Introduction

The topic enjoys a complexity, given the context of the pandemic situation we are currently in. Macroeconomic imbalances have always been an issue on the front page of the analysts’ agenda in order to remedy them and ensure financial stability, and implicitly the well-being of the economy.

The paper aims at analyzing indicators that describe vulnerabilities at the macroeconomic environment in order to quantify the banking crisis probability, with an impact on the sovereign risk premium. In this sense, the European Commission has proposed a series of macro-financial indicators, creating a common database for monetary policy makers with a role in supervising and ensuring financial stability at European level.

The motivation for choosing the theme consists in the paradoxical character that the propagation in both directions has the broadband connection between banking instability and sovereign risk. In this sense, a defining element in the description of the uncertainty on the market is the early warning systems.

The result of the interaction between vulnerabilities and macroeconomic shocks has led to banking crises. Usually, imbalances of any kind evolve against ensuring the well-being of the economy, an additional reason to capture the macroeconomic indicators that describe the health of the financial system. The importance of early warning systems lies in anticipating, in a timely manner, the probability of banking crises.

The main objective is to analyze the indicators’ ability to predict a possible banking crisis, with a major impact on sovereign risk, using logistic regression as a working tool.

The research aims at analyzing some secondary objectives to help meet the main one. Thus, one of the objectives is to capture the most representative indicators that describe the state of the economy. In this sense, the European Commission supports monetary policy makers, but also researchers in ensuring a common database for the harmonization of techniques and results, so that Member States act in a timely manner in the event of banking crisis and prevent, further, a global crisis spread.

Another objective refers to ensuring a common language and a common period for past crises, using a dummy variable to describe the crisis (marked with 1) or for its absence (marked with 0).

Establishing the strong connection between a banking crisis onset and government risk is another goal to be achieved, as well as finding solutions to minimize it, due to the multiple implications on the entire economy, especially the real one.

The last stage of the research aims at making predictions with the help of AUROC in order to anticipate a possible false alarm of a banking crisis onset or to omit a crisis due to the lack of signal.

The limits of the research consist in the lack of data for some EU countries, for certain periods of time (even annual), but also their frequency, respectively the quarterly one, which would capture a much more detailed description of the appearance of the signals.

The research continues with the presentation of several aspects of the literature, followed by the presentation of a methodology and results and ends by concluding the main ideas.

Literature Review

The financial imbalances, captured by the connection between the banking and the public sector, determined the appearance of studies in the specialized literature regarding the diminution of the banking stress, but also of the sovereign risk.

The connection between sovereign risk and the probability of banking instability can be attributed to three channels: the large share of government securities in banks’ balance sheets; the government seen as a financier of last resort for bank resolution funds and the significant impact on the real economy. Banks are an intermediary between those who save and those who want to invest, being a fundamental component of monetary policy (Peek, 2014). Non-performing loans accentuate financial instability and, implicitly, banking crises, which have a major impact on real economic activity, with negative effects on fiscal policy (Kroszner, 2007).

The issue of indicators that describe the health of the financial system and implicitly its vulnerabilities, seen as early warning systems, has been debated over time in the literature (Reinhart and Rogoff, 2008). However, the peculiarity that they capture the close connection with the implications on the sovereign risk is reproduced, especially in working papers, and less in specialized articles. On the one hand, this would be a positive aspect, as the present research brings an extra novelty and originality, contributing to the enrichment of the specialized literature, and on the other hand, due to the lack of empirical results, we cannot make comparisons with other papers.

However, the literature provides us with some examples of studies that refer to these topics. For example, Langedijk et. al (2018) examine the liquidity measures implications on the sovereign bonds market, with reference to EU member states, concluding that the use of liquidity proxies can lead to significant errors.

Moreover, Wijayanti et al (2020), using a panel of 43 developed countries, during the years 1960-2017, use two methods: the noise to signal ratio, for capturing the indicators signaling power, and binomial logistic regression, in order to build a general model. The authors concluded that the binomial logistic regression indicates better predictive power than the other method used, the noise to signal ratio.

In relation to these challenges, the literature indicates a number of possible answers, especially in the area of prudential regulations. They aim to adequately reflect sovereign risk in terms of banking rules, either by reviewing the risk weights associated with exposures to general government or by broadening the scope of high exposure limitation requirements. In this context, dosage and cadence are essential to avoid inducing undesirable procyclicality (IMF, 2019) associated with increased capital requirements in periods of vulnerability of public finances, which would further aggravate macroeconomic instability (Véron, 2017).

Research Design and Methodology

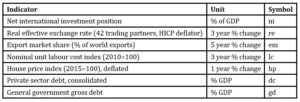

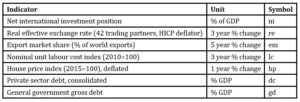

The methodological framework involves a logistic regression on a panel data of European Union countries in order to determine the banking crises probability and to capture its impact on sovereign risk. The description of the indicators is summarized in Table 1.

Table 1: Indicators’ description

Source: European Commission: https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/macroeconomic-imbalance-procedure/scoreboard_en

As exogenous variables were taken into account,the indicators of the European Commission’s scoreboard on macroeconomic imbalances.[1]The analysis covers a period of 15 years (2005-2019), with an annual frequency, and the sample consists of 28 European countries: Austria, Belgium, Bulgaria, Czech Republic, Cyprus, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Hungary, United Kingdom.

Regarding the data limits, there is a lack of a lower frequency, respectively quarterly, which would have been better suited to describe the indicators’ ability to emit signals in Eurozone countries. Also, not enough data were found for all EU countries, and the annual time period was reduced accordingly.

Logistic regression was used as an analysis tool because it captures the impact of indicators’ impact on a crisis likelihood, usually a value between 0 and 1, with a continuity in terms of sovereign risk implications.

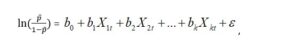

Therefore, given that the analyzed macro-financial phenomenon has a binary form, the methodological framework involves the use of logistic regression, and the conceptual model has the following specification:

where: t = 1, 2, … t observations from sample; Xt = independent variables; b0 = the constant (free term of the equation); b1,…bk = coefficients of independent variables; εt = residual value.

Taking into account the common database, provided by the European Commission, the model captures the connection between a bank crisis likelihood with an impact on sovereign risk.

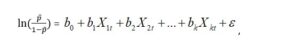

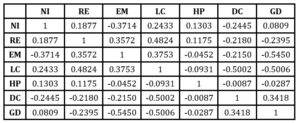

For a better empirical performance, we eliminated the statistically insignificant indicators, whose probability exceeds the confidence interval, or whose standard error is too high, also using the correlation matrix, for coefficients less than or equal to 0.5 (Table 2).

Table 2: Correlation matrix

Source: Author’s own estimates, using EViews

The model estimation is captured for a significance level of 1%, 5%, respectively 10%.

Results And Discussion

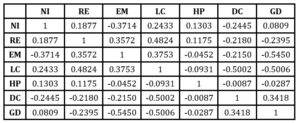

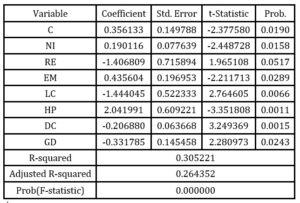

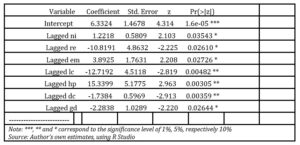

The model results show the sign of the regression model coefficients, which contribute to the identification of the banking sector vulnerabilities. The model estimate is given in Table 3.

Table 3: Logit regression estimate

The imbalances, highlighted by the net investment position (ni) and the export market share (% of world exports) (em), have a positive influence on the probability of early warning signals issuing.

On the other hand, domestic imbalances, expressed by house prices (hp), government debt (gd) and private debt (dc) also fuel the likelihood of banking crises.

Regarding the macroeconomic environment, both the labor cost (lc) and the real exchange rate (re) have a negative effect on the probability of banking stress, having an inverse influence on the endogenous variable.

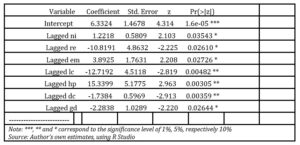

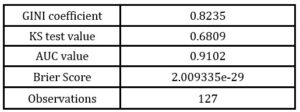

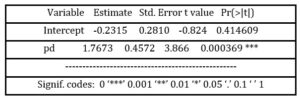

The robustness of the results is underlined by the multivariate regression, which indicates the same signs of the indicators’ coefficients included in the model, as in the logit model case, after the elimination of the insignificant ones. The relevance of the indicators is also underlined by the probabilities associated with the model coefficients, at a significance threshold of 1%, 5% and, respectively, 10% (Table 4):

Table 4: Multivariate regression

Source: Author’s own estimates, using EViews

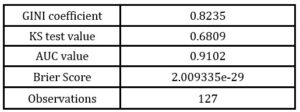

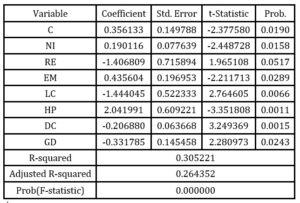

The logit regression model efficiency is represented by the AUC, Brier Score, GINI, respectively, KS indicators, which indicate a strong power of discrimination (Table 5).

Table 5: Indicators with discrimination power

Source: Author’s own estimates, using R Studio

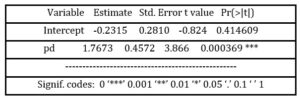

The relevance of the sovereign risk premium, expressed by the CDS 5Y rating, is shown by the positive impact it has on the banking crisis probability (Table 6).

Table 6: The CDS`s impact on probability of default (PD)

Source: Author’s own estimates, using R Studio

The predictive power of early warning indicators can be reproduced based on the probability that an indicator can emit signals regarding the occurrence of crisis events, but without emitting too many false alarms.

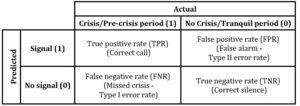

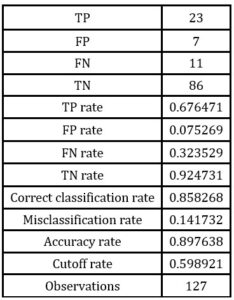

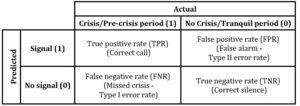

The confusion matrix classifies four results into one signaling framework (Table 7).

Table 7: Confusion Matrix

Source: Holopainen and Sarlin (2017)

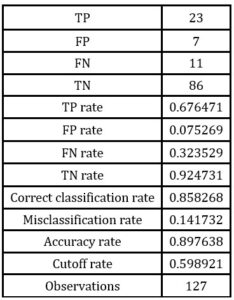

After a signal is emitted, ie exceeds a certain threshold, it is correctly classified (True positive rate-TPR); otherwise, it turns out to be a false alarm (False positive rate – FPR), called and type 2 error. On the other hand, a signal that is not emitted (indicator that does not exceed the threshold), is correct, when a crisis is in the last quadrant, respectively True negative rate – TNR) (Correct silence), and is incorrect when a crisis occurs (Type I error rate). The performance of the logit model is underlined by the indicators in the table below (Table 8):

Table 8: Logit model performance

Source: Author’s own estimates, using R Studio

The robustness of the model is given by the Correct classification rate, which registers a value of 85.82% and an accuracy rate of 89.76%.

The indicators used have the capacity to emit signals in a period of crisis in proportion of 67.64%, with a rate of missing crises of 32, 35% (Type I error rate) and issuing false alarms of 7,52% (Type II error rate).

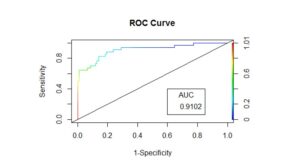

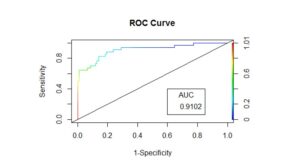

Figure 1: ROC curve

Source: Author’s own estimates, using R Studio

The superiority of a model logit is underlined by the Area Under the Receiver Operating Characteristic (AUROC) (Figure 1). A value higher than 0.5, as the one registered in the case of the model (AUC = 0.9102), indicates that the indicators used have the capacity to emit signals, which can be considered warning factors for banking crises.

Conclusions and future research directions

The importance of early warning systems lies in the ability to anticipate, in a timely manner, the banking crises onset, by issuing signals. These represent a tool for predicting banking crises, used over the years by policy makers, but which are also found in research in academia. Their relevance is also underlined by the values registered, by reference to significant thresholds, whose values are given either by the historical values and the context of the economy or offered by the national monetary authorities.

The implications of the warning indicators over time and, implicitly, of the banking crisis occurrence likelihood on the sovereign risk are multiple. Thus, the connection between banking instability and sovereign debt risk is underlined by the high share of government bonds in the bank balance sheet, on the one hand, and the quality of last-rate borrower for the banking system, on the other hand, makes the connection between the two be pronounced.

Therefore, the state of finances depends on banking stability and, implicitly, banking crises can have a devastating effect on the sovereign, a fact confirmed by the results of this research.

So, the estimated results aim at obtaining a model for quantifying the probability of banking crises, which integrates information on the public finances’ situation and its consequences in terms of external balance.

Financial instability is also reflected in the CDS quotation, proving that there is a relationship in the same direction between these two indicators. Thus, the implications in both directions of the banking crises probability reveal that banking stress generates a high cost of the sovereign risk premium, but also the sovereign risk can contribute to triggering imbalances, at the macroeconomic level and even banking crises.

Studies in the literature (Wijayanti, 2020) strengthen this assumption, showing that indicators such as government debt growth, external debt to exports, external debt to foreign exchange reserves, can generate debt crisis. On the other hand, a decrease in gross domestic product GDP) and government consumption can lead to an increase in the probability of government debt crisis.

Consequently, the solution to this problem would be to reduce the strong link between the banking sector and the sovereign (Weidmann, 2013) by decreasing the share of bonds, with major effects on the real economy.

As future research directions, the paper aims at capturing the link between sovereign risk and banking instability, highlighting the effect on the real economy.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- European Central Bank, Regulating the doom loop, No 2313 / September 2019

- European Commission: https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/macroeconomic-imbalance-procedure/scoreboard_en

- Ferrari, S.; Pirovano, M.; Cornacchia (2015) Identifying early warning indicators for real estate-related banking crises. Occasional Paper Series, No. 8

- Holopainen, M. and Sarlin P. (2017) Toward Robust Early-Warning Models: A Horse Race, Ensembles and Model Uncertainty. Quantitative Finance 17 (12), 1-31

- International Monetary Fund (2019). Vulnerabilities in a Maturing Credit Cycle, Global Financial Stability Report (april 2019)

- Kroszner, R., Laeven, L., Klingebiel, D. (2007) Banking Crises, Financial Dependence, and Growth, Journal of Financial Economics 84 (1), pp.: 187–228

- Laeven, Luc; Valencia, Fabian (2018) Systemic Banking Crises Revisited, IMF Working Paper, WP/18/206

- Langedijk, ; Monokroussos, G.; Papanagiotou, E. (2018) Benchmarking liquidity proxies: The case of EU sovereign bonds, International Review of Economics and Finance, no. 56, pp.: 321–329

- Lo Duca, Marco et all (2017) A new database for financial crises in European countries. ECB/ESRB EU crises database, Occasional Paper Series, No. 194, July 2017

- Nicolas Véron (2017) Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures. Bruegel & Peterson Institute for International Economics

- Peek, J., Rosengren, E. (1997) The International Transmission of Financial Shocks: The Case of Japan. American Economic Review 87 (4), pp.: 495–505

- Reinhart, C. M. and Rogoff, K. S. (2008) I the 2007 US Sub-Prime Financial Crisis so Different? An International Historical Comparation, The American Economic Review 98(2), 339-344

- Weidmann, Jens (2013), Stop encouraging banks to load on state debt, Financial Times (Dr. Jens Weidmann, president of Deutsche Bundesbank), published on 1 october 2013

- Wijayanti, Rani; Rachmanira,Sagita (2020). Early Warning System for Government Debt Crisis in Developing Countries, Journal of Central Banking Theory and Practice, special issue, pp. 103-124

[1] European Commission: https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/macroeconomic-imbalance-procedure/scoreboard_en