Introduction

The economy is the fundamental basis for human development. In 2020, the world went through one of the deadliest pandemics in human history, this pandemic was caused by Covid-19. According to Alburquerque (2017), Peru, country in development pathways, was one of the most affected economies, increasing the levels of poverty, unemployment and expansion of the informal sector due to the cessation of economic activities, adding this economic crisis to the one experienced in 1930, the following one in 1983, during the government of Fernando Belaunde, due to climatological problems (the phenomenon of El Little boy). Then the crisis presented at the culmination of the first government of Alan García. And finally, between 1988 and 1990, the economy fell by approximately twenty-five percent, according to Andia, V., et al. (2021).

In none of the cases presented were the crises linked to health factors, as there was no background similar to the impact caused by Covid-19, which limited the actions to be taken, evidencing the particular vulnerability of the Peruvian system to face unexpected situations and sudden economic changes, presenting to date uncertainty of how Peru and other Latin American countries will be able to face the future problems to come.

The main economic crises have been associated with certain indicators that presented some imbalances: loss in consumption, inflation, unemployment, among others. But what happened with the effects of Covid-19 offers an unprecedented panorama. It is not an economic crisis that was caused by some external factor, it is a health crisis whose end and effects are still unknown. This forces the mechanisms of the effects of a possible recession on everything that drives the economy: production, distribution, and consumption.

The indirect impact of the decrease in economic activity must be considered by all companies, not only those in the areas most affected by the spread of the virus. That is why this study describes and analyzes the effects that Covid-19 has caused in the economy of Peru, by comparing the effects that other diseases have had on our country.

The methodology used for the research is descriptive, with a qualitative approach, and for the collection of information, the documentary analysis technique was used through the description and interpretation of the state of the art.

Development and stages of the review (Review methodology)

Epidemics, their history, and implications for the economy of Peru

Swine flu (A H1N1 flu)

Swine flu caused an estimated 40 million deaths worldwide in less than a year. It is estimated that a fifth of the world population was infected; later it was determined that these events were due to the influenza A H1N1 virus, mentioned Cabezas (2009).

The swine flu spread throughout America in mid-April 2009, this being one of the epidemics that affected Peru. Suárez et al. (2011) indicated that the first case of influenza on May 9, 2009, occurred in a woman from the US, and the first death occurred on June 3 of the same year. The new influenza A H1N1 spread to the 24 departments of Peru and more than 10,000 confirmed cases were reported.

The world economy is related to how the A H1N1 flu ended up affecting international markets; due to this pandemic, there was a drop in stocks, closure of airports; swine flu was the first pandemic recorded in the 21st century.

However, A H1N1 influenza has not quarantined entire cities or nations. In some countries travelers have been tested, suspected cases have been isolated, but the spread of this virus has not paralyzed some of the largest economies as Covid 19 did, demonstrations of Barifouse (2020).

The H1N1 flu did not have the same economic impact because mandatory quarantine was not necessary to avoid contagion, because some people were immune to the flu and its mortality rate was much lower than that of Covid-19 and much less contagious. It is necessary to clarify that according to Barifouse, in 2009 the world was overcoming a global financial recession that occurred in 2008. Many financial entities had declared bankruptcy, crushing the stock markets. The credit crisis was of great magnitude that forced the injection of money in their economies to several countries.

During 2002, Peru had a great economic growth until the crisis of 2007 to 2009 originated, which resulted in a fall in export prices, an increase in short-term capital outflows, and a fall in long-term private investment; and an abrupt cut in foreign credit lines and a contraction in domestic credit, according to the study by García (2011, p. 79).

The GDP growth rate of the urban sector of the Peruvian economy decreased by an average of 11.8% in the first three quarters of 2008 to –0.19% in the period from January to June 2009, mention of Dancourt, & Mendoza, (2009a, p. 68).

The impact of these external crises was not significant, so the Peruvian economy was able to recover very quickly. Peru took advantage of the prosperity of external markets to increase the growth of exports and remain stable in the international market.

According to Dancourt & Mendoza (2009b, p. 62), the Peruvian economy, which had been growing at a rate of 9.9% in 2008, slowed down by 1.5% annually in 2009, but a serious decision was avoided, and a new rate was recovered, close to 9% in 2010.

Cholera

Cholera is a disease native to Asia and India that later spread along trade routes throughout almost the entire world, causing 6 pandemics from 1817 to 1923. Maguiña et al. (2010)

The increase in political violence and the cholera epidemic had a significant impact on the economy and the health of the population and directly affected the poorest people. Cardozo et al., (2000, p.11)

The American continent was cholera-free for the first 30 years of the current pandemic, until the first cases were reported on January 23, 1991, in Chancay, Peru, on the Pacific coast near Lima, and almost simultaneously in Chimbote, 400 km north of Chancay, according to Bahamonde & Stuardo, (2013, p. 41).

Peru was one of the most economically and health-affected countries between 1991 and 2002, ranking second in the world mortality rate. While the country tried to recover from the famous paquetazo of the government of Alan García, Peru was attacked by cholera, health benefits collapsed. Agriculture and fishing exports were the most affected, tourism reduced the arrival of international tourists, the Peruvian coasts had to close, affecting the entire Peruvian coast. The importation of practically all Peruvian products of marine and vegetable origin was prohibited.

In the period from 1987 to 1990, Peru lost 28% of its Gross Domestic Product (GDP) per capita, which occurred in the context of a violent inflationary process that culminated in a hyperinflation of the order of 7,650% accumulated in 1990 according to what was stated by Pan American Health Organization, (1992, p. 9).

In this same period, income distribution deteriorated. At the same time, during the period from 1985 to 1989, public spending on health decreased in real terms by 52%, which meant a cut in services in the development of infrastructure.

Bubonic Plague

According to the Ministry of Health of Peru (2010), it is an infectious disease that is found naturally in wild rats in some areas of northern Peru. Being a disease that arrived in Peru since 1903, this was transmitted by the bite of rat fleas and that over the years had a greater impact throughout Peru.

Between 1912 and 1915, it spread to rural areas where it remains enzootic; the largest outbreaks in the last 20 years occurred in 1993 with 610 cases and in 1994 with 1128 cases, as Pachas et al., (2010, p. 474) commented.

By the end of August 2009, 29 cases of plague had been reported in the department of La Libertad, of which 18 were probable, 11 confirmed, and two died; at that time, the Peruvian economy was stable, the endemic evils of poverty increase the concern about the lack of health and education, as indicated by Maguiña, (2010, p. 241).

As mentioned by Modesto et al. (2002, p. 74), in 1994, the estimated total cost of the pest was $2,333,169. While in 1999, the total cost was $741,431.

We can observe that the amounts to counteract the bubonic plague during the period of 1994 and 1999 were high; these amounts were distributed in different expenses for the purchase of supplies, support for families or other areas that had been affected by the disease.

Peru distributed the costs to combat the disease according to the following details:

- Institutional costs of the Ministry of Health (MINSA)

- Costs of other institutions

- Economic costs for families

- Mortality costs

When analyzing the economic theory of health itself, it has several problems due to the distribution of the costs according to Martillo, (2001). The prices do not include all the relevant social impacts, which is why there are problems in configuring the demand, indicated Modesto et al., (2002, p. 82).

This epidemic had also an impact on tourism. Peru had a health program to prevent the spread of the plague, which was not very effective since the outbreak in 2009 also affected the Peruvian economy.

To achieve economic stability, families played an important role. As we know, the economic cycle begins with families, which are the main consumers, but families have to consume according to their possibilities.

Dengue

The first reports of outbreaks of a febrile syndrome compatible with classic dengue in the country were described in 1700, 1818, 1850 and 1876, although there was no laboratory confirmation, as described by Schneider & Droll, (2001).

Researchers from the United States affirm that the financial burden of dengue fever in the affected countries was approximately 1,800 million dollars a year (BBC News, 2009), and Peru was not the exception, it was one of the countries that suffered a recession in its economy. This disease generated unemployment and a loss of tourism, especially in the Peruvian jungle, a contribution from the Ministry of Health (2010), also placed an economic burden on the country’s health systems, which is currently happening with Covid -19.

In Peru, techniques were implemented to disperse dengue. In addition, in 2019, a new dengue outbreak was detected in the city of Madre de Dios, where it was observed that there were more homes and the budget to combat the disease had decreased (Cabezas & Grupo, 2005), once again increasing the economic burden on the health systems of Peru, due to the lack of monitoring of the impact of dengue on the health of Peruvians.

During the year 2020, dengue continued to be a health problem; currently, it no longer has the same level of impact as in 1876, but there is a projected amount for its treatment.

The modified institutional budget (PIM) for the program for metaxenic diseases and zoonoses, which includes dengue, was 385.6 million soles in 2020, 10.9% less than in 2019, noted ComexPerú (2020a).

Covid-19 and its effects on the economy

Unlike the other diseases that affected Peru, Covid-19 was aggressive, keeping the entire population of Peru in isolation, thus affecting various sectors of its economy and certain aspects of accounting.

The current Covid-19 pandemic caused by a mutated strain of the SARS-CoV-2 coronavirus caused a global economic, social and health crisis unprecedented in the 21st century, which began in late December 2019. Maguiña, et al. (2020, p. 125)

The world economy in the year 2020 had a significant drop, some countries were more affected than others; Peru, a developing country, had a greater impact on its economy, the Peruvian government being the one who took measures to try to stabilize the economy, albeit slowly. The deterioration of economic activity, due to the global pandemic, as well as the paralysis of the country’s productive activities to prevent the spread of the virus, significantly reduced GDP. ComexPeru, (2020b).

Support measures for the economic sector

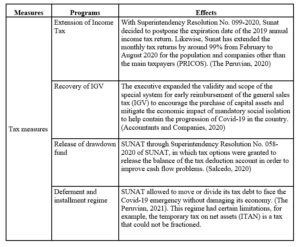

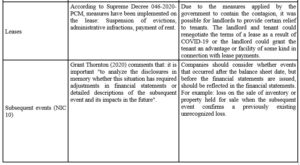

Table 1: Tax measures taken by the Peruvian Government to counteract the effects of Covid-19 on the economy

Note: Shows the fiscal measures to support the economic sector adopted by the Peruvian government, to promote economic reactivation. Source: Own elaboration.

Note: Shows the fiscal measures to support the economic sector adopted by the Peruvian government, to promote economic reactivation. Source: Own elaboration.

Taxation Measures

The pandemic affected almost all sectors of the business economy equally, and the picture of tax collection in Peru has not been very encouraging. The Ministry of Economy and Finance (MEF) presented the multi-year macroeconomic framework 2020-2024, in which a 20% drop in tax revenue is projected for the end of the year, according to Verona, (2020), this means that the coffers of the State will not have sufficient resources to carry out infrastructure works, improvements, services to the population, among others.

Since the beginning of the pandemic, the State has ordered fiscal measures to reduce the economic impact of the crisis in Peru, including the extension of the Income Tax and the Special Regime for early recovery of the Impuesto General a las Ventas (IGV), the early release of withdrawal funds and the creation of the Postponement and Fractionation Regime as stated El Comercio, (2020a); these measures were implemented to alleviate the tax commitments of all companies that were hit by the pandemic.

Income Tax Extension

The quarantine was declared on March 16, 2020, the companies ceased their activities, but they had to make the declaration and payment of the annual Income Tax as well as make the monthly declarations. The extension of the quarantine affected businesses, they did not have sufficient financial resources to pay taxes, which is why the Superintendencia Nacional de Aduanas y Administración Tributaria (SUNAT) took measures to postpone the time for declaration and payment.

With Superintendence Resolution No. 099-2020, SUNAT decided to postpone the expiration date of the annual Income Tax declaration for the 2019 period. SUNAT extended the monthly tax declarations by around 99% between the months of February to August 2020 for the population and companies other than the Main Taxpayers (PRICOS) published in El Peruano, (2020a)

With this extension, SUNAT developed a new payment schedule, which gave companies the facility to postpone the payment of taxes due to the situation they were going through. Another legal norm that SUNAT gave was the opportunity to pay taxes without penalty (the default interest rate was not applied) to taxpayers who were supposed to make their declarations in March, but due to the quarantine declaration they could not.

SUNAT recalled that the tax exemption measures taken in recent months to mitigate the economic impact of the pandemic meant a great effort by the Peruvian state to reduce the tax, so tax compliance at this stage must make an important contribution to the recovery of Peru. (Andina, 2020a)

Recovery of the Impuesto General a las Ventas

The executive extended the validity and scope of the special system for early reimbursement of the General Sales Tax (IGV) to encourage the purchase of capital assets and mitigate the economic impact of mandatory social isolation to help contain the progression of Covid-19 in the country, revealed Contadores y Empresas, (2020).

With Legislative Decree No. 1463, this special IGV early recovery regime sought to reduce the financial costs that may be associated with the acquisition of capital goods and the regime was enabled until December 31, 2023. (Gestión, 2020a)

The regime consists of the reimbursement of the tax credit for imports and / or local purchases of new capital goods by taxpayers with annual sales of up to 300 Unidades Impositivas Tributarias (UIT) that carry out productive activities of goods and services that pay general tax to sales or exports registered as micro or small companies in the Registry of Micro and Small Businesses (REMYPE), published by SUNAT (2015)

This decree helped the companies so that, with the money recovered, they can reinvest in their businesses and continue with their activities, but this affected the SUNAT fund.

Release of drawdown fund

Salcedo (2020) mentioned that SUNAT published Superintendence Resolution No. 058-2020 of SUNAT, with which tax options were granted to release the balance of the tax deduction account in order to improve the problems of Cash Flow.

SUNAT has increased 3,449 million soles for a total of 87,108 taxpayers (companies and individuals) by releasing funds from their source accounts in a timely manner to face the drop-in economic activity due to the impact of the Covid-19 pandemic, according to what was stated by the Peruvian News Agency, (2020).

In general, the SUNAT establishes deadlines to be able to release the deduction funds, but due to the situation, it had to open new deadlines for the release.

Deferment and installment regime

El Peruano, (2021, Julio 27) indicated that SUNAT allowed moving or dividing its tax debt to face the coronavirus emergency without damaging its economy.

The interest rate for this regimen has been set at 40% of the current Tasa de Interés Moratorio (TIM), and the maximum deferral terms and fees for the Régimen de Aplazamiento y/o Fraccionamiento (RAF) are up to 6 months (only for deferment) and up to 36 months (only for installment payments).

The RAF made it easy for taxpayers to split their debts if they did not have the financial solvency to declare and pay their taxes.

This regime had certain limitations, for example, the Temporary Tax on Net Assets (ITAN), the acronym in Spanish is Impuesto Temporal a los Activos Netos, is a tax that could not be fractioned

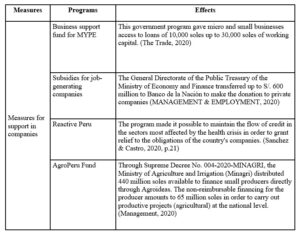

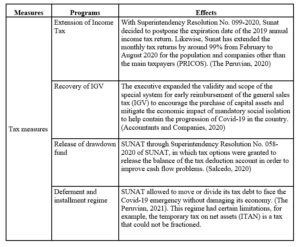

Table 2: Business support measures to counteract the effects of Covid-19 on the economy

Note: Shows the fiscal measures to support the economic sector adopted by the Peruvian government, to promote economic reactivation for companies, reducing the impact of Covid-19. Source: Own elaboration.

Measures for support in companies

Business support fund for MYPE

This government program provided access of micro and small businesses to loans for 10,000 soles up to 30,000 soles of working capital, according to El Comercio (2020b).

The Business Support Fund for Micro and Small Businesses (FAE-Mype) is a state fund that was established to guarantee micro and small businesses (Mypes) in all productive sectors working capital loans with a term of 3 years and a grace period of up to 12 months in companies of the financial system and savings and credit cooperatives. Ministry of Economy and Finance (2020)

Subsidies for job-generating companies

According to the D.U. Nº033-2020 Emergency Decree that establishes measures to reduce the impact on the Peruvian economy of the prevention provisions established in the declaration of a state of national emergency in the face of the risks of the spread of Covid-19, companies receive subsidies for each employee who earns income from the fifth category and whose working time does not indicate an end date. Management & Empleo (2020a)

If you were a private employer, you would receive a 35% salary bonus for each employee with income in the fifth category who earned up to S / 1,500. Ministerial Resolution No. 063-2021-TR (2021)

The General Directorate of the Public Treasury of the Ministry of Economy and Finance transferred up to S/. 600 million to Banco de la Nación to make the donation to private companies, Management & Empleo (2020b).

The subsidies helped companies that continued to work if their activities were classified as basic needs and they did not have the budget to meet their obligations as employers.

Reactive Peru

According to Sánchez & Castro (2020a, p.21), the program allowed maintaining the flow of credit in the sectors most affected by the health crisis in order to grant relief to the obligations of the country’s companies.

A state guarantee program of up to 8.4 percent of GDP (60 billion soles after the increase of originally 30 billion soles) was created according to what was stated by Montoro (2020, p. 25).

As of October 12, 2020, 480,122 companies from all economic sectors had received Reactiva Peru loans, of which 98 percent (471,642) are small and small businesses (Mypes), Central Reserve Bank of Peru (2020).

As Sánchez & Castro (2020b, p.20-21) mention, to achieve this objective, the program included 3 innovative features by allowing financial institutions to grant substantial amounts of credit at historically low rates in a scenario of high uncertainty and fall of GDP. These are:

- Competitive auctions in which financial institutions compete to charge a lower interest rate for companies.

- Partial guarantee of the national government, this allowed reducing the counterparty risk of the loans granted by the financial companies.

- Simple admission criteria based on the company’s compliance with its fiscal and financial obligations.

The Peru Reactive Fund was one of the most controversial funds because many companies declared bankruptcy after receiving it. Reactiva Peru promoted the expansion of credit in all economic sectors, mainly in commerce, services, construction and manufacturing.

Agroperú Fund

The Agroperú Fund was established on February 23, 2009, through Emergency Decree No. 027‐2009 and restructured on April 12, 2020, to promote access to guarantees to cover credit risks and direct financing for small agricultural producers. (Andean, 2020b).

Through Supreme Decree No. 004-2020-MINAGRI, the Ministry of Agriculture and Irrigation (Minagri) distributed 440 million soles available to finance small producers directly through AGROIDEASPerú. The non-reimbursable financing for the producer amounts to 65 million soles in order to carry out productive projects (agricultural) at the national level. (Gestión, 2020b)

In addition, S/.100 million from the Financial Inclusion Fund for Small Agricultural Producers to promote banking, productivity and associativity at preferential rates, as stated Gestión.

The Ministry of Agriculture and Irrigation (Minagri) reported that the Agroperú Fund gives access of small producers to loans with interest rates of 3.5% per year granted by the Agricultural Bank (Agrobanco). (Andean, 2020c)

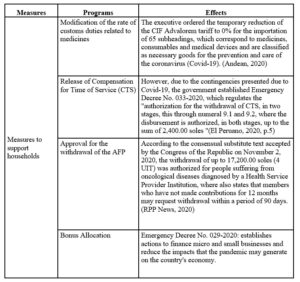

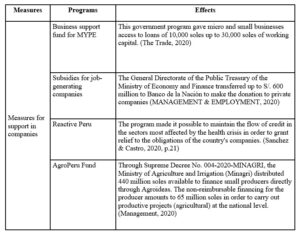

Table 3: Household support measures to counteract the effects of Covid-19 on the economy

Note: Shows the fiscal measures to support the Economically Active Population (EAP) and Peruvian households, adopted by the Peruvian government, in order to reduce the impact of Covid-19, on the personal and family economy. Source: Own elaboration.

Note: Shows the fiscal measures to support the Economically Active Population (EAP) and Peruvian households, adopted by the Peruvian government, in order to reduce the impact of Covid-19, on the personal and family economy. Source: Own elaboration.

Measures to support households

Modification of the rate of customs duties related to medicines

De la Lama & Lladó (2004, p.2) indicate that one of the main characteristics of the pharmaceutical industry in the world is the transnational business environment. The high price of medicines is related to the patent policy, which restricts market access for other competitors.

The price of medicines has been identified as the main determinant of access to medicines by citizens. Most of the measures to improve the conditions of access to medicines include strategies to lower or regulate prices, according to Meza (2010, p.6).

The executive ordered the temporary reduction of the CIF Ad-valorem tariff to 0% for the importation of 65 subheadings, which correspond to medicines, consumables and medical devices and are classified as necessary goods for the prevention and care of the coronavirus (Covid-19), according to Andean (2020d).

Release of Compensation for Time of Service (CTS)

According to Supreme Decree 002-97-TR, a worker has the right to withdraw up to 50% of his fund, either due to the contingency of dismissal or dismissal of the worker.

However, due to the contingencies presented due to Covid-19, the government established Emergency Decree No. 033-2020 that regulates the “authorization of withdrawal of the CTS, in two stages, this through numeral 9.1 and 9.2, where the disbursement is authorized, in both stages, up to the sum of S/. 2,400.00 soles”, according to El Peruano (2020b, p.5).

Approval for the withdrawal of the AFP

According to the consensual substitute text approved by the Congress of the Republic on November 2, 2020, the withdrawal of up to S/. 17,200.00 soles (4 UIT) for those who suffer from oncological diseases diagnosed by a Health Service Provider Institution, where it also states that members who have not made contributions for 12 months may request withdrawal within a period of 90 days, according to RPP Noticias (2020).

Bonus Allocation

Emergency Decree No. 029-2020 establishes actions to finance micro and small businesses and reduce the impacts that the pandemic may generate on the country’s economy. Similarly, the MYPE Business Support Fund (FAE-MYPE) was created to guarantee working capital loans to MYPE, as well as to restructure and refinance their debts, up to 300,000,000 soles.

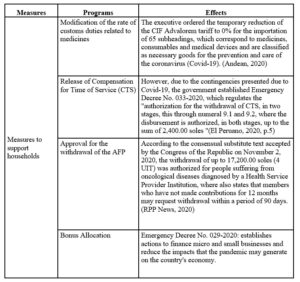

COVID-19 Effects on Accounting

There were no setbacks in the presentation of the financial statements as of December 31, 2020, however, the Covid-19 has caused a strong impact on the world economy in different ways, and the accounting has not been exempted from changes. Casal (2020) comments that: “entities face new challenges and complexities that particularly affect their financial statements”, this is due to the volatility in the market that can create new changes for private and public companies.

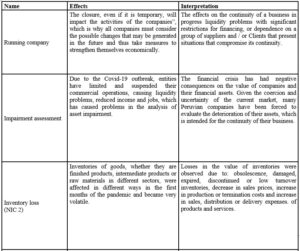

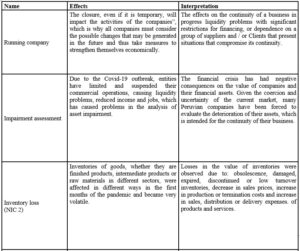

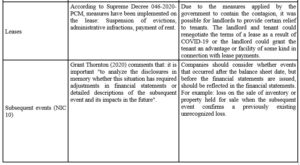

Table 4: Effects of Covid-19 on Peruvian accounting

Note: Refers to the effects of Covid-19 on accounting, considering international accounting principles and standards such as: going concern or business continuity, impairment assessment, inventory loss (NIC 2), leasing, events subsequent (NIC 10). Principles of accounting standards that provide for future events in the event of possible circumstances of suspension of support by the government. Source: Own elaboration.

Considerations for accounting closing

Running company

Companies must estimate whether the slowdown in the economy due to Covid-19 has affected their ability to continue doing business. Ruiz (2020) comments that: “the closure, even if it is temporary, will impact the activities of the companies”, which is why all companies must consider the possible changes that may be generated in the future and thus take measures to strengthen themselves economically.

The financial statements are prepared with the assurance that the company is in operation and continues with its economic activity, but due to the effects that the Covid-19 has caused in the world economy, many companies, mostly small and medium-sized, entered bankrupt and closed, this is because they were not sufficiently prepared to face a crisis.

Impairment Assessment

International Financial Reporting Standards (IFRS) require an entity to perform an assessment of signs of impairment of assets at the end of each reporting period. Van der Tas (2020) mentions that: “an asset is impaired when a company cannot recover its book value, either by using it or selling it”, that is why when making an estimate of impairment, companies must establish the recoverable amounts of the assets. Due to the Covid-19 outbreak, entities have limited and suspended their commercial operations, causing liquidity problems, reduced income and jobs, which has caused problems in the analysis of asset impairment.

Inventory loss (NIC 2)

Due to the social isolation in which the country was forced to abide, losses in the value of inventories were observed due to: “obsolescence, damaged, expired, discontinued or low turnover inventories, decrease in sales prices, increase in the costs of production or termination and increased expenses for the sale, distribution or delivery of products and services”, argued Tax Service & TFC Consultores Corporativos, (2020).

Leases

Because of the Covid-19 pandemic, modifications were made to leases, and due to government measures implemented to contain the contagion, it was possible for lessors to provide certain relief to lessees. Debell et al. (2020) mention that: “lessor and lessee could renegotiate the terms of a lease as a result of Covid-19 or the lessor could grant the lessee an advantage or facility of some kind in relation to lease payments” (Debell et al., 2020).

Subsequent events (NIC 10)

Subsequent events reveal whether there were changes in the environment from the cut-off date of the financial statements to the date of authorization of the financial statements. Currently, with the declaration of the Covid-19 pandemic, the greatest impact was on commercial operations that may not have been a direct consequence of the outbreak, but the result of the measures taken to contain the contagion; as the pandemic continues, governments will implement more measures, thus affecting all markets. That is why Grant Thornton (2020) comments that it is important “to analyze the breakdowns in memory whether this situation has required adjustments in financial statements or detailed descriptions of the subsequent event and its impacts in the future”.

Descriptive phase

Implications of epidemics, their history in the economy of Peru

According to Casalino (2017), the crises caused by diseases during the history of Peru made local authorities worry about improving sanitary conditions and promoting the concept of public hygiene as a state responsibility, although with marked deficiencies evidenced in the Covid pandemic. – 19.

Villasante (2020) comments that: “the responses to the current pandemic have been quite similar to those observed during the Black Death in 1903, but many countries, including the United States and Brazil, refused to impose isolation to avoid economic crisis.”

Covid-19 and its effects on the economy

According to Olivera & Ghurra (2020), due to the limited containment of the pandemic and the contagious recovery after resuming activities, the probability of a new outbreak is high and, therefore, it may be necessary to reintroduce some form of quarantine. However, it is not just about protecting life, but also the economic livelihood of the population.

Castillo & Ruiz (2020) mention that the implementation and distribution of liquidity is important both to increase the probability of reactivating the economy and to reduce the probability of contagion.

The Covid-19 effects on accounting

According to Casal (2020), “entities face new challenges and complexities that particularly affect their financial statements.”

Benites (2020) mentions that: “the gradual restoration of certain economic activities with strict security protocols generates uncertainty and an even more discouraging perspective for companies belonging to economic activities that are not authorized to restart and will continue to wait.”

Interpretive phase

Implications of epidemics, their history in the economy of Peru

Casalino and Cervello mention that epidemics and pandemics throughout history affected the world economy to a lesser degree. The contagion in the epidemics that affected Peru made the authorities take measures to prevent its spread.

Covid-19 was a disease that generated a mandatory quarantine, thus generating the cessation of activities, and because there are informal companies, they did not continue to pay their workers, and affected the main consumers, which are families.

Covid-19 and its effects on the economy

The authors Olivera & Ghurra, and Castillo & Ruiz, agree on the importance of the reactivation of the Peruvian economy going hand in hand with the fight against Covid-19.

The implementation of effective sanitary measures guarantees a lower rate of contagion, making Peru begin a new normality. Peruvians, due to the situation, adapted and started with electronic commerce, which prevented the economic activity from plummeting.

The Covid-19 effects on accounting

Casal and Benites agree that currently all companies in Peru, and in the world, are facing new challenges that they had not contemplated, and that there is still uncertainty about future changes that will be presented in accounting, affecting financial statements.

The economic damage caused by Covid-19 in the economy in general and in companies in particular is already reflected in the annual financial statements and in the financial and non-financial information derived from them.

Global Theoretical Construction

The present investigation is of a qualitative nature and methods were used to collect data focused on understanding the phenomenology with which the particular experience was socialized. The technique of documentary analysis was used through the description and interpretation of the state of the art with the objective of describing and analyzing the Implications of Covid-19 in the Peruvian economy, and its difference with the effects of other diseases.

The type of source analyzed was made up of documents, supreme decrees, legislative decrees, emergency decrees, ministerial resolutions, web books, virtual platforms, websites, magazine articles and virtual newspapers, among others. Hernández Sampieri et al. (2017) mention that this type of research “seeks to specify the properties, characteristics and profiles of people, groups, communities, processes, objects or any other phenomenon that is subject to analysis” (p.80).

Unfortunately, Peru was not prepared to face a pandemic with the characteristics of Covid-19, although it faced other diseases, it did so because they did not have the same impact on the health system and the economy. Covid-19 until December 2020 is the disease with a mortality rate never seen in the history of Peru.

Covid-19 was a disease that no one could predict, much less know its impact on the world economy. The Peruvian state, in its objective of reactivating the economy and avoiding a crisis, gave support measures to companies, households, and taxpayers, which affected the collection of taxes well. It is expected that by 2021 the Peruvian economy will recover its equilibrium point, for that it is necessary to eliminate informality.

We are facing an unprecedented crisis and we are still not sure of the real impact it may have on our economy. However, we have in our hands a great opportunity to improve the accounting aspects of our country.

Discussions

According to the Peruvian Institute of Economy (2020), the rapid spread of the virus has led the governments of different countries around the world to take drastic action to reduce the increase in cases and prevent the collapse of health systems; the emergency measures that have been issued include, for example, social isolation, mandatory quarantine and border closures. These measures have never been implemented before when trying to prevent the spread of a disease.

The difference of Covid-19 with respect to other diseases is not only the mortality rate, but also the impact on the economy since previous years saw the growth of the Peruvian economy, and, if it suffered an impact, it was not of great magnitude since it had the necessary funds to face the disease. Unfortunately, this was not seen in 2020 because the economic impact was greater due to the fact that social isolation was decreed for more than 8 months as never before.

The University of Lima (2020) stated that the GDP of our country would be close to -15% in 2020 and indicated that crises are opportunities and propitious moments to make structural changes, in order to improve our precarious health system, increase tax pressure and promote the growth of the formal market (it is estimated that 3 out of 4 workers in Peru are informal).

Peru is facing one of the largest GDP drops in Latin America It is estimated that by 2022 Peru will be able to stabilize GDP. What is expected is that Peru will increase GDP by 2021. Covid-19 showed us the lack of an efficient health system with many problems not only in the use of financing to improve hospitals, but also in the embezzlement of funds that affected the state coffers.

“The loss of labor income would bring with it an increase in the relative poverty rate for informal workers and their families”, National Labor Organization, (2020). Due to the informal market in Peru and the lack of a tax culture, the pandemic raised the level of unemployment since companies could not pay their workers and fired them.

The Peruvian Institute of Economy (2020) points out that the rapid spread of the virus has led the governments of different countries in the world to take drastic actions to reduce the increase in cases and avoid a collapse of the health system. In the face of this situation, emergency measures have been dictated that include, for example, social isolation, mandatory quarantine, and the closure of borders. In many countries, measures have currently been implemented to stop the contagion that Covid-19 is generating in the population. On the other hand, Peru and the rest of the affected countries, through the implementation of social distancing measures that imply a paralysis of economic activity, are consolidating a whole process of uncertainty about income, which ultimately reduces consumption and the economies of scale.

The Lima Chamber of Commerce (2020) indicates that “the Institute of Economy and Business Development (IEDEP) estimated that those who work in sectors of lower productivity (agriculture, commerce and services) would be the most vulnerable to the impact of Covid-19”, and indeed the activity of these sectors was reduced due to the social isolation caused by the pandemic.

Conclusions

The research showed that unlike other pandemics (flu A H1N1) and epidemics (dengue, cholera, etc.) that occurred in Peru, Covid-19 was more aggressive, affecting all economic and social sectors of the country, and forcing almost the entire population into social isolation, generating a considerable reduction in the economic cycle and the loss of income.

This is a health crisis, not an economic crisis; the longer it takes to solve the problem that causes it, the greater the economic crisis will be. As long as Peru fails to control the disease, it must continue to implement sanitary measures so that the population continues in isolation. And although Peruvian merchants adopted a new strategy to continue their activities, this is not the solution to the problem, informality still exists.

We are facing an unprecedented crisis and we are still not sure of the real impact it may have on our economy. However, we have in our hands a great opportunity to improve the accounting aspects of our country.

Although this crisis generated many problems, it also provided the opportunity to undertake and take measures to improve the tax system of our country.

Referencias

- Peruvian News Agency. (2020, agosto 18). SUNAT transfirió S/ 3,449 millones a empresas y personas naturales mediante detracciones. Actualidad Empresarial. Retrieved diciembre 01, 2020 https://actualidadempresarial.pe/noticia/sunat-transfirio-s-3-449-millones-a-empresas-y-personas-naturales-mediante-detracciones/26af5773-8a48-4a2d-a826-5f33ed554f35/1#

- Alburquerque, Germán. (2017) Non-alignment, third worldism and security in Peru: the foreign policy of the government of Juan Velasco Alvarado (1968-1980). Latin America Today, 2017, vol. 75, p. 149-166.

- Andia-Choquepuma, V., Leon-Escobedo, DJ, Avila-George, H., Sánchez-Garcés, J., Villafuerte-Alcántara, RE, y Moreno-Leyva, NR (2021). Repercussions of the COVID-19 health crisis in the Peruvian informal sector.

- https://ibimapublishing.org/articles/JESR/2021/948031/948031.pdf

- (2020a, junio 1). Sunat prorroga declaración y pago del Impuesto a la Renta anual y mensual. Andina.pe. Retrieved Noviembre 30, 2020, from https://andina.pe/agencia/noticia-sunat-prorroga-declaracion-y-pago-del-impuesto-a-renta-anual-y-mensual-799549.aspx

- (2020b, agosto 10). Fondo AgroPerú otorga créditos a pequeños productores con tasas de 3.5%.

- (2020c) Retrieved Diciembre 05, 2020, from https://andina.pe/agencia/noticia-fondo-agroperu-otorga-creditos-a-pequenos-productores-tasas-35-809316.aspx

- (2020d, marzo 14). Coronavirus: Ejecutivo reduce temporalmente tasa arancelaria a medicamentos. Andina. Retrieved Diciembre 02, 2020, from https://andina.pe/agencia/noticia-coronavirus-ejecutivo-reduce-temporalmente-tasa-arancelaria-a-medicamentos-788281.aspx

- Bahamonde Harvez, C., y Stuardo Ávila, V. (2013). La epidemia de cólera en América Latina: reemergencia y morbimortalidad. Revista Panamericana de Salud Pública, 33(1), 40-46. https://Doi.Org/10.1590/S1020-49892013000100006

- Central Reserve Bank of Peru. (2020, octubre 13). YA SON 480 122 Empresas Beneficiadas con Reactiva Perú, 98% de Ellas MYPE. Notas Informativas. Retrieved noviembre 28, 2020, from https://www.bcrp.gob.pe/docs/Transparencia/Notas-Informativas/2020/nota-informativa-2020-10-13.pdf

- Barifouse, R. (2020, abril 2). Coronavirus: why the A-H1N1 flu did not stop the world economy as the covid-19 pandemic is doing. BBC NEWS. Retrieved Octubre 30, 2020, from https://www.bbc.com/mundo/noticias-52115504

- BBC News. (2009, mayo 8). El enorme costo económico del dengue. BBC news mundo. Retrieved 12 1, 2020, from https://www.bbc.com/mundo/ciencia_tecnologia/2009/05/090508_dengue_costo_men

- Benites, A. (2020, junio 9). COVID-19: Empresas peruanas reportarán los primeros impactos en sus estados financieros. https://www.ey.com/es_pe/financial-accounting-advisory-services/empresas-peruanas-estados-financieros

- Cabezas, C. (2009, abril). New Influenza AH1N1: inexorable expansion of the pandemic to the southern hemisphere. Peruvian Journal of Experimental Medicine and Public Health, 26(2), 134 -135. http://www.scielo.org.pe/pdf/rins/v26n2/a02v26n2

- Cabezas, C., y Grupo de trabajo de dengue. (2005). Dengue En El Perú: Aportes para su Diagnóstico y Control, 3(22), 212 – 228. https://rpmesp.ins.gob.pe/rpmesp/article/download/997/997

- Cámara de Comercio de Lima. (2020, abril 13). Propuestas conta el Covid-19. Cámara de Comercio de Lima. https://apps.camaralima.org.pe/repositorioaps/0/0/par/edicion922/la_camara%20922_final.pdf

- Cardozo, R. I., Casanova, V., y Scatena, T. C. (2000) diciembre, Visión Panorámica De La Situación De Salud En El Perú. Revista Latino-Americana de Enfermagem, 8(6), 7-12. https://doi.org/10.1590/S0104-11692000000600002

- Casal, A. M. (2020, junio 1). Implicaciones contables de los efectos potenciales del COVID-19 para el año 2020. https://blog.errepar.com/efectos-covid19-contables/

- Casalino, C. (2017, Setiembre). Mortalidad por epidemias y endemia según causas y condiciones sanitarias a mediados del siglo XIX en Lima, Perú. Revista Peruana de Medicina Experimental y Salud Pública, 34(3), 564-568. https://dx.doi.org/10.17843/rpmesp.2017.343.2486

- Castillo, L., & Ruiz, M. (2020, junio). Covid-19 en Perú: Medidas de soporte a hogares y empresas. Revista Moneda, 10(182), 65-73. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-182/moneda-182-10.pdf

- ComexPerú. (2020a, marzo 13). Nuestra Epidemia: El Dengue. COMEX Sociedad de comercio exterior del Perú. Retrieved diciembre 01, 2020, from https://www.comexperu.org.pe/articulo/nuestra-epidemia-el-dengue

- ComexPerú. (2020b, noviembre 27). Los Persistentes Problemas Del Mercado Laboral Generarán 1.5 Millones de Personas Desempleadas al Finalizar el Año. ComexPerú – Sociedad de Comercio Exterior del Perú. Retrieved diciembre 02, 2020, from https://www.comexperu.org.pe/publicaciones?id=1&publicacion=Semanario&edicion=1053

- Contadores y Empresas. (2020, abril 17). Mypes con ingresos anuales de hasta 2.300 UIT podrán acogerse a recuperación anticipada del IGV. Contadores y empresas. Retrieved diciembre 05, 2020, from http://www.contadoresyempresas.com.pe/index.php?/detalle/1/mypes-con-ingresos-anuales-de-hasta-2300-uit-podran-acogerse-a-recuperacion-anticipada-del-igv-N000014911#:~:text=La%20norma%20se%C3%B1ala%20que%20la,31%20de%20diciembre%20de%202021.

- Dancourt, Ó., y Mendoza, W. (2009a). Perú 2008-2009: rom boom to recession External shock and macroeconomic policy responses. In International crisis Impacts and responses of economic policy in Peru (Fondo Editorial PUCP ed., Vol. 1, pp. 60-88). Óscar Dancourt / Félix Jiménez. https://textos.pucp.edu.pe/pdf/199.pdf

- Dancourt, Ó., y Mendoza, W. (2009b). Perú 2008-2009: rom boom to recession External shock and macroeconomic policy responses. In International crisis Impacts and responses of economic policy in Peru (Fondo Editorial PUCP ed., Vol. 1, pp. 60-88). Óscar Dancourt / Félix Jiménez. https://textos.pucp.edu.pe/pdf/199.pdf

- Debell, T., Kalidas, V., & PwC Reino Unido. (2020, marzo). A fondo: Implicaciones contables de los efectos del coronavirus. https://www.pwc.com/ia/es/publicaciones/noticias-niif/A-fondo-implicaciones-contables-de-los-efectos-del-coronavirus.pdf

- De la Lama, M., y Lladó, J. (2004). Precios y Política de Medicamentos en el Perú. Estudios Económicos, 5(11), 1-21. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Estudios-Economicos/11/Estudios-Economicos-11-5.pdf

- El Comercio. (2020a, septiembre 7). La recaudación y la pandemia. Instituto Peruano de Economía. https://www.ipe.org.pe/portal/la-recaudacion-y-la-pandemia/

- El Comercio. (2020b, agosto 18). FAE-Mype: qué es, cómo acceder al fondo y todo lo que debes de saber. El Comercio. Retrieved noviembre 30, 2020, from https://elcomercio.pe/respuestas/fae-mype-que-es-como-acceder-al-fondo-y-todo-lo-que-debo-conocer-mypes-micro-y-pequenas-empresas-cofide-estado-creditos-prestamos-10-mil-soles-covid-19-pandemia-coronavirus-bancos-requisitos-revtli-noticia/

- El Peruano. (2020a, marzo 27). Decreto de Urgencia N° 033-2020. https://cdn.www.gob.pe/uploads/document/file/572106/DU033_2020.pdf

- El peruano. (2020b, mayo 31). Sunat prorroga la declaración y pago de impuestos. El Peruano Diario Oficial. Retrieved noviembre 20, 2020, from https://elperuano.pe/noticia/96658-sunat-prorroga-la-declaracion-y-pago-de-impuestos

- El Peruano. (2021, julio 27). Resolución de Superintendencia que aprueba disposiciones para la aplicación de la excepción que permite a la SUNAT otorgar aplazamiento y/o fraccionamiento por el saldo de deuda tributaria contenido en una resolución de pérdida del Régimen de … El Peruano. Retrieved septiembre 8, 2022, from https://busquedas.elperuano.pe/normaslegales/resolucion-de-superintendencia-que-aprueba-disposiciones-par-resolucion-n-000111-2021sunat-1977251-1/

- García, N. E. (2011). Adjustment to the crisis and labor market (Peru 2008-2010). Journal of Business Studies. second epoch, 1988-9046(1), 79-96. https://dialnet.unirioja.es/servlet/articulo?codigo=4876838

- Gestión. (2020a, abril 17). Gobierno extiende régimen de recuperación anticipada del IGV hasta el 2023. Gestión Economía. Retrieved noviembre 15, 2020, from https://gestion.pe/economia/gobierno-extiende-regimen-de-recuperacion-anticipada-del-igv-hasta-el-2023-noticia/

- Gestión. (2020b, abril 12). Minagri reestructura fondo Agroperú para acelerar créditos a pequeños productores. Gestión Economía. Retrieved Diciembre 02, 2020, from https://gestion.pe/economia/minagri-reestructura-fondo-agroperu-para-acelerar-creditos-a-pequenos-productores-nndc-noticia/

- Grant Thornton. (2020). Impactos contables potenciales ante la pandemia mundial de coronavirus COVID-19. https://www.camaracaceres.com/wp-content/uploads/2020/04/aud_impactos-contables-potenciales-covid-19.pdf

- Hernández Sampieri, R., Fernández Collado, C., & Baptista Lucio, M. D. P. (2017). Metodología de la investigación (Quinta ed.). McGraw-Hill. https://www.esup.edu.pe/descargas/dep_investigacion/Metodologia%20de%20la%20investigaci%C3%B3n%205ta%20Edici%C3%B3n.pdf

- Instituto Peruano de Economía. (2020, marzo 19). Impacto del coronavirus en la economía peruana. Instituto Peruano de Economía. https://www.ipe.org.pe/portal/informe-ipe-impacto-del-coronavirus-en-la-economia-peruana/

- Maguiña, C. (2010). Actualización sobre peste en el Perú. Revista Peruana de Ginecología y Obstetricia, 56(3), 238-241. https://sisbib.unmsm.edu.pe/BVrevistas/ginecologia/vol56_n3/pdf/a12v56n3.pdf

- Maguiña Vargas, C., Gastelo Acosta, R., y Tequen Bernilla, A. (2020, junio). El nuevo Coronavirus y la pandemia del Covid-19. Revista Médica Herediana, 31(2), 125-131. https://dx.doi.org/10.20453/rmh.v31i2.3776

- Maguiña Vargas, C., Seas Ramos, C., Galán Rodas, E., y Santana Chancanya, J. J. (2010). Historia del cólera en el Perú en 1991. Scielo Perú, 27(3), 212-217. http://www.scielo.org.pe/scielo.php?script=sci_arttext&pid=S1728-59172010000300011

- Management & Empleo. (2020a, marzo 28). Subsidio de 35% a pago de planilla no aplicará a empresas con deudas tributarias. Gestión. Retrieved diciembre 01, 2020, from https://gestion.pe/economia/management-empleo/coronavirus-peru-covid-19-mef-transferira-hasta-s-600-millones-para-subsidiar-parte-del-pago-de-planillas-de-empresas-nndc-noticia/

- Management & Empleo. (2020b, marzo 28). Subsidio de 35% a pago de planilla no aplicará a empresas con deudas tributarias. Gestión. Retrieved diciembre 01, 2020, from https://gestion.pe/economia/management-empleo/coronavirus-peru-covid-19-mef-transferira-hasta-s-600-millones-para-subsidiar-parte-del-pago-de-planillas-de-empresas-nndc-noticia/

- Martillo, J. S. (2001, Abril 18). The economics of malaria control. World Bank Group, 1(11578). http://documents1.worldbank.org/curated/en/401881468766797381/pdf/multi-page.pdf

- Meza, E. (2010). Efectos del TLC en el acceso a medicamentos: Exoneraciones tributarias y propiedad intelectual. In TCL Medicamentos Comercio Propiedad Intelectual (Primera ed., Vol. 1, pp. 1-52). Neva Studio S.A.C. http://www.redge.org.pe/sites/default/files/Efectos%20del%20TLC%20en%20medicamentos%20-%20Edson%20Meza.pdf

- Ministry of Economy and Finance. (2020, diciembre 03). Plan Económico de Perú frente al COVID-19. MEF Ministerio de Economía y Finanzas. Retrieved diciembre 05, 2020, from https://www.mef.gob.pe/planeconomicocovid19/mype.html

- Ministerio de Salud. (2010). Impacto económico de la malaria.

- Ministry of Health of Peru (2010). Información sobre la peste bubónica. Retrieved November 4, 2020, from http://www.minsa.gob.pe/portada/er_peste.asp

- Modesto, J., Morales, A., Cabanillas, O., y Díaz, C. (2002a). Impacto económico de la peste bubónica en Cajamarca – Perú. Revista Peruana de Medicina Experimental y Salud Publica, 19(2), 74-82. http://www.scielo.org.pe/scielo.php?script=sci_arttext&pid=S1726-46342002000200005&lng=es&tlng=es.

- Modesto, J., Morales, A., Cabanillas, O., y Díaz, C. (2002b). Impacto económico de la peste bubónica en Cajamarca – Perú. Revista Peruana de Medicina Experimental y Salud Publica, 19(2), 74-82. http://www.scielo.org.pe/scielo.php?script=sci_arttext&pid=S1726-46342002000200005&lng=es&tlng=es.

- Montoro, C. (2020, junio). El programa Reactiva Perú. Reactivación Económica, 4(182), 24-33. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-182/moneda-182-04.pdf

- Olivera, L., y Ghurra, O. (2020, noviembre). El camino hacia una nueva normalidad. Revista Moneda, 11(182), 74-79. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-182/moneda-182-11.pdf

- Organización Nacional de Trabajo. (2020, mayo). La crisis de COVID-19 y la economía informal Respuestas inmediatas y desafíos de política. https://www.ilo.org/wcmsp5/groups/public/—ed_protect/—protrav/—travail/documents/briefingnote/wcms_745450.pdf

- Pachas, P. E., Mendoza, L., González, D., Fernández, V., y Céspedes, M. (2010). Control de la Peste en La Libertad, Perú. Rev Peru Med Exp Salud Pública, 27(3), 473-477. http://www.scielo.org.pe/pdf/rins/v27n3/a24v27n3.pdf

- Pan American Health Organization. (1992, setiembre). Impacto económico de la epidemia del cólera, Perú-1991. 13(3), 1-16. https://iris.paho.org/handle/10665.2/39976

- Resolución Ministerial N° 063-2021-TR. (2021, abril 11). Lima, Perú. https://cdn.www.gob.pe/uploads/document/file/1795899/RM%20N%C2%B0%20063-2021-TR.pdf

- RPP Noticias. (2020, noviembre 2). AFP: Congreso aprobó ley que permite el retiro de hasta S/17,200 de los fondos de pensiones, ¿de qué trata? https://rpp.pe/economia/economia/afp-congreso-aprobo-ley-que-permite-el-retiro-de-hasta-s-17200-de-los-fondos-de-pensiones-de-que-trata-sistema-de-pensiones-comision-de-economia-noticia-1300331?ref=rpp

- Ruiz, R. (2020, marzo). La pandemia del Covid-19 y sus efectos en la contabilidad. https://www.mgiworld.com/media/2123702/nota-rr-coronavirus.pdf

- Salcedo, J. (2020, marzo). Covid-19: Medidas dadas para la disposición de fondos de detracciones. Retrieved November 20, 2020, from https://www2.deloitte.com/pe/es/pages/tax/articles/Medida-de-emergencia-SUNAT-COVID19.html

- Sánchez, E., y Castro, F. (2020a, junio). Reactiva PERÚ y la estabilidad del sistema financiero. SISTEMA FINANCIERO, 1(128), 19-23. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-182/moneda-182-03.pdf

- Sánchez, E., y Castro, F. (2020a, junio). Reactiva PERÚ y la estabilidad del sistema financiero. SISTEMA FINANCIERO, 1(128), 19-23. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-182/moneda-182-03.pdf

- Schneider, J., y Droll, D. (2001). A Timeline For Dengue In The Americas To December 31, 2000, And Noted First Occurences. Washington DC: Pan American Health Organization. https://www.paho.org/hq/dmdocuments/2010/A%20timeline%20for%20dengue.pdf

- Suárez Ognio, L., Arrasco, J., Gómez, J., Munayco, C., Vílchez, A., Cabezas, C., y Laguna Torres, V. (2011, abril 1). Mortality related to influenza AH1N1 in Peru during the pandemic in 2009-2010. Peruvian Journal of Epidemiology, 15(1), 01 – 07. https://dialnet.unirioja.es/servlet/articulo?codigo=3749926

- (2015, enero). Régimen Especial de Recuperación Anticipada del IGV – LEY N° 30296. SUNAT. Retrieved December 01, 2020, from https://orientacion.sunat.gob.pe/index.php/empresas-menu/impuesto-general-a-las-ventas-y-selectivo-al-consumo/impuesto-general-a-las-ventas-igv-empresas/6892-09-regimen-especial-de-recuperacion-anticipada-del-igv-ley-30296

- Tax Service & TFC Consultores Corporativos. (2020, junio). ¿Cómo afecta en la contabilidad el Covid-19? https://www.tfc.com.ec/uploads/noticia/adjunto/670/BOLETIN_-_COMO_AFECTA_EN_LA_CONTABILIDAD_EL_COVID_19.pdf

- Universidad de Lima. (2020, junio 22). ANÁLISIS ECONÓMICO DE LA PANDEMIA. Universidad de Lima. Retrieved diciembre 03, 2020, from https://www.ulima.edu.pe/departamento/c-de-ee-en-economia-banca-y-finanzas/noticias/analisis-economico-de-la-pandemia

- Van der Tas, L. (2020). Cinco problemáticas de información financiera a considerar como consecuencia de Covid-19. https://www.ey.com/es_py/assurance/five-financial-reporting-issues-to-consider-as-a-consequence-of-covid-19

- Verona, J. (2020, septiembre 7). ¿Cómo ha sido el impacto de la pandemia en la recaudación tributaria? Grupo Verona. https://grupoverona.pe/como-ha-sido-el-impacto-de-la-pandemia-en-la-recaudacion-tributaria/

- Villasante Cervello, M. (2020, abril 14). Instituto de democracia y derechos humanos. La solidaridad en tiempos del coronavirus: el caso del Perú. https://idehpucp.pucp.edu.pe/notas-informativas/la-solidaridad-en-tiempos-del-coronavirus-el-caso-del-peru/