Introduction

The intellectual ability of the work force goes a long way in determining the prospect of an organization, whatever the type of organization. Stated differently, the success of organizations depends on the quality of their human resources because they occupy strategic positions. The failure to sufficiently report on activities on human resource management may suggest that, the financials do not present the true and fair view of the state of affairs. Investors may therefore have a wrong perception on the performance of an organization. Investment which would have been made in the company to contribute to economic development may not be forthcoming.

Some countries have started recognizing the strategic importance of human resource asset by managing, accounting and disclosing human resource; and also valuing and incorporating human assets in financials. Reflecting human assets in financials is a reflection of the value placed on human assets, and could be viewed as a step in the right direction towards achieving vision 2020, since human capital is a critical success factor for vision 2020 realisation/actualization. Nigeria, being part of a global community, should expectedly keep abreast with global practices. In assessing compliance of the country as per recognizing the strategic importance of human asset, there is a need to ascertain current practice. Gaps identified (if any) could then be bridged through policy recommendations towards achieving vision 2020.

It is against this backdrop that the research is carried out– to assess current Human Resource Management and Accounting Disclosure (HRMAD) practices, using financial service and manufacturing firms in Nigeria as bases for study. Two research hypotheses were formulated for the purpose of the study, and they are stated in their null forms as follows:

H0 1: There is no significant difference in HRMAD practice between the Financial and Manufacturing industries in Nigeria

H02: There is no statistically significant relationship between the size of a company and HRMAD practice in Nigeria.

Literature Review

The Concept of Human Resource Management and Accounting

Human Resource Management (HRM) is the activity that focuses on recruitment, selection, placement, induction, training, development, welfare and remuneration of workers in an organization. HRM is the combination and utilisation of human assets of an organisation in such an optimal manner that ensures the achievement of organisational objectives, while also helping to develop and improve such persons intellectually. Effective HRM brings about the accomplishment of employee’s goals, while also achieving objectives of the organisation. The human asset is the total knowledge, skills, creative abilities, talent, altitudes and beliefs of an organization’s workforce as well as values, altitudes and beliefs of the individuals involved (Leon, 1981).

Various theories in management exist that emphasize the relevance of human resource management. One of such theories is the 4 Ss of business, made up of skills, surroundings, suppliers and systems. Also, there are the 6 Ms of business such as men, money, markets, methods, machines and materials. Another principle, the 8 Ps of business, states that the business resources consist of people, process, policies, procedures, price, promotions, places/plants and products. The three perspectives on business resources (4 Ss, 6 Ms and 8 Ps of business) all start with a common factor which is the human resources (skills, men and people). These concepts demonstrate the importance attached to human resources. Realizing the supremacy of the human, asset over other assets has implication for strategy formulation by firms. It is the human asset that combines the other business resources in a way that ensure the achievement of specified objectives. The manner in which business resources are combined will vary from one organization to another, depending on the individual business strategies. Whatever strategy an organization adopts, the involvement of human resources is critical to the success of the strategy.

Public and private sector organizations are now focusing on using human asset to strategic advantage for achieving set goals. When organizations employ such personnel practices as job rotation, internal recruitment to fill vacancies with seniority positions, external or in-house formal training, effective performance management systems that reward productivity, employee participation and involvement, intrapreneurship encouragement, well-defined job functions, and performance-based compensations, they tend to achieve their goals and objectives the more (Schwarz, 2008; Moore, 2007; Johanson et al, 1996; Morrow, 1996; Hendricks, 1976).

Human resource accounting entails capturing, processing and presenting human resource management activities and transaction. Human resource accounting has also been defined as the system of recording of transactions relating to the value of human resource i.e. the cost of acquisition of their knowledge and utilization of the energy for production of goods and services in the most profitable manner, and thereby achieving the organization goals (Bassi, et al 1997). Human resource accounting could be viewed as the practice of recording, measuring and presenting details of human resource management such as costs incurred in connection with recruitment, selection, placement, induction, training, development, welfare and remuneration of workers. Accounting and reporting on human capital also involve putting monetary value on the human beings working for an organization. Organizations invest in human resources, like they invest in other resources that are inanimate; it is only intuitively appealing to report investments in the workforce, which is the crux of human resource accounting.

Research has shown that the accrual of human asset enhances decision making by investors. There is a significant impact of the human asset valuation information on investors’ decision regarding their selection of the company. The reporting of information of human asset valuation in published financial statements of the companies caused investment decision to be different (Schwarz, 2008; Moore, 2007). The result of the current reporting practices, of putting all expenditures pertaining to human asset as expense in statement of financial performance (profit or loss account) and non-disclosure of human resources costs information in Balance Sheet of business enterprise, has been that financial statements that do not reveal any reliable, numeric information on human resources; by implication, the state of affairs is improperly reported to different users of the financial statement.

Abubakar (2012) submitted that the expenditures on human resource like those relating to training, education, welfare, recruitment, selection, contribution to pension fund, and subsistence allowance are better accounted for when they are capitalized; and hence, it is a necessity to capitalize them. The main reason why human resource accounting have taken a long period to be incorporated in the company’s final report is the difficulty or challenge of assigning monetary value to various human asset cost, investment and employees worth (Schwarz ,2008; Moore,2007; Johanson et al,1996; Hendricks,1976).

Researches by Hermanson (1964), Likert (1967), Likert and Pyle (1971), Lev and Schwartz (1971) have made cases for the inclusion of human resource accounting information in annual financial reports, on the premise that such disclosures might benefit the investors and would be of immense use if such information are presented, so that investors (present and prospective) can evaluate properly assets and income of a firm.

The Link between Vision 2020 and Human Resource Management and Accounting

Different countries, organizations and institutions have varying 2020 visions, depending on what is to be achieved. For example, the vision for Europe 2020 is for the European Union to become a smart, sustainable and inclusive economy. According to the EU 2020 strategy, to concretize this plan, the Union has set five ambitious objectives – on employment, innovation, education, social inclusion and climate/energy – to be reached by 2020. Each Member State has adopted its own national targets in each of these areas. The 2020 vision campaign announced by the Mayors for Peace in 2003 seeks a nuclear-weapon-free world; the 2020 vision initiative launched by the International Food Policy Research Institute in 1993 seeks to reach sustainable food security for the world; the vision 2020 for science is the improvement of science centre to a state-of-the-art facility; World Health Organization vision 2020 is a global initiative that aims to eliminate avoidable blindness by the year 2020 ; India vision 2020 is a programme to transform India into a developed nation; Wawasan vision 2020 is Malaysia’s vision set in 1991 for the nation to become self-sufficient, industrialized and developed.

On the whole, the objective of vision 2020 for all the initiatives highlighted is to provide sustainable solution to different global issues. Nigeria also has its vision 2020. According to the National Population Commission (2009:9), the Nigeria vision 2020 states that:

By 2020 Nigeria will be one of the 20 largest economies in the world, able to consolidate its leadership role in Africa and establish itself as a significant player in the global economic and political arena

In order to achieve this, with reference to the blueprint, a Gross Domestic Product (GDP) of not less than $900 billion is required. This translates to a National per capita income of not less than $4000 annually by the year 2020 (Adedokun, 2013). It is also stated that, another implication of the Vision 2020 is that Nigeria’s economy must grow at an average rate of 13.8 percent during the period. The precursors of the vision 2020, referred to as the seven point agenda, encompasses areas such as; Power and energy; food security and agriculture; wealth creation and employment; mass transportation; land reform; security; and qualitative and functional education. Two out of the seven point agenda focus on human capital development-wealth creation and employment; as well as qualitative and functional education– these underscore the importance of human asset at the national/public sector level.

The global and local blue prints for vision 2020 both recognize the place of human capital. The potential for attaining global competitiveness rests with an effective human capital management. The collection of data and information to monitor progress, formulation of operational goals, which will break down the overall vision to working guide and the monitoring of implementation activities for delivery of this vision, are all largely dependent on carefully selected, qualified and motivated personnel. Human capital management focuses on issues as touching personnel.

Accountability in government is important; governance is all about accountability. Rendering stewardship of human resource management activities, in recruiting, training, remunerating and motivating human resources who will contribute to achieving the vision 2020, is done through the tool of human resource accounting in the public sector. We can deduce therefore that Human resource management and reporting apply to both the government and private sector organizations.

The private sector equally reckons with the competitive edge that human resources afford organizations. This is evidenced by the featuring of human resource management policies, practices and activities through disclosures in annual reports and accounts. Studies have also shown that the size of a firm determines its human resource accounting disclosure practice (Schwarz, 2008; Moore, 2007; Johanson et al, 1996).

Human resource accounting reports the human resource management activities through financials. Financial statements are one of the media through which companies communicate performance to investors. Investors in taking decisions assess how a company is performing (Enofe et al, 2013; Jaggi and Lau 1974). It becomes very fundamental that the financial statement presents the true and fair view of the state of affairs of the company. The exclusion of the human resource asset may distort the true state of affairs of the company which may negatively affect its performance appraisal. Since investments have positive effect on the economy and the central objective of the vision 2020 is sustainable development, the firm may not be able to attract investors (potential, local and/or foreign) which negatively affects the achievement of the vision. Investment attracted by companies (through the presentation of financial statements that represent the true and fair view) will boost the GDP of the country; an upward trend in GDP will contribute to achieving vision 2020.

Human Resource Valuation Practices

Approaches to Human Resource Accounting (HRA) were first developed in 1691; the second phase was during 1691-1960, and third phase was post-1960. There are two approaches to HRA (Schwarz, 2008; Moore, 2007; Johanson et al, 1996; Hendricks, 1976; Jaggi and Lau, 1974). The cost approach is also called human resource cost accounting method and it is subdivided into: (a) acquisition cost model and (b) replacement cost model. The value approach is also sub-divided into: (a) present value of future earnings method (b) discounted future wage model, and (c) competitive bidding model.

Some organizations around the world have embraced the idea of incorporating human assets in financial statements. Infosys was the first company to value it employees in India. The software company did the first valuation in fiscal year 1995-96 using Lev and Schwartz model. The value of the employee is taken as the present value of the future earning of workers. Another company—the Cement Corporation of India— considers human resources as important. The corporation determines the economic value of human asset by discounting the expected future earnings of worker and taking into consideration promotional policies and the salary scale. The valuation is based on principles, and guidelines enunciated in the model developed by Lev and Schwartz (1971), Eric Flamholtz (1974), and Taggi and Lau (1974) with appropriate modification done.

Human resource accounting has gained wider application in football business. According to Morrow (1996), 18 British football clubs included players in the balance sheet before the Bosman case. Most clubs used acquisition cost of player on the transfer market as the valuation method. One of the regions where human resource costing and accounting has gained much application is Sweden, and the factors that contributed to this are: extensive education in human resource accounting at colleges and universities; human resource accounting is viewed as a new approach to strategic thinking; and human resource accounting is used as a change instrument in shifting from regulated economy to a more market oriented economy (Olsson, 2001; Johanson 1998).

Research Methodology

Secondary data were used for analysing the human resource disclose practice of the selected Nigerian companies. Content analysis was used to derive scores for each company. Content analysis is a methodology developed for studying the contents, elements or features of an item, a report or any document. The assignment of codes to the items in a document makes it possible to render qualitative data to quantitative form which can be numerically analysed. In applying a content-analysis methodology, a scale for measurement in form of a checklist which features and captures all likely items is developed.

A checklist was developed as the research instrument to measure HRMAD for the study. In constructing a checklist, annual reports, published books, journals and periodicals were consulted in order to capture human resource management, accounting and reporting items as much as possible. Thirty (30) human resource management and accounting disclosure variables were identified and featured in the checklist. A total sample of 12 firms – 6 commercial banks and 6 manufacturing companies in the Food subsector based on the Nigerian Stock Exchange classification- were selected for content analyses of annual reports and accounts, for the year 2012. The year 2012 was selected as the basis period because the information disclosed in the financials for this year is expected to be the latest–it should contain the most current human resource management policy and financial reporting practice of sample firms.

Three classes of commercial banks currently exist based on the CBN licensing of banks in November 2010 in the category of regional, national and international banks. 1 regional, 3 national and 2 international banks were selected for the study. Based on these criteria, the selected banks are: First Bank PLC, GT Bank PLC and Diamond Bank PLC for the internationally licensed banks, Stanbic IBTC PLC and Eco bank PLC for the nationally-licensed banks and WEMA bank PLC for regionally licensed bank.

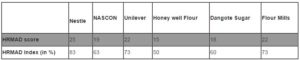

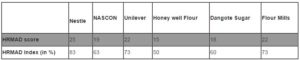

The 6 manufacturing companies chosen were selected based on their size. The selected manufacturing companies were the six biggest in size. Size was measured based on the market capitalization of ordinary shares of the publicly-quoted companies as at August 2013. The companies selected were Nestle PLC; Cadbury PLC; National Salt Company of Nigeria (NASCON) PLC; Dangote Sugar PLC; Flour Mills PLC and Honeywell Flour PLC.

Independent T-test was used to comparatively analyse if there is any significant difference in mean scores of HRMAD practice between the Banks and Manufacturing companies. A correlation analysis was carried out to establish if there was any statistically significant relationship between HRMAD and Size of companies.

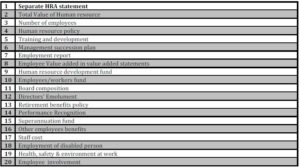

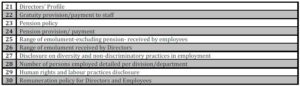

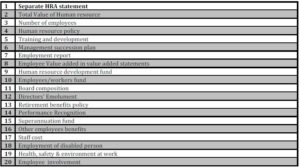

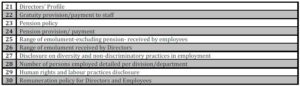

Table 1: Human Resource Disclosure Checklist

Source: Researchers’ Construction (2013)

The published accounts of sample companies were scrutinized for each of the items for disclosure: score1 is assigned if any of the parameters is found, while score 0 is assigned if an item is not found. The Human Resource Management and Accounting Disclosure (HRMAD) index was thereafter derived for each company and was obtained as follows:

HRMAD index= Total score obtained by individual firm x 100/ Total score obtainable

Reliability of Data

Data were sourced from the published annual reports and accounts of companies. The fact that the published reports were audited by external auditors and approved by the Securities and Exchange Commission (SEC), the Nigerian Stock Exchange (NSE) and the Central Bank of Nigeria (CBN) for banks are adjudged to provide credibility and the reliability for the data.

To recapitulate the research methodology, the research process adopted was as follows: development of a HRMAD checklist; scrutiny and scoring of annual reports & accounts of sample companies; derivation of a HRMAD index and the analysis—descriptive and inferential – of data.

Presentation and Analyses of Data

This section presents the HRMAD index of each company and the results of statistical procedures performed.

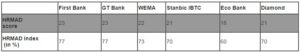

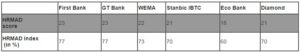

Table 2: HRMAD practice in the Banking Sector

Source: Researchers’ study (2013)

Table 3: HRMAD practice in the Manufacturing Sector

Source: Researchers’ study (2013)

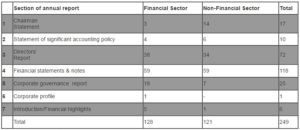

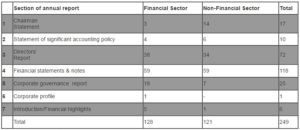

Table 4: Section of annual report where HRMAD practice is located

Source: Researchers’ study (2013)

Table 4 shows that the highest number of HRMAD items was disclosed in the financial statements and notes for both the financial service and manufacturing companies. This is supported by the result in table 5 which also shows that 55% of the disclosures were quantitative/numeric data. Financial statements and the notes contain mostly quantitative data; it was therefore not surprising that this section of annual reports and accounts captured the highest number of item disclosures. Items disclosed in numeric terms were total number of employees, employees’ value addition, human resource development fund, employees’ fund, number of persons on Board, composition of employees (Management and Non-management staff), details of directors emoluments such as amount, range of emolument, highest paid director, chairman’s emolument, staff cost, gratuity provision/payment to staff, pension payment/provision for staff, range of emolument-excluding pension- received by employees, while others in non-numeric terms disclosed in notes to the financial statements were other employees benefits, pension policy, and disclosure on diversity in employment.

The Directors’ reports also ranks high as per the number of HRMAD practice items disclosed for both industries. Items mostly disclosed in this section were predominantly qualitative/non-numeric such as human resource policy; employee categories; training and development; health, safety and environment at work; total number of employees; employment of disabled persons; employee involvement; performance recognition; employee involvement; directors’ profile; disclosure on diversity and non-discriminatory practices; directors’ emolument; and human rights and labour practices disclosures.

Management succession plan, directors’ profile and remuneration policy for employees and Board of Directors were mostly disclosed in the chairman’s statement, while board composition was regularly featured in corporate governance report. The majority of sample companies disclosed their policy on retirement benefits in the statement of significant accounting policy, while few others disclosed it in either the directors’ report or notes to the financial statement. Performance recognition was disclosed in either the Chairman’s statement or Directors report. Other information such as separate human resource accounting statement, human resource policy and other employees benefits were disclosed in other reports such as business review and corporate governance.

On the whole, there were certain items that were disclosed in different parts of the annual reports by different companies. This could be attributable to the non-harmonization of HRMAD and also the non-existence of an accounting or any regulatory reporting standard for human resource. Of all the disclosures by Nigerian companies, none placed monetary value on its entire workforce; there was no use of employee valuation model. Monetary value is not put upon human resources in Nigeria based on the various models for Human resource valuation, but the best that is done is the disclosure of qualitative and quantitative information that centre on human assets.

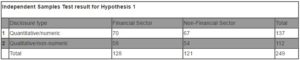

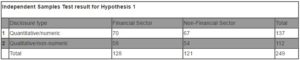

Table 5: Numeric/non-numeric disclosures

Source: Researchers’ study (2013)

Nigerian companies in the financial and manufacturing sectors disclose more of quantitative information (representing 55%) on human resource which supports the findings that, the financial statements and their accompanying notes are the sections of the annual reports that contain the highest number of items disclosed.

Test of Hypotheses

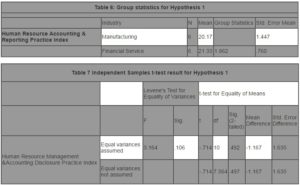

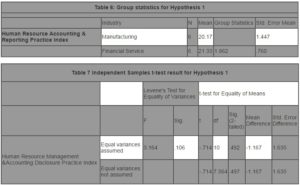

H0 1: There is no significant difference in HRARD practice between the Financial and Manufacturing industries in Nigeria

Tables 6 and 7 contain the t-test result for hypothesis 1. The sig value is greater than 0.05. The null hypothesis is accepted and we conclude that there is no significant difference in HRMAD practice between the Financial and Manufacturing industries in Nigeria. Although, the mean score for HRMAD practice in banks is somewhat higher than that of non-bank (from the t-test result for the mean), the difference is not statistically significant.

Tables 2 and 3 support the results of t-test that there is no significant difference in HRMAD practice between banks and manufacturing companies. The total HRMAD disclosure by financial institutions is 128 (meaning that on the average, each bank scored 21 items) and manufacturing companies is 121 (an average of 20 items per manufacturing company) which is not statistically different.

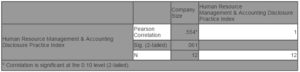

H02: There is no statistically significant relationship between the size of a company and HRARD practice in Nigeria

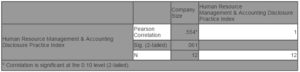

Table 8: Correlation table for hypothesis 2

The result shows that there is a strong positive relationship between HRMAD and company size, significant at 10%. Our findings are consistent with the work of other researchers (Syed, 2009; Adams et al., 1998; Marston and Shrives, 1991). Companies will generally like to disclose information on human resource in order to keep up with reputation, societal expectation and employment brand. The bigger the size of a company, the more it will willingly disclose HRMAD practice to boost employer brand.

Conclusion and Recommendations

The study attempts to analyse how human resource management, accounting and disclosure practices could be used as a global strategy to achieve vision 2020 in Nigeria. Current practices in human resource accounting in the private sector were evaluated by studying 12 publicly quoted companies.

For Nigeria to achieve vision 2020 there is the need to value and incorporate human resource in its financials. None of the Nigerian companies place monetary value on its entire workforce using any of the human resource valuation model .This explains why human assets are not integrates with other non-current assets in the statement of financial position and this distorts the view expressed by financial statement.

There is arbitrariness in reporting human resource management activities. Besides, there is currently no legislation on reporting human resource practice. This explains the lack of uniformity in the presentation of information on human capital in annual reports. Except for the accounting standard on intangible asset (IAS 38) and employee benefit-IAS 19 (employee benefit is only an aspect in human resource accounting), there is no accounting or financial reporting standard that specifically and comprehensively addresses the issue of human resource accounting, reporting and disclosure. To achieve wealth creation and employment, the third point agenda for the Nigeria vision 2020, human resource assets should be incorporated in financials to attract local and foreign direct investments into the country, as it is established that the valuation of human assets in published financial statements of the companies significantly influences investment decisions. Human resource management and accounting could also be applied to the operations of the government. As such, ministries, departments, parastatals, governmental agencies and other public sector organizations may consider adopting human resource management and accounting concepts to attract foreign investments, grants, aids, loans and others forms of financial assistance from international organizations which will correspondingly contribute to economic development. In order to address the challenge of lack of standardization for reporting human resource practice, it is recommended that relevant authorities should look into coming up with a financial reporting standard on human resource activities.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Abubakar, S. (2012) ‘Capitalizing Human Resource Investments of Quoted Service Companies In Nigeria: A Study Of Experts’ Perception. [Online], [Retrieved September 2, 2013], Available: www.abu.edu.ng/publications/2012-04-05-145727_1156.docx

2. Adams, A., Hill, W. and Roberts, C. (1996) ‘Corporate social reporting practices in Western Europe: legitimating corporate behaviour?’ British Accounting Review, 30, 1–21

3. Adedokun, N. (2013) ‘The mirage called vision 2020,’ [Online], [Retrieved September 2, 2013], Available: http://odili.net/news/source/2013/sep/13/819.html

4. Bassi, L., Lev, B., Low, J., and Siesfield, A. (1997) ‘Accounting for and measuring the impact of corporate investments in Human Capital,’ Paper presented at a conference organised by Brookings Institution held at MIT in January 1998.

5. Edwards, M. R., (2010) ‘An integrative review of employer branding and OB theory,’ Personnel Review 39 (1), 5-23

6. European Commission (2010). ‘Europe 2020: Commission proposes new economic strategy,’ [Online], [Retrieved August 24, 2013], Available: http://ec.europa.eu/news/economy/100303_en.htm

7. European Commission (2010). ‘Europe 2020: A strategy for smart, sustainable and inclusive growth’. [Online], [Retrieved September 4, 2013], Available: http://ec.europa.eu/commission_2010 2014/president/news/documents/pdf/20100303_1_en.pdf

8. Harrell, A.M. and Klick, H.D. (1980) ‘Comparing the impact of monetary and non- monetary human asset measures on executive decision making,’ Accounting, Organizations and Society, 5 (4), 393-400.

Publisher – Google Scholar

9. Hendricks, J. (1976) ‘The impact of human accounting information on stock investment decisions: An empirical study’. Accounting Review, 292-305.

Google Scholar

10. Jaggi, B., and Lau, S. (1974). ‘Toward a Model for Human Resource Valuation,’ The Accounting Review, 321-29.

11. Johanson, U. and Nilson, M. (1996) ‘The usefulness of human resource costing and accounting’, Journal of Human Resource Costing and Accounting, 1 (1), 117-138.

Publisher – Google Scholar

12. Leon C M. (1981). ‘Personnel management: A human resources approach,’ (The Irwin series in management and the behavioural sciences) R.D. Irwin; 4th edition

13. Marston, C. L. and Shrives, P.J. (1991) ‘The use of disclosure indices in accounting research: a review article,’ British Accounting Review, 25, 195–210.

14.Moore, R. (2007). ‘Measuring how ‘human capital’ appreciates in value over time’. Plant Engineering, 61 (4), 29.

15. Morrow, S. (1996) ‘Football players as human assets. Measurement as the critical factor in asset recognition: A case study investigation,’ Journal of Human Resource Costing and Accounting, 1(1), 26

Publisher – Google Scholar

16. National Population Commission (2009). ‘Nigeria Vision 20:2020 Economic Blueprint 2009,’ [Online], [Retrieved September 2, 2013], Available: http://www.npc.gov.ng/vault/files/nigeria-vision-20_2020_draftetb.pdf

17. Olsson, B. (2001). ‘Annual reporting practices: information about human resources in corporate annual reports in major Swedish companies,’ Journal of Human Resource Costing and Accounting, 5(1), 22

Google Scholar

18. Schwarz, J.L., and Murphy, R. E. (2008). ‘Human capital metrics: An approach to teaching Using data and metrics to design and evaluate management practices,’ Journal of Management Education. 32 (2), 164.

Publisher – Google Scholar

19. Smith, S. and Wheeler, J. (2002) ‘A new brand of leadership,’ Managing the Customer Experience’, FT Prentice Hall, UK.

20. Syed A.A (2009). ‘Human resource accounting disclosure of bangladeshi companies and its association with corporate characteristics’. BRAC University Journal, 4 (1), 35-43

Google Scholar