Introduction

This paper presents an analysis of how the equity influences the degree of assessing the performance of companies in Romania. Currently, Romanian companies increasingly impaired as a result of reporting financial statements that do not provide sufficient information to assess their true performance. Thus, it requires a better understanding of the main profitability indicators reflected in the financial statements, especially their influence on the degree of assessment of the company’s performance.

In the specialty literature, there are many meanings of the assessment of the company’s performance. The emphasis is increasingly focused on the importance of creating value for the company, and respectively on the efficient use of equity that has a significant impact on the assessment of the company’s performance. The need to know the influence of equity on the level of assessment of the company’s performance is even more important; given the fact that the shareholders aimed at increasing investment rather than increasing the rate of return. (Buglea A., Lala-Popa I., 2009)

According to International Accounting Standard (IAS 1), the change in equity over a financial year is reflected in the global result. It measures the global performance of the company based on changes in equity as a result of transactions and events that are generated by the relationship with the owners. Thus, the knowledge of the relationship between the equity and the global result as an instrument for assessing the company’s performance, is particularly important given that the requirements of the accounting financial information users are more demanding. (IASB, 2015)

„Statement of changes in equity” is the link between balance sheet and profit and loss account, serving to highlight the company’s performance based on changes in equity. In the current economic context, a great importance should be given to the preparation of the annual financial statements in order to reflect the impact of equity on the level of assessment of the company’s performance. (Jianu I., 2007)

As users of financial accounting information are increasingly oriented towards the future performance, the importance of equity in assessing the company’s performance is even higher, as gains and losses recognized in equity comprise elements that are oriented toward the future that will turn into future earnings or losses by selling related items. In this regard, it is essential to know the evolution of equity over a financial year, in order to reflect accurate and complete future performance of companies. (Breban L, 2017)

The aim of this study is to present the influence of equity on the level of performance appreciation of the Romanian companies. In order to present the impact that the equity has on performance appreciation of companies, we conducted a case study at Armatura S.A. company, based on the annual financial statements prepared in the 2011-2016 period. Armatura S.A. company is traded shares on the Bucharest Stock Exchange (BVB) and operating in the field of metallurgical industry. The company’s annual financial statements are prepared in accordance with the International Financial Reporting Standards (IFRS).

In this context, this article wants to develop a radiograph of the sector of metallurgical industry which consists of companies listed on BVB, aiming to provide a source of growth performance and a benchmark for investors in choosing the best companies.

Because the items included in equity are oriented toward the future, we believe that the equity is even more relevant to assessing the company’s performance at the end of the financial year. One of the main goal of any business is to create value for shareholders. So, the analysis of the influence of equity on the assessment of the company’s performance is a topical theme for all users of financial-accounting information, especially; for stakeholders.

The basic idea which released the research was that the company´s revenues (turnover) are capable of generating wealth for shareholders (equity) and profit for the company (global result).

Reviewed Literature

Reviewed literature gives an overview of the importance of equity in decision making. In any company, the accumulation of equity is the most important key to success. Because the evolution of equity influences the company’s performance, we consider that it is essential to know the factors that have an impact on changes in equity.

For evaluating the efficiency of equity, various methods can be used depending on the company´s objectives. The specialty literature puts more attention on creating value, which is the result of the link between accounting information contained in the financial statements and the share price. (Anghel, I., Man, M., 2016)

In the industrial sector, knowledge of changes in equity is essential, as it reflects the company´s productivity. The performance of these companies is given by the increasing seals generated by the use and effective financing of assets into equity.

According to the IASB, changes in equity reflects the global performance of the company during a period based on total incomes and total expenses, and gains and losses generated during a period. The wealth company is the increase or the decrease in net assets reflected on changes in equity. Helping to determine global result, shareholders’ equity is essential in assessing and reflecting the company’s performance. (IASB, 2015)

Company’s performance is closely linked to equity value because the profit; an important source of financing for development activity, is a component of equity. Increasing equity generates increased company’s performance, and respectively; the equity investment efficiency. Each element of equity presented in the “Statement of changes in equity” according to Romanian accounting regulations, helps to reflect the company’s performance and also helps the managerial decisions. (Balteș, N., Ciuhureanu, A., T., 2015)

Equity has the advantage of expressing the future performance of the company unlike the classic indicators of profitability which expresses only historical results of the financial performance. For investors, a particular importance has the commercial rate of return based on the net profit, which shows how many dividends rest to owners for each amount invested. Because the rate of return is determined by dividing net profit to turnover, we consider it essential to know about the changes in equity as a result of the dynamics of turnover.

For a better appreciation of the company´s performance from the operating activity, it is recommended to compare the operating result with the turnover. The equity invested in the business determines the turnover. However, a high turnover has a positive influence on the accumulation of capital. In this context, it is necessary to analyze changes in equity as a result of developments in turnover. (Achim, M., V., Borlea, S., N., 2012)

Bebchuk și Fried (2003) argue that the company’s goal is not necessarily to maximize shareholder wealth. Contrary to their opinion, Renneboog & al. (2008) consider that the main responsibility of companies is to maximize the value of shareholders’ equity along with the increased social responsibility of the company. Thus, the latter emphasizes the importance that companies should cooperate/unite to attract the investment and generate return on invested capital.

Also, the specialty literature speaks of an adjustment of equity by turnover. The ratio of turnover and return on capital employed measures the level of share transactions. Company’s performance is obtained when this ratio is equal to one. To that case, the shares can be sold or purchased easily. (Lawrence H., 2016)

In industry, the analysis of the company´s sales evolution will create a plan of production of those products capable of ensuring maximum profitability in relation to market requirements and resources of the company. In practice, a correlation analysis between the evolution of equity and the dynamics of turnover is recommended to highlight all the levels that may increase the company’s performance. Given the above research, the authors of this paper have identified the need for an additional research to determine how the company’s performance is expressed in terms of equity; in the sector of metallurgical industry.

This research is carried out to have a practical value for business managers and for all information users, giving them a vision on the development of the Romanian metallurgical sector. However, the study is valuable in addressing a particular case which has a great importance to the national economy.

Research Hypotheses

The main objective of the research is to highlight the usefulness of equity in the assessment of the company´s performance, providing tools for sustainable business management. The research hypotheses we want to test as a result of the analysis carried out are:

H1. The increase of the global result causes an increase of equity.

H2. The increase of the company´s turnover does not mean an increase of equity.

Research Methodology

The research methodology shows the theoretical and practical stages of the study; which is one of qualitative and quantitative. Thus, the theoretical research on existing concepts and theories in the field so far in the specialty literature (document analysis and observation) was complemented by the research at Armatura S.A. company.

This study is based on the induction and presents conclusions and results from testing research hypotheses. We consider that the quantitative tool is an effective method to determine changes in equity, turnover and global result in 2011-2016 period. With this method, we can determine changes in equity and the impact of these changes on the Armatura S.A. performance. With this method, we can determine changes in equity and the impact of these changes on the company’s performance. In this section, we will present the reasons why we chose the Armatura S.A. company in order to conduct the case study and tools for collecting and processing data.

To test the research hypotheses, quantitative research method was used at a sample consisting of information on the financial statements reported by the Armatura S.A. company, between 2011 to 2016. Quantitative research methods facilitate the collection of numerical information to present clear results of the study.

The data contained in the sample were extracted from the database www.mfinante.ro and on the official website of the Armatura S.A. company (www.armatura.ro). The data were processed and results were interpreted accordingly. In the examination of the data obtained, we apply basic scientific methods of analysis, comparison mathematics and graphics. Based on the results of analysis, conclusions were outlined regarding the influence of equity exerted on the level of assessment of the performance of companies at the financial year-end.

Case study: Armatura S.A. Romanian company

In order to achieve the objective and to test the two research hypotheses, we conducted a case study on the Armatura S.A. company.

This company which operates in the metallurgical industry, has shares traded on the Bucharest Stock Exchange and draft annual financial statements in compliance with the International Financial Reporting Standards (IFRS). (OMFP no. 1286/2012).

Armatura S.A. company was recorded since 1991 as a joint stock trading company and has a fully private capital. According to the annual financial statements prepared at 31.12.2016, the subscribed and paid capital was in the amount of 4 millions lei. The Company’s shares are listed on the Bucharest Stock Exchange since 1997, which has extensive experience in the stock markets trading. The company operates in the metallurgical industry having a portfolio of 1,500 articles of various sizes which is dedicated to national and international clients. According to the financial reports of the year 2016, the company had an average number of employees equal to 175.

The reason for choosing Armatura S.A. company for the analysis is related primarily to the financial equilibrium that the company proves during the reference period; it managed to maintain a relatively constant production. Using modern management techniques, the company offers customers a wide variety of competitive products at reasonable prices, in a time when the global economic crisis has increasingly placed its mark on the business environment. We consider that the choice of this company to the survey is not random, because Armatura S.A. company is one of the most important companies in the Romanian metallurgical industry, having existed for over 20 years, with a large portfolio of products and a spectacular financial evolution so far.

Armatura S.A. company is recognized because of long collaboration with renowned domestic customers such as Dacia Group Renault, Distrigaz Sud Romania, and E-on Gaz Romania, as well as external customers such as; HerzArmaturen (Austria) and AZ Gastechnik (Germany) Barberi (Italy). As a company whose shares are traded on the Bucharest Stock Exchange, we can easily determine the level of equity influence in the assessment of the company´s performance. In this case, the book value of equity refers to all elements of the capital of the company, namely; reserves, provisions, and reported result.

Armatura S.A company reports the annual financial statements according to the Minister of Public Finance no. 881/2012 on the application by companies whose shares are admitted to trade on a regulated market of the International Financial Reporting Standards, which justifies the better choice of the company to be used in the case study. So a series of financial and accounting information related to the performance of the Armatura S.A. company between 2011-2016 period can be easily retrieved and analyzed

Results and Discussions

In the current economic context, the value creation is the main objective of any company which aims to satisfy the expectations of various stakeholders, such as: investors, shareholders, employees, customers, suppliers, and the state, etc. When investment efficiency is higher than the rate of return expected by shareholders, the company is performing well.

In this sense, we can say that the effective use of equity should be interest, primarily for shareholders and investors, as well as for other users of financial accounting information.

Changes in equity has a significant impact on total earnings of shareholders and on the global performance of the company. Information on changes in equity over a financial year is included in the “Statement of changes in equity”, which is a separate component of the annual financial reports for the economic entities that prepare the annual financial statements in accordance with IFRS. This component shows net profit or net loss of (a) the period, items of income and expense recognized in other global results for the period, the effects of changes in accounting policies and corrections of errors recognized during the period, the value of investments and dividends, and other distributions to investors during the period. The objective of this component is to assess the company’s performance by presenting all items of income and expense recognized in a while.

Information about the global performance of the company, which involves achieving all goals, are included in the “Statement of comprehensive income”. The global result provides comparability in time and space for the global performance of companies and enables an overview of the company’s financial situation at the end of the financial year.

Changes in equity is reflected in the global result, but is not the only factor influencing the value of this result. The global result requires a summation of the following items: the financial year result, gains and losses reflected in equity, the effects of changes in accounting policies and the correction of fundamental errors. Therefore, gains and losses reflected in equity is a component of the global result influencing a certain level of the global performance of the company.

Therefore, we consider it indispensable to show the influence of changes in equity on the company´s performance, whereas investors are essential to know not only the cost of capital invested but also the effects of using capital.

However, we appreciate that based on changes in equity, the investors’ expectations regarding future results will be met. Thus, although apparently there are companies that seem powerful in financial terms, their activities do not create value, but rather lead to permanent loss of value.

Many participants of the business believe that turnover is an appropriate reporting financial performance of the company which provides information on the historical performance of the company, with a limited role in predicting its future evolution. For investors, the turnover represents a landmark in assessing the financial position of the company and a potential source of gain. An increase in turnover does not imply an increase in shareholder value created. Thus, there are cases where a company registered a spectacular increase in turnover while greatly reducing the value created.

The economic crisis effects in the second half of 2008, led to a decrease in turnover of Romanian companies, they managed to increase sales only in 2012. Reducing financial indicators of the Romanian companies has led to weakening the investors confidence in the Romanian companies. As a result, the increase of the turnover should be seen in close connection with the value created because of company’s equity.

Knowing the company’s capacity to make profits or to increase sales is not sufficiently representative. So, for a true appreciation of the company’s performance, invested capital is required to be compared to the turnover achieved as a result of sales. This comparison is very useful for investors because it shows how many dividend returns by owners for every dollar from the sale.

Practice recommends that the increase in sales revenue should be carried out in close conjunction with the company’s costs, with the purchasing power of customers, with features competitors, and with the dynamic regulatory environment, etc. Increased revenues collected by the company, respectively; the turnover, causes an increase of the equity´s rotation speed which increases the company’s credibility. Therefore, the equity analysis based on turnover expresses the profitability of using equity.

The efficiency of using equity is the guarantee of adequate payment of the owners and not only. In this respect, companies are oriented towards creating value that implies a higher return on equity in relation to the cost of their purchases.

Changes in equity and of global result at the level of Armatura S.A. company in the period of 2011-2016

To analyze the equity´s impact on the assessment of the company´s performance, we conducted a case study at Armatura S.A., based on the annual financial statements prepared for the period of 2011-2016. The values are expressed in thousands of LEI as the Romanian currency is LEU. According to the National Bank of Romania, the exchange rate on 31.12.2017 for the national currency (LEI) in US dollar (USD) is equal to 3.8915 (1 USD = 3.8915 LEI).

The information taken from the company’s annual financial statements were the starting point in the necessary calculations for size analysis and development of the changes in equity and the global result. Table 1 shows the dynamics of global result and equity between 2011 and 2016.

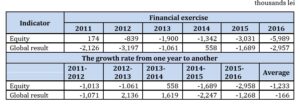

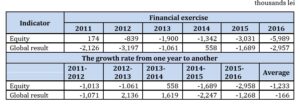

Table 1: The dynamics of global result and equity for Armatura S.A. in the period of 2011-2016

Source: Autor´s own processing based on data published on www.mfinante.ro

As shown in Table 1, equity values are negative in the period of 2012 – 2016, unlike the global result which records negative values between 2011 and 2013, respectively between 2015 and 2016 and only in 2014 a positive value was recorded. Thus, 2014 is the year that the company registered profit and performance, in terms of recordingthe global result indicator.

In 2011, equity recorded value of 174 thousands lei, which are of interest to investors companies. But if we analyze the value of global result in 2011, we find that the performance of the company is quite low.

However, the dynamic is a tendency to reduce its own financing sources heritage: during 2016, the equity decreased by 2,958 thousands lei compared to 2015, and by 1,689 thousands lei in 2015 compared to 2014. Regarding the dynamics of global result, it decreased by 1,268 thousands lei in 2016 compared to 2015, and by 2,247 thousands lei in 2015 compared to 2014. Between 2011 and 2016, the average decrease of equity was -1.233 thousands lei, while in the case of global result, the average decrease was only -166 thousands lei.

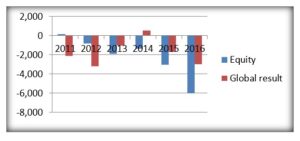

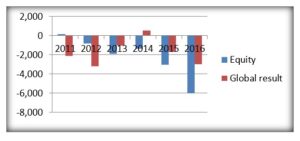

Graphically, the development of equity and global result in the period of 2011 – 2016, for Armatura S.A. company is shown in Figure 1.

Figure 1: The evolution of equity and global result for Armatura S.A. in the period of 2011 – 2016

Source: Autor´s own processing based on data published on www.mfinante.ro

As can be seen from Figure 1, equity´s curve evolution does not correspond to the evolution of the global result as an instrument for assessing the company´s performance. For example, in 2011, equity has the highest value, unlike the global result which has the highest value in 2014, when the company obtained profit. However, in 2014 compared to 2013, there is a tendency to increase the equity by 558 thousands lei and the global result by 1,619 thousands lei.

It is noted that a causal link can not be established between the global result and company´s equity. Thus, if we appreciate the company’s performance in terms of equity, we see that the highest level of the performance was recorded in 2011 and the lowest in 2016. If we analyze the company’s performance in terms of global result, we find that the highest level of the performance was recorded in 2014 and the lowest in 2012.

The causes of changes in equity at Armatura S.A. company may have an external character (shareholders investment, attracting subsidies etc.) or internal (reinvestment of profits obtained). În ceea ce privește rezultatul global, dinamica acestuia poate fi influențată atât de variația capitalului propriu cât și de politicile contabile adoptate, de corecția erorilor fundamentale și de alte elemente aferente rezultatului global. Regarding the global result, its dynamics can be influenced both by the change in equity and the accounting policies adopted, the correction of fundamental errors and other elements of the global result.

So, for a fair and complete assessment of the company´s performance, a great importance has not only be paid to create equity but also to the efficient use of it. However, the efficient use of the capital helps to increase the global performance of the company reflected on the basis of global result.

In conclusion, according to the information of the study conducted between 2011 and 2016, the first research hypothesis according to which an increase of the global result causes an increase of equity is invalidated.

Changes in equity and of turnover at the level of Armatura S.A. company in the period of 2011-2016

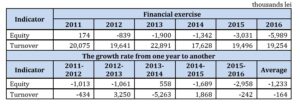

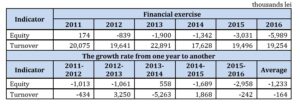

The dynamics of turnover and equity at the level of Armatura S.A. company in the period of 2011-2016 is shown in Table 2. It is noted that the highest value of equity is recorded in 2011 and the lowest in 2016. The evolution of turnover is not similar to the evolution of equity, whereas the highest value of turnover was registered in 2013 and the lowest in 2014.

Table 2: The dynamics of turnover and equity for Armatura S.A. in the period of 2011-2016

Source: Autor´s own processing based on data published on www.mfinante.ro

By analysing the information shown in Table 2, the results show that the turnover recorded the highest value in 2013, respectively 22,891 thousands lei and the lowest value in 2014, respectively 17,628 thousands lei. In the period of 2011-2012 and of 2015-2016, the turnover recorded approximately equal values, with no major fluctuations.

Unlike turnover, equity recorded the highest value in 2011, respectively 174 thousands lei and the lowest value in 2016, respectively -5,989 thousands lei. So, in terms of turnover, the company has the highest level of performance in 2013, while in terms of equity, the company achieved the highest level of performance in 2011.

In terms of growth from one year to another in turnover and equity, it is noted that between 2011 and 2016, equity has registred an average decrease of -1,233 thousands lei, while the turnover has registred an average decrease of -164 thousands lei. Therefore, the change in equity was not affected by the dynamics of turnover in the period of 2011-2016.

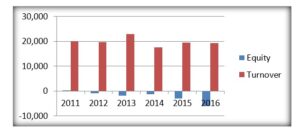

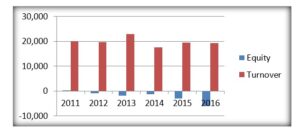

Graphically, the evolution of turnover and equity between 2011 and 2016 is presented in Figure 2.

Figure 2: The evolution of equity and turnover for Armatura S.A. in the period of 2011 – 2016

Source: Autor´s own processing based on data published on www.mfinante.ro

The analysis emphasises that the development of equity does not influence the dynamics of the company´s turnover. Thus, the increase in turnover does not imply an increase in equity and vice versa, whereas the period which has the highest turnover value did not record the highest value of equity. Under these circumstances, we can say that an increase of company´s turnover does not imply an increase of equity from investors who are interested.

Therefore, the increase of the turnover does not imply an increase in the company’s financial capacity to provide the necessary resources to investors. For a better assessment of the company´s performance, the dynamic analysis of equity and turnover is recommended. The company’s ability to generate surpluses to cover invested capital involves a correlation between the turnover and the necessary costs for achieving sales in order to obtain adequate profit margins. Therefore, an increase in profit shows an efficient operation in terms of recovery of invested capital for their activities. According to the results of the research carried out, the second assumption of the research has been validated. Therefore, an increase in turnover do not cause an increase in equity.

Conclusions

Following the case study conducted at the level of Armatura S.A. company, the influence of the equity on the global result,on the annual turnover w, and on the assessment of the company’s performance analyzed. In dynamics, between 2011 and 2016, a tendency was shown to reduce its own financing sources of assets, turnover and global result. In the period under review, equity was reduced by an average of -1,233 thousands lei, while in the case of global result and turnover, the average reduction was only of -166 thousands lei, respectively -164 thousands lei.

The results of the study carried out tested two research hypotheses and were starting points for further researchs. The first research hypothesis has been invalidated according to the results obtained from the research. Thus, it may be observed that the increase of the global result does not involve the increase of equity. The company’s performance can not be assessed only in terms of equity as they do not provide sufficient information to the assessment of the company´s true financial position at the financial year-end. Users of financial-accounting information could be improperly influenced in decision-making based on the incorrect assessment of the company´s performance. The assessment of the company´s performance based only on one of the two financial indicators would determine, in certain circumstances, the appearence of many errors in managerial decisions.

The second research hypothesis was validated according to the information provided from the case study conducted. Therefore, the increase of turnover does not imply the increase of equity. So the company’s investors can see, at a certain time, that the company’s revenue increased but the equity decreased. Considering the correlation between the turnover and equity for the case study, it is found that the company’s performance is assessed differently based on these indicators.

As a general conclusion, we consider that from the analysis and interpretation of results provided by the case study, we can conclude that the equity´s level significantly influences the assessment of the company’s performance. To increase the performance of the Armatura S.A. company, we recommend changing accounting policies in order to improve sales and increase the profit margins, which will lead to the increase of equity.

As the limit of this research, we can mention the impossibility to determine the performance of companies only based on equity, which are influenced by economic and legislative changes made at national level.

Future researches shall take into account the extension of the research across multiple sectors in Romania for a more accurate determination of the equity´s influence on the assessment of the performance of companies.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Achim, M.V. and Borlea, S.N. (2012), ‘Analiza financiară a entităţii economice,’ Editura Risoprint, Cluj Napoca.

- Anghel, I. and Man, M. (2016), ‘Stock performance analysis of listed entities at the Bucharest Stock Exchange. Case study on the energy and related utilities sector companies,’Annals of University of Craiova – Economic Sciences Series, 1 (44), 147-159.

- Arafat M. Y., Warokka A. and Suryasaputra R. (2014), ‘Capital Structure and Investment Decision: What Does Emerging Consumer Goods Industry Tell Us?,‘ IBIMA Publishing, Journal of Financial Studies and Research, Vol. 2014 (2014), Article ID 220243. [Online], [Retrieved February 20, 2018], https://ibimapublishing.org/articles/JFSR/2014/220243/220243.pdf.

- Balteș, N. and Ciuhureanu, A.T. (2015), ‘Contabilitate financiară,’ Editura Universității „Lucian Blaga”, Sibiu.

- Bebchuk, L.A. and Fried, J.M. (2003), ‘Executive compensation as an agency problem, ‘Journal of Economic Perspectives, 17 (3), 71-92.

- Bistrova J. and Lace N. (2012), ‘Defining Key Factors to Sustain Maximum Shareholder Value,‘ IBIMA Publishing,Journal of Financial Studies and Research, Vol. 2012 (2012), Article ID 391928. [Online], [Retrieved February 25, 2018],https://ibimapublishing.org/articles/JFSR/2012/391928/391928.pdf.

- Buglea, A. and Lala-Popa, I. (2009), ‘Analiză economico-financiară,‘ Editura Mirton, Timișoara.

- Breban, L. (2017), ‘IFRS pentru întreprinderi mici și mijlocii,’Revista CECCAR Business Magazine, 1, Ianuarie 2017, Editura CECCAR, București.

- Hada, T., Cioca, C. I., Avram, M. T. and Dumitrescu, I. D. (2014), ‘Management financiar, ‘ Editura Aeternitas, Alba Iulia.

- Jianu, I. (2007), ‘Evaluarea, prezentarea și analiza performanței întreprinderii – O abordare prin prisma Standardelor Internaționale de Raportare Financiară,‘ Editura CECCAR, București.

- Lawrence, H. (2016), ‘Turnover-Adjusted Momentum and Equity Returns,‘ SSRN Electronic Journal, [Online], [Retrieved February 26, 2018], http://ssrn.com/abstract=2758670.

- Man, M. and Ciurea, M. (2016), ‘Transparency of accounting information in achieving good corporate governance. Trueviewand fair value,‘Social Sciences and Education Research Review, 3 (1), 41-62.

- Renneboog, L., Ter Horst, J. and Zhang, C. H. (2008), ‘Socially Responsible Investments: Institutional Aspects, Performance, and Investor Behavior, ‘Journal of Banking & Finance, 32 (9), 1723-1742.

- Sofrankova B., Horvathova J., Kiselakova D. and Matkova S. (2017), ‘Identification of Key Performance Indicators with the Application of Mathematical and Statistical Methods,‘ IBIMA Publishing, Journal of Financial Studies and Research, Vol. 2017(2017), Article ID 403204. [Online], [Retrieved February 26, 2018],https://ibimapublishing.org/articles/JFSR/2017/403204/403204.pdf.

- Consiliul pentru Standarde Internaționale de Contabilitate IASB. (2015), Standarde Internaționale de Raportare Financiară (IFRS). Norme oficiale emise la 1 ianuarie 2015, traducere, Editura CECCAR, București.

- Ordinului Ministrului Finanțelor Publice nr. 881/2012 privind aplicarea de către societățile comerciale ale căror valori mobiliare sunt admise la tranzacționare pe o piață reglementată a Standardelor Internaționale de Raportare Financiară, publicat în Monitorul Oficial, Partea I, nr. 424 din 26 iunie 2012.

- Ordinului Ministrului Finanțelor Publice nr. 1286/2012 pentru aprobarea Reglementarilor contabile conforme cu Standardele Internaționale de raportare financiară, aplicabile societăților comerciale ale căror valori mobiliare sunt admise la tranzacționare pe o piață reglementată, publicat în Monitorul Oficial nr. 687 din 4 octombrie 2012.

- Ordinul Ministrului Finanțelor Publice nr. 1.802/2014 pentru aprobarea Reglementărilor contabile privind situațiile financiare anuale individuale și situațiile financiare consolidate, publicat în Monitorul Oficial nr. 963/30.12.2014, cu modificările și completările ulterioare.

- mfinante.ro.

- armatura.ro.

- bnr.ro.