Introduction

In the light of the way the COVID-19 pandemic influenced the economic activity, Russia turned out to be pretty resilient to the crisis. And mortgage became one of the fastest growing segments of the banking market; 2020 was a record year for mortgage lending. So, in Russia, 1.7 million mortgage loans were provided, amounting to 4.3 million rubles, which is 35% and 51%, respectively, higher than the level of 2019. The mortgage market has renewed its historical maximum for most of its characteristics.

There were two main reasons for the mortgage boom. The first one was the unprecedented decrease in mortgage rates because of the monetary policy easing by the Central Bank of the Russian Federation. The second one was the launch of a state support program for mortgages in May 2020, which implies subsidizing rates and providing mortgages for new buildings at the rate of 6.5%.

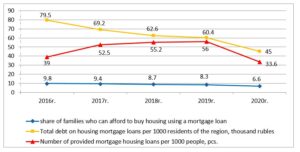

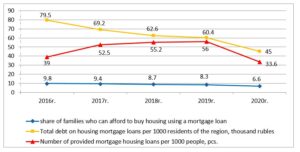

Despite the quantity characteristics, the quality parameters of the mortgage market improved too. That includes the increase in the share of families who can afford to buy housing using a mortgage loan. According to the RiaRating assessment, this parameter went from 31,3% (2019) to 32,7% (2020). Statistics show that state support measures affected favorably the “poor” regions, where the availability of mortgages by the end of 2020 increased more than in the “rich” ones. As a result, the gap shortened in the KPIs characterizing the efficiency of local mortgage markets development between developed and developing. Calculation showed the differential coefficient of “The share of families who can afford to buy housing using a mortgage loan” went down to 6,6 (8,3 on 2019), of “Total debt on mortgage loans per 1000 residents of the region” – went down to 45 (60,4 in 2019), and of “The amount of provided mortgage loans per a thousand of economically active citizens” – went down to 33,6 (56,0 in 2019).

Table 1: Analysis of regional mortgage inequality based on the fund ratio for extreme values of the regions, 2016–2020

Source: authors’ calculations based on data provided by the Central Bank of the Russian Federation, Rosstat, RiaRating agency

An illustration of the decrease in regional mortgage inequality dynamics for the selected set of indicators is shown in Figure 1.

Fig. 1. Dynamics of differentiation coefficients for the main indicators characterizing the regional mortgage markets’ development

Source: authors’ calculation

Despite the significant improvement of indicators, characterizing the magnitude of the spread in the values of key mortgage parameters, regional inequality of mortgage markets in Russia remains very high. The obtained differential coefficient values prove that, for example, in the Republic of Ingushetia in 2020 the number of mortgage loans was issued per 1000 economically active citizens, 33,5 times less than in the Yamalo-Nenets autonomous area. At the same time, the size of mortgage debt between the same constituent entities of the Russian Federation in 2020 was 45 times different!

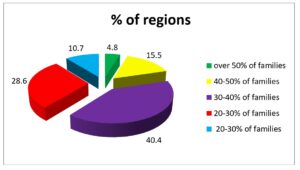

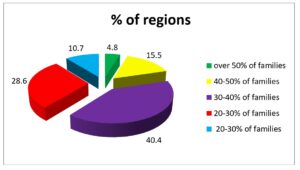

As for the share of families, it should be stated that according to the maximum values in 9 regions (10,7% out of total amount), in the year 2020, buying a housing via a mortgage loan is affordable for only 20% of the residents, and in 24 Russian entities buying housing via mortgage systems is affordable for 20-30% of the population.

Fig. 2. Distribution by the level of affordability of mortgage purchase in the regions, 2020

Source: authors’ compilation based on RiaRating data

For modern economic conditions, when the state proclaims mortgage lending its main tool for improving the living conditions of citizens, such statistics prove the need to strengthen government support for regional mortgage markets.

In addition, the question arises if the development efficiency values obtained in 2020 are sustainable in the Russian mortgage market. Should we expect the indicators to stabilize at the achieved levels and is it possible to increase both quantitative and qualitative characteristics of mortgage development in the country more?

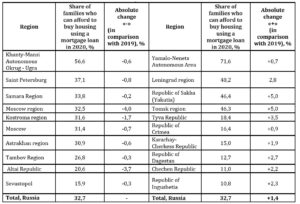

Analysis of existing trends does not allow an unambiguous positive answer to the question. First, the conditions for preferential mortgages have changed. This mortgage program at 6.5% per annum, under which 95% of loans for new buildings were provided, was to expire on July 1, 2021. Earlier, according to the head of the Central Bank, it was reported that the prolongation of the program is possible only for some regions where demand for housing had not fully recovered. And only 24 regions of the country were included in the list of candidates (Lun’kova (2021)).

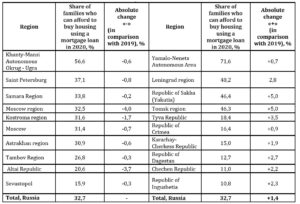

The Central Bank decision to stop the program was facilitated by a decrease in the availability of buying housing via a mortgage loan in some regions of the country. So, despite the fact that in general in Russia the affordability of mortgage loans increased by 1.4% (compared to 2019), in such regions as Moscow, St. Petersburg, Samara region and some others (Table 2), affordability indicators decreased. The most significant decrease in the affordability of mortgage lending was observed in the Moscow Region (-4.0%) and the Altai Republic (-3.7%).

Table 2: Dynamics of the affordability of buying a home via a mortgage loan in the regions, 2019-2020

Source: authors’ compilation based on RiaRating data

The reason for the decline in affordability in most of the regions indicated in Table 2 was the growth in housing prices, largely stimulated by a decrease in rates both for key market products and for mortgages with state support. In this regard, despite the generally positive result achieved from the implementation of the state support program, its disadvantage can be called the total provision of state support, which is carried out without any connection to a complex of socio-economic and mortgage indicators of the regional markets development.

However, the economically justified decision of the Central Bank of the Russian Federation was revised. In June 2021, Russian President Vladimir Putin announced that the preferential mortgage program will be extended for absolutely all regions for a year – until July 2022. The rate under this program will be increased from 6.5% to 7%. At the same time, the maximum amount of the housing cost on a preferential mortgage and the maximum loan amount have been reduced. According to the President of the Russian Federation, preferential mortgages were introduced as an anti-crisis measure and cannot be abruptly cut off. But, the preferential mortgage program remained time restricted, and its conditions became stricter. For some regions, where under the influence of this program, there was a tendency of decreasing housing affordability; one can expect its continuation, though at a slower pace. For other regions, we should expect its appearance with toughening of the program conditions. These circumstances cannot but affect the sustainability of mortgage development in Russia in 2021-2022.

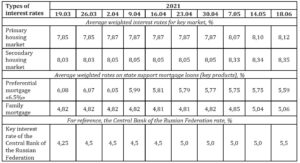

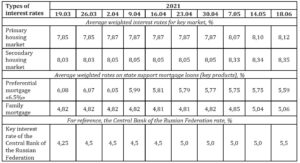

There is the second reason why quantity and quality parameters of the mortgage market development that were achieved in 2020 might deteriorate. It includes the monetary policy toughening by the Central Bank and the mortgage rates increase due to the key interest rate of the Central Bank increase, firstly, from 4,25% to 4,5% per annum, then to 5,0% p.a. (23.04.2021), and finally, to 15,5% p.a. (15.06.2021). Dynamics of mortgage rates for both key market products and state support mortgage loans of the last three months of 2021 is presented in Table 3. The analysis shows that in the primary market the average weighted interest rate has already increased by 0.27 points; in the secondary market the growth turned out to be even more significant and amounted to 0.32%.

Table 3: Dynamics of mortgage rates of the top 15 banks in the housing market for the period 03/19/2021 – 05/14/2021

Source: authors’ compilation based on DOM.RF data

State support program called “Family mortgage” the increase was by 0.24 points but the time restricted program “Preferential mortgage “6,5%”” rates are still going down. And this leap in the cost of a mortgage loan occurred in the context of a second increase in the refinancing rate, when the market did not have time to respond to a new increase in the key interest rate of the Central Bank of the Russian Federation (June 15, 2021).

In this regard, the development of targeted mechanisms and state support mortgage programs in regions of the Russian Federation is very relevant.

These programs should be based on an economically proven methodology for classifying Russian entities by the level of mortgage potential that has developed in the region. At the same time, the conditions of a dynamically changing market environment dictate the need to use both complex methods based on fundamental assessments of the state of mortgage markets and express models for assessing the level of mortgage development in the regions, in general, and regional mortgage inequality, in particular. Such methods will become a key tool for substantiating management decisions for improving the quantity and quality characteristics of the regional mortgage markets development.

Background Research

The issues of managing imbalances in regional socio-economic development, including managing individual qualitative and quantitative characteristics that are integrated into encompassing criteria, are among the most relevant and interesting for studying problems among foreign and Russian researchers. Scientists analyze the problem either on a global scale, assessing the general socio-economic development of the region (for example, Ozkan and Beyazli (2018), Skuf’ina, Baranov and Samarina (2018), Kislitsyna, Cheglakova, Karaulov and colleagues etc. (2017), Shabunova and Gruzdeva (2016), Nizhegorodtsev, Piskun and Kudrevich (2017)), its competitive capacity (for example, Moirangthem and Nag (2021), Bronisz, Heijman and Miszczuk (2008), Žitek and Klimova (2015)) and (or) the investment potential (for example, Lapin and Makeeva (2013), Mustafakulov (2017), Kuznetsov, Vladimirov and Sycheva (2019)), or a bit more specifically, when the most important subsystems of the economic system of the region, such as production and financial ones, become the object of the study and comparative assessment. So, there are a lot of studies that assess the financial potential of the region (for example, Suhodoev (2021), Rytova and Gutman (2019), Badylevich and Verbinenko (2019)). And its structure elements are often studied inseparably including budgetary potential, credit potential, investment potential, etc. (for example, Radchenko and Lazutina (2018), Zenchenko and Berezhnoj (2008)). Other researchers consider each of the constituent elements of the financial potential as an independent object of research, developing and applying different assessment methodologies. Now, when the mortgage market is becoming the most important segment of the financial market, the regional mortgage potential is being studied as one of such independent objects of research.

Despite the range of assessing regional imbalances in economic development being narrowed to the level of the region’s mortgage potential, the very problem of inequality of regional mortgage markets is quite relevant for Russia. Solving this problem is a priority task for the country.

The priority of it is proven, firstly, by the low competitive capacity of the Russian mortgage market in the global economy. In today’s Russia, mortgage market is a very raw mechanism that has been operating slightly more than twenty years making it unsuitable for competing with mortgage markets of other countries. The main indicators characterizing the level of mortgage development in cross-country comparisons show that the Russian Federation is still significantly behind the developed countries of the world. For example, according to the key indicator, which is the share of mortgages in GDP, at the end of 2019, Russia, with a result of 7.8%, is not only several times behind the leading mortgage powers, for example, Denmark (10.6 times), Switzerland (19.6 times), the USA (6.6 times) and Canada (9.2 times), but it does not even reach the countries of the former socialist bloc. For example, at the end of the same 2019, the share of mortgages in GDP of Bulgaria, Hungary and Romania was 10.5%, 9.5% and 7.8%, respectively.

Secondly, the priority is proven by the development of the residential mortgage lending being the most important socio-economic task for Russia as it is transiting from the principle of free housing distribution to all those in need, operating in the administrative economy area, to citizens buying housing at the expense of both their own and credit resources, operating in a market economy.

And, thirdly, it is dictated by the goals of the state regional development policy presented in “Guideline of the state regional development policy of the Russian Federation for the period until the year 2025” document. It states that ensuring economic growth sustainability, as well as increasing the competitiveness of the Russian Federation economy on world markets should be achieved by balancing and developing regional systems.

Researchers are driven by the problems of regional mortgage inequality and regional mortgage mechanisms of sustainable development in all Russian entities to find effective and reasonable regional mortgage potential assessment methods. Mostly, such assessment is based on calculations of integral criteria. The purpose of this paper is to develop approaches to the formation of integral criteria in the analysis of regional disparities of the mortgage lending market.

Analysis of methodological approaches for assessing regional mortgage potential based on integral criteria allows us to identify several groups of approaches:

- General methods of an integral criterion formation. In this case, researchers follow the “classic” path from the choice of particular indicators, their subsequent transformation, for example, normalization, to the aggregation of the transformed particular indicators based on additive or multiplicative convolution into the desired integral criterion (for example, Gritsenko, Peredera and Teryaeva (2017), Kuznetsova (2017)).

- Multivariate statistical analysis methods, namely:

- Сluster analysis (e.g., Ivashkov (2011); Savrukov (2012); Chukanov (2019)).

- Factor analysis (e.g., Grezina (2011)).

- Discriminative analysis (e.g., Grezina (2011)) and some others.

As for the foreign experience analysis, exploring foreign scientific literature indicates that despite the fact that the topic of sustainable mortgage development in both developed and developing countries of the world is also very popular (e.g., Ganbarov, Smolag, Muradov and colleagues etc. (2020), Spilbergs (2019), Dübel (2011)), the problem of the residential market segmentation is studied more often abroad (e.g., Chen, Ji, Su and colleagues etc. (2021), Vatansever, Demir and Hepsen (2019), Bourassa, Hoesli and Peng (2003). At the same time, when forming integral criteria, the same method composition is used.

It should be noted that on the basis of the one chosen method, it is not always possible to obtain the desired integral criterion in quantitative terms, therefore, in most of the analyzed studies, the authors used a set of methods to obtain the desired result with the possibility of economic interpretation. The latter is more related to the methods of multivariate statistical analysis, for example, cluster analysis.

Another important remark refers to the fact that “the main feature of all regional economy integral assessments is their subjectivity. Therefore, no integral assessment of the region’s economy can be perceived as an absolute truth” (Zenchenko and Berezhnoj (2008)). The choice of a particular methodology should be determined, at least, by such parameters as the purpose and objectives of the assessment, the level and scope of the methodology, as well as its advantages and disadvantages in implementation.

An analysis of the existing approaches to assess the regional mortgage potential allows us to draw several fundamental conclusions, each of which, in turn, is a consequence of the complexity and multistage nature of calculations. So, any of the studied methods begins with the private indicators’ selection, the formation of data arrays for the entire set of regions based on retrospective indicator values, the subsequent processing of these arrays, using Excel tools or applied statistical programs, etc. As a result, an integral criterion forms a demonstrating place of the region in the ranked list but does not contain additional information for the economic justification of the direction choice for obtained regional positions’ further improvement. These conclusions allow us to claim that: firstly, the level of existing methods’ usage refers to the federal one. Conducting such assessments at the regional level (by the authorities, mortgage operators and banks) can hardly be considered appropriate.

Secondly, the calculation complexity, the need for skills while working with software statistical systems, for example Statistica or SPSS, the assessment development based on retrospective indicator values do not allow us to call the existing methods a flexible tool for solving regional mortgage problems.

Thirdly, for the same reasons, the nature of assessments is more related to the fundamental problems’ assessment in the regional mortgage market development. The authors do not set the goal to obtain a tool for their express assessment that allows them to respond to current changes in the market environment.

Obtaining a simplified assessment mechanism based on an express analysis of regional mortgage markets can become an important milestone in the practical use of criterion values and significantly expand the scope of the methodology to a larger circle of users.

Materials and Methods

The following research continues the previous multistage work for developing regional mortgage market management tools. The first stage was to create the comprehensive methodology for assessing regional mortgage potential that is the most economically justified “fundamental” approach for assessing regional imbalances in the mortgage markets’ development. This study explores the development of a fundamental approach by adding a new structural element, namely, a methodology for a regional mortgage inequality express assessment. The basis for the development of express models in this study is regression analysis.

Let us address the results obtained at the first stage of the integrated methodology development. So, “it is based on the differential indicator of the development level of the regional RML system (ki), represented by the following formula:

where,

F1i – value of the first factor (the first principal component);

F2i – value of the second factor (the second principal component);

F3i – value of the third factor (the third principal component);

i – region number» (Korosteleva and Tselin (2021)).

The general method for obtaining a differential indicator, as can be seen from formula 1, is the factor analysis (Principal Component Method).

The factors (principal components) are identified by processing panel data arrays formed by 23 primary variables for 85 constituent entities of the Russian Federation.

The source of most of the panel data was the state statistics agencies of the Russian Federation, such as Rosstat and the Central Bank. At the same time, several primary variables were used, identified by high-quality information and analytical agencies, including the “RIA Rating” agency. Thus, the resulting model made it possible to take into account not only quantitative, but also qualitative indicators of the regional mortgage lending development, such as, for example, the share of families who can buy housing using a mortgage loan or the housing affordability coefficient in the region and some others.

The composition of the factors identified as a result of processing in the Statistica software for each of the 7 data sets for 2013-2019 proved to be comparable; the structure of the model was explained. The last conclusion is supported by the fact that for all the years of the study, the accumulated share of the explained group variance for the three identified factors was more than 70%. The study of the primary variables’ composition of each of the selected factors allowed us to give them the following economic interpretation:

«- F1 – regional mortgage market performance indicator;

– F2 – indicator of the housing mortgage affordability in the region;

– F3 – indicator of the business activity in the housing construction» (Korosteleva (2020)).

The proposed method has a significant set of advantages, already substantiated in the scientific literature (Korosteleva and Tselin (2020)), including the complexity of the formed criterion, the accuracy of the assessment, the possibility of visual interpretation, and a number of others. However, its primary scientific and practical value is that it offers a reliable basis for making economically justified decisions in managing the development of regional mortgage markets and their convergence. State support for regional mortgage markets, based on the differential indicator model, becomes targeted, as it is carried out in the identified problem areas of the regional mortgage policy. These problem areas within the terms of the model (1) practical application are identified by the low values of the factors (F1-F3) obtained during the processing of primary indicators.

But it also has some disadvantages, which are its complexity and calculation intensity, the need to use specialized software for data processing, for example, Statistica, etc.

Those drawbacks can be eliminated by using the express analysis method for regional mortgage markets that will complement the already existing regional mortgage potential assessment method.

The use of regression analysis is proposed in this study as a basic method of forming express-methodology. Its application will allow adapting the methodology for determining the differential indicator by primary factor regression models.

Then, the reverse “convolution” of the differential indicator is possible on the basis of the following primary factor regression:

where, – approximate value of the m-factor for the i-region.

fj – standardized values of primary variables as part of the m-factor;

kj – obtained regression coefficients;

b – intercept term;

j – the number of the primary variable of the factor, j=1…n.

The set of primary variables in model (2) is proposed to be formed on the basis of a reduced set of variables that form the main components for a comprehensive assessment model of the regional mortgage potential (1).

So, on the basis of the supported by scientific literature studies, based on studies conducted and tested in the scientific literature ten indicators were included in the first principal component (F1), and five indicators were included in the second principal component (F2). The third principal component (F3) was also formed by two indicators (Korosteleva and Tselin (2021)).

Results

As an example, the results of the inverse convolution of factor F2 are presented. Factor 2 is an indicator of the housing mortgage affordability in the region. The inverse convolution is based on the multilinear regression model.

Regression analysis was carried out using the capabilities of the Excel add-in “Data Analysis”, as well as the statistical package Statistica. While developing regression models, data sets formed by 23 variables for 85 regions of the Russian Federation for 2014-2018 were used. The simulation results are presented in tables 4, 5, 6.

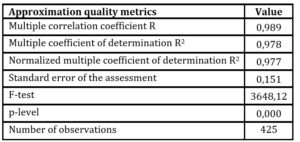

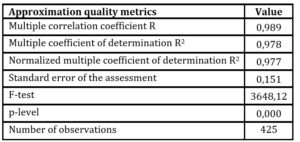

Analysis of the results presented in table 4 showed a high quality of the approximation. Thus, the accuracy degree of the description obtained by the model of the process of regional housing mortgage affordability in the region forming (Factor 2) (basing on the value of the R-square = 0.978 (Table 4)) can be assessed as high.

Table 4: Assessment of the regression model approximation accuracy

Source: authors’ calculation

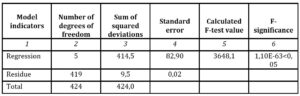

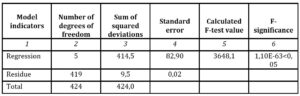

Analysis of the analysis of variance results via the F-test also confirmed the quality of the resulting model. As shown in Table 5, the significance level following the calculated F-statistic is much less than 0.05, which once again allows us to conclude that the model is significant.

Table 5: ANOVA: Fischer Model Quality Assessment

Source: authors’ calculation

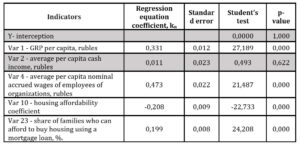

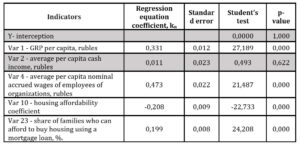

P-values for var1, var4, var10, and var23 coefficients turned out to be much less than 0,05 (Table 6) making it possible to include them into the forming model of the multilinear regression model for Factor 2 whilst var2 was excluded from the model as its р‑value = 0,622 > 0,05. The value of the intercept term (Y-intersection) was excluded too as its p-value = 1.

Table 6: Multiple regression model parameters

Source: authors’ calculation

Thus, a multilinear regression model (2) for F2 for i-region can be presented as:

where Х1 — normalized values of Var1;

Х2 — normalized values of Var4;

Х3 — normalized values of Var10;

Х4 — normalized values of Var23.

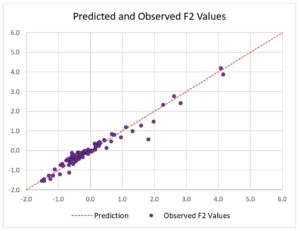

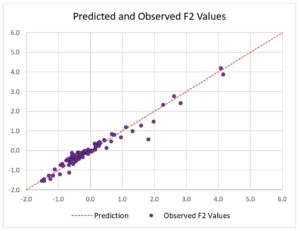

Then, via the obtained model (3), the forecast of Factor 2 values on the regional level for the year 2019 was carried out.

Figure 3 shows the grouping of regions according to the organized estimations of the predicted Factor 2 values for 2019. The analysis of the forecast accuracy, carried out with the t-statistics and analysis of variance, as well as the visual interpretation of the results obtained (Fig. 3) demonstrate the high predictive ability of the obtained model and prove the possibility of its subsequent use for the purpose of multidimensional regions ranking according to the differential indicator (1). At the same time, a high forecasting error is observed in no more than 11% of the constituent entities of the Russian Federation. The number of regions with a high error includes subjects with abnormal characteristics of socio-economic development, in general, and mortgage markets, in particular. As a rule, these are the metropolitan regions (for example, Moscow (c18) and the Moscow region (c10)), as well as the northern regions that are significantly far from the center of the country (for example, the Irkutsk region (c70), the Republic of Tyva (65)) and the Far Eastern regions (for example, Sakhalin Region (s81)).

Fig. 3. Diagram of deviations of predicted and observed Factor 2 values based on model (3)

Source: authors’ research

In general, assessments of the housing mortgage affordability in individual regions are well grouped around the obtained multiple regression model, which once again clearly illustrates the adequacy and acceptable accuracy of the obtained forecast.

Discussion and Conclusion

On the one hand, the proposed approach for analyzing regional mortgage development imbalances is a logic extension of the authors’ methodology for a comprehensive assessment of the regional mortgage potential. On the other hand, it differs from it in a whole set of characteristics. To get the idea of these differences, an analysis was carried out and the following parameters were identified: purpose, main goals, methodology, model, composition of primary indicators, method and area of application, advantages and disadvantages. The results of the comparative analysis are presented in table 7.

So, if the purpose of the author’s methodology for a comprehensive regional mortgage potential assessment is a fundamental analysis of regional mortgage systems, then the express methodology allows obtaining a simplified assessment. The assessments gained from the express analysis make it quick and easy to identify the bottlenecks in the regional RML systems and to define preliminary conclusions about the regional imbalance scale on the RML market. The results of the express assessment can be complemented with fundamental analysis indicators of the regional mortgage potential, if necessary.

The results of express assessments will be in demand, first of all, by regional authorities, but at the same time, they may also be of interest to a wider circle of users, for example, the financial institution for development in the housing sector (DOM.RF), regional mortgage operators, as well as credit institutions (e.g., banks).

Table 7: Comparative analysis of the express assessment and an integrated approach in assessing the inequality in the development of regional RML systems

Source: authors’ calculation

In particular, regional authorities could use this method, firstly, to monitor the state of the regional mortgage system; secondly, to analyze the effectiveness of the regional mortgage programs and national projects’ implementation that subsidized by the state within the terms of state support of the constituent entities of the Russian Federation.

At the same time, the express approach for assessing the regional mortgage potential can be in demand by such subjects of the RML system as DOM.RF, regional mortgage operators, as well as mortgage banks for inner budget and financial planning of their operating activities for the coming period, as well as in the development and justification feasibility of introducing own’s mortgage products and programs in the regions of operation.

The express method usage will help to avoid the drawbacks of the fundamental assessment, such as the complexity of calculations, the need to use software packages like Statistica and have appropriate skills. In turn, users will receive a flexible and simple tool for tactical management of regional mortgage markets that will allow them to quickly respond to adverse changes in the market environment.

Summarizing the study, the following conclusions can be drawn:

- Currently, the need to develop methods for the express assessment of the regional mortgage potential is becoming highly relevant.

- The express analysis method should be a logical extension for comprehensive assessments of regional mortgage potential, expanding the level and scope of their application, as well as leveling the disadvantages of the latter. The most justified comprehensive approach to assess the regional mortgage potential is the authors’ methodology based on finding the differential indicator of the level of regional RML system development.

- The methodological basis of the proposed express method is regression analysis, which allows the reverse convolution of the principal components (factors). Principal components form the differential indicator. The regression analysis also allows obtaining their approximate values via regression models of primary factors.

- The proposed approach to the express assessment of regional mortgage potential provides users of the methodology with a reliable, methodologically justified basis for preparing balanced decisions on the regional mortgage market management.

Acknowledgment

The reported study was funded by RFBR, project number 20-010-00654.

References

- Badylevich, R.V., Verbinenko, E.A. (2019), Approaches to building a system of financial regulation of the development of the regions of the North based on an assessment of the financial potential, FRC KSC RAS.

- Bourassa, S.C., Hoesli, M. and Peng, V.S. (2003), ʻDo housing submarkets really matter,ʼ Journal of Housing Economics, 12, 12-28.

- Bronisz, U., Heijman, W. and Miszczuk, A. (2008), ʻRegional competitiveness in Poland: Creating an index,ʼ Jahrbuch f¨ur Regionalwissenschaft, 2, 133–143.

- Chen, J.H., Ji, T.T., Su, M.C., Wei, H.H., Azzizi, V.T. and Hsu, S.C. (2021), ʻSwarm-inspired data-driven approach for housing market segmentation: a case study of Taipei city,ʼ Journal of Housing and the Built Environment, 36 (1), 1-25.

- Chukanov, А.I. (2019) ʻСlusterization of russian regions by the level of mortgage developing. Research and development,ʼ Economy, 7(1), 31-36.

- Dübel, H.J. (2011) Regulation and Access to Finance. In: Köhn D., von Pischke J. (eds) Housing Finance in Emerging Markets. Springer, Berlin, Heidelberg.

- Ganbarov, F., Smolag, K., Muradov, R., Aghayeva, K., Jafarova, R. and Mammadov Y. (2020), ʻSwarm Sustainable Development of the Mortgage Market in Azerbaijan: Commercial Risks of Housing Construction, Social Vision, and State Influence,ʼ Sustainability, 12(12), 5116.

- Grezina, M.A. (2011) ʻEconomic and mathematical methods for making managerial decisions in the field of mortgage lending,ʼ News of the SFU. Technical science,11(124), 51-60.

- Gritsenko, T.S., Peredera, Zh.S. and Teryaeva, A.S. (2017), ʻDetermining the level of development of mortgage lending in the regions on the basis of cluster analysis and integrated assessment,ʼ Internet journal “SCIENCE”. [Online], 9(3), [Retrieved May 25, 2021], http://naukovedenie.ru/PDF/28EVN317.pdf.

- Ivashkov, A.O. (2011) ʻClassification of constituent entities of the Russian Federation by the level of potential in the field of development of mortgage lending,ʼ Russian business, 12(8), 98-103.

- Kislitsyna, V.V., Cheglakova, L.S., Karaulov, V.M. and Chikisheva, A.N. (2017), ʻFormation of the integrated approach to the assessment of socio-economic development of regions,ʼ Economy of Region, 13(2), 369-380.

- Korosteleva, T.S. (2020) ʻNew approaches to the study of regional mortgage inequality on the basis of the principal component analysis,ʼ Russian Journal of Housing Research, 7(2), 127–152.

- Korosteleva, T.S. and Tselin ,V.Y. (2020), ʻAssessment of regional mortgage inequality: comparative analysis of methods and results,ʼ Vestnik of Samara University. Economics and Management, 11(3), 92-106.

- Korosteleva, T.S., and Tselin, V.Y. (2021), ʻManagement of regional imbalances in the Russian mortgage market using the principal components method,ʼ Journal of Economics Studies and Research, 2021 (2021), Article ID 126542. [Online], [Retrieved July 14, 2021], https://ibimapublishing.org/articles/JESR/2021/126542/.

- Kuznetsov, V.I., Vladimirov, N.A. and Sycheva, M.A. (2019), ʻAbout differentiation of regions of the Russian Federation on the level of investment attractiveness,ʼ Statistics and Economics, 16(2), 25-33.

- Kuznetsova, E.O. (2017) ʻAssessment of the development of the mortgage market in the regions of Russia,ʼ Entrepreneur’s Guide, 33, 123-129.

- Lapin, A.E. and Makeeva, V.A. (2013), ʻRating Appraisal of Investment Attractiveness of the Region (on the Materials of the Ulyanovsk Region),ʼ Bulletin of the Saratov University. New series. Series Economics. Management. Right, 13(3(2)), 398-403.

- Lun’kova, V. (2021), “Preferential mortgage at 6.5%: in which regions it will remain’, / RBK. [Online], [Retrieved May 11, 2021], https://realty.rbc.ru/news/5f3f71b29a7947cc7eac6f76.

- Moirangthem, N.S. and Nag, B. (2021), ʻMeasuring regional competitiveness on the basis of entrepreneurship, technological readiness and quality of institutions,ʼ Competitiveness Review. [Online], [Retrieved July 27, 2021], https://www.emerald.com/insight/content/doi/10.1108/CR-11-2020-0139/full/html.

- Mustafakulov, Sh. (2017) ʻInvestment Attractiveness of Regions: Methodic Aspects of the Definition and Classification of Impacting Factors,ʼ European Scientific Journal, 13(10), 433–449.

- Nizhegorodtsev, R.M., Piskun, E.I. and Kudrevich, V.V. (2017), ʻForecasting indicators of socio-economic development of the region,ʼ Economy of region, 13(1), 38–48.

- Ozkan, S. D. and Beyazli, D. (2018), ʻData Set for the Determination of Regional Development Level: Criticism and Recommendations,ʼ PLANLAMA-PLANNING, 28(1), 22-39.

- Radchenko, O. and Lazutina, L. (2018), ʻMethodological approaches to assessing the financial potential of rural development in Ukraine,ʼ Agrarian Economics, 12, 52-58.

- Rytova, E. and Gutman, S. (2019), ʻAnalysis of Financial Potential of a Region: Case of Yamal,ʼ Proceedings of the 34th Conference International Business Information Management Association, (IBIMA) – Vision 2025: Education excellence and management of innovations through sustainable economic competitive advantage, 2019; Spain, 3651-3658.

- Savrukov, A.N. (2012) ʻMethodology for assessing the potential of housing mortgage lending in the region,ʼ Regional Economics: Theory and Practice, 8, 33-43.

- Shabunova, A.A. and Gruzdeva, M.A. (2016), ʻThe development of the regions of the Russian Federation: an integrated methodology as an assessment tool,ʼ Regional Economics: Theory and Practice, 1(424), 100-112.

- Skuf’ina, T., Baranov, S. and Samarina, V. (2018), ʻDifferentiation of Socio-Economical Environment as Factors of Regional Development (The Case Study of Murmansk Region, Russia),ʼ Advanced Science Letters, 24(9): 6329-6331(3).

- Spilbergs, A. (2019) ʻHousing loans risk drivers and their impact on banking and residential market sustainability in Latvia,ʼ Proceedings of the 39th International scientific conference on economic and social development – sustainability from an economic and social perspective, Portugal, 256-266.

- Suhodoev, D.V. (2013) ʻAssessment of the financial potential of the region,ʼ Finance and Credit, 19(4), 24–28.

- Vatansever, M., Demir, I., and Hepsen, A. (2019), ʻCluster and forecasting analysis of the residential market in Turkey: An autoregressive model-based fuzzy clustering approach,ʼ International Journal of Housing Markets and Analysis, 13(4): 583-600.

- Zenchenko, S.V., and Berezhnoj, V. I. (2008), ʻThe system of integral assessment of the financial potential of the region and the method of its formation,ʼ Regional problems of transforming the economy, 2 (15), 27-37.

- Žítek, V. and Klímová, V. (2015), ʻThe Competitiveness Index of Czech Regions,ʼ Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis. Mendel University Press, 2, 693–701.