies in Event Studies’. Journal of Accounting Research, 28(2), 398–408.

- Dyckman, T., Philbrick, D. and Stephan, J. (1984) ‘A Comparison of Event Study Methodologies Using Daily Stock Returns: A Simulation Approach’. Journal of Accounting Research, 22(supplement), 1–33.

- Ernst and Young (2016) Kingdom of Saudi Arabia white land tax: Opportunities, implications and challenges for the real estate sector. KSA:E&Y Publication.

- Fama, E. F. (1998) ‘Market efficiency, long term returns, and behavioural finance’. Journal of Financial Economics, 49(3), 283-306.

Lin, H. and Zeng, T. (2005) ‘Stock Market Reactions and Capital Gains Tax: Evidence from the 1985 Canadian Lifetime Capital Gains Exemption’. Review of Accounting and Finance, 4(2), 149-164.

- Kadioglu, E., Telceken, N. and Ocal, N. (2015) ‘Market Reaction to Dividend Announcement: Evidence from Turkish Stock Market’. International Business Research, 8(9), 83-94.

- Kalay, A. and Loewenstein, U. (1985) ‘Predictable events and excess returns: the case of dividend announcements’. Journal of Financial Economics, 14(3). 423-449.

- Kelly, R.(1994) ‘Implementing property tax reform in transitional countries: the experience of Albania and Poland’. Environment and Planning C: Government and Policy, 12(3), 319‐3

- Mahayni, Z. (2016) Saudi Arabia: The Saudi Arabian White Land Tax Law. [Online]. Available from: mondaq.com [Accessed 15 August 2016]

- Malme, J. H. and Youngman, J. M. (1997) Property Tax Developments in Transition Economies. In: Fourth International Conference on Local Government Taxation, Institute Rating Revenues and Valuation, Rome.

- McCluskey, W.J., Almey, R. and Rohlickova, A. (1998) ‘The development of property taxation in the new democracies of Central and Eastern Europe’. Property Management, 16(3), 145-159.

- Miley, H. W. Jr. (1977) ‘Property Taxation and Efficient Urban Land Allocation: The Land Value Tax Revisited’. Studies in Economics and Finance, 1(2), 29-40.

- Ministry of Housing, KSA (2017) Announcement date for registration. [Online]. Available from: https://lands.housing.sa/ar/all-target-cities [Accessed 12 March 2017]

- Parasie, N. (2015) Saudi Arabia Issues Rules for Foreign Investing in Stocks. [Online]. The Wall Street Journal. Available from: https://www.wsj.com/[Accessed 23 September 2017]

- Rae, J. (2002) An Overview of Land Tenure in the Near East Region: Part II (Individual country profiles). [Online]. Available from http://www.fao.org/3/a-aq202e.pdf [Accessed 23 September 2017]

- Ritter, J. R. (1991) ‘The Long-Run Performance of Initial Public Offerings’. Journal of Finance, 46(1), 3-28.

- Sait, S. and Lim, H. (2006) Land, Law and Islam: Property and Human Rights in the Muslim World. London & New York: Zed Books.

25. Squires, G. D. (2005) Urban Sprawl: Causes, Consequences, & Policy Responses. Washington D.C: The Urban Institute Press.

26. Wenner, F. (2016) Sustainable Urban Development and Land Value Taxation: The case of Estonia. Land Use Policy.