Introduction

Financial market integration is fundamental for the well-being of economies and, implicitly, to financial stability. Monetary authorities encourage an increase in the degree of integration by promoting regulations and standards recognized by financial markets.

Arguments that motivate the choice of topic consist in the importance of ensuring and maintaining financial stability in the conditions in which the financial markets are growing. The need for integration helps collaboration and economic development, but it also generates risks.Economic development is supported by FinTech innovation, but this may be a trigger for financial stability.

The purpose of this research is to capture the degree of financial intermediation, and, implicitly digitization, based on a survey from about 140 economies. The importance of the study consists in the analysis of the indicator the Global Findex Index, that measures the use of financial services every 3 years, starting in 2011, using a Vector Autoregressive model. The main objective of the paper is to capture the influence of digitization, as an effect of integrated financial markets, on financial stability. As intermediate objectives, I considered both the analysis of the benefits and risks of financial intermediation development, as well as the impact on the well-being of the economy.

The paper is structured in five parts. The first two parts capture the importance, benefits and risks, associated with the integration of financial markets, on financial stability, because artificial intelligence has become a very common fact nowadays. The impact of information technology on the balance sheet of credit institutions may have both positive, considering a high trend of performance, and negative aspects, taking into account the risks to which it may be exposed. The specialized literature does not contain many studies that capture a concrete framework of this phenomenon.

My own contributions consist in the next three parts, that aim to capture the effects of digitization as a competitive factor on integrated markets, as well as the way technology information influences bank performance and risks. At the same time, the risks to which banks may be exposed also exert effects on the soundness of the financial system, which the supervisors need to be careful about. The originality of the study consists in capturing the effects of random shocks on the financial intermediation indicators, using a vector autoregressive model.

Consequently, fintech innovation, influenced by macroeconomic conditions as an effect of the development and integration of financial markets, is a challenge for financial stability.

Financial Markets Integration – Benefits and Riskson Financial Stability

Financial integration is a process that involves a closer interaction between global economies and people. The degree of integration of financial markets around the world has increased greatly in recent decades. Underlying this process was the phenomenon of globalization and the opportunity to diversify risk. Many countries have encouraged the mobility of financial flows, ensuring the development of a border economic framework.

Developed and emerging economies in Eastern Europe, Latin America and East Asia, have lifted restrictions by encouraging international transactions, as well as new ways to facilitate them. In this sense, financial services have known a new era in their development, namely, fintech innovation. Nowadays, digitization is one of the most important actors with a role in financial markets integration. It can be seen both as a benefit and as a risk to financial stability. Financial technology (Fintech) describes new tech and seeks to improve financial services. Thus, financial intermediation is based on artificial intelligence and, implicitly, digitization.

Benefits and Risks

FinTech can be seen, on the one hand, as a benefit, in terms of facilitating transactions and reducing the time used to complete them etc. On the other hand, the risks that may arise from the implementation of this innovation refer to cyber attacks, lack of customer privacy, etc.

Financial openness captures a number of benefits of financial markets integration, such as: domestic investment, consumption smoothing, macroeconomic discipline, increased banking system efficiency and financial stability (AgEnor, 2003). Potential risks refer to: the very degree of concentration, which cause a lack of access to capital flows, losses of macroeconomic stability, the contagion effect, the risk of new banks entering the market etc. In other words, foreign bank penetration helps to improve and develop financial services by increasing competition. But, on the other hand, this fact may also generate risks by creating more advanced risk management systems (Caprio and Honohn, 1999).

Some risks are related to informational asymmetry, effect of financial markets integration. So, there are some market participants that may have acces to information in a shorter time than others. Moreover, the pro-cyclicality effect generates macroeconomic instability, as positive market rumors encourage consumption and spending at an unsustainable level for the economy in the long run. Chang and Velasco (2000) argue that a high level of short-term debt negatively affects international reserves, creating a major risk to the economy. Another risk consists in the contagion effect of the financial markets, which develops in direct proportion to the volatility of the markets and to the degree of their integration.

Financial market integration mobilizes the financial resources between the holders of money availability and those who need capital, ensures the mobility of capital flows, indicates the state of the economy and maintains the development of financial markets in order to increase financial intermediation, helps to diversify the risk.

The benefits of the integration process as: ensures financing of economies (banks, companies, especially SMEs, capital markets), eliminates barriers to cross-border activities and, consequently, reduces costs, are based on a rigorous legislation. EU initiatives to remove cross-border barriers can be found in legislative acts such as: EU Banking Directives (1977, 1988), the Financial Services Action Plan (1999), the White Paper (2005), which creates a regulatory framework for fair competition.These functions complement the fundamental objective of any central bank of maintaining price stability and ensuring financial stability, by promoting collaboration and financial integration.

Financial Integration and Financial Stability

There is a strong connection between financial integration and financial stability. It is an irreversible and indispensable process for an economy to function properly.Financial integration aims at financial development, considering the complexity and size of the financial system.

The lack of intelligibility in terms of the complexity of a product can lead to the wrong assumption of risks and, implicitly, of the wrong allocation of resources.In terms of size, the more a financial system is very large, the more it can have negative effects on the economy, given that it entails more system-level resources, but also the creation of cyclical effects, regarding the accumulation of non-performing loans.

However, there are some obstacles in financial integration related to legislation, culture, technical elements.Integrated financial markets facilitate the transmission of monetary policy at the level of the member countries, ensuring equal treatment in the application of monetary policy decisions.

Financial stability is supported by a high degree of financial integration (Tumpel-Gugerell, 2010).Financial integration leads to the creation of strong connections between states, which helps the development of the financial system, but which can also leads to risks. Risks from one part of the system can have a domino effect on other areas, through contagion (non-performing loans).

On the other hand, the lack of financial integration does not necessarily mean the complete reduction or elimination of risks and, therefore, would not be a solution. Given the broad links developed at the informational, cultural, social level, cancels the idea of financial isolation of states.

In general, financial development refers to a system of complex financial markets, characterized by innovation, digitizationand organized systems, which promote fair competition, by reducing information asymmetry, to reduce cross-border costs (ECB).Thus, these measures can contribute to economic growth.

The size of the financial sector is an indicator that shows the capacity to allocate resources. Thus, a very large financial system may indicate a misallocation of resources.However, a suitable size of the financial system can contribute to the development of financial markets, helping to a more efficient allocation of resources, thus promoting economic growth.

The interaction between financial markets and institutions can trigger macroeconomic risks. The harmful effects were visible with the onset of the recent financial crisis, which demanded the establishment of a micro and macro-prudential regulatory framework.

Macro-prudential policies contribute to the creation of a safeguard framework in order to ensure financial stability and shock resistance. It is aimed at regulatory and supervisory actions, aimed at reducing risks within the financial market activity.Usually, an integrated market is defined by: equal access and treatment regarding the trading of goods and services, based on a single set of rules (Baele et al., 2004).

Thus, a financial system can be seen as an interaction between financial intermediaries and financial markets (Hartmann, et al., 2003). Financial development is a process of financial innovation, a well-developed infrastructure from an organizational and institutional point of view that promotes fierce, complex and fair competition and, implicitly, a reduction of information asymmetry, with minimum trading costs (ECB, 2016).

The monetary authorities encourage the idea of integration and development of financial intermediation, and, implicitly, of digitization (FinTech), especially in the euro area (ECB, 2023). These elements have a significant impact on the monetary police and on the channels of transmission of the monetary policy and, implicitly, on the financial stability.For example, the Eurosystem promotes maintaining price stability, as a major objective in ensuring financial stability.

Moreover, it supports the development of financial services by promoting the EU Single Market, such as Banking Union (2012), Capital Market Union (2014).

Bank consolidation was an important step in the process of integrating economies. In recent decades, bank mergers and acquisitions in the euro area have registered a moderate value in trends with the evolutions of the EU (ECB, 2020).

Despite the creation of the Banking Union, cross-border consolidation had a low value compared to expectations (Hartmann et al., 2017). Moreover, since 2016, this consolidation has led to a decrease in the level of non-performing loans.

Based on Capital Market Union (CMU) Action Plan in 2015, integrated capital markets have become an important step in the integration of EU economies, by developing access to finance for companies and households.

CMU contributes to economic growth and financial stability by ensuring capital mobility between states, reducing cross-border costs, extending the development of investment projects and encouraging financial integration and competition. By launching this initiative, the European Commission aims to stimulate development and integration of EU capital markets, while also considering measures related to FinTech and sustainable finance.

Digitizationof financial services has many benefits, but with the potential to amplify the financial stability risks. According to the Financial Stability Report (ECB, 2024), the number of retail investors directly involved in the stock markets increased during the pandemic. This fact was associated with the digitization development, by increasing access to stock exchanges, using trading.

Among the benefits, is listed: the risks diversification, as well as the reduction of transaction costs. On the other hand, the associated risks can mainly refer to periods of excessive volatility in the case of shares, such as in the first half of 2021, when individual investors managed transactions through social networks.

Also, the problematic period from March 2023 in the case of the banking sector in the United States accentuated the phenomenon of bank runs, as a result of the interaction intensification of online banking and social networks, causing an unfavorable impact of digitization on financial stability.

Digitization of financial services can have a significant impact on financial markets and banks. The intense interaction of investors on the financial markets is due, in most cases, to digitization, a fact that can generate excessive risk-taking. One of the most eloquent cases of banking activity in the digital era is represented by the situation of the Silicon Valley Bank, as access to money was done, in most cases, remotely, through banking applications and phone calls and not physically, as few depositors were present.

As a result, the monetary authorities should take measures in this sense, in order to have a more prominent control over the phenomenon of bank runs in crisis situations, with major implications also on financial stability.

Finally, the statistics highlighted the benefits of Fintech for the financial system, but also the importance of monitoring the potential risks and impacts on financial stability.

In conclusion, although the strong connection between the global financial markets has led to the development of risks and the creation of imbalances and the transmission of shocks at the level of the economies, the integrated financial markets have been an important step in the process of developing. The advantages, opportunities, but also the challenges and risks that tendencies on financial markets represent for financial stability are not to be neglected.

Fintech Innovation – Effect of Financial Markets Integration

In recent years, the monetary authorities have improved regulation, both nationally and internationally, regarding the resilience of the financial system to shocks. Creating an appropriate regulatory framework for financial services innovations becomes an indispensable element in ensuring financial stability. The proper regulation of payment systems, which contain digitized elements and, implicitly, the trading of virtual currencies, becomes one of the necessary components of the macroprundential framework. Thus, along with the digital finance opportunities, the risks to which the financial system is subjected are not to be neglected.

Among the positive effects, the diversification and decentralization of the system, facilitated by FinTech innovations, helps to mitigate the impact of future shocks. Thus, a wide range of services, products, business models can help increase financial intermediation in terms of financing and investments, generating economic growth and economic well-being.Due to this innovation, financial services can be available to the whole world, having a significant impact especially on economies whose access to financial goods and services is somewhat limited.

The literature abounds in presenting the main features of fintech evolution, but it failed to surprise the critics addressed to the impact of fintech (digital finance) for financial inclusion and financial system stability. In addition to its benefits, there are a number of risks with effects on financial inclusion and financial stability (Peterson, 2018).

The G-20 and World Bank initiative to increase financial inclusion has strengthened since 2010. This is primarily aimed at reducing poverty among the population and, consequently, economic growth (GPFI, 2010). Nowadays, fintech has acquired a more evolved nuance by discovering the multiple benefits that this technology can have. Therefore, digital finance contributes to the improvement of the services addressed to the governments, the business environment, but especially to the economy and the final consumer. Among the benefits, we mention: access to finance for the poor population, reducing the cost of financial intermediation for banks (reducing queues at counters, reducing tonnes of paper, the number of bank branches) and Fintech providers.

Digital finance refers to financial services run through mobile phones, Internet, digital payment system (Manyika, 2016). In Europe, digital platforms have become part of the banking industry, and the Internet is recognized as a distribution channel of fintech (Barbesino, 2005). Financial inclusion aims at framing the poor population among those who use formal financial services (Bruhn and Love, 2014).

Digitization has many benefits, such as: the extension of financial inclusion, respectively of financial services, and the facilitation of delays both for the bank and especially for clients, by reducing the time spent at the counter, or by reducing the time and distance in order to achieve a bank transfer, for example. Moreover, new technologies help reduce the complexity and costs of back-office operations, especially in terms of ensuring an efficient interface between the provider and the beneficiary of financial services.

Also, fintech contributes to securing banking service for the poor population. In other words, financial services help the poor population to exchange cash transactions with digitized transactions on a secure digital platform.

The digitization of financial services contributes to increasing the level of GDP, by providing a wide range of financial services and products, which contributes to business development, and to the private sector in general, with a positive impact on financial intermediation and, implicitly, financial stability. Also, the adoption of artificial intelligence facilitates the application of models by financial institutions and the business environment in order to optimize decision-making processes.

Levine (2000) argues that liberalization of capital flows is closely linked to economic growth, by stimulating the financial accelerator.

Innovation in fintech has a positive effect on banking performance. For example, a study (Scott, 2017) on SWIFT lending to approximately 6,800 banks highlighted the positive impact on small than onlarge banks. Moreover, the application of the advanced methods based on Big Data implies a reduction of search costs with a positive impact on the allocation of capital for institutions, but also for final consumers.

Fintech assists the government by providing a platform to facilitate the increase of aggregate expenses, which generates high taxes on the volume of financial transactions. Digital finance contributes to the individual’s well-being, but also to the business environment that they have available in the bank accounts in order to carry out multiple financial transactions. So, the digitization of financial services supports an adequate management of the financial risk, contributing to ensuring financial stability, both at micro and macroeconomic level. Starting from the final consumer, fintech helps the population in managing the financial risk, especially in terms of facilitating the process of collecting money from people at a relative physical distance (Klapper et al, 2019). Other benefits of financial inclusion are related to time and costs. Thus, digital financial services can reduce the costs of receiving payments.

The obstacles encountered in the development of financial intermediation are due to the low level of education of a people, the culture, the policy of attracting deposits, respectively, granting credits, innovating financial instruments.

Instruments proposed by the authorities for increasing financial inclusion are related to financial education, adequate legislative measures, improving access to finance for SMEs, financial institutions (banks and IFNs).

In the interaction with fiscal and monetary policy, the inclusion and financial stability are mutually reinforcing. Financial inclusion can change the behavior of households in the sense that the efficiency of monetary and fiscal policy can be influenced. Financial stability can be affected by facilitating access to financial resources and, implicitly, granting loans by unregulated institutions. In this respect, the central bank has the role to monitor and control the risks regarding the granting of financing to households, as well as recalibrating the macro-prudential instruments in order to ensure financial stability (FSR, 2023).

Research Design and Methodology

The main objective of this research aims to capture a number of indicators that describe the degree of financial intermediation, and, implicitly, Fintech innovation, as an effect of financial markets integration. The indicators are based on the Global Findex Index, provided by the World Bank. It measures the use of financial services. Access refers to the offer of services, determined by the demand and the offer on the market.

The Global Findex database contains a data set about financial inclusion, regarding savings, loans, payments etc. of adults, which is published every 3 years, since 2011. The data were collected based on a survey;about 150,000 adults from about 140 economies have been surveyed. The year 2017 includes updates of access and use of formal and informal financial services. A series of indicators on the use of financial technology (fintech) are used, taking into account the use of mobile phones and the Internet for financial transactions.

In the research, I started from a database proposed and funded by the Bill & Melinda Gates Foundation. The data were collected in partnership with Gallup, Inc., and are published every 3 years, starting in 2011. I took into account a number of representative indicators, according to Global Findex database for South Asia, Europe & Central Asia, Sub-Saharan Africa, Latin America & Caribbean, East Asia & Pacific, Middle East & North Africa (Table 1). In this regard, I have divided the database into countries with high income and countries excluding high income (Annex 1).

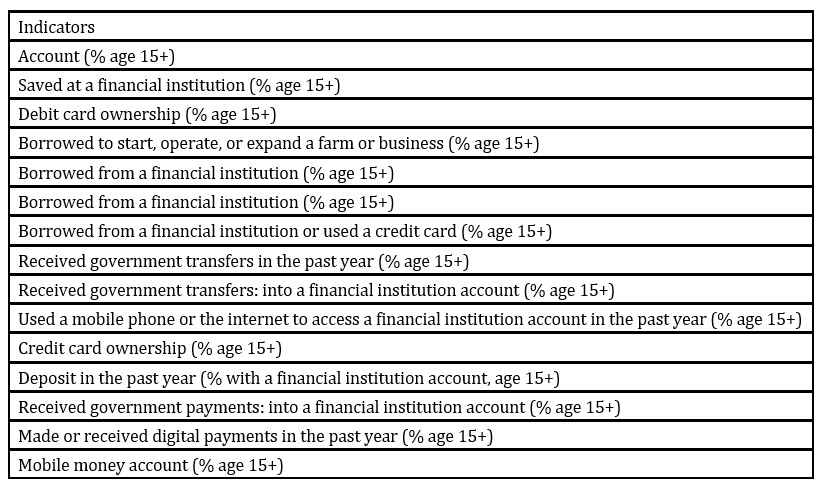

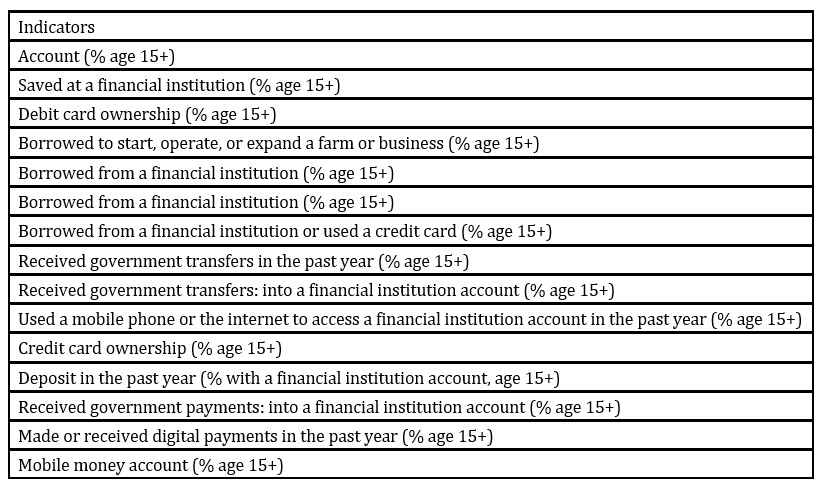

Table 1. Financial inclusion indicators

Source: World Bank

The data were taken from the World Bank and a homogeneous database was created, globally, with the following indicators: Account (%), Savings (%), Debit card ownership (%), Credit to real sector (%), Credit card ownership (%).

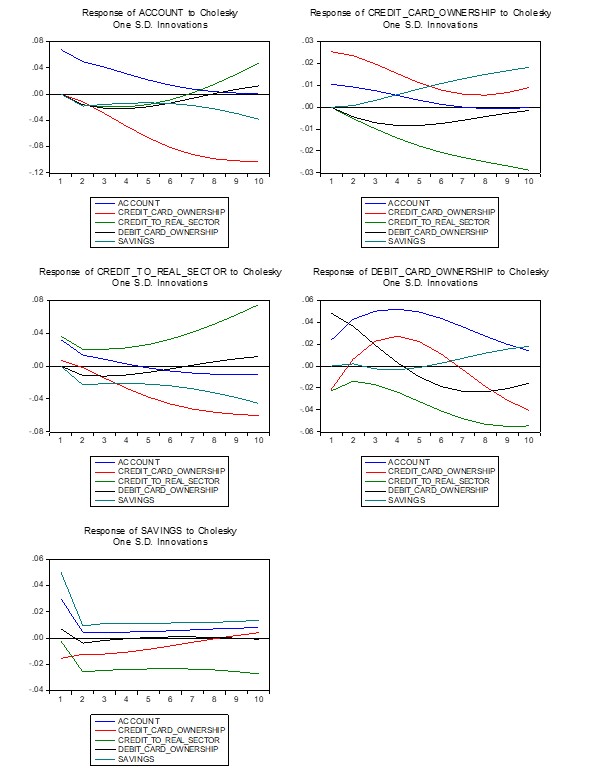

Next, I used the Vector Autoregression model (VAR) to analyze the effects of random shocks on the other variables in the system. The equations in the system use the technique of least squares to estimate the coefficients, and the problem of simultaneity is solved by the appearance of the lag of the explanatory variable among the terms of the regression. To determine the optimal number of lags introduced in the model, we used the informational criteria: Sequential modified LR statistical test (each test at 5% level), Final prediction error, Akaike information criterion, Schwarz information criterion, Hannan-Quinn information criterion (Table 2).

Table 2. Optimal number of lags

Source: author’s estimates using Eviews

Source: author’s estimates using Eviews

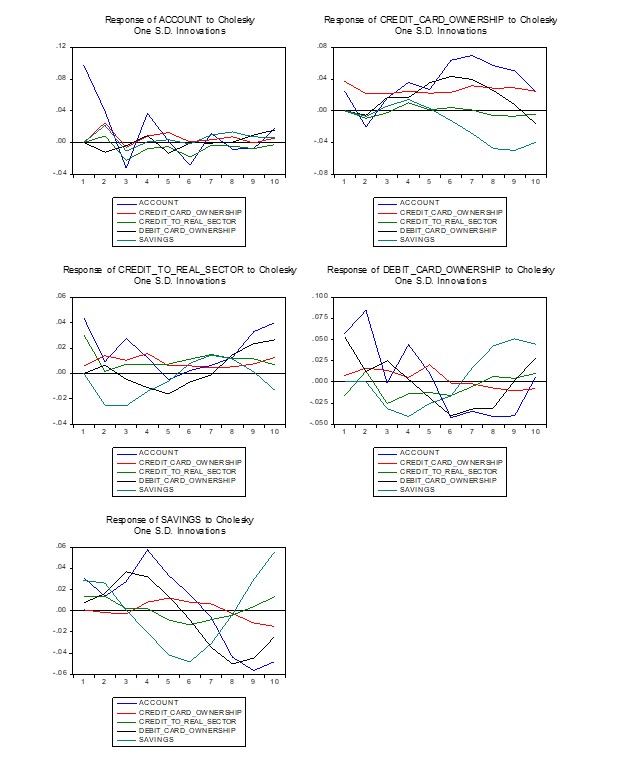

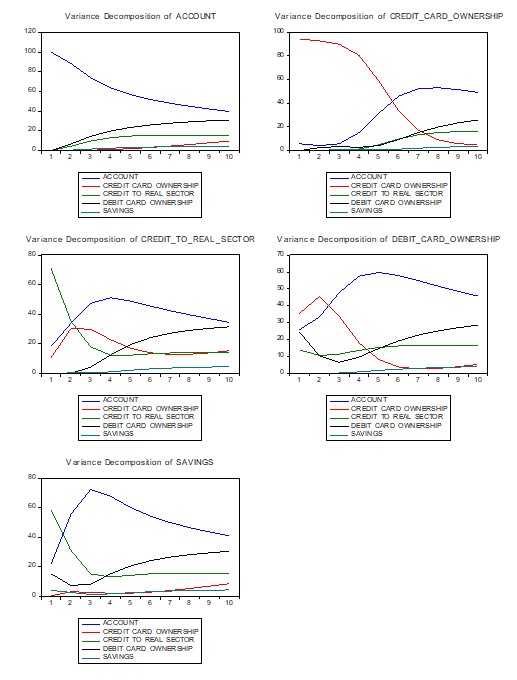

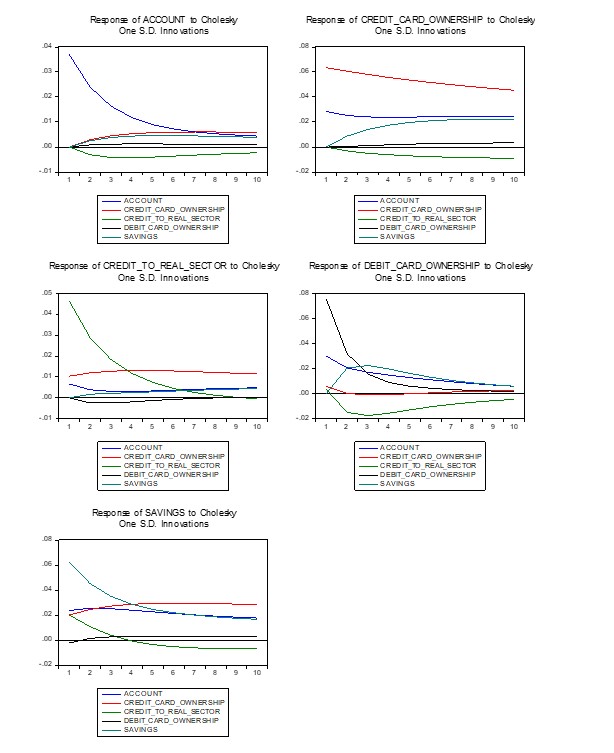

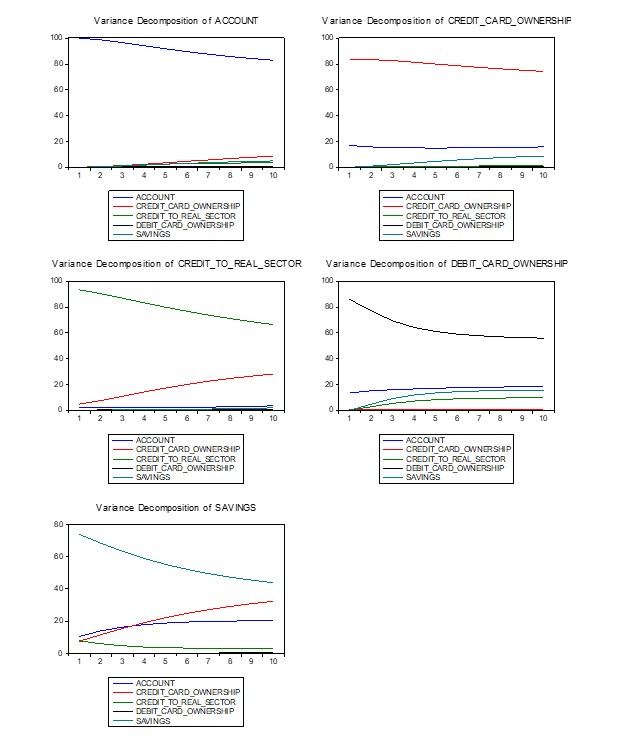

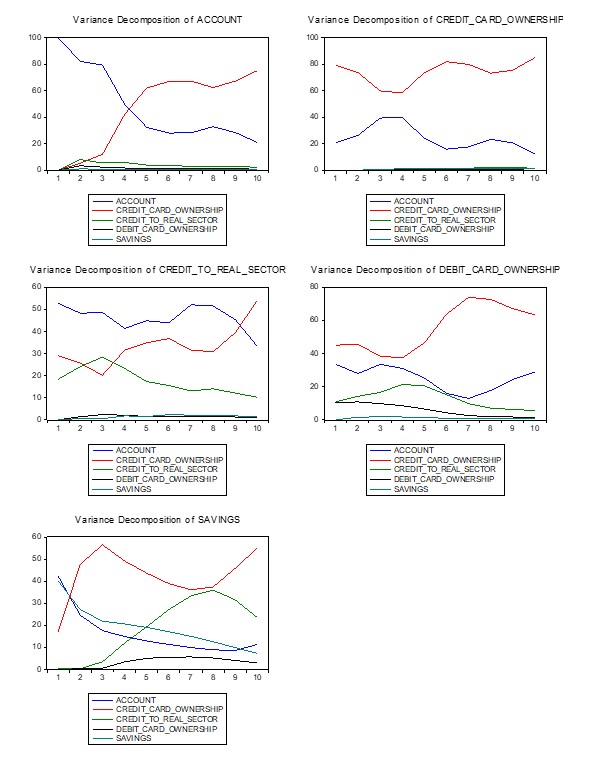

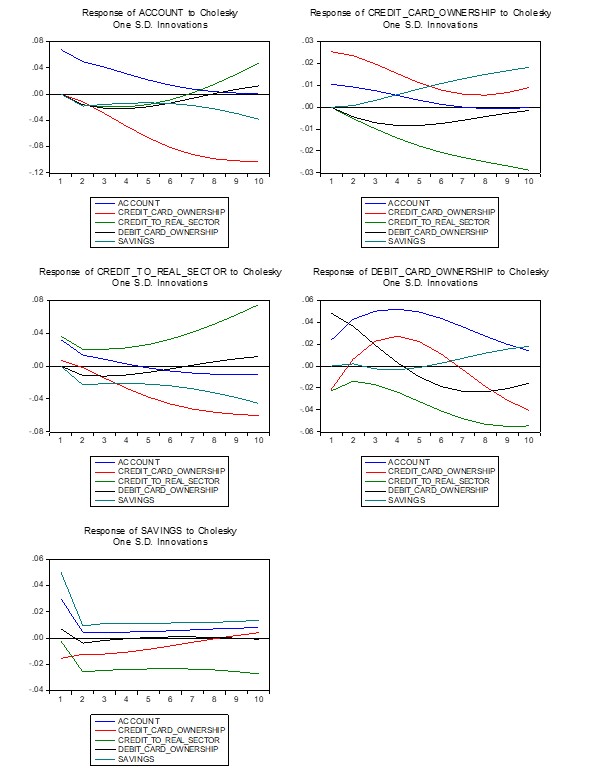

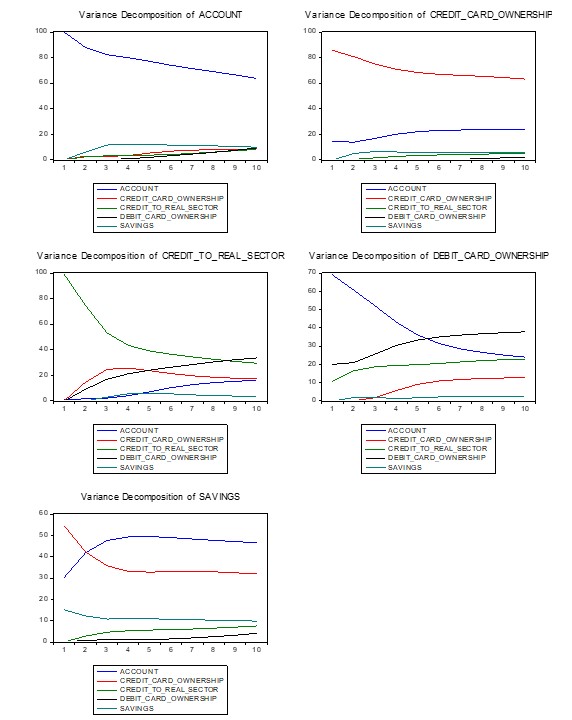

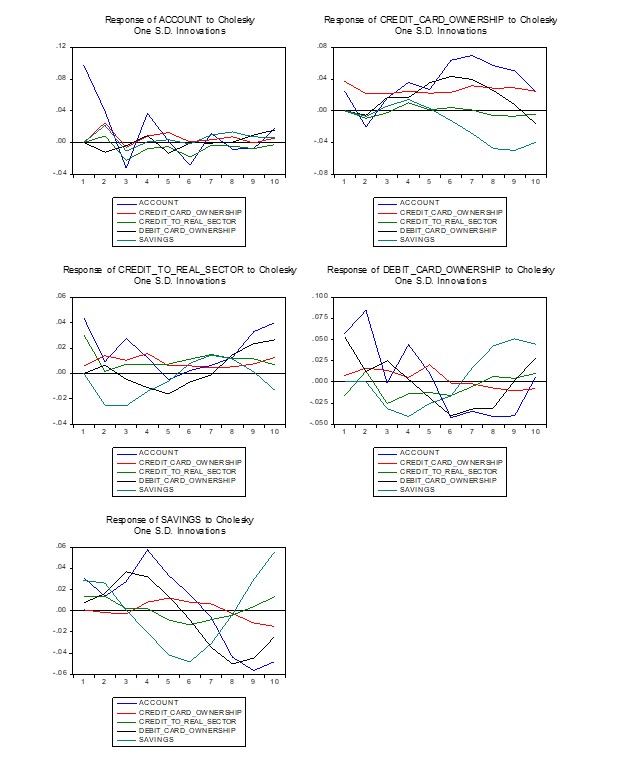

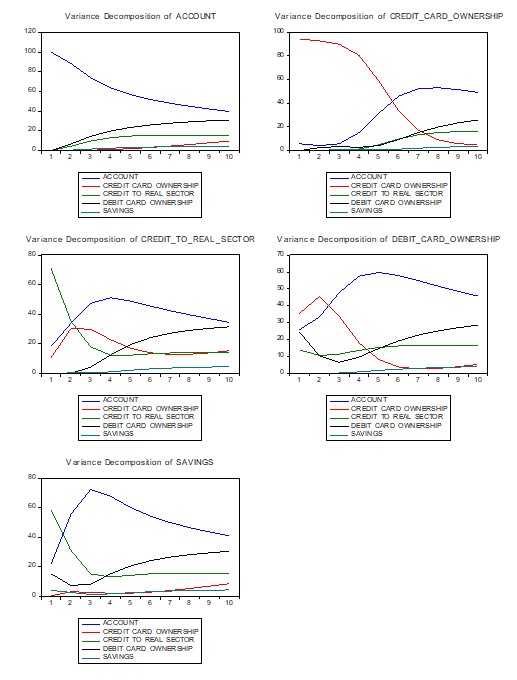

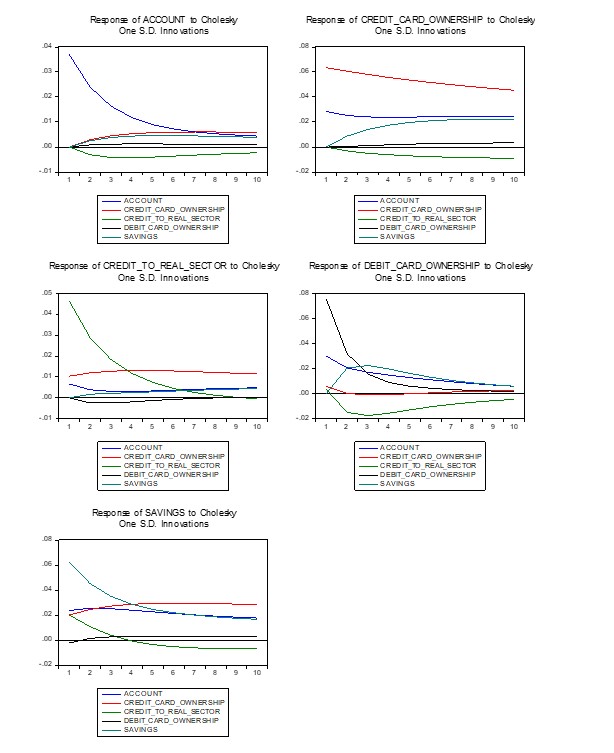

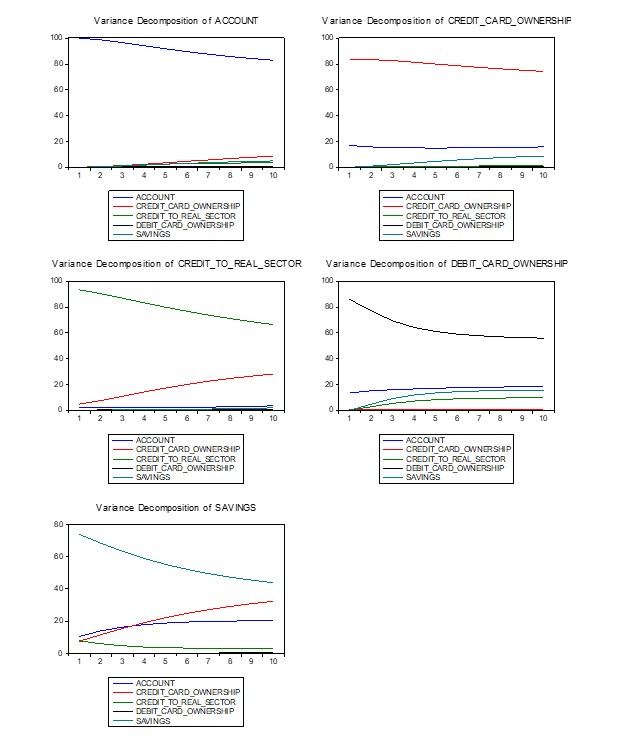

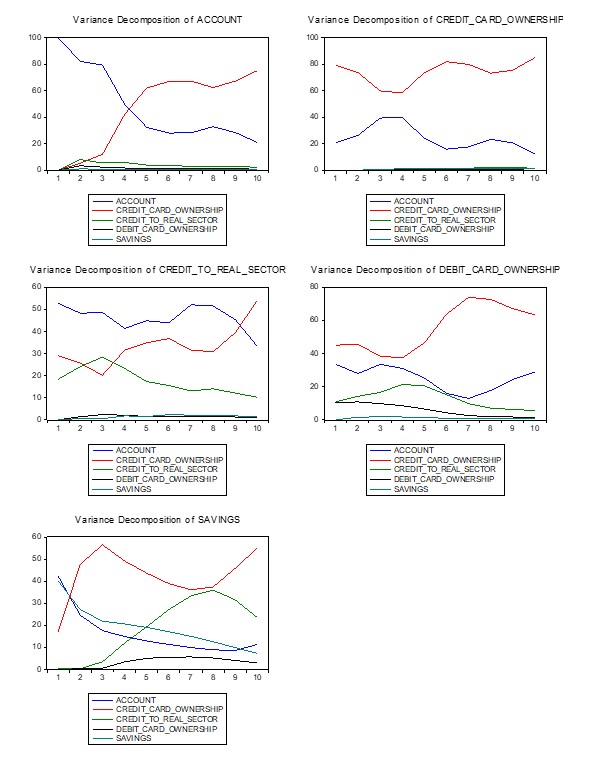

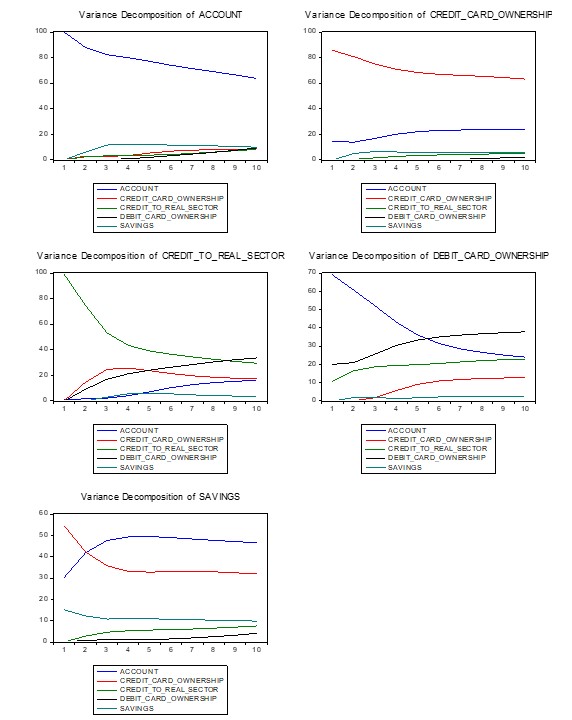

I used, also, the variance decomposition to indicate the relative importance of the external shocks in explaining the evolution of the variables, and, with the help of the impulse-response functions (Figure 4 and Annex 2), I tested the interaction between the variables included in the model.

Results and Discussion

In all the indicated areas, the results suggest an upward trend in financial intermediation and, in particular, digital fintech, especially in the last decades. Thus, current accounts, but also debit cards are used with an increasing frequency, as compared to the use of cash for financial transactions. Economies are, in most cases, in inverse proportion to the credits granted to the real sector, which coincides with the economic reality (Table 3).

Table 3. Estimation of indicators

Source: author`s estimates using Eviews

FinTech innovation has spread very fast and has permeated almost all economies worldwide. Itcovers the entire area of financial services, with major impact on business models. Investments in digital finance have grown considerably in recent decades. In Asian economies, which have seen rapid growth, financial intermediary systems have developed less. In North America, there is a delay in investment progress. On the other hand, in Europe, digital finance is making slow but safe progress.

Financial inclusion makes its presence felt, especially in Europe and Central Asia. Most of the population has at least one active account, which they use. The use of credit and debit card is facilitated by a developed banking system, in most regions. However, the study shows that there would be regions in which the payment system, in terms of current cards and savings accounts, would have payment delays of 1-2 periods, depending on the seasonality of the time series.

Europe’s Nordic countries enjoy a higher degree of intermediation (Kavuri and Milne, 2019). An example is Sweden, which plays a leading role in terms of individual investments, made from 2014 until now. This fact is due in particular to available finance, high access to education, adequate regulation, etc.

FinTech industry has beneficial effects on the economy and does not represent a systemic risk. Taking Germany as an example, it is the second largest FinTech market in Europe. Furthermore, Fintech can increase access to finance for small and medium-sized enterprises (SMEs) in Europe.

Figure 1. Impulse-response functions and variance decomposition

Source: author’s estimates using Eviews

The results of the research (see Annex 2) show that the loans granted to the real sector have as their main purpose the investments and not the saving, given the current economic situation of some economies in South Asia. Also, of the total population that owns a current account, only a part are its users. About 50% of the population do not constitute deposits, deposits or withdrawals in digital or classical form in the last 12 months and therefore have inactive accounts.

In Sub-Saharan Africa, there is a high degree of development of financial inclusion among the major regions of the world. As the results of the study indicate, the use of accounts, debit and credit cards and savings, is noted with at most two lags, with direct links between the variables of the study. So, about 20% of adults now own a mobile money account, almost double the 2014 share.

Studies (Asli Demirgüç-Kuntet al., 2023) have shown that the use of digital financial services, and, implicitly, mobile money services and Internet, credit and debit cards and other technological applications help reduce poverty. Thus, the use, storage, or transfers made using mobile phone services contribute to the improvement of earning potential and, then, poverty alleviation.

In high-income economies, about 94% of adults have at least one current account, and in developed countries the proportion drops to 63%. Of the total of 94%, about 77% of the population make payments for utilities, using financial services.

High-income countries include: United Arab Emirates, Australia, Austria, Belgium, Bahrain, Canada, Denmark, Chile, Cyprus, Czech Republic, Germany, Spain, Estonia, Finland, France, United Kingdom, Greece, Hong Kong SAR, China, Hungary, Ireland, Israel, Italy, Japan, Korea, Rep., Kuwait.

The estimates made coincide with the economic reality. As expected, the degree of financial inclusion is at a high level. The use of credit card for loans is one of the classic methods of high-income regions. It is also used to access urgent payments, but, most of the time, from own funds (savings). In relation to the government, approximately 43% of adults receive and make payments with the card and 46% of the population receive their salary through the current account.

Rapid growth in innovation fintech may generate risks, with a negative impact on the level of leverage and maturity mismatch between assets and liabilities. Operational risks are deficient in the methods implemented in the information systems, data collection and processing, data protection and cyber risks.

In Latin America & Caribbean, cost is one of the main reasons why the degree of inclusion remains at an average level. Thus, about 25% of adults do not have a current account. In East Asia & Pacific, real sector lending involves making investments to the detriment of saving. About 70% of adults use the current account for making payments to utilities.

The government could support financial inclusion by establishing a formal financial system, which involves making digital payments to the detriment of cash. Thus, the number of adults banked would increase.

In most Middle East & North Africa economies, there is a very large gap between the labor force and the unemployed. Thus, the active population is more than 5-6 times more likely to hold current accounts than the inactive population. Most of the population prefers cash for making payments at the expense of cards.

In conclusion, financial inclusion, implicitly, fintech helps minimize the risks regarding financial stability. Thus, digital finance facilitates currency circulation in the economy, by transferring the deposits in one account to another, in a short time, without taking into account physical distance. Investments are encouraged by digitizing the business environment and extending financial intermediation among clients. Moreover, for governments, benefits include lessening corruption and money laundering. So, the transitions from cash to digital payments can streamline its actions and, at the same time, reduce corruption.

Conclusions and Study Limitations

Financial markets integration facilitated the development of fintech and, implicitly, financial inclusion, which proved to have positive effects on financial stability, thus reducing the risks to which it is exposed.

The results reinforce the idea that the use of digital financial services reduces poverty and the digitization of financial services has a beneficial impact for the economic development and, at the same time, the welfare of the economy. This helps reduce the costs of time-consuming transactions. The use of digital financial services and mobile applications, in particular, helps reduce poverty. Financial inclusion and stability are mutually reinforcing.

Fintech helps minimize the risks regarding financial stability. Thus, digital finance facilitates currency circulation in the economy, by transferring the deposits in one account to another, in a short time, without taking into account physical distance. Investments are encouraged by digitizing the business environment and extending financial intermediation among clients.

As policy implications, for governments, benefits include lessening corruption and money laundering. So, the transitions from cash to digital payments can streamline and, therefore, reduce corruption.

Innovation in digital finance involves new activities, developed in new compartments of institutions of systemic importance, with a major impact on systemic risk. The competitive advantage of entrants is a risk factor, as this may result in an increase of concentration risks. The widespread use of fintech technology may increase the pro-cyclicality of the financial sector, with spill-over effects to the other sectors. So, the financial system is sensitive to industry-specific news, and volatility could increase systemically.

The importance of the paper consists in providing an analysis support for researchers, academia, and the authorities involved in order to make strategies more efficient, contributing to financial stability. The limitations of the research consist in the analysis of some geographical areas for which we have available data such as: South Asia, Europe & Central Asia, Sub-Saharan Africa, Latin America & Caribbean, East Asia & Pacific, Middle East & North Africa, but I propose, as future research directions, to capture as many regions of the world as possible (Australia, North America etc.).

References

- Asli Demirgüç-Kunt, Leora Klapper, Dorothe Singer, and Saniya Ansar (2023) The Global Findex Database, 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19

- Barbesino, P., Camerani, R., Gaudino, A. (2005) Digital finance in Europe: Competitive dynamics and online behavior. Journal of Financial Services Marketing, 9(4), pg.: 329-343

- Bruhn, M., Love, I. (2014) The real impact of improved access to finance: Evidence from Mexico. The Journal of Finance, 69 (3), pg.: 1347-1376

- Caprio, Gerard, and Patrick H. (1999) Restoring Banking Stability: Beyond Supervised Capital Requirements.Journal of Economic Perspectives, 13, pg.: 43-64

- Chang, R., and Andres V. (2000) Banks, Debt Maturity, and Pinancial Crises.Journal of International Economics, 51, pg.: 169-94

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess (2018) The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. Washington, DC: World Bank. doi:10.1596/978-1-4648-1259-0

- Dorfleitner, Gregor, Lars Hornuf, Matthias Schmitt, and Martina Weber (2017) The FinTech Market in Germany. In FinTech in Germany, pg.: 13-46

- Fáykiss, P., Papp, D., Sajtos, P., Tőrös, A. (2018) Regulatory Tools to Encourage FinTech Innovations: The Innovation Hub and Regulatory Sandbox in International Practice. Financial and Economic Review, Vol. 17 Issue 2, pg. 43–67

- Kavuri A.S., Milne, A. (2019) FinTech and the future of financial services: What are the research gaps? CAMA Working Paper 18/2019. ISSN 2206-0332

- Leora Klapper, Dorothe Singer, Saniya Ansar, Jake Hess (2019) Financial Risk Management in Agriculture Analyzing Data from a New Module of the Global Findex Database. World Bank Group, Development Economics Development Research Group, December 2019. Policy Research Working Paper no 9078

- Levine, R. (1996) Foreign Banks, Financial Development, and Economic Growth, Intemational Financial Markets. American Enterprise Institute Press, Washington DC

- Manyika, J., Lund, S., Singer, M., White, O., & Berry, C. (2016) Digital finance for all: Powering inclusive growth in emerging economies. McKinsey Global Institute

- Peterson K. Ozili (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18 (4), pg.: 329-340

- Pierre-Richard AgÈnor (2003) Benefits and Costs of International Financial Integration: Theory and Facts, The World Economy, Wiley Blackwell, vol. 26(8), pg.: 1089-1118

- Scott, S. V., Van Reenen, J., Zachariadis, M. (2017) The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Research Policy, 46(5), pg.: 984-1004

Websites:

- https://globalfindex.worldbank.org/ – World bank

- http://www.gpfi.org/publications/g20-principles-innovative-financial-inclusion-executive-brief – G20 Principles for innovative financial inclusion – executive brief

- bnr.ro – National Bank of Romania – Financial Stability Review (November 2023)

- https://www.ecb.europa.eu/ – Financial Stability Review (November 2023)

Annex 1 – Countries

Source: Global Findex database

Annex 2 – South Asia

Sub-Saharan Africa

High income

Latin America & Caribbean

East Asia & Pacific

Middle East & North Africa

Source: author’s estimates using Eviews