Introduction

Since the 90s of the last century, a sharp increase in the quantitative and qualitative forms of regional integration of the states of the Caucasus, Central Asia, the Middle East and Southeast Asia into Europe, the development of the Asia-Pacific Region and the emergence of the Eurasian macro-region led to the compilation of new and renegotiation of existing cooperation agreements between these countries. Possessing natural resources and a strategic geopolitical position between Europe and Asia, being a reliable partner and initiator of many projects, such as being the main participant and investor of international infrastructure projects and a supporter of energy security, Azerbaijan contributes to the increasing role of the Caucasus and the Caspian Sea in the system of world economic cooperation. In the context of globalization, the effectiveness of joining the world economic processes depends on the competitiveness of the state at the international level. In order to increase competitiveness, the Republic of Azerbaijan, along with other developed and developing states, is forming its regulatory framework for investment activities. The main task with the support of investment activities is the creation of effective mechanisms for the benefit of the country’s economic development. One of such mechanisms is the interaction with financial institutions.

Among the many financial institutions operating in the Asia-Pacific Region, the most in line with the national interests of Azerbaijan is the Asian Development Bank. Developing the energy, transport and agricultural sectors with their infrastructure, improving the living standards of the population, eliminating poverty and many other goals, are mutual priorities for Azerbaijan and the Asian Development Bank. Moreover, further cooperation and its directions, identification, coordination of mutual actions and support, in another word, all the pros and cons in this context require a deeper understanding and analysis.

The purpose of the study is to consider areas for improving the legal framework for cooperation on investment collaboration in the areas of infrastructure development and socio-economic growth and prospects for the participation of the Asian Development Bank in the economy of Azerbaijan.

It should be noted that since joining the Asian Development Bank in 1999, approved loans, grants and technical assistance to Azerbaijan for support purposes have been set at $ 4.61 billion. The loan program of the Asian Development Bank, guaranteed by the state for 2018-2020, is $ 900 million. Ordinary capital resources and aggregate resources on loans and grants, financed by the Asian Development Fund and other private funds, make up $ 2.46 billion [17].

The operations of the Asian Development Bank in Azerbaijan were initially focusing on the short-term operational strategy approved in 2000. It aimed at reducing poverty in Azerbaijan by enhancing human development, promoting sustainable growth and supporting good governance and institutional strengthening. It was followed by a five-country strategy, updating the program during 2001-2006 and Country Operations Business Plans after 2010.

The head of the representative office of the Asian Development Bank in Azerbaijan Nariman Mannapbekov noted [5] that if one of the main tasks of the Asian Development Bank is regional cooperation in energy security, then the Southern Gas Corridor (with a cost of more than $ 40 billion) will become an additional source of this direction and will give Azerbaijan the opportunity to implement social programs, provide more than 1800 jobs and diversify the economy through the income received from this project. It is predicted that in 2020, 31 billion cubic meters of gas will be exported through the TANAP pipeline. The support of the Asian Development Bank will contribute to the development of economic opportunities of the private sector, the creation of new jobs and the development of relations between Azerbaijan and other countries. Vice-President of the Asian Development Bank Venchai Zhang noted [31] that the Azerbaijan’s conservative approach to external borrowing requires a new approach; a new 5-year strategy of the Asian Development Bank, which will support the Government of Azerbaijan at the beginning of the implementation, based on technical assistance, political dialogue and capacity development of major government agencies.

Azerbaijan’s Investment Attractiveness at The International Level and Existing Problems

One cannot ignore the fact that an open economy without regulations can lead to the presence of problems of national security, sovereignty and national interests of the state, which integrate into the global economy. Despite the difficulties that developing countries are experiencing from the radical concept of an open economy, the correct application of the concept of an open economy can give positive results [Barteneva, V. I. & E. N. Glazunova, (2012), Dynkin, A. A. & Baranovsky, V.G. (2018), Nureyev, R. M. (2001), Nureyev, R. M. (2001) and Huseyn, A. (2019)], [14]. But the problems of foreign economic security are often identified with the problems of protecting the national economy. In November 2014, the Vienna Program of Action for 2014-2024 for landlocked developing countries, Azerbaijan is one of 12 countries that envisage mobilizing national, regional and international efforts to support the development and diversification of the national economy. The influence of not only the major powers, such as the Russian Federation, USA, KND and EU countries, but also the neighboring states represented by Turkey and Iran, increase the importance of regional integration mechanisms for Azerbaijan [28]. The efforts to strengthen their military-political and economic positions of these countries in the South Caucasus, on one hand, and the interest of ensuring their own sovereignty and economic well-being, on the other hand, require the use of IFI opportunities for the good of the country. Today, “there is a huge number of organizations, usually with overlapping memberships and not always clear delineations of functions” [Tolorai G. D. (2012), p.8]. And such problems are increasingly encountered during the period of increased agitation of the ideas of globalization [Ilyin, I. V. (2016), Kulakov, A. V. (2013) and Fedotova, V. G., Kolpakov, V. A. & Fedotova, N. N. (2008)], [27]. Manufacturing enterprises; exporters from economically developed countries, make numerous attempts to keep domestic and foreign markets through the use of measures to protect national corporations from foreign enterprises. Enterprises from developing countries which understand that they will not be able to resist the competition of foreign companies for a long time, require the introduction of a particular protective measure.

The stages of developing the relations between Azerbaijan and the Asian Development Bank can be divided into 2 stages:

The first stage covers 1999-2012 – when Azerbaijan just entered the Asian Development Bank and the relations just formed. The Asian Development Bank has not sought to consider a long-term strategy over the years for two reasons:

– The economic conditions and needs of the government were changing rapidly during the first decade of operations of the Asian Development Bank in Azerbaijan,

– The Asian Development Bank has stepped up its activities and maintained sufficient flexibility to develop opportunities for deeper participation in Azerbaijan.

The second stage is from 2013-2017, a period of close cooperation and partnerships. It is interesting that in 2017 alone, the number of loans without state guarantees exceeded the number of loans with state support.

President of the Republic of Azerbaijan, I. Aliyev in his order “On a set of measures to promote investment activity and protect the rights of foreign investors” in January 18, 2018, noted that “reforms in this area should be expanded to increase investment in the economy, especially in the field of supporting entrepreneurial activity, as well as legislation on the protection of investments. One of the goals set before 2025 is to create a business environment that will allow foreign investors to work in accordance with international standards, reforms in this area will increase the share of private investment in the economy” [9]. The experience of different countries and the analysis showed that foreign investors are looking for a favorable system for protecting their investments [Makshantseva, Yu. S. (2011), Tirskikh, M. G. (2016) and Stefan, W. Schill. (2013)], [1]. Therefore, it is necessary to create a structure that will expand investment opportunities. It should be noted that the laws of the Republic of Azerbaijan “On investment activity” and “On the protection of foreign investments” currently do not fully meet the international standards [33, 34]. These laws provide a state regulation of the investment process, which in particular includes: the application of a tax system with differentiation between tax rates and benefits; the provision of budget loans, subsidies and subventions for the development of individual regions and industries; holding credit; pricing and depreciation policies; implementation of antitrust activities and determination of conditions for the use of land, water and other natural resources, etc. [33]. However, there is a number of shortcomings, for example, inaccurate regulation of the concept of “foreign investment”, which does not completely give all forms of participation of foreign investors in entrepreneurial activity; the contract form of joint ventures (contractual joint ventures), production sharing contracts, etc. Although they are included in the list of the types of foreign investments, and those forms that are given in the law are not fully regulated, there are no specific clarifications regarding liquidation or determination of the results of violating the rights of foreign investors by state bodies.

One of the important points in attracting foreign capital is the allowance by the government of unlicensed export of manufactured products (works and services) to enterprises in which more than 30% of the authorized capital consists of foreign investment [33] . As the President of the Republic of Azerbaijan I. Aliyev noted “After the application of the investment promotion system, more than 300 investment promotion documents were issued. As a result of the implementation of these projects, 20 thousand jobs were created. The total investment volume of projects implemented and planned after the investment promotion mechanism, has been 2.7 billion manats” [32].

Another significant point is the state guarantee to foreign investors duty-free import of goods necessary for the activities of foreign investors, as well as double taxation and free export of acquired profits for the investment period [5, 18]. The Republic of Azerbaijan signed bilateral double taxation agreements with 53 states until 2017, 49 of which were adopted and are in force. At the same time, it will enter into force after the relevant procedures for the entry into force of similar documents signed with Denmark, Spain, Israel and Jordan. 1 Bilateral and 2 multilateral agreements were signed with 10 countries on the topic “Cooperation and mutual assistance in order to comply with tax laws” [13].

7 bilateral and 1 multilateral agreements have been signed on cooperation in the fight against tax violations. Bilateral cooperation agreements were signed with eight countries [13]. But due to the frequent changes in tax rates and amendments to the Tax Code, their purely fiscal nature negatively affect the investment process. So, investors are either reluctant to invest in underdeveloped sectors of the economy, or they avoid paying taxes. Therefore, tax rates should contribute specifically to the investment activity.

The author believes that in the future, in order to limit the outflow of capital from the country, the state should determine the maximum level of export of profits made by a foreign investor. Although this may limit the inflow of foreign investment, on one hand, but on the other hand, it will provide reliable partners to the country and force them to use these resources in the country’s economy.

Analysis of The Forms of Participation and Investment of The Asian Development Bank in The Development of The Economy of Azerbaijan

Azerbaijan is interested in using its natural resources as a springboard for long-term economic growth and development of the non-oil sector of the national economy. For example, the “Development Strategy of the Transport Sector of Azerbaijan 2006-2015”, prepared with a grant of the Asian Development Bank in the amount of 350,000 US dollars, is a project that covers all areas of transport development – aviation, automobile, rail, maritime sectors and road development economy [Abbasov, Ch. M. (2006)]. The project envisages the development of the country’s transport infrastructure by attracting additional cargo along the transport corridors passing through the territory of Azerbaijan, by increasing in traffic, the construction and reconstruction of roads and transport facilities including regional airports. In December 2017, the Asian Development Bank approved two programs worth $ 650 million for Azerbaijan. The first is the $ 400 million Rail Sector Development Program. This program supports the restoration of roads and structures of the Sumgait-Yalama railway. It will provide Azerbaijan Railways with corporate governance, operational efficiency and financial sustainability. It will also provide the assistance to implement reforms in the road sector. The second program is the Program to Improve Management and Public Sector Effectiveness which costs $ 250 million [17]. This is the first attempt of Azerbaijan, based on the introduction of a programmed policy. It covers the rules of substantial financial planning, restructuring of state-owned enterprises, expanding the participation of the private sector and expanding access to finance and contributes to the creation and expansion of economic opportunities by improving the business environment.

Considering the analytical materials and reports of the Asian Development Bank and the European Development Bank, the author found that while using the evaluation method, the success rate of the projects in 2010-2016 in Azerbaijan was 80%. So, in 2010, 2014 and 2016, 3 projects were completely successful, and in 2012, 2 projects were only half fruitful [17].

From 2002 until the end of 2017, the Asian Development Bank officially co-financed in the amount of $ 2.5 million for one investment project (which forms a direct total additional cost for Azerbaijan) and six technical assistance projects in the amount of $ 2.72 million. The total commercial co-financing for Azerbaijan amounted to $ 1.1 billion for six investment projects. Co-financing of products without state guarantees for 2007-2017, covers 9 operations in the amount of $ 959.67 million. 4 joint projects financed for the period January 1, 2013 – December 31, 2017, were commercial and in the amount of $ 952.4 million, as well as 4 technical assistance grants in the amount of $ 1.87 million [17].

The Asian Development Bank provides loans, grants and technical assistance to developing countries every year to finance projects and activities, and also provides several billion dollars on the basis of contracts for the purchase of goods, work and consulting services. Most contracts are awarded on the basis of an international competition open to any regional or non-regional company, or an individual from any member country of the Asian Development Bank.

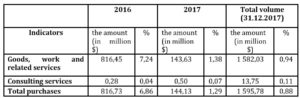

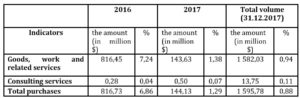

Table 1: Share of purchase contracts on loans, grants and technical assistance projects for Azerbaijan

Source: Information Sheet Partnership between the Asian Development Bank and Azerbaijan, (2018), Publication | July 2018, 2 р. https://www.adb.org/az/publications/azerbaijan-fact-sheet

Contracts for the purchase of goods, works and services under the Credit and grant operations project of the Asian Development Bank in the Asia-Pacific region amounted to $ 11.28 billion in 2016 and $ 10.43 billion in 2017. For comparison, it is noted that the total purchases of the Asian Development Bank in the Asia-Pacific region since 1966 include 211,316 contracts worth 169.12 billion US dollars. Since 1999, the Asian Development Bank has signed and provided 134 contracts to contractors and suppliers in the amount of $ 1.58 billion in Azerbaijan. As seen, only in Azerbaijan, the Asian Development Bank did allocate almost 0.93% of all purchases in the Asia-Pacific region for the procurement of goods, work and related services [5, 6, 8, 17, 35].

The Asian Development Bank’s portfolio in Azerbaijan consists of 7 projects worth 1.85 billion US dollars; 49% is for transport, 24% for water and sanitation and 13.5% for energy and public sector management [17]. The Asian Development Bank cooperates with the government in accordance with the standard practices of the bank itself in improving the environmental and social security of the country, procurement, financial management and anti-corruption initiatives, and providing a basis for gender equality. Particular attention is paid to strengthening the managerial and institutional capacity of the government implementing agencies, as well as the economic and financial sustainability of investments.

Mutual Interests of Azerbaijan And the Asian Development Bank: Development Directions

It is noted that the positive effect of the integration of some countries contributes to the development and accession of other countries to this process. However, as noted in a textbook edited by N. N. Liventsev: “a comparative analysis of the existing trade and economic groups also speaks of certain general laws governing the development of regional integration, successively passing it through a series of special stages, each of which has its own characteristic features in terms of different degrees of integration intensity, its depth and scale” [Liventsev N. N. (2006), p. 384]. Countries beyond integration feel difficulties over time in international economic relations because regional integration allows to use the opportunity of regional competitive advantages and economies of scale, that is, expand the market and reduce production costs and strengthen the cooperation of the countries of the region in different directions. Allowing, the use of the natural raw materials, financial investment, labor and information resources of the countries of the region to ensure production for a more capacious market and reduce social problems, such as migration, unemployment, poverty, etc. According to N. N. Liventsev, with whom the author of this paper agrees, it is necessary to take into account the fact that “the integration rapprochement of the countries of the Asia-Pacific Region was made possible thanks to the intensive investment of transnational corporations that contribute to the formation of a horizontal division of labor in the region. Trade and investment liberalization proceed from the principles of voluntariness and non-binding of member countries by mutual obligations. Each country develops an individual liberalization plan and implements it as necessary as possible, with pressure from the Asia-Pacific Economic Cooperation and individual countries. At this stage, a differentiated approach is needed in relation to developing countries, which is manifested in the asymmetry of liberalization in developed and developing countries” [Liventsev, N. N. (2006), p. 433].

As a developing country, Azerbaijan, participating in the regional integration process of Asia-Pacific Economic Cooperation, has been receiving investment assistance from the Asian Development Bank for several years in a row. However, technical assistance developed in the format of a medium-term investment plan for the coming years will be associated with the budget and industry results. The government’s capacity to develop, implement and monitor (through cost-benefit analysis) the results-oriented investment plan that will help prioritize investments in the future, will be strengthened.

For the subsequent cooperation of the Asian Development Bank and Azerbaijan, it is required to study the possibilities of providing advisory services on transactions. Inadequate control and weak internal controls and audits that impede effective cost management can result in financial losses [Abdullaev, T. N. (2019)] Therefore, the inclusion of Azerbaijan in regional technical assistance, which will result in a diagnostic study of the practice of accounting and auditing, will help strengthen the capacity for the implementation and preparation of the financial statements of the project and provide audit opinions. Also, regulatory documents, including loan agreements, will include the requirements of an external audit.

The partnership strategy until 2030 will support Azerbaijan’s transition to a diversified knowledge-based economy and support sustainable non-oil economic growth, focusing on individual sectors and topics that contribute to the diversification and create opportunities for creating new jobs, especially in rural areas [8]. A diversified, knowledge-based economy will stimulate new economic opportunities and exports in the non-oil sectors, which will contribute to inclusive growth and reduce inequalities between a town and a country. The development of a more sustainable non-oil economy can help Azerbaijan avoid the “middle-income trap”, which plagues many countries with above-average incomes [Mehdiyev, R. (2018) and Amirov, N. (2017)].

Several strategic priorities formed the choice of priority sectors for further cooperation, including the state strategy and government development programs, the medium-term plan of the Asian Development Bank, a review of the concept “Azerbaijan 2020: a look at the future”, the Central Asian Regional Economic Cooperation 2020, other strategies and complementarities with many development partners. Restrictions on resources available from the Asian Development Bank require a careful selection of sectors that have been identified in consultation with the government. The subsequent selectivity in the sector corresponds to the needs, government strategy, gaps and complementarity with other partners, as well as its own strategic priorities, comparative advantages and proven experience in Azerbaijan [9, 10].

Reliable electricity can increase work time and productivity and create jobs, while urban infrastructure and services provide access to basic services such as water and sanitation, education and healthcare by reducing the time and cost of providing services.

The Asian Development Bank in Azerbaijan is going to follow a system-wide approach to develop a transport infrastructure network that can contribute to the development of the non-oil sector. The East-West and the North-South corridors remain the main priority of the government since they are the main arteries providing international relations with neighboring countries. Financial assistance from the Asian Development Bank will help the government complete these priority transport corridors. The Asian Development Bank will help add value via knowledge components through an ongoing multi-tranche of the road. These financing tools will help in the development of the legal framework and operational procedures for toll roads (including possible public-private partnerships), and road safety procedures. The implementation of agreements for commercial vehicles and performance-based maintenance contracts are envisaged [32, 35].

A prerequisite for decision-making should be a preliminary examination of each investment program and project with a view of their compliance with the goals and priorities of socio-economic policy, economic security and the return on capital investment. The use of joint or shared state-commercial financing of investment projects, including the attraction of capital from foreign countries, allows obtaining additional financial resources. Therefore, it is necessary to explore the possibility of public-private partnerships.

In the author’s opinion, a model of mutual cooperation aims at common interests, goals and objectives of business and government of the country and society that is interesting to the country. The author believes that it is more profitable to introduce a model of the partnership (mutual cooperation) that interests both parties. However, there is a need for further analysis of the possibilities of using this model. The Asian Development Bank will assist the government in selecting potential private sector investors and commercial lenders for public-private partnerships. The support of the Central Bank of Azerbaijan will be aimed at improving the political, regulatory and supervisory structure for microfinance services in order to provide access to a wider range of financial services for low-income individuals and micro-enterprises outside Baku [6], [Salihov, A. (2015)]. As a result of the implementation of its operational strategy, the Asian Development Bank will support public-private partnerships, creating an enabling environment for public-private partnerships and assisting in the development of projects that will ultimately be funded by the Asian Development Bank. The initial work includes:

– Developing a regulatory framework for public-private partnerships,

– Creating public-private partnership units in order to develop a public-private partnership scheme (for example, for risk management),

– Building the potential of possible partners for public-private partnerships.

Unforeseen changes in the global or regional political and economic situation undermine the relevance of the proposals of the Asian Development Bank. To implement practical steps in the field of international, regional and interstate investment relations, it is envisaged to improve the legislative framework and procedures for drafting and concluding agreements. The main aspects are:

– The formation of a correct relationship, governed by the norms and principles of the international law;

– The solution of international, regional and interstate conflicts peacefully, primarily through negotiation;

– Accounting and observing the sovereign rights of all states;

– Coordination and regulation of economic interests;

– Creation of protective mechanisms for mutual guarantees;

– The expansion of multiculturalism, the removal of barriers and the exchange of cultural values.

Findings

The Asian Development Bank is an important financial and legal instrument of the international community for regulating regional relations, having over the years carried out ordinary volumes of investment operations in priority sectors of the economy in Azerbaijan.

Having a short experience in cooperation with the Asian Development Bank, Azerbaijan was able to use this interaction with the maximum benefit for itself. So, due to the received large loans, grants and technical assistance, it was able to solve important socio-economic problems, create a highly developed infrastructure and carry out large-scale projects. In the future, Azerbaijan will be able to adopt the valuable experience, selected from the best practices and proposed by the Asian Development Bank, in public administration.

Azerbaijan, taking large loans from the Asian Development Bank on very favorable conditions on one hand, solving its own socio-economic problems and meeting the interests of the Asian Development Bank on the other hand, contributes to the development of the entire Asia-Pacific Region, strengthening its position in the international arena. Therefore, this multilateral relationship will be relevant and beneficial for a long time, both for the country and for the countries of the Asia-Pacific Region. This study believes that the main directions of further cooperation of the Asian Development Bank with Azerbaijan may be through:

– Providing technical assistance to state bodies of state administration for the development of expenditure priorities and criteria for the management system;

– Providing support to government agencies to address investment and operation issues and financing maintenance;

– Conducting a regular dialogue with the Ministry of Finance and relevant ministries and departments on cost recovery, operation and maintenance, on mechanisms to support investment and encourage private participation in infrastructure support.

(adsbygoogle = window.adsbygoogle || []).push({});

Bibliography

- A guide to best practices in creating a positive business and investment climate. 2006 Organization for Security and Co-operation in Europe (OSCE) https://www.osce.org/ru/eea/19769?download=true

- Abbasov Ch.M. (2006) Azerbaijan’s economy on the paths of globalization: prerequisites and consequences. Baku, “Elm”, 2006. p. 192

- Abdullaev T. N. (2019), The goals, principles and main directions of activity of the Asian Development Bank and the national interests of Azerbaijan. Eurasian Union of Scientists (ESU) # 2 (59), 2019, pp. 19-25 .https://euroasia-science.ru/wp-content/uploads/2019/03/Euroasia_journal_7_part_14-1.pdf

- Amirov N. (2017), Strategy of deep economic reforms. Azerbaijan State News Agency 04/26/2017.https://azertag.az/ru/xeber/Strategiya_glubokih_ekonomicheskih_reform-1054804

- Asian Development Bank on the significance of the Azerbaijani gas project (Exclusive) (2018), Information site az. https://www.trend.az/business/energy/2871018.html

- Asian Development Bank, (2012). CAREC 2020: A strategic framework for the Central Asia Regional Economic Cooperation Program 2011–2020. Mandaluyong City, Philippines: Asian Development Bank, 2012. https://www.carecprogram.org/uploads/CAREC-2020-Strategic-Framework.pdf

- Barteneva V.I., E.N. Glazunova (2012), Promotion of international development. The course of lectures / Under the editorship of V.I. Barteneva and E.N. Glazunova. 2012 .– 408 p. http://documents.worldbank.org/curated/en/912971468294636076/text/763150RUSSIAN00B0lectures0RUS0final.txt

- CAREC 2030 Connecting the region for collaborative and sustainable development. October 2017, p. 35.https://www.adb.org/sites/default/files/institutional-document/388801/carec-2030-ru.pdf

- Decree of the President of the Republic of Azerbaijan on additional measures to encourage investment,(2018), https://azertag.az/ru/xeber/Ukaz_Prezidenta_Azerbaidzhanskoi_Respubliki_O_dopolnitelnyh_merah_po_pooshchreniyu_investicii-920626

- Decree of the President of the Republic of Azerbaijan on the approval of strategic roadmaps for the national economy and major sectors of the economy. December 6, 2016. https://ru.president.az/articles/21953

- Dynkin A.A., Baranovsky V.G. (2018), Russia and the world: 2019. Economics and foreign policy. Annual Forecast / Hands. project – A.A. Dynkin, V.G. Baranovsky. – M.: IMEMO RAS, 2018 .– 170 p. https://www.imemo.ru/files/File/ru/publ/2018/2018_25_1.pdf

- Fedotova V.G., Kolpakov V.A., Fedotova N.N. (2008), Global capitalism: three great transformations. – M.: Cultural revolution, 2008. – 608 p. https://iphras.ru/uplfile/root/biblio/kapitalizm_2008.pdf

- For foreign investors (2019), Website of the Ministry of Transport, Communications and High Technologies of the Republic of Azerbaijan. http://mincom.gov.az/az/view/pages/97/

- From transition to transformation: sustainable and inclusive development in Europe and Central Asia. Focal points: United Nations Economic Commission for Europe and United Nations Development Program, New York and Geneva 2012, p. 165 https://www.unece.org/fileadmin/DAM/publications/oes/ECE_RIO_20_RUS.pdf

- Huseyn A. (2019)Theoretical and practical aspects of the participation of civil servants in decision-making affecting business activities/ 37th International Scientific Conference on Economic and Social Development – “Socio Economic Problems of Sustainable Development”, Baku, 2019, p.57-67, https://www.esd-conference.com/past-conferences

- Ilyin I.V.(2016), Global processes and new formats of multilateral cooperation: a collection of scientific papers of conference participants / edited by I.V. Ilyin. – M., MOOSIPNN N.D. Kondratyev, 2016 https://istina.msu.ru/media/publications/article/7d9/d7e/40974845/Sbornik_FGP_2016.pdf

- Information Sheet Partnership between the Asian Development Bank and Azerbaijan, (2018),Publication | July 2018, 2 р. https://www.adb.org/az/publications/azerbaijan-fact-sheet

- Investment environment in Azerbaijan. https://www.azerbaijans.com/content_1614_ru.html

- Isazade F. (2018), President Aliyev: “Azerbaijan plays a stabilizing role in the region”, Interfax – Azerbaijan News Agency, 15.03.2018.http://interfax.az/view/728331

- Kulakov A. V. (2013), Influence of globalization processes on the border security of the Russian Federation // Electronic scientific publication Almanac Space and Time. 2013. No1. https://cyberleninka.ru/article/n/vliyanii-globalizatsionnyh-protsessov-na-pogranichnuyu-bezopasnost-rossiyskoy-federatsii

- Liventsev N. N. (2006), International economic relations, textbook. M:, Publishing House Prospect, 2006, 648 p.

- Makshantseva Yu. S. (2011), International methods of legal protection of foreign investment // Bulletin of OSU. 2011. No3 (122).https://cyberleninka.ru/article/n/mezhdunarodnye-sposoby-pravovoy-zaschity-inostrannyh-investitsiy.

- Mehdiyev R. (2018), Azerbaijan, under the leadership of Ilham Aliyev, has become the most promising country in the region. State News Agency AZERTAC04.2018.https://novosti.az/politics/21324.html

- Note by the secretariat. Regional implementation of the Vienna Program of Action for Landlocked Developing Countries for the Decade 2014–2024. United Nations E / ESCAP / 73/3, Economic and Social Council. Distr.: General 28 February 2017 https://www.unescap.org/commission/73/document/E73_3R.pdf

- Nureyev R.M. (2001), Development Economics: Models of the Formation of a Market Economy. Textbook. Moscow: INFRA-M, 2001, p. 152. – (Series “Higher Education”).http://library.asue.am/open/3013.pdf

- Order of the President of the Republic of Azerbaijan on a number of measures to promote investment activities and protect the rights of foreign investors, № 3586, January 18, 2018. https://president.az/articles/26765

- Protection of state sovereignty (2017), a monograph. M .: Norma, 2017 .– 790 p.http://ljournal.ru/wp-content/uploads/2017/10/g-2017-755.pdf

- Resolution adopted by the General Assembly on 12 December 2014. Resolution 69/137. Program of Action for Landlocked Developing Countries for the Decade 2014–2024 United Nations A / RES / 69/137, General Assembly, January 2015 https://undocs.org/ru/A/RES/69/137

- Salihov A. (2015), Saving children’s lives is the most precious reward and result of our work. ADB annual report 2015. р 16-19. https://www.adb.org/sites/default/files/institutional-document/182852/adb-annual-report-2015.pdf

- Stefan W. Schill.(2013), Investment protection law as an element of international development law. DPP IMP 2 (2013), https://www.hjpl.de/02_2013/02_2013_157_217.pdf

- The Asian Development Bank is changing the approach to partnership with Azerbaijan. (2018), Information site Day.az ECONOMY, October 26, 2018. https://news.day.az/economy/1055596.html

- The high ratings of Azerbaijan in the reports of international structures help to attract investment in the country (2018), Information site 1news.az. Economy. November 13, 2018. http://1news.az/mobile/news/vysokie-reytingi-azerbaydzhana-v-otchetah-mezhdunarodnyh-struktur-pomogayut-privlekat-v-stranu-investicii

- The Law of the Republic of Azerbaijan “On Investment Activities” confirmed by decree of the President of the Republic of Azerbaijan No. 952 of January 13, 1995. http://www.e-qanun.az/framework/9367

- The Law of the Republic of Azerbaijan “On the Protection of Foreign Investments” confirmed by decree of the President of the Republic of Azerbaijan No. 57 of January 15, 1992. http://www.e-qanun.az/framework/7000

- The role of development banks in implementing the strategic interests of the state. Analytical report. Center for Economic and Financial Research and Development, Series “Analytical Reports and Development” No. 40 November 2014, file:///C:/Users/User/Downloads/PP40_1.pdf

- Tirskikh M. G. (2016), Problems of establishing international legal standards for the protection of investor rights and their implementation in national legislation. Journal of the Institute of Legislation and Legal Information M.M. Speransky; Publisher: Institute of Legislation and Legal Information. M.M. Speransky (Irkutsk) No. 4, 2016.,https://elibrary.ru/item.asp?id=27466978

- Tolorai G.D. (2012), Northeast Asia: the key to Russia’s entry into regional integration in the Asia-Pacific region? // East and Southeast Asia-2011 domestic and foreign policy, inter-country conflicts. -M.: Institute of Economics, RAS, 2012.p. 8.