The study confirmed that there is a significant positive link between analysts’ following and bonds ratings in MENA region, as we can see in the table above, analysts’ following’s coefficient is very significant and positive. A company that could generate a high level of analysts following will directly experience higher rating bonds. This further explains that the costs of debt, in the form of bonds, are decreased as a result of creditors asking for lower premium to lend their money.

Limitations

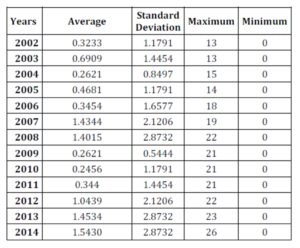

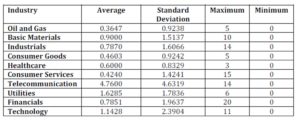

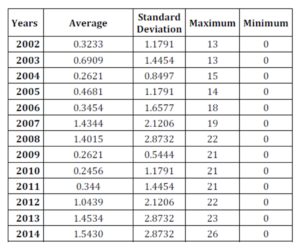

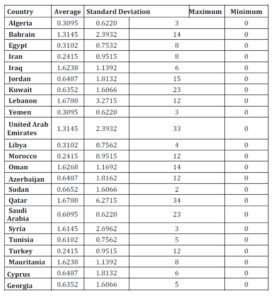

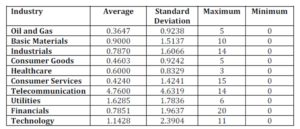

One major drawback was noticed about the sample selected. In point of fact, F-Database and W-Database gave us the bonds ratings data and recommendations’ data, respectively. These two databases allowed us to assemble 600 observations that followed the distribution presented in Table 2. In fact, this statement could have influenced our sample representativeness.

Conclusion

The study carried out in this paper seeks to show that there is a positive connection between analysts’ following and the bonds rating. For this reason, a sample of 600 companies selected from MENA region was used. The sample data is from 2002 to 2014, a period of 12 years. Our expectations agree with the results of the Ordered Probit regression. Consequently, a company that’s able to produce a high level of analysts’ following is able to have higher bonds rating. In other words, a company with good performance is one with high level of bonds ratings and this has an effect on the debt cost by reducing it. Bearing in mind that there are no previous studies carried out to explain the purpose discussed in our paper, this research done will bring more value on this, even in the developing markets context. When the firm is being followed by a high number of analysts, it gives a favorable signal about the company’s corporate governance, because high level of analysts’ following can be translated to a large number of specialists that are zooming on the company and every single action conducted by its management will be communicated widely to the market, even in less efficient markets, Satt (2015). Therefore, high levels of analysts following, reduces the fear of creditors and assures them that if there is any piece information that they should now about certain company, it will be already known to them; thus, they will boost their credit ratings and lower the interest rates. This piece of work can be of a value to both, creditors and shareholders; it is the first attempt to translate the analysts’ following into a variable that gives an insight about the company’s level of corporate governance and credit quality.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Alderson, M. and B. Betker. “Liquidation costs and capital structure.” Journal of Financial Economics 39 (1995): 45-69

Publisher – Google Scholar

2. Allen, F. and Gale, D. (2000). “Financial Contagion,” Journal of Political Economy, Vol. 108

(1), 1-33.

Google Scholar

3. Defond, M. and J. Jiambalvo. “Debt covenant violation and manipulation of accruals.” Journal of Accounting and Economics 17 (1994): 145-176.

Publisher – Google Scholar

4. Bhojraj, S. and P. Sengupta, (2003), “Effect of corporate governance on bond ratings and yields: the role of institutional investors and the outside directors.” The Journal of Business, 76, pp. 455-475.

Publisher – Google Scholar

5. Bhattacharya, N., H. Desai and K. Venkataraman (2008), “Earnings quality and information asymmetry: Evidence from trading costs,” Working Paper, Edwin L. Cox School of Business, Southern Methodist University.

6. Bhattacharya, N., F. Ecker, P. Olsson and K. Schipper (2009), “Direct and mediated associations among earnings quality, information asymmetry and the cost of equity,” Working Paper, Fuqua School of Business, Duke University.

7. Boubakri, N., and Ghouma, H., (2007), “Creditor rights protection, ultimate ownership and the debt financing costs and ratings: international evidence.” Working Paper, School of Business, Al Akhawayn university.

Google Scholar

8. Brennan, M., T. Chordia and A. Subrahmanyam (1998), “Alternative factor speciï¬cations, security characteristics and the cross-section of expected stock returns,” Journal of Financial Economics, 49, 345-373.

Publisher – Google Scholar

9. Gilson, S. C. “Transactions costs and capital structure choice: evidence from financially distressed firms.” Journal of Finance 52 (1997): 161-196.

Publisher – Google Scholar

10. Hamdi B. Hatem G. and El-Mehdi A. (2014) “Auditor choice and corporate bond ratings: international evidence” International Journal of Economics and Finance; Vol. 6, No. 1; 2014.

11. Satt, H. (2014) “The Impact of positive cash operating activities on the cost of debt: international evidence” European Journal of Contemporary Economics and Management. Vol, NO 2.

12. Satt, H. (2015) “The Impact of positive cash operating activities on bonds’ pricing: international evidence” Journal of Corporate and Ownership Control 12.4 (2015): 708-717

13. Holmström, B. and Tirole, J. (2001). “LAPM: a liquidity-based asset pricing model”, The Journal of Finance, Vol. 56 (5), 1837-1867.

Publisher – Google Scholar

14. Kasznik, R. (1999), “On the association between voluntary disclosure and earnings management,” Journal of Accounting Research, 37 (1999), 57—81.

15. Kim, O. and R. E. Verrecchia (1991), “Market reaction to anticipated announcements,” Journal of Financial Economics, 30, 273-309.

16. Kim, O. and R. E. Verrecchia (1994), “Market liquidity and volume around earnings announcements,” Journal of Accounting and Economics, 17, 41-67.

Publisher – Google Scholar

17. Klock, M., S. Mansi and W. Maxwell, (2005), “Does corporate governance matter to bondholders.” Journal of Financial and Quantitative Analysis, 40, 4, pp. 693-720.

Publisher – Google Scholar

18. Kubota, K. and H. Takehara (2009), “Information based trade, the PIN variable, and portfolio style differences: Evidence from Tokyo stock exchange ï¬rms,” Paciï¬c-Basin Finance Journal, 17, 319-337.

Publisher – Google Scholar

19. Omar Farooq and Harit Satt. “Does analyst following improve firm performance? evidence from the MENA region” Journal of corporate and Ownership control 11.2 (2014): 145-154.

Google Scholar

20. Sengupta, P., (1998), “Corporate disclosure quality and the cost of debt.” The Accounting Review, 73, pp. 459-474.

Google Scholar

21. Shleifer, A. and Vishny, R., (1997), “A survey of corporate governance”. Journal of Finance, vol. 52, issue 2

Publisher – Google Scholar

22. White, H. “A heteroscedasticity-consistent covariance matrix and a direct test heteroscedasticity.” Econometrica 48 (1980): 817-838.

Publisher – Google Scholar

23. Willenborg, M. “Empirical Ana lysis of the economic demand for auditing in the initial public offering market.”Journal of Accounting Research 37 (1999): 225-238

Publisher – Google Scholar