Introduction

The Internet, being the fastest mode of communication, multidirectional in nature and very fast in transmission (Sanchez et al., 2011), has the widest reach in the present world of globalized economics (Garg & Verma, 2010) and can be a powerful tool for building shareholder value (Seetharaman & Subramaniam, 2005/2006). The Internet also is a unique information disclosure tool that encourages flexible forms of presentation and allows immediate, broad, and inexpensive communication to investors (Kelton & Yang, 2008). Furthermore, the Internet also provides a unique form of corporate voluntary disclosure that enables companies to provide information instantaneously to global audience (Abdelsalam, Bryant & Street, 2007). Moreover, the Internet enables companies to voluntarily communicate share prices, preliminary announcements, press conferences, and other information via email and web casts to a large global audience of current and perspective investors (Abdelsalam & Street, 2007).

Using the Internet allows a company to provide on-line a large volume of information which users can access on demand, in function of their particular area of interest (Bonson & Escobar, 2006). Also, corporate information on the Internet provides benefits in cost-cutting, distribution, frequency and speed (Gandia, 2008). In the present global era, the use of Internet in financial reporting plays a significant role in the market (Al Arussi et al., 2009) and forming investors worldwide (Abdelsalam & Street, 2007). In relation to the Internet as a medium for disclosure, the management can reduce the agency problem and alleviate information asymmetry due to its unlimited space, wide coverage, easy-access report, and real-time information (Al Arussi et al, 2009). Internet financial reporting (herein after known as IFR) has become quite a popular practice of communicating with stakeholders in recent times. Therefore, research on the evolution of it is considered relevant to public. Therefore, this paper aims to examine and synthesize the previous studies on IFR research.

The remainder of this paper is organized as follows: the next section provides a review of the literature on IFR research and describes the categorization of IFR. The following section describes the descriptive studies, association studies, dimension of IFR and timeliness of IFR. Conclusions are drawn in the last section. This section should follow keywords. This section should provide background of the study and highlight research motivation.

Review of Literature on IFR

Literature in relation to financial reporting on the Internet is growing (Oyelere et al., 2003). In recent years, Internet usage has significantly impacted companies’ corporate reporting practices (Khadaroo, 2005) and the issue of IFR has been the subject of attention of a number of researchers (Chatterjee & Hawkes, 2008). There are lots of IFR researches. The growing use of the Internet for corporate dissemination, including providing annual reports on the Internet, and the extent and sophistication of IFR practices vary across countries (Mohamed et al., 2009). In general, the research of IFR can be divided into several themes, as follows: descriptive research, comparative research and explanatory research (Pervan, 2006). Furthermore, most researchers include a comprehensive set of financial statements and financial highlights extracted from the statements in their corporate website to qualify as IFR company (Ali Khan, 2010; Ali Khan & Ismail, 2011).

Categorization of IFR

An extensive review of the literature reveals that several studies have looked into IFR and could be classified into two themes (Hassan et al., 1999). Hassan et al. (1999) categorize IFR research that examine (1) the practice of companies for reporting purpose and investor relations (IR) communication strategy; and (2) the determinants of Web-based disclosure policy choice. Moreover, the literature in IFR area can be classified into two themes: (1) the practices of companies using the Internet for financial reporting purposes and as an investor relations communication strategy; and (2) the determinants of web-based disclosure policy choice (Joshi & Al-Modhahdki, 2003). Furthermore, the research on web reporting can be divided into two main categories: descriptive research and explanatory research (Marston & Polei, 2004; Garg & Verma, 2010). Otherwise, the research on IFR can be divided into three main categories: descriptive research by one or more countries, research by professional bodies and explanatory research (Ali Khan, 2010).

A number of studies discuss the benefits of IFR, speculate on its future, and identify issues and concerns in relation to the use of such medium (Oyelere et al., 2003). Oyelere et al. (2003) find that some studies report on surveys on IFR practices in single countries while others undertake cross-country comparisons. Furthermore, literature in IFR field differentiates research for three main groups; single-country studies, multi-country studies and international studies (Celik et al., 2006). A few studies examine the corporate characteristics associated with the choice of Internet corporate financial reporting (Oyelere et al., 2003).

The extent of the studies on corporate internet reporting (CIR) can be categorized as either descriptive studies or association studies (Abdelsalam et al., 2007). Abdelsalam et al. (2007) explain that descriptive research focus on providing statistics on how many items of given disclosure checklist are disclosed/provided. Otherwise, association research (i.e., providing evidence of independent variables associated with the level of disclosure) emphasizes the determinants of CIR (Abdelsalam et al., 2007).

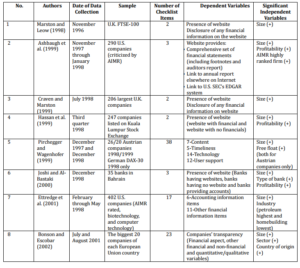

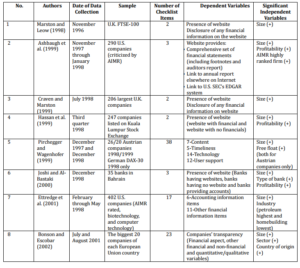

In summary, several prior studies describe IFR disclosure and presentation in specific countries or listed companies on specific stock exchanges. Additionally, as summarized in Table 1, evidence links several firm specific characteristics with the level of IFR disclosure. These include the size of the firm, which appears to be positively associated with the disclosure on the Internet. Also, evidence on other variables examined is largely inconclusive.

Table 1: Summary of Selected Empirical Studies Addressing Determinants of Internet Financial Reporting

Explanatory Studies

Most of early studies on IFR are descriptive in nature. Petravick and Gillett (1996) reported that 69% of the top 150 of Fortune 500 companies had websites and 54% of them made some form of financial information available on their websites. Louwers, Pasewark and Typpo (1996) found that approximately 23% of the top 150 Fortune 500 corporations include virtually all the information typically shown in a paper based annual report, on the web. Petravick and Gillett (1998) discovered that 99 (79.2%) of the top 125 of the Fortune 500 companies published their earnings online simultaneously with an earnings announcements. Gowthrope and Amat (1999) analyzed the financial reporting on the Internet by a total of 379 firms quoted on the Madrid Stock Exchange and note that 19% of the firms disclose financial information on the web. Deller, Stubenrath and Weber (1999) reported that U.S. corporations were using the Internet for investor relations more extensively than their counterparts in the U.K. and Germany. Hedlin (1999) analyzed the web based investor relations activities of 60 companies listed on the Stockholm Stock Exchange in Sweden and found that 83% of the firms had financial reports on their websites.

Craven and Marston (1999) analyzed a sample of 2006 companies obtained from FTSE-100 index and from companies with high stock capitalization according to the Financial Times in January 1998. Findings included that 153 companies (74%) had web pages, 67 companies (33%) provided their accounts in detail, whereas 42 companies (20%) only provided a summary.

Debreceny and Gray (1999) surveyed the corporate website of 45 large, listed U.K., German, and French companies to examine audit implication of electronic dissemination of financial information. Their findings raised significant issues regarding the format and usability of the information provided, such as: is the audit opinion safe from change by the client or related other party?, should the web-based auditor’s report reside at the auditor’s or the client’s website?, what is the meaning of an audit report in a hyperlinked web environment?, should the auditor allow hypertext links to the auditor’s report?, should the auditor allow hypertext links from the auditor’s report?, home of the financial statements and the audit, auditor’s report `look and feel’, and authority of the audit statements.

The disclosure of corporate information by Internet is attracting the attention not only of various accountings bodies but also researchers (Bonson & Escobar, 2006). Several standard setters and professional groups have also sponsored IFR studies. These include the Institute of Chartered Accountants in England and Wales (ICAEW, 1998, 2004), the International Accounting Standards Committee (IASC) (Lymer et al., 1999), Canadian Institute of Chartered Accountants (CICA) (Trites, 1999), the U.S. Financial Accounting Standards Board (FASB, 2000, 2004), and the International Federal of Accountants (IFAC, 2002).

Relationship Studies

While descriptive studies provide valuable insights into the studies of IFR, this probably would not explain the factors that influence the IFR. Therefore, several studies have been carried out to explain the factors that influence IFR. Research on IFR has produced valuable insights into the determinants of companies’ Internet disclosure choice (Kelton & Yang, 2008). Ashbaugh et al. (1999) document IFR practices and provide preliminary evidence on why some firms disseminate financial information on their corporate websites, while others do not. Ashbaugh et al. (1999) find that firms engaging in IFR are larger and more profitability than those not engaging in IFR. Furthermore, firms responding to their survey indicate that disseminating information to shareholders is an important reason for establishing an Internet presence. Ashbaugh et al. (1999) is one of the pioneer studies to investigate the IFR issue; however, it does not provide a theoretical rationale for its analysis.

Craven and Marston (1999) present the result of a survey of Internet reporting based on the top 200 UK companies. They find that larger companies are more likely to disclose information on their website, although industrial classification did not seem to be significant. Pirchegger and Wagenhofer (1999) find that whereas firm size and profitability affect the IFR of Austraian companies, they do not affect German companies’ IFR choices. Joshi and Al-Bastaki (2000) survey the current state of Internet usage by a sample of 35 banks in Bahrain. Their study finds that large size banks have been using their websites of financial reporting purposes.

Debreceny et al. (2002) examine voluntary IFR in 22 countries to identify the firm and environment determinants of IFR. They used two dimensions (i.e., content and presentation) to measure the level of IFR. They find that presentation aspect of IFR is more associated with the level of technology and disclosure environment than the content of IFR. They also find that voluntary adoption of IFR in 22 countries is associated with company size and listing on an U.S stock exchange, but not associated with leverage, risk, or Internet penetration in the countries.

Xiao et al. (2004) measure IFR in four dimensions (i.e., content, presentation methods, mandatory items, and voluntary items) and analyze the determinants of Internet-based corporate disclosure by Chinese listed companies. They find that IFR is positively and significantly associated with the proportion of institutional ownership (also called legal person ownership), but not with ownership by domestic private investors, foreign investors, or the state. Al Arussi et al. (2009) find that level of technology, ethnicity of CEO and firm size are determinants of both internet financial and environmental disclosure.

More recently, Ali Khan (2010) also measure IFR in two dimensions (i.e., content and presentation) and analyzes the determinants of IFR by Malaysian listed companies. He finds that IFR is positively and significantly associated with firm size, listing age and return on equity. Furthermore, Aly et al. (2010) find that profitability, foreign listing and industrial sector (communications and financial services) are the most important factors that affect the amount and the presentation formats on the internet reporting in Egypt.

One characteristic of prior studies on IFR research is strong focus on the economic aspects of determinants of IFR (Kelton & Yang, 2008). A number of studies investigate the association between IFR and factors such as firm size, profitability, leverage, etc. (Craven & Marston, 1999; Debreceny et al., 2002; Ettredge et al., 2002; Oyelere et al., 2003).

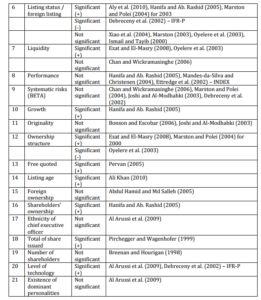

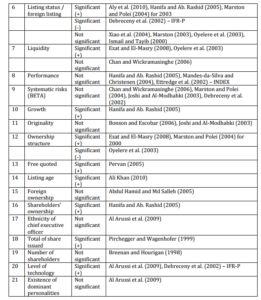

After having an extensive literature review, this section concludes that the dimension of IFR had been defined in various and inconsistent ways. Consequently, the use of different dimensions of IFR construct creates problem and difficulties in integrating the existing knowledge. Table 2 show a summary of independence variables result of IFR research.

Table 2: Summary of Independence Variables Results for IFR

Timeliness of IFR

Although many studies investigate the extent of IFR and its determinants, few studies focus on the timeliness (Ezat & El-Masry, 2008). According to Abdelsalam and Street (2007), numerous studies examine the level of corporate internet reporting (CIR) and/or the determinants of IFR level of CIR: only few studies focus on timeliness. Pirchegger and Wagenhofer (1999) analyze five items in the dimension of timeliness: regular website updating, ability to distinguish current from older information, the availability of daily stock quotations, the response time to standard requests, and the response time to special requests. Pirchegger and Wagenhofer (1999) find that, on average, German and Austrian companies satisfy 66.3% of the five timeliness criteria studied.

Ettredge, Richardson and Scholz (2002) find an average delay of 30 days from U.S. companies file Form 10-K and the date Form 10-K appears on the company website. Shorter delays are associated with greater profitability, shorter lags in announcing earnings through press releases, and the use of multiple file formats for Form 10-K presentations. Longer delays are associated with external links to U.S. Security and Exchange Commission (SEC) dan Electronic Data Gathering, Analysis and Retrieval (EDGAR).

Moreover, two CIR studies focusing on timeliness were published in 2004. Oyelere et al. (2004) identify growing user demands for increased timeliness of CIR. Davey and Homkajohn (2004) measure CIR timeliness and find that Thai companies perform better on user support and content than timeliness and technology. Ezat and El-Masry (2008) examine the key factors that affect the timeliness of IFR by Egyptian listed companies on the Cairo and Alexandria Stock Exchange. They find that a significant relationship between the timeliness of IFR and firms size, type of industry, liquidity, ownership structure, board composition and board size. Abdelsalam and El-Masry (2008) provide evidence of a link between timely IFR and the ownership structure characteristics of board independence and size.

Conclusion

This paper provides insights into the evolution of IFR research to contribute to the literature by reviewing and documenting the research of IFR. It is perhaps the conclusion of this paper that many are keen to see pointers for the direction of future empirical and more conclusive work in the IFR field.

Previous studies reveal that the trend of IFR researches starts from descriptive research, comparative research, association research, dimension and timeliness of IFR. As suggested by Ashbaugh et al. (1999), Oyelere et al. (2003), and Ali Khan and Ismail (2011), future research should develop a comprehensive predictive model for the choice of IFR. Furthermore, in line with the proposition before, changes in the IFR environment necessitate current examination and broader analysis of disclosure practices (Kelton & Yang, 2008). Therefore, question such as determinants or factors underlying the influences for adopting practices needs more detailed examination and analyses. This situation will give an opportunity to further investigate the factors that influence the practice of IFR.

A comprehensive review of existing literature disclosure index indicates that different researchers used different dimensions to represent IFR disclosure index. These differences contribute to the variations in the findings among the researchers and thus are unable to clearly explain the phenomenon and the influence factors. Therefore, the dimension of IFR disclosure index has also become an important and an interesting agenda to be investigated.Based on extensive literature review, as mentioned by Ali Khan and Ismail (2010), and Ali Khan and Ismail (2011), it could be concluded that a more comprehensive and holistic reporting index using a relevant dimension is needed. Content dimension will reveal information on how to use latest display in disseminating a company corporate information and website design. Then, presentation dimension will supply information on the usage of the latest display criteria in disseminating corporate information and company’s web design.

Acknowledgement

The financial support for the authors’ research from Minister of Higher Education (MOHE), Malaysia and Research Management Center (RMC), Universiti Teknologi Malaysia, Johor Bahru, Johor, Malaysia vote no. 77972 by Short Term Research Grant (New Academic Staff with PhD) also are appreciated.

References

Abdelsalam, O. H., Bryant, S. M. & Street, D. L. (2007). “An Examination of Comprehensiveness of Corporate Internet Reporting Provided by London-Listed Companies,” Journal of International Accounting Research, 6(2), 1-33.

Publisher – Google Scholar

Abdelsalam, O. H. & El-Masry, A. (2008).” The Impact of Board Independence and Ownership Structure on the Timeliness of Corporate Internet Reporting of Irish-Listed Companies,”Managerial Finance, 34(12), 907-918.

Publisher – Google Scholar

Abdelsalam, O. H., Street, D. L. & Byrant, S. M. (2004).’ Corporate Internet Reporting by BSE Sensex Companies,’Indian Accounting Review, December 8(2), 1-18.

Abdelsalam, O. H. & Street, D. L. (2007). “Corporate Governance and the Timeliness of Corporate Internet Reporting by U.K. Listed Companies,” Journal of International Accounting, Auditing and Taxation, 16, 111-130.

Publisher – Google Scholar

Abdul Hamid, F. Z. & Md Salleh, M. S. (2005). “The Determinants of the Investor Relations Information in the Malaysian Companies’ Website,” Corporate Ownership & Control, 3(1), 173-185.

Publisher – Google Scholar

Al Arussi, A. S., Selamat, M. H. & Hanefah, M. M. (2009). “Determinants of Financial and Environmental Disclosures through the Internet by Malaysian Companies,” Asian Review of Accounting, 17(1), 59-76.

Publisher – Google Scholar

Ali Khan, M. N. A. (2010). “Pelaporan Kewangan Menerusi Internet: Indeks, Tahap Pelaporan Dan Faktor Penentunya,” Unpublished Phd Dissertation: Universiti Utara Malaysia, Sintok, Kedah.

Publisher

Ali Khan, M. N. A. & Ismail, N. A. (2010). “A Study on the Index of Internet Financial Reporting,” International Postgraduate Business Journal, 2(1), 1-23.

Publisher – Google Scholar

Ali Khan, M. N. A. B. & Ismail, N. A. (2011). “The Use of Disclosure Indices in Internet Financial Reporting Research,”Journal of Global Business and Economics, 3(1), 157-173.

Publisher – Google Scholar

Allam, A. & Lymer, A. (2003). “Development in Internet Financial Reporting: Review and Analysis Across Five Developed Countries,” the International Journal of Digital Accounting Research, 3(6), 165-199.

Publisher – Google Scholar

Almilia, L. S. (2009). “An Empirical Study of Factors in Influencing Internet Financial Reporting and Sustainability Reporting in Indonesia Stock Exchange,” Paper Presented at Accounting & Finance Association of Australia and New Zealand (AFAANZ) Conference 2009, Adelaide, July 5-7, 2009.

Publisher

Aly, D., Simon, J. & Hussainey, K. (2010). “Determinants of Corporate Internet Reporting: Evidence From Egypt,”Managerial Auditing Journal, 25(2), 182-202.

Publisher – Google Scholar

Ashbaugh, H., Johnstone, K. M. & Warfield, T. D. (1999). “Corporate Reporting on the Internet,” Accounting Horizons, 13(3), 241-257.

Publisher – Google Scholar – British Library Direct

Barako, D. G., Rusmin, R. & Tower, G. (2008). ‘ Web Communication: an Indonesian Perspective,’ African Journal of Business Management, 2(3), 53-58.

Google Scholar

Board, F. A. S. (2000). ‘ Business Reporting Research Project: Electronic Distribution of Business Reporting Information,’ Steering Committee Report Series. Financial Accounting Standards Board.

Google Scholar

Bonson, E. & Escobar, T. (2002). “A Survey on Voluntary Disclosure on the Internet: Empirical Evidence from 300 European Union Companies,” the International Journal of Digital Accounting Research, 2(1), 27-51.

Publisher – Google Scholar

Bonson, E. & Escobar, T. (2006). “Digital Reporting in Eastern European: an Empirical Study,” International Journal of Accounting Information System, 7, 299-318.

Publisher – Google Scholar

Celik, O., Ecer, A. & Karabacak, H. (2006). “Impact of Firm Specific Characteristics on the Web Based Business Reporting: Evidence from the Companies Listed in Turkey,” Problems and Perspectives in Management, 4(3), 100-133.

Publisher – Google Scholar

Chan, W. K. & Wickramasinghe, N. (2006). ” Using the Internet for Financial Disclosure: the Australian Experience,”International Journal Electronic Finance, 2(1), 118-150.

Publisher

Chatterjee, B. & Hawkes, L. (2008). “Does Internet Reporting Improve the Accessibility of Financial Inforamtion in Global World? a Comparative Study of New Zealand and Indian Companies,” the Australian Business & Finance Journal, 2(4), 33-56.

Publisher – Google Scholar

Craven, B. M. & Marston, C. L. (1999). “Financial Reporting on the Internet by Leading UK Companies,” the European Accounting Review, 8(2), 321-333.

Publisher – Google Scholar – British Library Direct

Davey, H. & Homkajohn, K. (2004). “Corporate Internet Reporting: an Asian Example,” Problems and Perspectives in Management, 2, 211-227.

Publisher – Google Scholar

Davey, H. & Homkajohn, K. (2004). “Corporate Websites, Design & Disclosure: the Thailand Position,” Malaysian Accounting Review, 3(1), 61-79.

Publisher

Debreceny, R. & Gray, G. L. (1999). “Financial Reporting on the Internet and the External Audit,” the Eruropean Accounting Review, 8, 335-350.

Publisher – Google Scholar – British Library Direct

Debreceny, R., Gray, G. L. & Rahman, A. (2002). “The Determinants of Internet Financial Reporting,” Journal of Accounting and Public Policy, 21(4-5), 371-394.

Publisher – Google Scholar

Deller, D., Stubenrath, M. & Weber, C. (1999). “A Survey on the Use of the Internet for Investor Relations in the USA, the UK and Germany,” the European Accounting Review, 8(2), 351-364.

Publisher – Google Scholar – British Library Direct

Ettredge, M., Richardson, V. J. & Scholz, S. (2001). “The Presentation of Financial Information at Corporate Web Sites,” International Journal of Accounting Information Systems, 2, 149-168.

Publisher – Google Scholar – British Library Direct

Ettredge, M., Richardson, V. J. & Scholz, S. (2002). “Dissemination of Information for Investors at Corporate Web Sites,” Journal of Accounting and Public Policy, 21, 357-369.

Publisher – Google Scholar

Ezat, A. & El-Masry, A. (2008). “The Impact of Corporate Governance on the Timeliness of Corporate Internet Reporting by Egyptian Listed Companies,” Managerial Finance, 34(12), 848-867.

Publisher – Google Scholar

Gandia, J. L. (2008). “Determinants of Internet-Based Corporate Governance Disclosure by Spanish Listed Companies,” Online Information Review, 32(6), 791-817.

Publisher – Google Scholar

Garg, M. C. & Verma, D. (2010). “Web-Based Corporate Reporting Practices in India,” the IUP Jorunal of Accounting Research & Audit Practices, IX(3), 7-19.

Publisher – Google Scholar

Gowthorpe, C. & Amat, O. (1999). “External Reporting of Accounting and Financial Information Via the Internet in Spain,” the European Accounting Review, 8(2), 365-371.

Publisher – Google Scholar – British Library Direct

Hassan, S., Jaffar, N., Johl, S. K. & Mat Zain, M. (1999). ‘Financial Reporting on the Internet by Malaysian Companies: Perceptions and Practices,’ Asia-Pacific Journal of Accounting, 6(2), 299-319.

Google Scholar

Hedlin, P. (1999).” The Internet as a Vehicle for Investor Relations: the Swedish Case,” the European Accounting Review, 8(2), 373-381.

Publisher – Google Scholar – British Library Direct

IASC. (1999).’ IASC Publishers Study of Business Reporting on the Internet,’ Press Release: International Accounting Standards Committee, 15 November 1999.

ICAEW. (1998). “The 21st Century Annual Reporting,” London. the Institute of Chartered Accountants in England and Wales.

Publisher

ICAEW. (2004). “Digital Reporting: a Progress Report,” London. the Institute of Chartered Accountants in England and Wales.

Publisher

IFAC. (2002, August). ‘ Financial Reporting on the Internet ‘International Federation of Accountants.

Joshi, P. L. & Al-Bastaki, H. (2000). ‘ Factors Determining Financial Reporting on the Internet by Banks in Bahrain,’ the Review of Accounting Information Systems, 4(3), 63-74.

Joshi, P. L. & Al-Modhahki, J. (2003). “Financial Reporting on the Internet: Empirical Evidence from Bahrain and Kuwait,” Asia Review of Accounting, 11(1), 88-101.

Publisher – Google Scholar

Kelton, A. S. & Yang, Y.-W. (2008). “The Impact of Corporate Governance on Internet Financial Reporting,” Journal ofAccounting and Public Policy, 27, 62-87.

Publisher – Google Scholar

Khadaroo, M. I. (2005). “Business Reporting on the Internet in Malaysia and Singapore: a Comparative Study,”Corporate Communications: an International Journal, 10(1), 58-68.

Publisher – Google Scholar

Larran, M. & Giner, B. (2002). “The Use of the Internet for Corporate Reporting by Spanish Companies,” The International Journal of Digital Accounting Research, 2(1), 53-82.

Publisher – Google Scholar

Lodhia, S. K., Allam, A. & Lymer, A. (2004). “Corporate Reporting on the Internet in Australia: an Exploratory Study,” Australian Accounting Review, 14(3), 64-71.

Publisher – Google Scholar

Louwers, T. W., Pasewark, W. & Typpo, E. (1996). “Silicon Valley Meets Norwalk,” Journal of Accountancy, 186, 20-24.

Lybaert, N. (2002). “On-Line Financial Reporting: an Analysis of the Dutch Listed Firms,” the International Journal of Digital Accounting Research, 2(4), 195-234.

Publisher – Google Scholar

Lymer, A., Debreceny, R., Gray, G. L. & Rahman, A. (1999). Business Reporting on the Internet, IASC Research Report.

Publisher – Google Scholar

Marston, C. (2003). “Financial Reporting on the Internet by Leading Japanese Companies,” Corporate Communication: an International Journal, 8(1), 23-34.

Publisher – Google Scholar – British Library Direct

Marston, C. & Leow, C. Y. (1998). ‘ Financial Reporting on the Internet by Leading UK Companies,’ Paper Presented at the 21st Annual Congress of the European Accounting Association, Antwerp, Belgium.

Google Scholar

Marston, C. & Polei, A. (2004). “Corporate Reporting on the Internet by German Companies,” International Journal of Accounting Information System, 5, 285-311.

Publisher – Google Scholar

Mendes-Da-Silva, W. & Christensen, T. E. (2004, August). “Determinants of Voluntary Disclosure of Financial Information on the Internet by Brazilian Firms,”

Publisher – Google Scholar

Mohamed, E. K. A., Oyelere, P. & Al-Busaidi, M. (2009). “A Survey of Internet Financial Reporting in Oman,”International Journal of Emerging Markets, 4(1), 56-71.

Publisher – Google Scholar

Oyelere, P., Laswad, F. & Fisher, R. (2003). “Determinants of Internet Financial Reporting by New Zealand Companies,” Journal of International Financial Management and Accounting, 14(1), 26-61.

Publisher – Google Scholar – British Library Direct

Pervan, I. (2006). “Voluntary Financial Reporting on the Internet- Analysis of the Practice of Stock-Market Listed Croatian and Slovene Joint Stock Companies,” Financial Theory and Practice. 30(1), 1-27.

Publisher – Google Scholar

Petravick, S. & Gillett, J. W. (1996, July). “Financial Reporting on the World Wide Web,” Management Accounting, 78(1), 26-29.

Publisher – Google Scholar – British Library Direct

Petravick, S. & Gillett, J. W. (1998, October). ‘ Distributing Earnings Reports on the Internet,’ Management Accounting, 80(4), 26-29.

Google Scholar – British Library Direct

Pirchegger, B. & Wagenhofer, A. (1999). “Financial Information on the Internet: a Survey of the Homepages of Austrian Companies,” the European Accounting Review, 8(2), 383-395.

Publisher – Google Scholar – British Library Direct

Trabelsi, S., Labelle, R. & Laurin, C. (2004). “CAP Forum on E-Business: the Management of Financial Disclosure on Corporate Websites: a Conceptual Model,” Canada Accounting Perspectives, 3(2), 235-259.

Publisher – Google Scholar

Trites, G. (1999). ‘ The Impact of Technology on Financial and Business Reporting,’ Canadian Institute of Chartered Accountants.

Google Scholar

Sanchez, I.-M. G., Dominguez, L. R. & Alvarez, I. G. (2011). “Corporate Governance and Strategic Information on the Internet: a Study of Spanish Listed Companies,” Accounting, Auditing & Accountability Journal, 24(4), 471-501.

Publisher – Google Scholar

Seetharaman, A. & Subramaniam, R. (2005/2006). ‘ Navigating the Web of Financial Reporting,’ European Business Forum, Winter, 23, 51-54.

Google Scholar

Spanos, L. (2006, June). “Corporate Reporting on the Internet in a European Emerging Capital Market: The Greek Case,”

Publisher – Google Scholar

Xiao, J. Z., Yang, H. & Chow, C. W. (2004). “The Determinants and Characteristics of Voluntary Internet-Based Disclosures by Listed Chinese Companies,” Journal of Accounting and Public Policy, 23, 191-225.

Publisher – Google Scholar