Introduction

At present, there are still many uncertainties about the pandemic caused by the SARS-CoV-2 virus: the true extent of its spread, the duration of outbreaks, its contagious nature and whether there will be a solution to combat it in the future. One thing is certain: the economic impact of this pandemic is one of the worst economic crises in world history.

The slowdown in the growth of the economies of states around the world has been indirectly affected by the COVID-19 pandemic through government measures to control it, ranging from a simple restriction on movement from one region to another to a complete lockdown, which stopped the activity of many economic agents. Thus, the emergence of a deadly combination of collapsing supply and demand has contributed substantially to the economic decline of the Romanian state.

The inflationary phenomenon, the lack of basic necessities, the reduction of the trade flow, are therefore due to the factors generated by the consequences of the COVID-19 pandemic, among which are: increases in raw material prices and international transport costs; tightening the conditions for carrying out economic activities; highlighting a large current account deficit and accelerating the increase in indebtedness of states.

For many economic societies, the SARS-CoV-2 pandemic can be classified into two categories: an economic crisis or an opportunity for favorable financial results. For this reason, this paper aims to investigate the impact of the COVID 19 pandemic on the financial results of authorized intermediaries on the Bucharest Stock Exchange (BVB) regulated market. The practical significance and relevance of the paper is due to the role played by the pandemic on the financial results of licensed brokers whose core business income is directly correlated with a volatile environment (in most cases, the fluctuation of the price of financial instruments on the stock market).

Development of research hypotheses

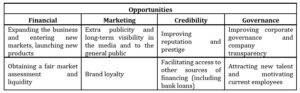

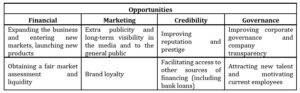

The listing of a company in a regulated stock market is becoming more and more attractive mainly for a sustainable development of the activity. With the decision to trade the shares, the company can take advantage of the following opportunities offered by the stock exchange:

Table 1: The benefits of listing companies in a stock market according to the BVB Financing Guide (2022)

An important aspect to mention in the process of listing companies is the fact that there is a possibility for investors to become customers, and to the same extent, loyal customers to start investing in the given business. Therefore, both the listed aspects, the listing of companies and the making of investments by legal entities and individuals in the BVB stock market, are carried out and coordinated by the intermediary companies authorized by the regulatory body. At present, the access of individuals and legal entities to the trading platform has become easier due to the technologies used. To make an investment in BVB, you only need to create an account with an authorized broker. In accordance with Goldring broker regulations (2022), the procedure requires certain conditions to be met:

- Minimum age of 18 years;

- Owning a device with Internet access;

- Copy of ID card;

- Copy to a personal bank account statement;

- Minimum amount of BVB account opening: 5,000 RON, foreign markets account: 2,000 EUR”

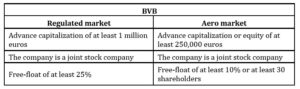

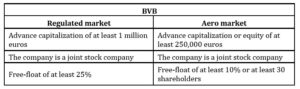

Companies wishing to be listed on one of the capital markets must comply with the following requirements imposed by the Bucharest Stock Exchange (2021):

Table 2: Conditions for listing companies on the BVB stock market

The listing of companies is mediated directly by the brokers authorized by the BVB market regulator. According to the rules of listing a company on the Stock Exchange presented by the broker Goldring (2022), an intermediary must ensure that his client has taken all the correct steps to launch an Initial Public Offering (IPO):

- Shareholders’ decision to start the IPO with all the characteristics of the share issue;

- If the customer is not a joint stock company, the legal form must be changed;

- Obtaining a positive opinion on the launch of an IPO from the Financial Supervisory Authority (FSA);

- Registration of shares with the Central Depository.

Typically, the core business of a stockbroker is structured in two business directions, namely the brokerage segment and the trading segment. In the management segment of its own portfolio, the company operates transactions on its own account, market-making operations and operations with structured products, and in the intermediation segment, the company operates customer transactions and corporate operations.

In turn, the activity of financial intermediation constitutes all the services of intermediation of the operations offered to individuals and legal entities, as well as to institutional clients. Brokerage services may include the following:

Fig. 1: Services provided by brokerage firms

Fig. 1: Services provided by brokerage firms

According to the accounting regulations, the revenues that make up the turnover of a brokerage firm are those that come from brokerage and fund management fees, corporate services and other related brokerage services. As we can see, the turnover is largely formed on a volatile basis, respectively on trading fees that depend on the variation of the prices of financial instruments on the stock exchange and the activity of investors expressed by the number of transactions performed. For this reason, for such companies there may be an inadequate budgeting of the necessary resources and investment needs to be achieved, being affected by a high degree of difficulty in making forecasts such as: a possible crisis or growth, pandemic, volume of processed transactions, etc.

Data and sample

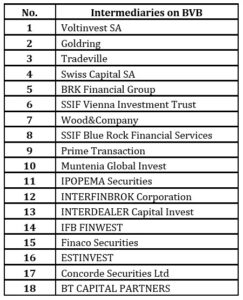

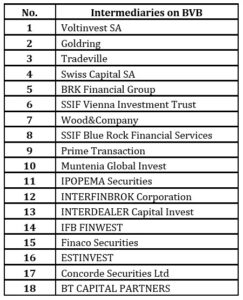

Therefore, for conducting this study, a sample of 18 intermediary companies authorized on the regulated market of the Bucharest Stock Exchange was used. The financial results have been extracted from the annual reports prepared by each financial investment services company or credit institution and cover a time interval of three financial years (2018, 2019 and 2020). Thus, the structure of the commercial entities analyzed in this article is presented in table no.2.

Table 3: Structure of the studied sample

The impact of the COVID-19 lockdown on the revenues of authorized intermediaries on the Bucharest Stock Exchange

The year 2020 was an atypical one for all capital markets, largely characterized by the COVID-19 pandemic, which contributed to one of the most severe economic and health crises in human history.

The first manifestations of the pandemic on the regulated market BVB appeared at the end of February 2020. According to the BVB graphic data, between 21-27 February 2020, the rumors about the rapid spread of the virus and the appearance of restrictions on economic activity, negatively influenced the market evolution, respectively with a loss of 2.9 billion euros of the total capitalization value.

According to a study conducted by economists from PwC Romania (2020), it shows that the Romanian regulated market BVB “lost 34% or 13 billion euros in capitalization in the first three months of 2020, since the news about the new coronavirus appeared, a decline that exceeded the increase of 23.4% registered in 2019.”

The context created by COVID-19 had a direct impact on changing the investment strategies of both individuals and legal entities. Using the comparative analysis of the evolutions of the representative stock index on the Romanian market-(BET) and the number of active investors, we notice that these two indicators were directly influenced by the trend of the number of COVID-19 cases registered in Romania.

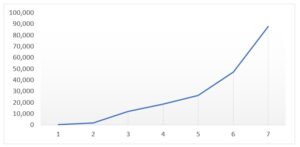

Fig. 2: Evolution of number of COVID-19 cases at the beginning of 2020

The rapid spread of the SARS-CoV-2 virus has led government authorities to introduce specific measures to combat it. Therefore, one of the first actions taken by the state was to issue a state of alert on March 15, followed by a state of emergency 10 days later due to a large explosion of infected people. For the majority of investors on the local BVB stock exchange, the imposition of such restrictions was an alarm signal regarding the continuity of the activity of the companies in which they invested and their personal financial returns. The deterioration in the level of confidence in the financial instruments held has led to a large number of investors withdrawing their cash investments and discontinuing operations.

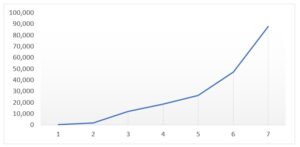

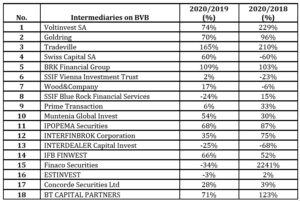

Fig. 3: Evolution of number of investors between 2015-2021 on the Bucharest Stock Exchange based on the information provided by the Investor Compensation Fund

According to Fig no.3, we note that with the onset of the COVID-19 pandemic in Romania, the Bucharest Stock Exchange registered the lowest number of active investors registered over an analyzed period of five years (2015-September 2021). Thus, the withdrawal of the capital from the stock market determined the reduction of the capitalization of the traded companies by 34% in a period of three months from the declaration of the state of alert.

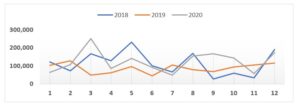

Fig. 4: Evolution of the BET index between 2017- december 2021 (BVB,2022)

All the indicators analyzed – the BET index, the number of investors and the evolution of the COVID-19 virus had a major influence on the financial results of the financial investment services company and investment firm authorized on BVB (SIFFs). As mentioned earlier, the pandemic for most companies has proved to be an opportunity or a financial crisis. These classifications also apply to stockbrokers.

Therefore, in order to determine the impact of the pandemic on the financial results, only the revenues related to the turnover based on the intermediation segment and the trading segment were analyzed without including the revenues from the administration of its own portfolio of financial assets. The financial year 2020 was also chosen as the reference year due to severe restrictions and an unprecedented year for the world’s population.

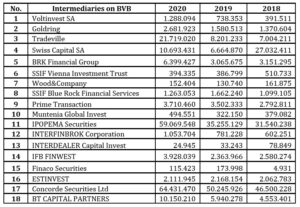

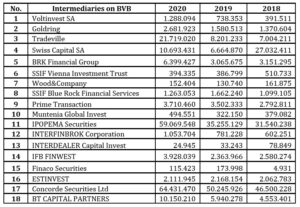

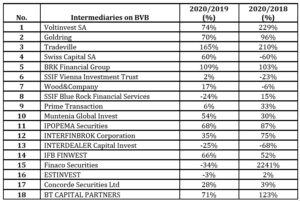

Table 4: Evolution of turnover of SIFFs authorized on BVB (RON)

For most of the companies analyzed, the financial year 2020, characterized by the health and financial crisis, proved to be one of the most profitable. Therefore, the largest percentage increase in turnover was recorded by BRK Financial Group (109%), Tradeville (165%) and BT Capital Partners (71%):

Table 5: Evolution of turnover of SIFFs authorized on BVB (%)

The factorial analysis of the upward evolution of the incomes related to the basic activities presents the following factors that contributed to the registration of such results:

The quantitative and value increase of the transactions performed within the Bucharest Stock Exchange

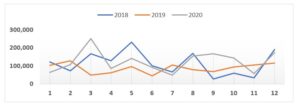

The numerical aspect of the transactions carried out on the BVB market directly influences the income from commissions charged for the intermediation of capital operations. The year 2020 is characterized by a volume of transactions above the forecasts of financial analysts. According to Chart no. 4, the COVID-19 virus determined a higher number of transactions by 42% compared to 2019 and 8% compared to 2018, respectively.

Fig. 5: Numerical evolution of transactions on BVB

The massive withdrawal of invested capital after the declaration of the state of emergency and after the increase of the stock market attractiveness through favorable financial returns with the publication of the financial statements of the listed companies, contributed to an atypical increase for SIFF revenues. Therefore, the appreciation of the BET index and a large volume of intermediated transactions was reflected in the collection of considerable commissions based on the variable share (%) of the value of financial instruments and fixed rate per operation.

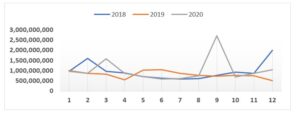

Fig. 6: Value evolution of transactions on BVB (RON)

Listing of new shares and bonds on BVB

Implications of the COVID-19 pandemic by imposing restrictions on economic activity has led many companies to focus on obtaining funding resources on the BVB market. During 2020, “within the Romanian stock market, 17 bond issues with a value of over 1.1 billion euros were carried out, carried out by both entrepreneurial companies and the Romanian State, through the Ministry of Public Finance.” (Gutu,2021)

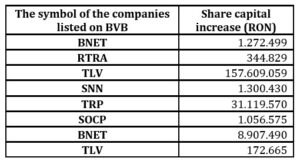

Increasing the share capital of listed companies

Many companies listed on the Bucharest Stock Exchange have resorted to an increase in share capital to remunerate shareholders but also to increase the attractiveness of the image towards potential investors. Such transactions were brokered by SIFFs, generating a substantial increase in corporate revenues. During 2020, the share capital increases registered a value of 201,783,116 RON:

Table 6 :Share capital increases in the Romanian stock market (BVB,2020)

Increasing the number of investors

The historical increase in the number of investors on the BVB market, according to chart no. 2, due to the attractive financial returns, was directly reflected on the revenues from the administration fees. Respectively, a larger number of investors determined the increase of the volume of transactions and of the stock market capitalization on the basis of which the intermediation revenues are based (fixed share / transaction + variable share / transaction value):

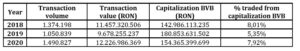

Table 7: Stock indicators (BVB,2020)

Conclusions

The analysis of the information and data presented in the study allowed me to formulate the following conclusions:

- The study followed the evolution of turnover in the context of the pandemic created by the Sars-Cov-2 virus. Thus, based on the sample studied by 18 companies, it was found that in the atypical financial year for the entire national economy, there was an increase in revenues related to the turnover of intermediaries authorized on BVB by an average of 41% compared to the reference financial year 2019 and by 177% compared to 2018;

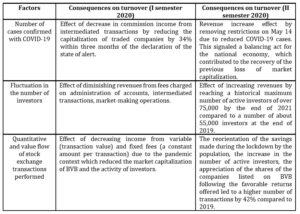

- It is confirmed that a high volatility of the turnover of intermediaries on BVB was directly influenced by the COVID-19 pandemic by the determining factors such as:

Table 8: Effects of determinants on the turnover of intermediaries in the context of COVID-19

References

- Bucharest Stock Exchange, (2022), “Benefits of Listing on the Stock Exchange”, [Online], [Retrieved January 3, 2022], https://m.bvb.ro/ForCompanies/WhyBvb/ListingBenefits;

- Bucharest Stock Exchange, (2022), “Finance your company through the Bucharest Stock Exchange”, [Online], [Retrieved January 5, 2022], https://bvb.ro/info/Rapoarte/Ghiduri/BVB_brosura_Finanteaza-ti_compania_211109.pdf;

- Bucharest Stock Exchange, (2022), “Guide: Fluent in finance”, [Online], [Retrieved January 5, 2022], https://www.bvb.ro/info/Rapoarte/Ghiduri/Ghid%20Fluent%20in%20Finante%202017.pdf;

- Bucharest Stock Exchange, (2022), “Investing România”, [Online], [Retrieved January 6, 2022], https://bvb.ro/info/Rapoarte/Ghiduri/ghid%20membri%20RO%20web.pdf;

- Bucharest Stock Exchange, (2022), “Index profiles”, [Online], [Retrieved January 6, 2022], https://bvb.ro/FinancialInstruments/Indices/IndicesProfiles.aspx?i=BET;

- Bucharest Stock Exchange, (2022), “Statistical reports”, [Online], [Retrieved January 6, 2022], https://bvb.ro/TradingAndStatistics/Statistics/MarketEvolution;

- Goldring, (2022), “Brokerage fees”, [Online], [Retrieved January 2, 2022], https://www.goldring.ro/comisioane/;

- Goldring, (2022), “The stages of listing companies at BVB”, [Online], [Retrieved January 2, 2022], https://www.goldring.ro/wp-content/uploads/2021/10/Etapele-listarii-la-Bursa-de-Valori-Bucuresti-1.pdf;

- Gutu A., “BVB in 2020”, Journal Forbes Romania. [Online], [Retrieved January 2, 2022], https://www.forbes.ro/bvb-17-emisiuni-de-obligatiuni-cu-o-valoare-de-peste-11-miliarde-de-euro-au-fost-listate-2020-si-altele-circa-20-sunt-programate-pentru-2021-203769;

- Iacomi A., “The evolution of the number of investors on the Bucharest Stock Exchange”, Journal Bursa. [Online], [Retrieved January 2, 2022], https://www.bursa.ro/tot-mai-multi-investitori-vin-catre-bvb-48768447;

- Ministry of Internal Affairs, (2020), “Evolution of the number of COVID-19 cases”, [Online], [Retrieved January 3, 2022], https://www.mai.gov.ro/informare-covid-19-grupul-de-comunicare-strategica;

- Petre S. and Gutu I., (2020), “The influence of the COVID-19 pandemic on the BVB market”, PwC Romania. [Online], [Retrieved January 3, 2022], https://www.pwc.ro/ro/media/press-release-2020/studiu-pwc-romania–bvb-a-pierdut-de-la-inceputul-anului-34–din.html.