Introduction

The chosen sample offers a particularly interesting scenario, as the automotive and truck manufacturing industry has been analyzed worldwide and 224 listed companies have been identified, as evidenced by the Refinitiv Eikon database. At the same time, a number of ESG reports from companies such as Volvo, Hyundai, Mazda, Mercedes, Stellantis, Renault and Tesla were analyzed. At a first analysis, it can be seen that ESG reporting started in different years and with individual reporting models. Reporting standards are not yet homogeneous, each company reflects information, but do not yet have unitary approaches.

Therefore, the independence and expertise of the Audit Committee of the Board of Directors in ESG reporting has an important role, because through the expertise of its members it can provide users with increased confidence about the quality of ESG reports, especially that the members of the Board of Directors with financial expertise could provide through the Reporting Standards a channeling of these reports to common understandings of the terms, factors, and other elements that make up the reports.

Companies that want to have a good reputation in the market and success should pay attention to ESG reporting in their agendas and try to integrate these priorities into their governance strategies. At the same time, a regulatory mechanism is needed to strengthen CSRD in companies. Through the shareholding structure that functions as an internal governance mechanism through its effective supervisory role, it leads the company to make corporate decisions in line with shareholders’ interests (Bataineh, 2021). The Board of Directors is responsible for establishing the corporate social agenda, controlling the flow of information, allocating company resources, determining the responsible for decisions on disclosure and transparency policies (Jizi, 2017). CA is expected to have a role in strengthening board supervision. At the same time, it plays an important role in improving the quality of financial and non-financial reports and leads to the reduction of information asymmetry at the level of management and stakeholders. Thus, shareholders, the Board of Directors and audit committees, taking into account their duties, could influence the decision-making process at company level and help improve the level of transparency in ESG reporting.

Analysis of the effect of audit committees on transparency in ESG disclosure remains unexplored, but may prove to be a major issue for companies and regulators in terms of establishing appropriate corporate governance mechanisms aimed at improving ESG reporting practices

Specialized Literature Review

One of the Council’s most important monitoring mechanisms is QA (Bajra & Čadež, 2018a). Its features and existence can improve board supervision, enhance auditors’ performance, and reduce information asymmetry between different stakeholders and managers, thereby improving firm disclosures such as CSR (Mangena & Pike, 2005; Pucheta-Martínez et al., 2016). According to Salleh and Stewart (2012), CA attributes could also affect CSRD credibility, as they are anticipated to address risk, sustainability, and control issues.

The independence of the AC is often seen as a key feature that affects the effectiveness of the audit committee in overseeing financial reporting.

CAs comprising non-executive and independent board members contribute to increased accountability and transparency, thereby promoting greater reliability of the financial statements (Mohammadi et al., 2021). However, the empirical evidence on the relationship between the independence of the audit committee and the CSRD is mixed. Some studies have found that the degree of independence of the audit committee is positively associated with CSR. Mangena and Pike (2005) and Pucheta-Martínez and De Fuentes (2007) indicated that a higher proportion of independent directors on audit committees are most successful in increasing the credibility of financial and non-financial reports, such as CSRDs, as they have no influence from management. Qaderi et al. (2020) and Garas and ElMassah (2018) reported that the presence of the members of the independent audit committee has a positive effect on CSRD as they are a key factor in improving information transparency for the benefit of all stakeholders. On the other hand, Rahman and Ali (2006) revealed an inverse relationship between the independence of the audit committee and CSRD, suggesting that independent members may play an ineffective supervisory role due to management’s dominance over the board’s affairs, excessive workload, and limited industry experience. However, Othman et al. (2014) found no significant relationship between audit committee independence and CSR reporting.

The financial expertise of the audit committee refers to the presence of members with financial expertise, such as accounting or financial professionals or those who hold specialized certifications. The audit committees’ financial expertise and audit knowledge increase the reliability of financial reporting and the quality of disclosure (Salehi and Shirazi, 2016). B ‘edard J Sand Gendron (2010) suggested that financial expertise allows audit committee members to ask investigative questions and conduct more thorough investigations, leading to greater transparency in financial reporting and reducing inter-agency conflicts. Ryu et al. (2021) stated that companies with various financial expertise within their audit committees tend to have higher quality financial reporting and stronger CSR practices as they have a better ability to monitor and control management.

Regarding the moderators’ analysis, Al-Shaer and Zaman (2018) stated that the negative link between CSR and CSRA committees turns into a positive relationship through the independence and expertise of the audit committee. Thus, interdependencies between CSR committees and audit committees are crucial.

Implementing a robust reporting system requires strict reporting standards that are missing in ESG presentations. Therefore, an independent and active internal control system is needed to increase the quality and quantity of ESG reporting without compromising shareholders’ objectivity and interest. Appuhami and Tashakor (2017) argue that an independent AC could provide effective oversight needed to balance managerial and stakeholder objectives in the context of ESG disclosures. Karamanou and Vafeas (2005) argue that AC is a vital management control mechanism that monitors financial and non-financial reporting practices. Similarly, the Blue Ribbon Committee report considers AC as the “final monitor” of the organizational reporting process. Therefore, having a competent CA is mandatory to improve the quantity and quality of ESG reporting.

Recently, transparent sustainability reporting is becoming a core responsibility of business organizations, requiring the CA to oversee sustainability reporting to promote shareholder confidence. The Cadbury Code suggests the formation of a CA that complies with rules and regulations and examines financial records to avoid misrepresentation or fraud (Sattar et al., 2020). Hąbek and Wolniak (2016) studied the quality of audit reports in a sample of six European countries and indicated the low quality of sustainability reports. They report that disclosure of information is more critical for the sampled firms than the credibility of the reporting. Among the selected countries, the Netherlands and France have the highest level of quality indicators. The French government has asked companies to report sustainability information, while the Netherlands has developed accounting standards for the quality of sustainability reporting.

Continuous monitoring is one of the critical activities in management control mechanisms. Proponents of the agency’s theory argue that effective monitoring can reduce the opportunistic behavior of corporate managers and increase compliance with corporate governance requirements (Campbell et al., 2009; Rossi and Cebula, 2016). Among several features of the CA, the frequency of its meetings is the feature that allows members to monitor corporate activities more frequently and effectively (Samaha et al., 2015). Carcello et al. (2011) state that one of the main reasons for meetings is to ensure audit quality and effective management control. Similarly, regular and frequent monitoring activities, such as AC meetings, can increase the effectiveness of AC. Lisic et al. (2016) suggest that regularly scheduled meetings will help AC to monitor accounting records and internal control systems. It is pertinent to note that due to the large size of corporations, the CA cannot detect fraud or irregularities due to lack of time; therefore, the CA should meet more frequently so that the quality of sustainability information can be maintained. The members of the audit committee must understand how the environment, social, and risks as well as governance opportunities are identified, prioritized and supervised using disclosure practices accordingly (Bamahros et al. 2022).

ESG reporting practices indicate a real corporate commitment to environmental responsibility and are a significant mechanism for protecting stakeholders’ interests. In this regard, disclosure of information related to ESG aspects has become crucial for stakeholders’ decisions. Disclosure of ESG information helps minimize asymmetries between investors and information intermediaries, reducing uncertainty and thereby helping improve access to finance and valuation of firms (Almeida, Paiva, 2022). The increasing emphasis of investors on ESG criteria reflects a paradigm shift in the assessment of corporate performance beyond traditional financial metrics (He, et al., 2023).

The correlation between the independence and expertise of the Audit Committee (AC) at the company level and the efficiency of ESG reporting, green and sustainable financing, corporate social responsibility (CSR), and overall company performance is well-documented. An independent AC, free from management influence, ensures objective and impartial supervision. The expertise of AC members in finance and ESG issues enhances the quality of reporting and sustainability performance. Studies such as “An Exploratory Study Based on a Questionnaire Concerning Green and Sustainable Finance, Corporate Social Responsibility, and Performance: Evidence from the Romanian Business Environment” (J. Risk Financial Manager, 2019) and “The Impact of Audit Committee Characteristics on ESG Performance: Evidence from European Companies” (Journal of Business Ethics, 2021) demonstrate that an independent and skilled AC is crucial for efficient ESG reporting, accessing green and sustainable financing, and improving CSR and overall performance. Thus, the AC’s role is vital in promoting transparency, sustainability, and the long-term success of the organization.

Research Methodology and Analysis of Results

Given the theoretical framework, as well as the fact that there is currently great interest in the evolution of ESG indicators in the context of the mechanisms that ensure their effectiveness, the overall objective of the research is to identify the impact of the independence and expertise of the audit committees on the reporting of ESG indicators. Thus, through a quantitative research methodology, we analyzed the information presented in the Refinitiv Eikon database.

In this regard, we resorted to selecting a sample of all global companies in the automotive and truck industry, respectively 224 public companies, which have data published in the Refinitiv Eikon database, between 2019 and 2022. The selected sample includes companies from 36 countries (United States, Australia, Bangladesh, Bosnia and Herzegovina, Brazil, Bulgaria, Canada, China, Egypt, France, Finland, Germany, Hong Kong, India, Indonesia, Italy, Ivory Coast, Japan, Korea, Malaysia, Pakistan, Philippines, Poland, Portugal, Serbia, Russia, Singapore, Slovenia, Sri Lanka, Sweden, Switzerland, Taiwan, Tunisia, Turkey, United Kingdom, Vietnam) on 6 continents (Europe, Africa, Australia, Asia, North and South America). All businesses are publicly traded and can be found on regional or global stock exchanges. At the same time, the study includes the analysis of the reports of several companies representing globally recognized brands: Tesla, Renault, Toyota, Volvo, Apple, Ferrari, Ford, Hyundai, Lincoln, Nissan, Porsche, Suzuki and Mercedes Benz. The rationale for selecting this industry was based on the fact that this sector is characterized by complex supply networks, strict environmental laws, and high standards of social responsibility. We can examine complex aspects of ESG compliance, such as working practices, regulatory compliance, and environmental mitigation, by closely examining the function of audit committees in these organizations. Strong ESG reporting systems overseen by capable and impartial audit committees are particularly important because of the industry’s vulnerability to investor interest and public scrutiny. Quantitative examination of these processes advances sustainable practices in an industry that is critical to global economic and environmental management, while providing useful insights to stakeholders.

Therefore, the correlation between ESG score and AC independence, AC non-executive members, AC independence score and AC expertise score was analyzed, over a period of 4 years, respectively, 2019 – 2022, based on data published by 224 companies in the automotive and truck industry.

It was decided to analyze the last 4 years based on the idea of observing the changes following the Covid 19 pandemic in companies from the point of view of ESG reporting, based on the reference year 2019, before the outbreak of the pandemic. We considered that reporting to the pandemic period is essential to understand the global impact on the information industry, the changes in human behavior and the necessary adaptations, thus providing insights and information relevant to the management of similar future events.

Methodologies for Data Analysis and Processing

To highlight the correlation between independent variables such as AC independence, non-executive AC members, AC independence score, AC expertise score, and ESG score dependent variable, this research focuses on a linear regression model that was run through the SPSS application.

The linear regression model, being of the form: Yi=β0 +β1X1i+β2X2i+β3X3i+β4X4i+εi

Where:

- Yi= ESG score dependent variable for observation i;

- β0 = interception model;

- β1, β2, β3, β4 = coefficients associated with independent variables (Independence of the Audit Committee and of the Audit Committee’s expertise)

- εi = random error associated with observation i.

Therefore, regression (1): ESGi = β * + β * X * i + β * X * i + β * X * i + β * X * X * i + β *i + εi

Where the independent variables are:

- Xi: independence of the Audit Committee

- X₂i: Non-executive members of the audit committee

- Xi: Audit Committee Independence Score

- Xi: Audit Committee Expertise Score

By estimating these coefficients, the linear regression model explores the linear relationship between the dependent variable ESG Score and the independent variables mentioned, in order to test the following research hypotheses:

- Null hypothesis (H0): There is no significant correlation between ESG score and independent variables (Independence of AC and AC Expertise).

- Alternative hypothesis (H1): There is at least one independent variable that has a significant correlation with ESG score.

In order to analyze both the null hypothesis and the alternative hypothesis, for the analyzed period 2019 – 2022, a distinct regression analysis was performed for each year, respectively; the linear regression model was destroyed within the SPP application 4 times. The centralized results of the 4 regression models, related to the analyzed 4 years, are presented centrally in Table no. 1 – Results of regression models.

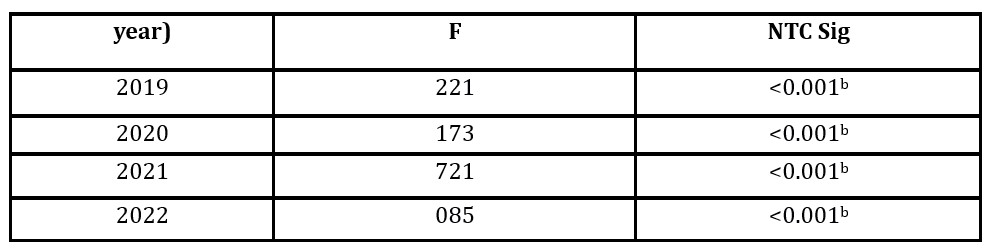

Table no. 1 – Results of regression models

Source: source: (the authors’ own work using SPSS soft)

For each year, the correlation coefficients and the coefficients of determination are relatively high, indicating a strong correlation and a good explanation of the variation of the dependent variable on the independent variables included in the model. The standard estimation error is relatively small for all years, indicating good model accuracy in estimating dependent values.

The coefficient of determination (R Square), which determines the proportion of the variability of the dependent variable that can be explained by the independent variables included in the model, indicates that, at the level of 2022, about 64.6% of the variability of the ESG Score can be explained by the independent variables, the difference of up to 100% indicating the variation that remains unexplained, which can be attributed to other factors or variables that have not been taken into account in this research. Higher R-square values indicate better pattern matching with observed data.

Adjusted R-square: This is an adapted determination coefficient metric that takes into account the number of predictors in the model and penalizes the introduction of redundant predictors. Its value, in this case, referring to 2022 is 0.64, which suggests that about 64% of the variation of the ESG score is explained by the independent variables in the regression model, given the number and size of the sample. We mention that in the following years, the value of the adjusted Square R remains relatively constant, being around 0.634 – 0.640. This stability suggests that the regression model retains the same ability to explain the ESG score variation over these years, with small variations attributable to natural data fluctuations or minor changes in the model structure.

Std. Estimation error: This is the standard estimation error and is a measure of how close the estimated values are to the actual values. In the present case, we notice that the Standard Error of the Estimate varies between 17.17 and 15.44 in the period 2019-2022. These values indicate that model estimates can vary, on average, by this value from the actual values of the dependent variable. It is important to note that the lower values of this indicator indicate a more accurate model in the estimation of dependent values, while the higher values may indicate a higher uncertainty in these estimates. What the above data tell us is that predictors (AC independence, AC non-executive members, AC independence score, AC expertise score) have a significant influence on the dependent variable, ESG score. Thus, changes in the audit committee’s expert score, its independence, the number of non-executive members, and the audit committee’s independence score are expected to have a significant impact on a company’s ESG score. These findings may suggest that greater audit committee expertise and independence, coupled with greater involvement of non-executive members, can lead to significant improvements in a company’s ESG performance.

The conclusions are that the variables analyzed have a significant and constant influence on the ESG score of companies during the analyzed period, which indicates the importance of responsible governance and management in the field of environment, social and governance.

In order to evaluate the performance of the regression model and determine whether the independent variables contribute significantly to explaining the variability of the ESG score, we will centrally present in the following table Anova Results – Analysis of Variance.

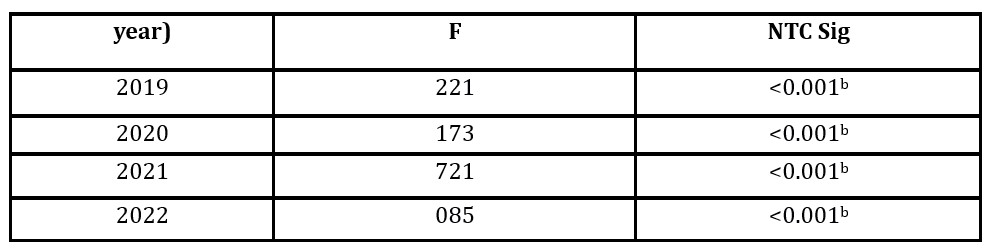

Table no. H.2 Analysis of variance

Source: (the authors’ own work using SPSS soft)

The ANOVA test indicates whether the regression model is significant or not. In this case, it gives us information about the variation explained by the model (Regression) and the unexplained variation (Residual), depending on the year under review.

The sum of the values of the squares is 96,841 for 2019, 96,712 for 2020, 76,721 for 2021 and 99,085 for 2022. They represent the variation explained by the model. The residual square sum values represent the unexplained variation of the model. F-test values have very significant statistical significance (p < 0.001). This means that there is a significant difference between the variation explained by the model and the unexplained variation, and the model is globally significant in explaining the variation of the ESG score each year.

In conclusion, the ANOVA model shows that the regression model is significant in explaining the ESG score variation in each year analyzed.

Table no. 3

Source: (the authors’ own work using SPSS soft)

Source: (the authors’ own work using SPSS soft)

Non-standard coefficients indicate the contribution of each predictor to the dependent variable. For each predictor, we have the value of the coefficient (B), the standard error (Std. Error), standardized coefficient (Beta), statistical value t and p (Sig.).

P-values below 0.05 indicate that predictors are significant at a 95% confidence level. By analyzing the p-values associated with the coefficients for each year, we can draw the following conclusions:

The non-executive members of the Audit Committee record strong statistical significance (p < 0.001) in all the years analyzed, indicating that the number of non-executive members of the Audit Committee is a significant predictor of the ESG score.

The independence score of CA is also significant (p < 0.05 or p < 0.001) in all years except 2022 (p = 0.001), indicating that the independence score of CA has a significant impact on ESG score in most years analyzed.

The independence of the Audit Board is significant in 2019, 2020 and 2021, but not in 2022, where it has marginal significance (p = 0.082). This suggests that the independence of the audit committee may have a significant impact on ESG reporting in previous years, but may be less relevant in 2022.

The CA Expertise Score does not show consistent statistical significance in all analyzed years, except for 2020 (p = 0.024). This suggests that the audit committee’s expertise may have a limited or variable impact on ESG reporting over time.

In conclusion, the number of non-executive members of the audit committee and its independence score have a significant impact on the efficiency of ESG reporting in companies, while the relevance of the independence and expertise of the audit committee may vary depending on the context and the year under review. Therefore, the analysis indicates that audit committees with more non-executive members and higher levels of expertise are associated with better ESG reporting, thus supporting the claim that these issues have a significant and positive influence on the ESG score.

Research Limitations

Although the relevance of the independence and expertise of its audit committee has not been significantly associated with ESG score in this model, it does not necessarily mean that these issues are not important for the impact of these factors in ESG reporting. Other variables or factors not considered in this model are likely to influence the relationship. It is therefore important to consider that the impact of these factors on ESG reporting may be influenced by more factors than those included in this model.

Conclusions

This study aimed to explore the impact of the independence and expertise of audit committees on ESG reporting for automotive and truck firms. GRI compliance and ESG disclosure scores represent the quality and quantity of ESG reporting, respectively. Using a linear regression framework at firm and year level, we find that the independence of audit committees has a stronger positive influence on the reporting of ESG factors compared to the expertise of audit committees.

At the same time, we note that the impact of the independence of the investigated audit committees is more pronounced for the environmental dimension of ESG reporting. All this points to the importance of a management control system in the form of active and independent audit committees, which could improve the much-needed ESG disclosures for sensitive firms in the industry. Regarding the expertise of the audit committees, more transparency will probably be needed in reporting some aspects related to their component, in order to be able to analyze their influence in ESG reporting.

The findings of this study provide significant implications for shareholders, managers, and regulators to improve the quality of ESG reporting in environmentally sensitive industries as well as the amount of information reported. Stakeholders could use this information to mandate the formation of self-directed and committed audit committees, thereby protecting them from opportunistic behaviour by managers to use ESG reporting as a self-improvement tool.

Given the positive associations between sustainability reporting and the existence of audit committees, we recommend that automotive and truck companies focus more on AC attributes to ensure sustainable transparency for stakeholders.

In conclusion, we recommend that regulators give greater weight to audit committees in their role in sustainability disclosures. Despite the increase in the number of published studies on sustainability reporting, companies in the automotive and truck industries are just starting out, especially in countries undergoing modernization. These issues are partly related to data unavailability and the limited interest of companies, regulators and other users.

This paper aims to motivate research in the field, to contribute to the reform of economies and markets and, last but not least, to reduce the harmful effects on the environment by making the activity of companies more transparent, in order to make the best decisions on ensuring global sustainability.

The current literature on the specific role of ESG performance during the crisis, such as the COVID-19 crisis, is limited (Broadstock et al., 2021; Takahashi and Yamada, 2021). The paper also presents methodological sub-limits, as the econometric models used may lead to interpretations on the use of variables that may be important but have not been considered. However, the use of robustness checks could lead to a reduction in these limitations.

Thus, future research can help to observe the changes caused by the pandemic in people’s awareness of the importance of increasing transparency in reporting.

In conclusion, future research could be sources of information to improve regulatory processes on how to set up audit committees, as well as to identify ways of mandatory transparency in reporting on the component of audit committees, as it could provide users with guidance on the political decision-making process by global leaders, in order to capitalize on the role of audit committees in the field of ESG reporting.

References

- Abdul Rahman, R., & Haneem Mohamed Ali, F. (2006). Board of Directors, Audit Committee, Culture and Earnings Management: Events in Malaysia. Managerial audit log, 21(7), 783–804. https://doi. org/10.1108/02686900610680549;

- Almeida M., Paiva S., (2022), Audit Committees and its effect on Environmental, Social, and Governance Disclosure, 2022 17th Iberian Conference on Information Systems and Technologies (CISTI), Retrieved from https://doi.org/10.23919/CISTI54924.2022.9820167;

- Al-Shaer, H. and Zaman, M. (2018). Credibility of Sustainability Reports: Contribution of Audit Committees. Business Strategy and Environment, 27(7), 973–986;

- Appuhami, R. and Tashakor, S. (2017), “The impact of audit committee characteristics on CSR disclosure: an analysis of Australian firms”, Australian Accounting Review, 27, No. 4, pp. 400-420

- Bataineh, H. (2021), “The impact of ownership structure on dividend policy of listed firms in Jordan”, Cogent Business and Management, Vol. 8, No. 1, p. 1863175;

- Bajra, U., & Cadez, S. (2018b). Impact of corporate governance quality on earnings management: Evidence from US cross-listed European companies. Australian Accounting Review, 28(2), 152–166. https://doi.org/10.1111/auar.12176;

- Bamahros, Hasan Mohamad, Abdulsalam Alquhaif, Ameen Qasem, Wan Nordin Wan-hussin, Murad Thomran, Shaker Al-Duais, Siti Norwahida Shukeri, and Hytham M. A. Khojally. 2022 Corporate Governance Mechanisms and ESG Reporting: Evidence from the Saudi Stock Market. Sustainability 14: 6202. |||UNTRANSLATED_CONTENT_START|||[CrossRef];|||UNTRANSLATED_CONTENT_END|||

- B_edard, J. and Gendron, Y. (2010), “Strengthening the Financial Reporting System: Can Audit Committees Deliver?”, International Journal of Audit, vol. 14 no. 2, page

- Campbell, K., Jerzemowska, M. and Najman, K. (2009), “Corporate governance challenges in Poland: evidence from ‘complicated or explain’ disclosures,” Corporate Governance: The International Journal of Business in Society, Vol. 9, No. 5 p.p. 623;

- Carcello, J.V., Hermanson, D.R. and Ye, Z. (2011), “Corporate governance research in accounting and audit: insights, practice implications, and future research directions”, Audit: A Journal of Practice &Theory 30No. 3, p. 1-31;

- Garas, S. and ElMassah, S. (2018), “Corporate Governance and Corporate Social Responsibility disclosures: the case of the GCC countries “, Critical Perspectives on International Affairs, vol. 14 no. 1, p. 2-26;

- Hąbek, P. and Wolniak, R. (2016), ‘Evaluating the quality of corporate social responsibility reports: the case of reporting practices in selected European Union Member States’, Quality &Quantity, Vol. 50No. 420.

- He et al., 2023, f. He, C. Ding, W. Yue, G. Liu, ESG performance and corporate risk-taking: Evidence from China International Review of Financial Analysis, 87 (2023), 10.1016/j.irfa.2023.102550;

- Jizi, M. (2017), “The influence of board composition on sustainable development disclosure”, Business Strategy and the Environment, Vol. 26, No. 5 p.p. 655;

- KaramaNou, I. and Vafeas, N. (2005), The association between corporate boards, audit comtees, and management earnings forecasts: an empirical analysis, Journal of Accounting Research, Vol. 43No. 3, pp.

- Lisic, L.L., Neal, T.L., Zhang, X.I. and Zhang, Y. (2016), “CEO power, internal control quality, and audit committee effectiveness in substance versus in form”, Contemporary Accounting Research, 33, No. 3, pp. 1199

- Mangena, M. and Pike, R. (2005). Effect of audit committee ownership, financial expertise and size on interim financial information. Accounting and Business Research, 35(4), 327–349. https://doi.org/10.1080/00014 788.2005.9729998;

- Mohammadi, S., Saeidi, H. and Naghshbandi, N. (2021), “The Impact of Board and Audit Committee Characteristics on Corporate Social Responsibility: Evidence from the Iranian Stock Exchange”;

- Othman, R., Ishak, I.F., Arif, S.M.M. and Aris, N.A. (2014), “Influence of audit committee characteristics on voluntary ethics disclosure”, Procedia – Social and Behavioral Sciences, Vol. 342

- Pucheta-Mart’ınez, M.C. and De Fuentes, C. (2007), “The impact of audit committee characteristics on the enhancement of the quality of financial reporting: an empirical study in the Spanish context”, Corporate Governance: An International Review, Vol. 15, No. 6, pp. 1394

- Pucheta-Martínez, M.C., Bel-Oms, I., & Olcina-Sempere, G. (2016). Corporate governance, female directors and the quality of financial information. Business Ethics: A European Review, 25(4), 363–385. https://doi.org/10.1111/beer.12123;

- Qaderi, S.A., Alhmoud, T.R. and Ghaleb, B.A.A. (2020), “Audit Committee Features and CSR Disclosure: Additional Evidence from an Emerging Market”, International Journal of Financial Research, Vol. 11, No. 5 p.p. 237.

- Rahman, R.A. and Ali, F.H.M. (2006), “Board, audit committee, culture and earnings management: Malaysian evidence”, Managerial Audit Journal, Vol. 21, No. 7, 1973, pp. 804

- Rossi, F. and Cebula, R.J. (2016), “Debt and Shareholding Structure: Evidence from Italy”, Corporate;

- Ryu, H., Chae, S.J. and Song, B. (2021), “Corporate social responsibility, audit committee expertise, and financial reporting: empirical evidence from Korea”, Sustainability, 13, No. 19

- Samaha, K., Khlif, H. and Hussainey, K. (2015), “The impact of board and audit committee characteristics on voluntary disclosure: a meta-analysis”, Journal of International Accounting, Audit and Taxation, Vol. 24, 1896, pp. 11:00 PM

- Salehi, M. and Shirazi, M. (2016), “Audit Committee Impact on the Quality of Financial Reporting and Disclosure: Evidence from the Tehran Stock Exchange”, Management Research Review, vol. 39, no. 12/2000, pp. -1662

- Salleh, Z., & Stewart, J. (2012). The role of the Audit Committee in resolving disagreements between the auditor and the client: a Malaysian study. Journal of Accounting, Audit and Accounting, 25(8), 1340–1372, https://doi.org/10.1108/09513 57121 1275506;

- Sattar, U., Javeed, S. and Latief, R. (2020), “How audit quality affects the firm performance with the moderating role of the product market competition: empirical evidence from Pakistane manufacturing firms”, Sustainability, Vol. 12No. 10 p.p. 1-20.