Introduction

When searching for the compromise between his or her long and short-term goals, investor always faces a dilemma of whether to receive benefit immediately in the form of dividend payout or invest these funds to get higher return in the future.

High immediate benefits, such as short-term corporate profit maximization (which drives stock price), can be achieved by various means: manipulating accounting figures, cutting R&D investments, saving on the employee safety or on the waste treatment technologies. The problem, however, is seen in the sustainability of these returns and whether the long-term investment return can be maximized.

The answer to the question about the corporate goal usually is profit maximization, or better – shareholder value maximization. However, some see as a possible answer the stakeholder theory, which targets to satisfy all interested parties connected to the company: investors, employees, customers, suppliers, environment. Jack Welch, former CEO of General Electric, for more than 25 years was a proponent of shareholder value importance, but now is questioning the consequences of investor wealth maximization by companies (Thompson, 2009). There appear more and more academic works, which criticize the dogmatic theory that the ultimate goal of a company should be shareholder value maximization. The highest credit is given to the agency problem, when managers are engaged in short-term thinking and demonstrate unethical behavior in order to achieve company’s maximum market capitalization, not thinking about long-term goals. Companies are created to benefit their owners, to provide them with maximum return. It is interesting that Jim Collins (2004) not directly touching upon the social aspect shows that those companies, which provide long-term returns, are acting with the vision to satisfy societal needs, to help people solve the problem but not to earn as much as possible.

More and more investors are becoming socially responsible by limiting their investment universes to the companies, which care about the environment, employees and customers. Most of them believe that only this type of investment can provide sustainable long-term returns. Stock indices based on the socially responsible investing (SRI) criteria are being created: FTSE4Good, DJ Sustainability World Index, SSE Sustainability index etc. The criteria include corporate governance factors, ethical behaviour of the company towards stakeholders and environmental care.

Taking into account the emergence of new trends on the market, the researchers try to find out what is understood under the shareholder value maximization in the latest academic publications and how much attention is paid to the social aspect. The present research aims to crystallize those factors that significantly influence shareholder value using qualitative analysis. Content analysis tools are employed, such as word frequencies and joint frequencies to find the most important themes within shareholder value or investor return issues.

The following hypotheses were stated prior to the research:

Hypothesis I: Shareholder value maximization is the major goal of a company imposed by the investors, which should be understood as a long-term concept.

Hypothesis II: Accountability, corporate governance and capital budgeting are the major factors, which can sustain maximum shareholder return in the long-term.

The approach to shareholder value creation and maximization in the most widely used academic books is analyzed as well. After obtaining the results based on the research of theoretical information, the researchers look at the corporates to find out whether the companies set shareholder long-term benefit as the main priority. The analysis of the performance success of 120 Eastern European companies depending on the mission statement contents was included in the paper as well. In this case, the third hypothesis was stated:

Hypothesis III: Companies having long-term shareholder value creation as a priority should also be able to deliver higher performance in the longer period.

Based on the obtained study results shareholder’s goal model is created where the researchers try to compromise investor’s short (not sustainable) and long-term (sustainable) goals.

Research Methodology

Literature analysis with the help of content analysis was mainly employed in the course of the present research. To understand the determinants of the long-term shareholder value and the factors which succeed shareholder value sustainability, the authors adhere to the two strategies of the qualitative analysis:

- Departure from the theory, when there are certain assumptions stated and ‘hunches’ about critical factors and relationships. This is done when considering the essence of investor’s long and short-term goals in academic literature;

- Departure from the observations, when inspection of the data results in explanation. This approach is used in an attempt to discover the factors which have the major influence on shareholder value in the long-term.

Initial data for qualitative content analysis was extracted mainly from the most popular academic books on corporate finance and investment management as well as abstracts of the published scientific papers in the Business Source Complete EBSCO database, the world’s definitive scholarly business database, providing searchable cited references for more than 1,300 journals. For word frequencies and joint frequencies analyses, 27 papers published after the financial year 2000 were used.

To determine the major constituents of the sustainable corporate development and long-term shareholder value creation, the authors employed two text statistical software programs TextStat and Hamlet, which have also helped to analyze the relationships between the factors influencing the longevity of the company.

Mission statement analysis was done on the basis of the data for 120 companies quoted on stock exchanges in 10 Central and Eastern European (CEE) countries: Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Romania, Poland, Slovakia, Slovenia. Mission statements primarily were extracted from the corporate web-sites. By selecting the key words and searching for them in the corporate mission statements, content analysis of the stated corporate goals was performed. The results were put in the context of cumulative stock performance for 5Year period from 2006 till 2010.

Shareholder Value and Investor Goals – Academic Literature Review

The majority of books on corporate finance and investment management define investor’s goal as dividend payments and stock price appreciation, which can be either absolute return or outperformance of the relative benchmark. However, these notions seem to be rather simple and not covering the complexity of the shareholder intentions. Moreover, they also are short-term related notions.

James van Horn (2002) puts profit maximization, which is often regarded as one of the proper corporate objective, in contrast to the value creation. He notes that there are certain shortcomings connected with earnings per share (EPS) maximization, such as: duration of expected returns is not included; accounting figures are subject to manipulation; risk/uncertainty of the future earnings; high EPS does not mean high dividend payments. Horn scarcely mentions social responsibility, which should be put in consideration when companies strive to achieve maximum shareholder’s return.

Glen Arnold (2005) also discusses uselessness of EPS and accounting rate of return (ARR) when finding a solution about the ultimate goal of investor and corporation. He pays more attention to value creation aspect, discussing that the most important key elements of value creation are: amount of capital invested, actual rate of return on capital, required rate of return on capital and planning horizon. It is worth to note that the author does not mention clearly the corporate ethics, agency problem, accountability, Corporate Social Responsibility (CSR).

The book published in 2009 by Frank Fabozzi and Pamela Peterson provides arguments to prove uselessness of the accounting profit in the owner’s wealth maximization process and focus the attention on recently developed tools for measuring shareholder value: economic and market value-added. The authors do not neglect agency problem, discussing the costs of agency relationship and the ways to motivate managers to create shareholder value in the long-term. Manipulation of accounting data and social responsibility of the operating entity are also mentioned in this context.

Pierre Vernimmen’s book (2009) on corporate finance associates shareholder value with various important issues: capital structure decision, dividend policy, various shareholder value creation measures. The truth, he appeals to, is that the only strategy able to create the value for the investor is realized only in the case when shareholder’s equity increases by more than the amount of reinvested earnings. He mentions agency problem but does not expound on it.

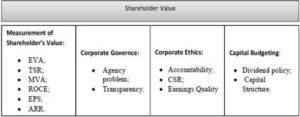

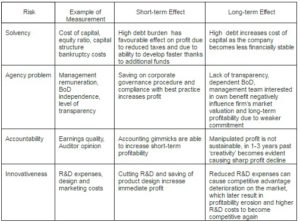

The following table briefly summarizes the main concepts associated with the shareholders’ value creation, which unanimously was admitted to be an ultimate investor’s long-term goal.

Table 1: Main Concepts Related to Shareholder Value Reflected in the Business Literature and Academic Books

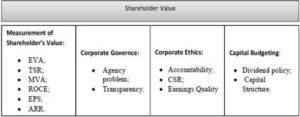

The summary table refers to hypothesis II, as it provides the evidence that shareholder value can be maximized when corporate governance, corporate ethics and capital budgeting policy are taken care of and are the most favourable for investors. Besides, profitability as measured by various ratios such as total shareholder return (TSR), return on capital employed (ROCE) or Economic Value Added (EVA) make the basis for shareholder value generation.

Shareholder Value and Investor Goals – Analysis and Review of Contemporary Research

Review of Relevant Literature

For decades, there has been an ongoing debate regarding whose interests need to be satisfied: shareholders or stakeholders. The proponents of the shareholder theory argue that the main goal of the company should be firm value increase, stock price growth and thus, maximization of the shareholder wealth (Lasher, 2008; Ross et al., 2008). However, this approach is criticized for encouraging management short-termism, which can turn into unethical behavior. Proponents of the stakeholder theory believe that the economic profits of the company should be distributed among all stakeholders (Blair and Stout, 1999; Jorg et al., 2004; Kaler, 2006). But again this seem to be a short-term approach as distributing the profits at one moment would hurt investment in R&D and thus, will not benefit society in the long term (Danielson et al., 2008). Another weak point of stakeholder theory is constant change of the stakeholder, which means that one can receive benefit and exit relationship with the company, while another can have losses as company was unprofitable at a different time.

The compromise between these two conflicting theories can be found in the long-term. According to Danielson et al., shareholder theory is more apparent as a corporate and investors goal, but the management should be dedicated to the long-term view, which means they should invest in all positive net present value projects regardless of whether these decisions will cause immediate increase in stock price (Danielson and Press, 2006). Compensation incentives should be defined for managers accordingly.

In 1997, McKinsey conducted a study of the relationship between shareholder value creation, labour productivity and employment growth of 2700 companies across 20 countries (Bughin and Copeland, 1999). The research results showed that focus on boosting shareholder value, also increases labour productivity and offers more employment opportunities on the long run.

However, the study by Loderer et al. (2010) proves that real corporate world is not too willing to bind itself to the shareholder value commitment. An empirical research of 1800 large companies quoted in 23 countries shows that by far not every company shows the commitment to shareholder value maximization in the corporate mission statement. Three reasons are provided by the authors to explain this failure by the company: agents do not consider principals to be the ultimate beneficial, managers are committed to the interest of largest shareholders, managers can find it difficult to implement the strategy of shareholder’s value maximization. It seems to be logical that performance analysis results provided the reason to believe that the companies disclosing principal-agent commitment tend to perform better than their peers that ignore shareholders in their mission statement.

By continuing to consider the real corporate world, one understands that just a commitment to shareholder value might be not enough. A string of events on financial markets forced shareholders to consider sustainability of return on investment and turned attention to such problems as agency cost, social responsibility and accountability. Enron was worth only 30 bn USD at its peak market value of 70 bn USD, when manipulating with off-balance sheet items (Jensen, 2005). The stock price of Sino-Forest, Chinese timberland operator, according to Muddy Waters Research, should cost below 1 USD, while the company’s market capitalization at the time, when the report was published, was 3.2 bn USD and stock price was 18.2 USD (Block, 2011).Zijin Mining, Chinese gold miner, was trying to keep silent about the devastating accident on one of its mines and attempted to bribe journalists covering this issue (Meidong, et al., 2011). These are just several examples of the unethical behavior of the corporations to achieve higher returns, which definitely had huge negative impact on the investing returns. Just recently investors in many countries started to think not only about the ethics but also about the risks connected with it and its influence on the long-term value creation.

Hart and Milstein (2003) speak about the attitude of companies towards the need to become sustainable which is often viewed as an additional regulation, liability and additional costs as a result. The researchers offer strategies that would make the company sustainable simultaneously increasing shareholder value, calling it “creation of sustainable value by the firm”. Four strategies offered by the authors are the following: First, pollution prevention (cost and risk reduction as a payoff); second, product stewardship (reputation and legitimacy as a payoff); third, sustainability vision, meeting unmet needs (growth trajectory as a payoff); fourth, clean technology (innovation and repositioning as a payoff).

CSR viewed as a potential contributor to shareholder value also by professors Martin, Petty and Wallace (2009). Their argumentation is that the reciprocal commitment of the firm and its stakeholders can provide some basis for the long-term success. They also speak about the return from investments in CSR, which should be at least 100%. However, it is not clear what is the time range for the payoff. Another moment worth to mention is that not often the investments in social aspects can be received in material form. Often these are intangible benefits.

Another aspect, which is crucial to the shareholder value and which was the only determinant (besides operating profitability naturally) of its creation until recently, was capital budgeting policy and all ratios connected with it: return on capital, cost of capital, capital structure, dividend policy – ratios which directly influence main shareholder value measures: EVA, MVA, TSR, ROCE etc. Capital budgeting policy and cost of capital minimization are mentioned as a basis in the academic textbooks and research.

Long-termism included in the management commitment to the shareholder value should become part of the mission statement of each company to achieve maximum return for the shareholder (Hypothesis I). This part of the ultimate corporate goal should be accompanied by the commitment also to the ethical behavior and to the CSR (Hypothesis II).

Content Analysis Results

The research starts with the overall review of the themes covered in the selected publications on shareholder value creation sustainability and factors influencing it. The analysis of the research topics (not older than 2000, extracted from EBSCO database), on the factors that have significant impact on shareholder returns maximization and sustainability, defines 6 major topics, which deserved most attention in the scientific articles:

- Capital budgeting (dividend policy, capital structure, weighted average cost of capital, required rate of return);

- Corporate governance (agency theory);

- Market environment (industry regulations);

- Business ethics and corporate social responsibility (accountability, earnings quality, stakeholder theory);

- Shareholder’s return measurement (TSR, EVA, Cash return on investment);

- Innovations as return driver (R&D investments, intangibles)

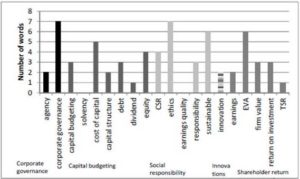

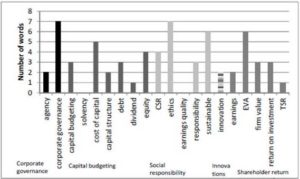

With the help of TextStat software, the researchers conducted also content analysis based on word frequencies. All words selected for analysis are split into 5 major groups. The division into groups is based on the results obtained during the analysis of the business literature and the published scientific papers. The groups of words were dedicated to: corporate governance, capital budgeting, social responsibility and ethics and innovations; the rest were related to shareholder value notion and its measurement.

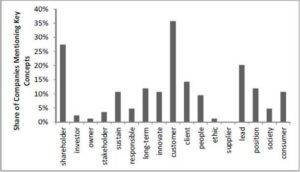

Fig 1. Frequency of Words Describing the Major Factors Influencing Shareholder Value

Fig 1. Frequency of Words Describing the Major Factors Influencing Shareholder Value

The chart includes those notions, which according to the primary analysis, are the most frequent in the analyzed text. As the chart shows, the most important concepts appear to be corporate governance and ethics. However, overall, the word group related to the capital budgeting in the end turned out to be the most frequently referred to. The analysis shows that frequency of referring to ‘shareholder value’ exceeds the number of references to ‘stakeholder value’ more than twice.

Looking at shareholder value in the context of its sustainability, particular attention is paid to the frequency of the related words. ‘Long-term’ was used 3 times, ‘sustainable’- 7 times and ‘sustainability’ – 2 times, which points that the long-term approach of shareholder value creation is one of the keys to the authors of the selected scientific papers.

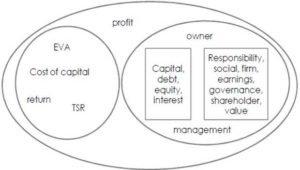

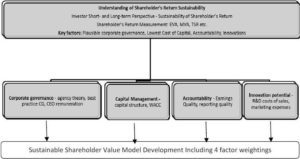

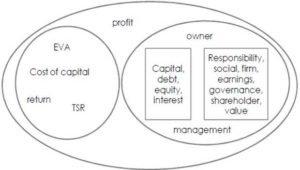

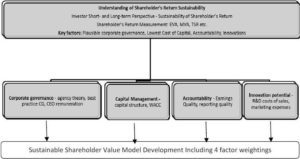

Hamlet II software allows the researchers to conduct also a thorough joint frequencies analysis, which confirms previous research results as it builds a hierarchy based on the concepts related to shareholder value in the long-term (see Fig.2). Company profitability as an umbrella notion unites other concepts, related to measurement of shareholder value and to the principal-agent problem. The latter includes two groups, one of which is dedicated to the capital management and another – to ethics and responsibility. Thus, the analysis shows the most important notions for delivering sustainable shareholder value.

Fig 2. Main Relationship between Concepts Discovered With Help of Hamlet II

To sum up the research of theoretical academic literature and of the scientific papers, which are usually more dynamic and are able to capture latest trends on financial markets, the researchers conclude that there are several factors that can help to sustain shareholder value. This complements the commonly accepted factors, which are profitability and capital budgeting, directly influencing cost of capital. Company compliance with business ethics rules and the quality of corporate governance should be definitely considered, when evaluating the company’s ability to create maximum long-term value for its owners. The researchers advise to consider also a company’s innovativeness as it often becomes value driver, determines firm’s longevity and ability to achieve above average returns in the long-term.

Analysis of Mission Statement Lexis

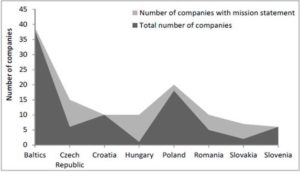

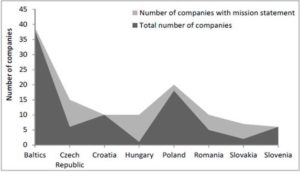

To find out how careful are the companies regarding shareholder value when defining their mission statements, the researchers conducted mission statement analysis of the largest 120 companies in Central and Eastern European countries. It was puzzling to find out that only 85 companies or 71% of total sample have stated their mission. Especially unexpected was to find that less than half of the companies provide mission statement in such well-developed investment markets as Czech Republic, Hungary and Slovakia (see Fig 3.).

Fig 3. Mission Statement Availability at CEE Companies

Content analysis of the provided mission statements shows that only a third mentions their commitment to the shareholders, while more companies seem to be more dedicated to the customers to deliver better product quality. The frequency of ‘shareholder’ mentioning in CEE region greatly differs from the corresponding frequency in developed markets: Canada – 64%, USA – 38%, Sweden – 52% of the analyzed companies (Loderer et al., 2010).

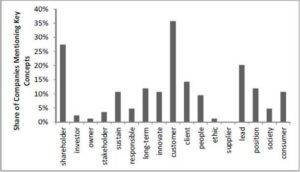

Fig 4. Content Analysis of CEE Companies Mission Statements

Fig 4. shows that a significant number of companies speak about their leadership goals and high positions in their market niches. Relatively much attention is enjoyed by concepts related to sustainability and long-term, which proves the longevity of the company intentions.

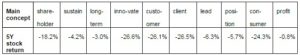

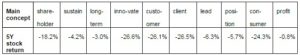

Table 2 shows the results of analysis whether CEE companies performance depends on the choice of lexis used in the mission statements. Only those notions were selected for analysis, which had substantial frequency in the analyzed sample, i.e. were mentioned by more than 5% of companies. Equal-weighted performance of the sample companies during the period from 01.01.2006. to 31.12.2010 was -25%. Those companies concentrating on the delivering value to customers, showed below average 5Y return. Companies mentioning other notions in the mission statement were able to outperform during 5Y time. Focus on ‘shareholder’ notion provided -18.2% stock return. The best results were achieved by the companies with commitment to profitability, long-term and sustainability. The most surprising was that companies, which have innovativeness as a corporate goal, show weaker than average stock performance.

Table 2: 5Y Stock Return Based on the Concepts Mentioned in the Mission Statements

The findings of the mission statement analysis show that the companies in CEE markets do not exhibit strong commitment to shareholder value, which possibly can be explained by the high ownership concentration in this region (Bistrova and Lace, 2010). Having shareholder value commitment encourages companies to deliver higher value, which is reflected in the above average performance results. The companies, which are able to deliver highest performances, have ‘long-termism’ philosophy and are focused on profitability, which is the main determinant of the shareholder value level.

Assessment and Application of the Defined Factors to Sustain Maximum Shareholder Value

Efficiency of the Key Concepts

Further logical steps to work out the model would be to check if the discovered factors influencing the sustainability of returns are efficient within the financial markets.The model could be applied in the process of company selection for the stock portfolio in order to understand if the company is capable of delivering maximum shareholder value at a certain point of time and if this value is sustainable enough.

Fig 5.Development Process of Sustainable Shareholder Value Model

The diagram disclosed in figure 5 shows the process of the development of shareholder model. The importance of each factor has to be tested empirically to be able to assign the weights to each factor accordingly. The empirical tests are to be done within Central and Eastern European stock universe, which includes over 100 companies located in 10 countries: Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Romania, Poland, Slovakia, Slovenia.

The authors have already conducted research studies on certain key factors, which exert an influence on the stock return of the companies. Probation of the Corporate Governance importance for the CEE investors demonstrates that the value of high quality corporate governance is being recognized by the investors and is gaining importance if the investment horizon is relatively long, i.e. over 3 years (Bistrova, Lace, 2011). It is also worth noticing that during the liquidity crunch, poorly-governed companies showed a steep setback. Besides, companies with quality corporate governance offer lower risk as measured by stock beta.

The study on the capital structure of the companies listed in the Baltic States shows that lower debt level helps to improve the performance. Another factor tested, sufficiency of equity capital, shows that the best stock performance is demonstrated by the companies, which have a sufficient level of equity capital. While the companies with undercapitalized balance sheets performed rather poorly. In the post-crisis period, the companies with overcapitalized balance sheets were the first and the fastest to recover (Bistrova et al., 2011).

The test of the financial reporting quality was conducted in 2008 within the Baltic stock universe (Grigorjeva, Lace, 2008). The main findings proved that the quality of the Baltic States earnings are rather poor and one sees a number of creative accounting practices in the corporate financial documents, which obviously had a negative influence on the corporate performance.

As can be figured out from the above mentioned statements, the factors defined by the qualitative analysis turned out to be rather important as they are capable to influence the share price performance and thus, shareholder’s return. In addition, all of these factors gained importance during the recent financial market crash, which discovers their relation to the sustainability philosophy.

Hypothetical Sustainable Shareholder Value Model

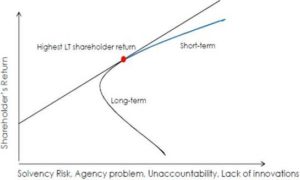

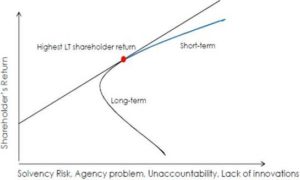

Based on the results presented in the study, the authors propose the model of the long-term shareholder value maximization, which resembles Markowitz portfolio theory. Efficient frontier and Markowitz efficient portfolio are applied to the best possible choice of security selection on the stock market. The concept of capital allocation line, which is associated with the efficient frontier, describes the combinations of expected return and standard deviation (risk) of return available to an investor from combining an optimal portfolio of risky asset and risk free asset (Defusco, 2011).

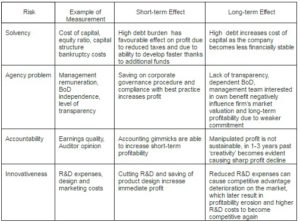

The present hypothetical model is also based on maximizing return at a given level of risk. On y axis instead of expected return, there should be shareholder return or shareholder value, which can be measured as TSR or EVA or ROCE etc. X axis, same as in efficient frontier case, represents risk as well. However, the risk is defined not as standard deviation. The risk in this case covers 4 spheres, which according to the study have the biggest influence on shareholder value in the long-term. The risk-free asset line determines the tangency point, where highest long-term return on a unit of risk can be achieved.

Fig 6. Hypothetical Sustainable Shareholder Value Model

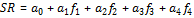

The model return for the specific stock in the portfolio will be found based on the 4 factors: solvency risk (capital budgeting), agency problem (corporate governance), unaccountability (ethics, social responsibility) and lack of innovations. Every factor is going to be assigned with a certain weight, which would be determined based on various methods, such as expert evaluation, Pareto principle, golden section and regression based on the empirical research.

Therefore, the return on the separate stock in the portfolio could be calculated as follows:

(1),

Where a – weights of the factors,

f – factor values (solvency risk, agency problem, level of accountability, innovation potential).

The total portfolio performance can be found by summing up all returns of the stocks, according to their weights in the portfolio. While the portfolio risk will be calculated as the sum of the individual risks assigned to each stock.

(2),

(2),

Where  – portfolio risk,

– portfolio risk,

x – weight of individual stock in the portfolio,

– risk of individual stock in the portfolio.

– risk of individual stock in the portfolio.

The blue line on the chart (Fig 5.) provides a concept of the short-termism. In case the company carries significant risks; such as cutting R&D budget, cheating with accounting figures; high short-term return can be achieved, as it should artificially inflate the earnings, but obviously this strategy is not sustainable. When considering long-term performance, one sees that the higher the risks , the weaker the sustainability of the long-term return, the lower the performance, which can reach zero and become negative if the risks are very high. For example, in the short-term, the company may borrow funds to reduce its tax payment, thus increasing profit. But in the long-term, the company may go bankrupt as debt burden grows. If the company reduces investments in R&D, it will enjoy immediate profit but may lose its competitiveness on the market. It needs to be mentioned though, that there is a certain limit for short-term return as the company, which is highly exposed to the above-mentioned risks, may deliver negative short-term return.

The mentioned risk measurement tools, and risk effects on the stock return in short and long term are summarized in the table below.

Table 3: Risk Measurements and Effects

Conclusions and Recommendations

The objective of the study, to find a compromise between investors’ short- and long-term goals, was achieved by creating a model, which provides a concept of long-term shareholder value. All the hypotheses stated in the introduction of the present research were proved with the help of qualitative analysis of the academic literature as well as contemporary scientific research papers.

Indeed, as the majority of researchers stick to the shareholder theory and consider that the ultimate corporate goal is shareholder value maximization. Although some emphasize its long-term context, many neglect the fact that corporate goal, which is shareholder value generation, can be achieved solely in the long-term period, when company’s management has low incentives to act unethically to achieve short-term result. The analysis of contemporary scientific papers and articles reassured that there should be a long-term focus when speaking about the shareholder value creation. Moreover, the sustainability of the return is achieved not only by high profitability, but also by such factors as optimal capital structure, good level of corporate governance, accountability and high innovative potential. Determining these factors has helped us to prove hypothesis II on achieving shareholder value sustainability.

To prove hypothesis III and to find out whether CEE companies are committed to delivering shareholder values, the authors made mission statement analysis, as a result of which we found out that only 27% of the analyzed companies mention shareholders in the mission statements. Looking at the mission statement vocabulary through the prism of stock return provided the authors with the evidence that the companies with focus on shareholder value deliver above average performance: -18% vs. -25% of the total sample. Best performing companies concentrated on the notion of profitability, long-termism and sustainability in their mission statements.

The researchers have designed the framework, which can be used when further developing the concept of the stock return sustainability. The return sustainability, as the text analysis has shown, is based on the 4 factors: plausible corporate governance structure, reasonable capital management, accountability of the results as well as innovativeness of the company. All of these factors are included in the hypothetical long-term shareholder value maximization model as the main sustainability determinants. The hypothetical model allows us to understand where the maximum long-term shareholder value can be achieved and which risks can be minimized when investing in a particular company. X-axis shows the risks of poor corporate governance system – agency problem, unaccountability, lack of innovations and also solvency risk. Should these risks increase in the short-term, investors could be able to earn higher returns as profit is maximized at the expense of reduced R&D budget for example. But there is a limit for increasing short-term risk as in case of very high exposure, the performance of the company can be pitiable. In the long-term, increased risks lead to zero and often negative shareholder value.

Thus, the return of a separate stock is defined based on the Arbitrage Pricing Theory (APT) model, which depends on the factors mentioned. The total risk of the stock is described by the standard deviation. The return and risk can be also calculated for the total portfolio considering the weight of each stock.

The proposed model needs to be proved for its accuracy and tested with the real companies. Besides, the levels of the risk, at which the company is able to deliver maximum long-term return and at which short-term return can be limited, should be defined.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Arnold, G. (2005). Corporate Financial Management, Third Edition, Pearson Education Limited, Harlow.

Publisher

Bistrova, J. & Lace, N. (2010). “Ownership Structure in CEE Companies and its Influence on Stock Performance,” Economics and Management, 15, 880-886.

Publisher – Google Scholar

Bistrova, J. & Lace, N. (2011). “Evaluation of Corporate Governance Influence on Stock Performance of CEE Companies,” WMSCI 2011 Proceedings I, United States of America, Orlando, 19.-22. July, 59-64.

Publisher – Google Scholar

Bistrova, J., Lace, N. & Peleckienė, V. (2011). “The Influence of Capital Structure on Baltic Corporate Performance,” Journal of Business Economics and Management, 12 (4), 655-669.

Publisher – Google Scholar

Blair, M. M. & Stout, L. A. (1999). “A Team Production Theory of Corporate Law,” Virginia Law Review, 85 (4), 247-328.

Publisher – Google Scholar – British Library Direct

Block, C. C. (2011). “Muddy Waters Initiating Coverage on TRE.TO – Strong Sell,” Muddy Waters Research. [Online], [Retrieved August 3, 2011], http://www.muddywatersresearch.com/wp-content/uploads/2011/06/MW_TRE_060211.pdf.

Publisher

Bughin, J. & Copeland, T. E. (1997). “The Virtuous Cycle of Shareholder Value Creation,” The McKinsey Quarterly, 3, 156-167.

Publisher – Google Scholar – British Library Direct

Collins, J. (2009). How The Mighty Fall: And Why Some Companies Never Give in, JimCollins.

Publisher – Google Scholar

Danielson, M. G, Heck, J. L. & Shaffer, D. R. (2008). “Shareholder Theory – How Opponents and Proponents Both Get It Wrong,” Journal of Applied Finance, Fall/Winter, 62-66.

Publisher – Google Scholar

Danielson, M. G. & Press, E. (2006). ‘Do Stock Options Always Align Manager and Shareholders’ Interests? An Alternative Perspective,’ Advances in Financial Education, 4 (2), 1-16.

Defusco, R. A., McLeavey, D. W., Pinto, J. E. & Runkle, D. E. (2011). ‘Portfolio Concepts,’ Derivatives and Portfolio Management, CFA Institute, Pearson Education Limited, Harlow, 375-459.

Fabozzi, F. J. & Drake, P. P. (2009). Finance: Capital Markets, Financial Management, and Investment Management, John Wiley & Sons, Hoboken.

Publisher – Google Scholar

Grigorjeva, J. & Lace, N. (2008). “Evaluation of Impact of Financial Result Plausibility of BalticState Companies on Equity Performance,” Economics and Management, 13, 115-120.

Publisher

Hart, S. L. & Milstein, M. B. (2003). “Creating Sustainable Value,” Academy of Management Executive, 17 (2), 56-67.

Publisher – Google Scholar – British Library Direct

Jensen, M. C. (2005). “Agency Costs of Overvalued Equity,” Financial Management, 34 (1), 5-19.

Publisher – Google Scholar

Jorg, R., Loderer, C. & Roth, L. (2004). “Shareholder Value Maximization: What Managers Say and What they Do,” DBWDieBetriebswirtschaft, 64 (3), 357-378.

Publisher – Google Scholar – British Library Direct

Kaler, J. (2006). “Evaluating Stakeholder Theory,” Journal of Business Ethics, 69 (2), 249-268.

Publisher – Google Scholar – British Library Direct

Lasher, W. R. (2008). ‘Practical Financial Management,’ Thomson South-Western, Mason.

Loderer, C., Roth, L., Waelchli, U. & Joerg, P. (2010). “Shareholder Value: Principles, Declarations, and Actions,” Financial Management, spring, 5-32.

Publisher – Google Scholar

Martin, J., Petty, W. & Wallace, J. (2009). “Shareholder Value Maximization— Is There a Role for Corporate Social Responsibility?,” Journal of Applied Corporate Finance, 21(2), spring, 110-119. 2009.

Publisher – Google Scholar

Meidong,H.,Xingxin, Z. H. & Yanfeng, Q. (2010). “Zijin Mining Offered Bribe to Reporters:GAPP,” China Daily, August 28, 2010. [Online], [Retrieved August 3, 2011], http://www.chinadaily.com.cn/bizchina/2010-08/28/content_11218360.htm.

Publisher

Ross, S. A., Westerfield, R. W. & Jordan,B. D. (2008). ‘Fundamentals of Corporate Finance,’ McGraw-Hill/Irwin, New York.

Google Scholar

Thompson, L. M. Jr. (2009). “Shareholder Value and Your Sustainability Goals,” Boards& Shareholders, June, 60-61.

Publisher

Van Horne, J. C. (2002). ‘Financial Management and Policy,’ Twelfth Edition, Prentice Hall, Upper Saddle River.

Google Scholar

Vernimmen, P., Quiry, P., Dallocchio, M., Fur, Y. & Salvi, A. (2009). ‘Corporate Finance: Theory and Practice,’ Second Edition, John Wiley & Sons, Chichester.

Google Scholar