Introduction

The increasing Internet and mobile applications have sharpened global awareness that technology advancement can drive the ability to manage firms better. However, technologies innovations are meaningless if people do not value these innovations as a way to meet their needs.

Firms need to keep up-to-date with the pace of technology to improve their information infrastructures in order to grow both nationally and globally. Mobile payment system enables users to make payment via Short-Message-Service (SMS).

The mobile technology is undeniably an important application for mobile commerce (m-commerce) (Hu et al, 2008b). However, the factors which determine mobile payment (mobile payment) usage are equally or more important. Thus, firms need to understand the benefits of m-payment, which could help in satisfying customers and possibly enable the firms to access greater business opportunities.

The simplest and oldest form of payment for any business transaction is what may be called the barter system, which enabled the exchange of goods or services for another. Fast forward to the 21st century, the most common payment system is through legal tender, cheque, debit, credit, or bank transfer.

In business transactions, payment can be made by an invoice, which would result in a receipt. In addition, the use of electronic payment methods has been increasing in the past 2 decades and they include the magnetic stripe card, smartcard, contactless card, and mobile handsets. As the technology and communication systems improve, the transition from online to mobile payment system improves as well. In the future, every individual would be able to make payments via their mobile payment devices such as cellular phone, smart phones, and personal digital assistants (PDAs), or mobile terminals.

Thus, the m-payment will become a new trend for individuals and corporate entities to make payments for their business dealings

To address the key issues in this research, we aim to identify the determinants of m-payment from customers’ perspective. Mobile payment can be defined as a wireless-based electronic payment for m-commerce to support point-of-sale / point-of-service (POS) payment transactions on user’s mobile devices (Gao et al, 2005).

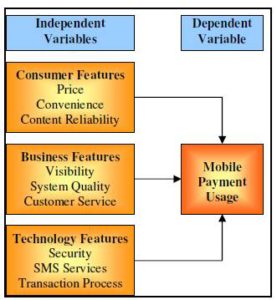

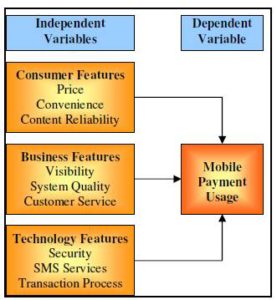

The determinants in this paper are divided into three constructs including consumer features (price, convenience, and content reliability); business features (visibility, system quality, and customer service); and technology features (security, SMS services, and transaction process). Finally, these three constructs will be measured and examined to understand consumers’ perspective on mobile payment usage in Malaysia.

Conceptual Development

The proliferation of science and technology has improved methods of paying for purchases. The advancement of mobile devices has created a new business concept. Consumers will find it an inexpensive alternative means to ease their difficulties in making payments for goods and services. For example, consumers can make payment via mobile devices from anywhere at anytime and for anything. Technologies such as SMS can create a simple transaction for an e-banking and e-payment process, which could provide lots of convenience to consumers.

Furthermore, consumers can easily credit the payment into their bank account with just a simple SMS. Based on the foregoing, we develop the consumer features construct in the framework and we will use three variables to describe the construct.

In addition, the mobile technology sector is fast growing in size. The concept of mobile payment (m-payment) has created a much more dynamic approach to collect payment from consumers by sellers. For example, a firm that implements an m-payment system can directly receive payment from the bank with the approval of the consumers.

There will be 3-tier interaction between consumer, firm and the bank. The m-payment payment shall be visible to all types of mobile devices. These include the system quality and the customer service by the firm that implements the m-payment system.

Based on the foregoing, we will develop the business features construct in the framework and we will use three variables to describe the constructs.

Addressing consumer features and business features may be inadequate for a firm to enhance the m-payment system. Firms, therefore, would require technology features to manage the entire flow of the point of sales (POS) to ensure smooth operations.

This will include the provision of adequate security for m-payment such as authentication. A firm will implement an SMS service for their consumer feedback and enquiry. Effective transaction process for the m-payment will also increase the mobile payment usage.

Thus, we will examine the impacts of consumer features, business features and technology features on the mobile payment usage. In each of the input variable, we will discuss three sub-items. The model generated could be analyzed from both consumer and business perspectives, but in this paper we will focus on the consumer’s perspective

Fig. 1: Research Framework

Figure 1 represents the research framework for this paper and illustrates nine independent variables for the three constructs: price, convenience, content reliability, visibility, system quality, customer service, security, SMS services, and transaction process.

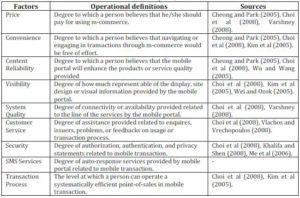

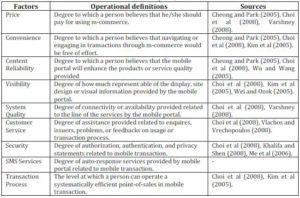

We also generated nine hypotheses — three for each of the constructs namely consumer features, business features and technology features — to test the influence of the independent variables on mobile payment usage in Malaysia. Table 1 presents the dimensions of the variables we intend to examine in this paper, the operational definitions and the selected sources of the definitions and related works.

Table 1: Variables, Description, and Sources

Consumer features in m-payment can be defined as any distinctive, singular, typical or special feature or features, which may be used to distinguish a customer or group of customers from any other consumer group of consumers in buying or payment process for products or services. These features will be different from one consumer to another consumer. This article identified three consumer features that could influence mobile payment usage in among consumers and they include price, convenience, and content reliability.

Price in m-payment can be defined as the degree to which a person believes that they should pay for the price of using m-commerce (Cheong and Park, 2005; Choi et al, 2008; Varshney, 2008). Businesses such as retailers will offer low prices to capture higher store traffic while consumers will respond differently indicating varying levels of price consciousness (Choi et al, 2006; Kukar-Kinney, 2007; Tan et al, 2009).

For example, the m-payment can be integrated with common price strategies such as low-price services, mobile point accumulation for complete transaction, and zero-fee SMS transactions for e-banking or e-business. Furthermore, the lower fee of m-payment will encourage more users to use mobile payment services.

According to Poon (2008), one of the determinants of e-banking usage in Malaysia is reasonable fees and charges. In addition, price plays a major role in purchasing process in the retail firms’ perspectives (Alvarez and Casielles, 2008).

As for m-payment, reasonable fees and charges should be applied in order to capture wider market share of mobile users. Smart consumers are insistent on making price comparisons within the products or services to measure the quality and performance (Tan et al, 2009). A minimum transaction fee for SMS transaction fee will make the consumers keen to use m-payment. Thus, mobile service providers (MSP) that provide lower fee to consumers will enhance the possibility of consumers to use m-payment. Hence the following proposition:

Proposition 1: Price will significantly affect m-payment usage.

Convenience in m-payment can be defined as the degree to which a person believes that navigating or engaging in transactions through m-commerce would be free of efforts (Cheong and Park, 2005; Choi et al, 2008; Kim et al, 2005). In retailing, a consumer satisfaction will increase when the consumer value increase with higher return on investment (ROI) (Ramaseshan, 2006; Tan et al, 2009).

As such, a firm can implement an m-payment system in their businesses to increase consumer loyalty. The usage will allow their consumers to make payment with the concept of “3A” that is “Anywhere, Anytime, Anything”. The concept allows consumers to make payment from any location without the boundary of time to purchase any products or services.

According to Zhang (2008), the biggest advantage of mobile payment is the opportunity to conduct trading anytime and anywhere and it is characterized by mobilization and individualization. Consumers with mobile devices can easily make payments by sending SMS to a system application. This SMS will then be authenticated with the related e-banking system for complete transaction process. In addition, consumers may not need to queue-up like in retail industry to make payment or even find a PC for online payment.

As such, consumers can get products or services faster, which can lead to customer satisfaction. Thus, the convenience m-payment provides would enable consumers to use m-payment system. Hence the following proposition:

Proposition 2: Convenience will positively influence m-payment usage.

Content reliability in m-payment can be defined as the degree to which a person believes that the mobile portal will enhance the quality of products or services provided (Cheong and Park, 2005; Choi et al, 2008; Wu and Wang, 2005).

In a research (Choi et al, 2008), content reliability is proven to be significant influence in mobile system satisfaction (m-satisfaction) and mobile loyalty (m-loyalty) in digital music transaction industry in Korea. The type of product or service transacted will be in the form of virtual products, digital content, information, etc. Consumers who use the mobile portal, which provide a good quality products or services will enhance the consumer’s trust and ability to re-purchase the goods. In like manner, the content reliability will enhance re-purchase power from the consumers in m-payment.

The system requirement for m-payment will allow products to be personalized or customized upon request by consumers (Hu et al, 2008a). For example, Web content in mobile application can be viewed via either browsers or micro browsers.

The content accuracy and precision provided by m-payment companies will be a key determinant for m-payment usage. If the data are reliable and up-to-date, this will increase the trust of the consumers to make payment via mobile payment system. The growth of e-banking and e-business with the advancement of technology will enhance the usage of m-payment. Thus, the content reliability in m-payment could change the manner of business being conducted and may enable great m-payment usage. Hence the following proposition:

Proposition 3: Content reliability will positively influence m-payment usage.

Business features in m-payment can be defined as any distinctive, singular, typical or special feature or features, which may be used to distinguish a firm or a business entity from any other firms or group of business entity in the industry in creating the buying or payment process for products or services. These features will be different for different industries.

This article identified three business features that could influence mobile payment usage among consumers and they include visibility, system quality, and customer service.

Visibility in m-payment can be defined as the degree of representation made possible in the display, site design or visual information provided by the mobile portal (Choi et al, 2008; Kim et al, 2005; Wei and Ozok, 2005). The information must be able to be represented in the display using various types of mobile techniques and consumers should be able to appreciate the content.

The content and the pre-details of the m-payment must be able to shown in the mobile screen. Reliable and detail information for m-payment is encouraged by the firm and this should be well arranged and organized. For example, the overall design of the screens offered by m-payment must be able to satisfy consumers’ requirements.

In addition, the overall design of the screens offered by m-payment must be able to be constructed in a way convenient to the consumers. According to Delic and Vukasinovic (2006), the m-payment services can be categories into three key mobile payment transactions, which include SMS based applications, micro point of sales (mPOS) based applications, and Internet based applications.

All these services should be visible in the m-payment so that the consumer visualizes the information. For example, if a user uses SMS based application, the user should be able to send a string of SMS in their mobile screen to the mobile provider in order to make a successful transaction. Thus, the visibility in the m-payment will affect the usage of the m-payment services. Hence the following proposition:

Proposition 4: High visibility in m-payment will positively influence m-payment usage.

System quality can be defined as the degree of connectivity or availability provided by the firm, which is related to the line of services by the mobile portal (Choi et al, 2008; Varshney, 2008). According to Chen & Zhou (2008), service quality on mobile commerce demonstrates user perception towards vendor service level, which includes on-time service, timely response and personalization.

With good system quality, consumers will able to use the services to make payment. For example, consumer can make their payments by debiting the items purchased into their bank account. Next, by the end of the month, the consumers just need to pay the total amount for buying product or services. Thus, a good system quality can increase the rate of success to m-payment usage.

In mobile applications, the system quality must be able to have data-mining logic system. For example, if there is a technological problem in the system, then the m-payment must be able to identify the error by providing a next page loaded with information.

The system, as much as possible, should be error free to avoid unnecessary wait of time and frustration. Furthermore, the consumer should only disconnect the access to m-payment due to a technological problem. If the system quality of the m-payment is good, then this will encourage more users to use the m-payment system. By applying the 3A concept, the adoption of m-payment would increase as well. Thus, an m-payment should have a good integrated system quality. Hence the following proposition:

Proposition 5: System quality will positively influence m-payment usage.

Customer service in m-payment can be defined as the degree of assistance provided by a firm in relation to enquires, problems, or feedbacks on usage or transaction process (Choi et al, 2008; Vlachos and Vrechopoulos, 2008). According to Ball et al (2005), service personalization is important and that it is related in multiple ways to loyalty.

For example, consumers can ask for an issue related to failure of their transaction process. The customer service provided by the m-payment system to assist the consumer would be helpful to ease their plight. Such service will encourage the consumers to use the m-payment. Thus, the consumers would feel at ease in using the m-payment to conclude their business transactions.

In addition, consumers also expect the time-to-response (TTR) to inquiries by the mobile service provider to be fast. Their answers on inquires should the useful and able to solve related problems. The m-business and e-business should recommend the content specification when the user is accessing the m-payment.

For example, the consumer can ask for a location map via their mobile devices by making a small payment to a GPRS system. Furthermore, there should be several methods for the user to submit their enquiry about the m-payment. These could include the details about the content and services. Thus, a reliable customer service would be a key factor to encourage m-payment usage. Hence the following proposition:

Proposition 6: Customer service will positively influence m-payment usage.

Technology features in m-payment can be defined as the system used to manage customer information, products and services need. A good technology feature will enable information to be process from databases with data mining execution.

Effective m-payment system will enable better understanding of customer need, which would drive m-payment usage. This article identified three business features that could influence mobile payment usage among consumers and they include security, SMS services, and transaction process.

Security in m-payment can be defined as the degree of authorization, authentication, and privacy statements related to mobile transaction (Choi et al, 2008; Khalifa and Shen, 2008; Me et al, 2006). According to Mohd and Osman (2005), the security of a payment method is undoubtedly crucial if the payment method is to gain widespread acceptance.

As a whole, security can be view from five perspectives namely confidentiality, authentication, integrity, authorization, non-repudiation, and accessibility. For example, the typical content for authentication of a SMS for a top-up system (Delic and Vukasinovic, 2006) as below:

AmountTopupNumber

(optional)AccountNameCode(optional):GreetingMessage

(optional)

Next, the message will be sent with defined content to short number (E.g. 8585) to complete the process.

In Malaysia, for example, you may receive advertisement from a mobile service provider. For example, this SMS sent by mobile service provider: “RM0. Keep yourself updated with the latest 2010 World Cup Qualifiers! Get match previews, goal alerts, stats & results from Maxis. Sent ON WCQ to 22006. RM0.30/SMS”.

In order to activate, just type “ON WCQ” in the SMS and send to 22006. This will be charged RM0.30 per SMS into the user’s mobile account. With mobile technology, consumers are able to make purchase of the information through the m-payment system. The firm that plans to implement m-payment system should emphasis the authorization, authentication and privacy statement to be able to gain consumers’ confidence in the use of m-payment. Thus, proper security plays an important role in determining m-payment usage. Hence the following proposition:

Proposition 7: High security will positively influence m-payment usage.

SMS services can be defined as the degree of auto-response services provided by mobile portal related to mobile transaction. The enquiry by consumers to the mobile service provider should be in auto-reply system. For every successful transaction, there should be a reply indicating the success or failure of the process.

It will be good if the system will prompt the user to their mobile devices. It also can generate an email to the user indicating their transaction had been completed. For example, if a consumer enquires about a movie ticket, the system will send a response to the consumer within seconds, which charge a minimum fee. Thus, the consumer will be able to get the information need without the hassle to look online.

In addition, Maxis Communications Berhad (Maxis) launched the AeroMobile system, which enables post-paid consumers to make communication services such as voice calls, SMS, e-mail and GPRS (InTech, 2009). The service will be billed to their consumers’ monthly phone bill as with any other international roaming calls.

The consumer will be able to make and receive voice calls at RM15 per minute, or send or receive data at RM100 per megabyte. For SMS, each SMS sent is charged at RM3 per message while receiving SMS if free of charge. These SMSs and data usage are frequent amongst travellers and business travellers. If a firm utilizes the m-payment system, they will capture this uncontested business opportunity. Thus, an effective m-payment should have relevant SMS services to enable proper implementation process. Hence the following proposition:

Proposition 8: SMS services will positively influence m-payment usage.

Transaction process entails the unambiguous and independent execution of a set of operations on data in a relational database, which treats set of actions as a single event (Choi et al, 2008; Kim et al, 2005). If any part of the transaction process fails, the entire transaction fails and all participating resources are rolled back to their previous state (Pete, 2001).

For example, the consumer can make a micros point of sales (mPOS) with their mobile application. Upon success, a bank will credit their bank account, which indicates payment being made. Thus, the cost and time for purchasing the products and services will reduce with effective transaction process.

A good system is needed for transaction processing and must pass the ACID Test: atomicity, consistency, isolation and durability (Pete, 2001). Transaction processing systems may consist of computer hardware and software hosting a transaction-oriented application that performs the routine transactions necessary to conduct business.

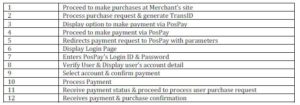

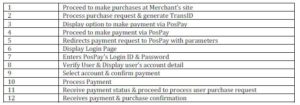

For example, PosPay (2009) is Malaysia’s first Ringgit-based Virtual Account, which provides an alternative to traditional online payment system. It enables customers to open virtual accounts for payments for online shopping transactions, utility bills, mobile content downloads, and the reloading of points for online games. PosPay payment services make it easy for customers to process micro-payments without fear of credit-card fraud and for merchants to process transactions and receive payment easily and without hassle. Table 2 presents how PosPay works and the sequence.

Table 2: PosPay — How it works and the sequence

Hence the following proposition:

Proposition 9: Effective transaction process will positively influence m-payment usage.

Conclusion

We hope that, based on the findings of this research, we would be able to understand specific key factors that tend to influence the decision to use mobile payment systems and in the process appreciate consumers’ need in this respect.

An effective mobile payment system will not only be valuable to the firms, particularly as these firms embark on expansion initiatives to grow their customer base, it will also be valuable to consumers as it will provide higher level of convenience in business transactions including the payment of bills. M-payment will enable the transaction process to be completed within a very short period. Consequently, consumers would be satisfied with the quality of m-payment and this will generate more profit to the firms implementing the system.

Finally, the three constructs discussed in this paper are considered important factors for firms to take into consideration as they develop approaches for serving their existing and potential customers. Theoretical developments in this field of research is still in early stages and this paper provides part of initial assessment of what could be considered key factors that would be relevant to future research in the specific discipline.

Our assessment is that firms that effectively deliver on these three constructs would be able to increase mobile payment usage in their respective business, which could have an expanded effect in the overall business operations in Malaysia.

References

Alvarez, BA, and Casielles, RV. (2008), ‘Effects of price decisions on product categories and brands,’ Asia Pacific Journal of Marketing and Logistics, 20 (1), 23-43.

Babbie, E. (1990), Survey research methods (2nd ed.), Wadsworth, Belmont, CA.

Ball, D, Coelho, PS, and Vilares, MJ. (2005), ‘Service personalization and loyalty,’ Journal of Services Marketing, 20 (6), 391-403.

Chen, ZY, and Zhou, T. (2008), ‘Examining the determinants of mobile commerce user repurchase behavior,’ Proceedings of the 4th International Conference on Wireless Communications, Networking and Mobile Computing (WiCOM ’08), 12-14 October 2008, Dalian, China, 1-4. IEEE Computer Society Press.

Cheong, JH, and Park, MC. (2005), ‘Mobile Internet acceptance in Korea,’ Internet Research, 15 (2), 125-40.

Choi, JW, Seol, HJ, Lee, SJ, Cho, HM, and Park, YT. (2008), ‘Customer satisfaction factors of mobile commerce in Korea,’ Internet Research, 18 (3), 313-335.

Choi, DH, Kim, CM, Kim, SI, and Kim, SH. (2006), ‘Customer loyalty and disloyalty in Internet retail stores: Its antecedents and its effect on customer price sensitivity,’ International Journal of Management, 23 (4), 925-944.

Delic, N, and Vukasinovic, A. (2006), ‘Mobile payment solution: Symbiosis between banks, application service providers and mobile network operators,’ Proceedings of the Third International Conference on Information Technology: New Generations (ITNG ’06), 10-12 April 2006, Las Vegas, Nevada, USA, 346-350. IEEE Computer Society Press.

Gao, J, Cai, J, Patel, K, and Shim, S. (2005), ‘A wireless payment system,’ Proceedings of the 2nd International Conference on Embedded Software and Systems (ICESS’05), 16-18 December 2005, Xian, China. IEEE Computer Society Press.

Hu, WC, Yang, CHT, Yeh, JH, and Hu, WH. (2008a), ‘Mobile and electronic commerce systems and technologies,’ Journal of Electronic Commerce in Organizations, 6 (3), 54-73.

Hu, XP, Li, WL, and Hu, Q. (2008b), ‘Are mobile payment and banking the killer apps for mobile commerce?’ Proceedings of the 41st Hawaii International Conference on System Science (HICSS 41), 7-10 January 2008, Big Island, Hawaii, USA. IEEE Computer Society Press.

InTech. (2009), ‘Make calls in the sky’, The Star Online, retrieved 31 March 2009, from http://star-techcentral.com/tech/story.asp?file=/2009/3/31/prodit/3477394&sec=prodit

Khalifa, M, and Shen, KN. (2008), ‘Explaining the adoption of transactional B2C mobile commerce,’ Journal of Enterprise Information Management, 21 (2), 110-124.

Kim, H, Kim, J, and Lee, Y. (2005), ‘An empirical study of use context in the mobile Internet, focusing on the usability of information architecture,’ Information Systems Frontiers, 7 (2), 175-86.

Kukar-Kinney, M, Walters, RG, and MacKenzie, SB. (2007), ‘Consumer responses to characteristics of price-matching guarantees: The moderating role of price consciousness,’ Journal of Retailing, 83 (2), 211-221.

Me. G, Strangio, MA, and Schuster, A. (2006), ‘Mobile local macropayments: Security and prototyping,’ IEEE Pervasive Computing, 5 (4), 94-100.

Mohd, F, and Osman, S. (2005), ‘Towards the future of mobile commerce (MCommerce) in Malaysia,’ IADIS International Conference Web Based Communities 2005, 23-25 February 2005, Algarve, Portugal.

Pete, L. (2001), ‘Transaction processing,’ Computerworld, 35 (40), 49.

Poon, WC. (2008), ‘Users’ adoption of e-banking services: The Malaysian perspective,’ Journal of Business & Industrial Marketing, 23 (1), 59-69.

PosPay (2009), ‘PosPay — How it works?’, Neowave Sdn Bhd, retrieved 31 March, 2009, from http://www.neowave.com.my/pospay-howitworks.asp.

Ramaseshan, B, Bejou, D, Jain, SC, Mason, C, and Pancras, J. (2006), ‘Issues and perspectives in global customer relationship management,’ Journal of Service Research, 9 (2), 195-207.

Sekaran, U. (2003), Research methods for business: A skill building approach (4th ed.), John Wiley & Sons Hoboken, NJ.

Tan, CB, Kwan, PY, and Eze, UC. (2009), ‘The impact of consumer characteristics, business characteristics, and knowledge management system on customer loyalty: A conceptual framework’ Proceedings of the 2009 International Conferences on e-Commerce, e-Administration, e-Society, and e-Education (e-CASE 2009) and e-Technology, 8-10 January 2009, Singapore, 323-336. Knowledge Association of Taiwan.

Varshney, U. (2008), ‘Business models for mobile commerce services: Requirements, design, and the future,’ IT Professional, 10 (6), 48-55.

Vlachos, PA, and Vrechopoulos, AP. (2008), ‘Determinants of behavioral intentions in the mobile internet services market,’ Journal of Services Marketing, 22 (4), 280-291.

Wei, J, and Ozok, A. (2005), ‘Development of a web-based mobile airline ticketing model with usability features,’ Industrial Management & Data Systems, 105 (9), 1261-1277.

Wu, J, and Wang, S. (2005), ‘What drives mobile commerce? An empirical study evaluation of the revised technology acceptance model,’ Information and Management, 42 (5), 719-729.

Zhang, QH. (2008), ‘Mobile payment in mobile e-commerce,’ Proceedings of the 7th World Congress on Intelligent Control and Automation (WCICA), 25-27 June 2008, Chongqing, China, 6650-6654. IEEE Computer Society Press.